Blank Illinois Deed in Lieu of Foreclosure Form

The Illinois Deed in Lieu of Foreclosure form serves as a crucial legal instrument for homeowners facing financial distress and potential foreclosure. This form allows property owners to voluntarily transfer the title of their property back to the lender, effectively relinquishing their ownership in exchange for the cancellation of the mortgage debt. By opting for this process, homeowners can avoid the lengthy and often costly foreclosure proceedings, which can have lasting impacts on their credit and financial stability. The form outlines essential details such as the property description, the parties involved, and any relevant stipulations regarding the transfer. It is important to understand that while this option can provide a quicker resolution, it may also carry implications for the homeowner’s credit report and future borrowing capabilities. Therefore, careful consideration and consultation with a legal professional are recommended before proceeding with the Deed in Lieu of Foreclosure in Illinois. This form not only represents a strategic move for distressed homeowners but also offers lenders a way to minimize losses associated with foreclosure. Understanding its components and implications is vital for anyone considering this route.

Other Common Deed in Lieu of Foreclosure State Templates

Foreclosure Process in Georgia - This arrangement can help preserve the homeowner's credit score compared to a traditional foreclosure process.

When buying or selling a boat in California, it's important to have a properly filled out California Boat Bill of Sale form to formalize the transaction. This form not only serves as proof of the sale but also includes crucial details that can assist in future registrations. To ensure you have the correct documentation, you can access the form here.

California Property Surrender Deed - Homeowners should consider all options and implications before deciding on a Deed in Lieu.

Similar forms

- Short Sale Agreement: A short sale occurs when a homeowner sells their property for less than the amount owed on the mortgage. Similar to a deed in lieu of foreclosure, it allows the borrower to avoid foreclosure and settle their debt, but it involves selling the property rather than transferring it back to the lender.

- Loan Modification Agreement: This document alters the terms of an existing loan to make it more manageable for the borrower. Like a deed in lieu of foreclosure, it seeks to prevent foreclosure by providing a solution that allows the borrower to keep their home, but it does so by changing payment terms instead of transferring ownership.

- Forebearance Agreement: In this arrangement, the lender agrees to temporarily reduce or suspend mortgage payments. This document is similar because it aims to help the borrower avoid foreclosure, but it focuses on delaying the payment rather than relinquishing the property.

- Quitclaim Deed: A quitclaim deed transfers ownership rights from one party to another without guaranteeing that the title is clear. Like a deed in lieu of foreclosure, it involves a transfer of property, but it does not necessarily involve debt settlement or foreclosure avoidance.

- Property Settlement Agreement: This document is often used in divorce proceedings to divide property. Similar to a deed in lieu of foreclosure, it involves the transfer of property rights, but it typically occurs as part of a legal separation rather than a foreclosure process.

- Release of Mortgage: This document officially releases the borrower from their mortgage obligations once the debt is paid off. It shares similarities with a deed in lieu of foreclosure in that both result in the borrower being free from the mortgage, but a release occurs after payment, while a deed in lieu involves a transfer of property to the lender.

- Deed of Trust: A deed of trust secures a loan by transferring title to a third party until the debt is repaid. This document is similar because it involves a property transfer, but it serves as collateral for a loan rather than a method to avoid foreclosure.

- Real Estate Purchase Agreement: This contract outlines the terms of a property sale. While it is primarily a sales document, it can be similar to a deed in lieu of foreclosure in that it involves the transfer of property ownership, albeit in a traditional sale context rather than a foreclosure avoidance strategy.

- Dog Bill of Sale: The Bill of Sale for Dogs is crucial for ensuring a smooth transfer of ownership and protecting both parties in the transaction.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide relief from debt. This document is similar to a deed in lieu of foreclosure in that both aim to address financial distress and avoid the loss of property, though bankruptcy involves a legal process that can affect a borrower’s credit for a longer duration.

