Blank Illinois Articles of Incorporation Form

Starting a business in Illinois is an exciting journey, filled with opportunities and challenges. One of the first crucial steps in this process is completing the Illinois Articles of Incorporation form. This essential document lays the groundwork for your corporation by establishing its legal identity. It includes vital information such as the corporation's name, the purpose of its existence, the address of its registered office, and details about its registered agent. Additionally, the form requires information about the corporation's stock structure, including the number of shares authorized and their par value. By providing this information, you not only comply with state regulations but also set the stage for your business's growth and success. Understanding the nuances of the Articles of Incorporation is key to ensuring that your corporation operates smoothly and effectively in the competitive landscape of Illinois. This article will guide you through the major aspects of the form, empowering you to navigate this important step with confidence.

Other Common Articles of Incorporation State Templates

Bizfile Online California - Identifies any special rights or restrictions on shares.

Llc Articles of Organization Nj - Filing with state authorities is a necessary step in incorporation.

The Colorado Real Estate Purchase Agreement form is a legally binding document used in the buying and selling of real estate in Colorado. This form outlines the terms and conditions of the transaction, protecting the interests of both the buyer and the seller. Understanding this agreement is essential for anyone engaged in real estate transactions within the state, and you can find the necessary document at the Real Estate Purchase Agreement form.

Ga Corporation - Some states allow for additional provisions to be included in the Articles.

Similar forms

-

Bylaws: Bylaws outline the internal rules and procedures for a corporation. They govern how the company operates, including the roles of officers and directors, meeting procedures, and voting rights. Like the Articles of Incorporation, they are essential for establishing the framework of the organization.

- Bill of Sale: To ensure a smooth transaction, utilize the detailed bill of sale form guidelines for accurate and legally binding documentation.

-

Certificate of Incorporation: This document is often used interchangeably with the Articles of Incorporation. It serves as proof that a corporation has been legally formed and includes similar information, such as the corporation's name, purpose, and registered agent.

-

Operating Agreement: While typically used by LLCs, an Operating Agreement outlines the management structure and operational procedures of the company. It shares similarities with the Articles of Incorporation in that both documents define the organization's framework and governance.

-

Partnership Agreement: This document governs the relationships and responsibilities of partners in a business. Like the Articles of Incorporation, it sets the rules for operation, decision-making, and profit-sharing, ensuring that all parties understand their roles.

-

Business License: A business license is required to legally operate a business within a specific jurisdiction. While it serves a different purpose, both the business license and the Articles of Incorporation are necessary for compliance with local regulations and for establishing the legitimacy of the business.

Document Properties

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Articles of Incorporation form is used to create a corporation in the state of Illinois. |

| Governing Law | This form is governed by the Illinois Business Corporation Act of 1983. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation to the Illinois Secretary of State. |

| Information Required | Key information includes the corporation's name, purpose, registered agent, and the number of shares authorized. |

| Submission Method | The form can be submitted online, by mail, or in person at the Secretary of State's office. |

Things You Should Know About This Form

-

What is the purpose of the Articles of Incorporation in Illinois?

The Articles of