- Loan Assumption Agreement: This document allows a buyer to take over the seller's mortgage. Like a deed in lieu of foreclosure, it can relieve the original borrower from their mortgage obligations, but it does so by transferring the debt to another party rather than returning the property to the lender.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | The Illinois Deed in Lieu of Foreclosure is governed by the Illinois Compiled Statutes, specifically 735 ILCS 5/15-1401. |

| Eligibility | Homeowners facing foreclosure may be eligible for this option if they are unable to make mortgage payments. |

| Process | The borrower must negotiate with the lender to agree on the deed transfer terms before signing the document. |

| Benefits | This option can help homeowners avoid the lengthy and costly foreclosure process, allowing for a quicker resolution. |

| Impact on Credit | A Deed in Lieu of Foreclosure can negatively impact credit scores, but typically less than a foreclosure. |

| Tax Implications | Borrowers may face tax consequences on any forgiven debt, so consulting a tax professional is advisable. |

| Title Issues | It is crucial to ensure there are no liens or title issues that could complicate the transfer of ownership. |

| Legal Advice | Seeking legal counsel before proceeding is recommended to understand all implications of the deed transfer. |

Things You Should Know About This Form

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender in order to avoid the foreclosure process. This option can help the homeowner mitigate the negative impacts of foreclosure on their credit score and provide a more amicable resolution to a struggling mortgage situation.

-

What are the benefits of using a Deed in Lieu of Foreclosure?

There are several advantages to consider:

- The process is generally quicker and less expensive than foreclosure.

- Homeowners can avoid the lengthy foreclosure process, reducing stress and uncertainty.

- It may have a less damaging impact on the homeowner's credit score compared to a foreclosure.

- Homeowners may be able to negotiate terms with the lender, such as the possibility of debt forgiveness.

-

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility typically depends on the lender's policies, but generally, homeowners who are facing financial hardship and are unable to keep up with mortgage payments may qualify. It's important to demonstrate that you have exhausted all other options, such as loan modifications or short sales, before pursuing this route. Lenders will also want to ensure that the property is free of liens and in good condition.

-

How do I initiate the Deed in Lieu of Foreclosure process?

To begin the process, contact your lender to express your interest in a Deed in Lieu of Foreclosure. They will provide you with specific requirements and documentation needed. Be prepared to submit financial information and possibly a hardship letter explaining your situation. Once both parties agree on the terms, you will sign the deed, and the lender will record it with the county.

Documents used along the form

When navigating the complexities of property ownership, especially in the face of foreclosure, several documents often accompany the Illinois Deed in Lieu of Foreclosure. Understanding these forms can empower you to make informed decisions and streamline the process.

- Letter of Intent: This document outlines the borrower's intention to transfer property ownership to the lender voluntarily. It sets the stage for negotiations and demonstrates the borrower's commitment to resolving the situation amicably.

- Release of Liability: This form releases the borrower from any further obligations related to the mortgage after the deed is executed. It provides peace of mind, ensuring that the borrower is not held accountable for any remaining debt associated with the property.

- Lease Agreement Form: To ensure a clear understanding of rental terms, explore our thorough guide on Lease Agreement essentials for both landlords and tenants.

- Property Condition Disclosure: This document details the current condition of the property being transferred. It protects both parties by providing transparency regarding any existing issues, helping the lender assess the property's value and condition.

- Settlement Statement: Also known as a HUD-1 form, this statement outlines all financial aspects of the transaction, including any fees, credits, and debits. It serves as a comprehensive summary, ensuring clarity on the financial terms of the deed in lieu of foreclosure.

- Affidavit of Title: This sworn statement confirms the borrower's ownership of the property and asserts that there are no undisclosed liens or claims against it. It is crucial for the lender to ensure they are receiving clear title to the property.

By familiarizing yourself with these associated documents, you can approach the deed in lieu of foreclosure process with greater confidence. Each form plays a vital role in facilitating a smoother transition and ensuring that all parties are adequately protected throughout the transaction.

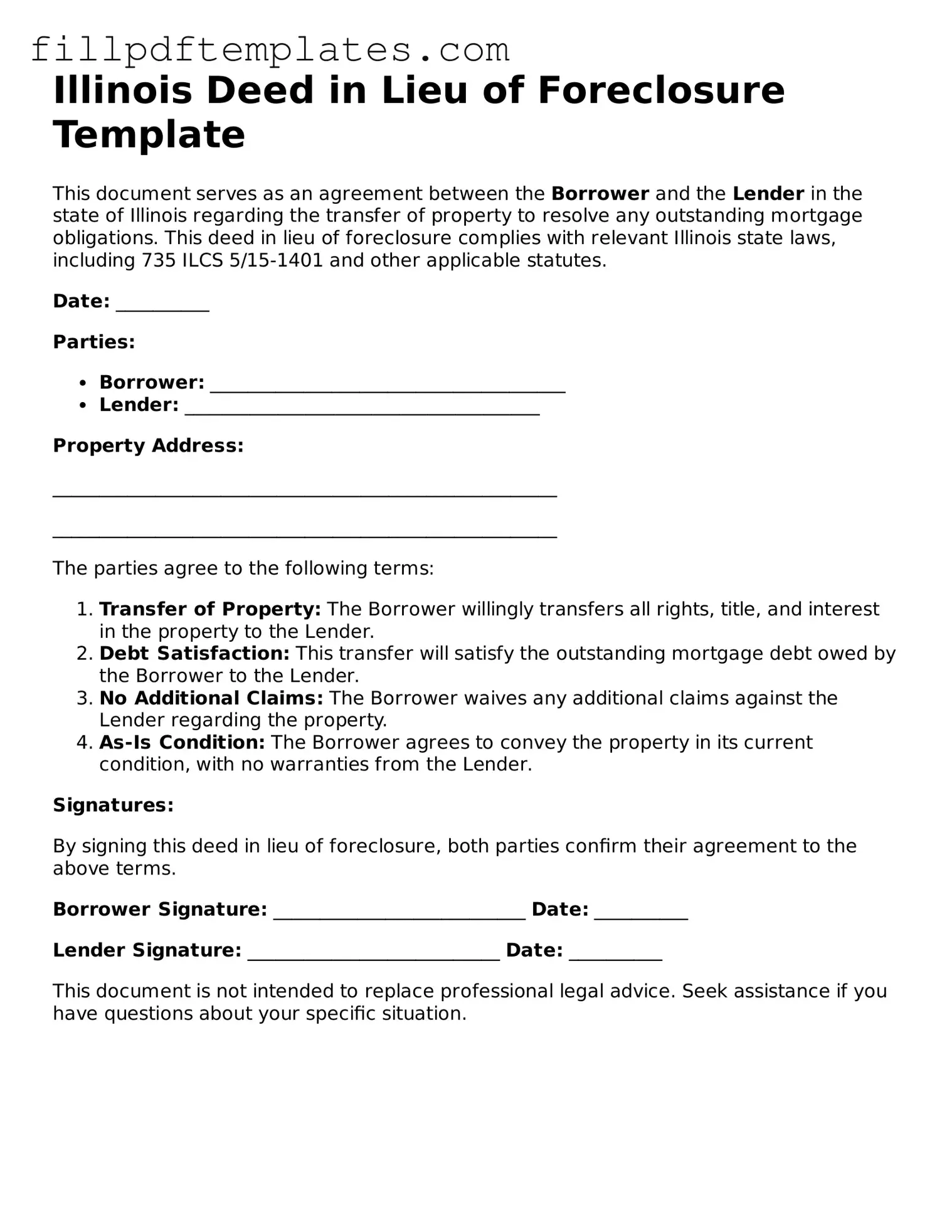

Illinois Deed in Lieu of Foreclosure Preview

Illinois Deed in Lieu of Foreclosure Template

This document serves as an agreement between the Borrower and the Lender in the state of Illinois regarding the transfer of property to resolve any outstanding mortgage obligations. This deed in lieu of foreclosure complies with relevant Illinois state laws, including 735 ILCS 5/15-1401 and other applicable statutes.

Date: __________

Parties:

- Borrower: ______________________________________

- Lender: ______________________________________

Property Address:

______________________________________________________

______________________________________________________

The parties agree to the following terms:

- Transfer of Property: The Borrower willingly transfers all rights, title, and interest in the property to the Lender.

- Debt Satisfaction: This transfer will satisfy the outstanding mortgage debt owed by the Borrower to the Lender.

- No Additional Claims: The Borrower waives any additional claims against the Lender regarding the property.

- As-Is Condition: The Borrower agrees to convey the property in its current condition, with no warranties from the Lender.

Signatures:

By signing this deed in lieu of foreclosure, both parties confirm their agreement to the above terms.

Borrower Signature: ___________________________ Date: __________

Lender Signature: ___________________________ Date: __________

This document is not intended to replace professional legal advice. Seek assistance if you have questions about your specific situation.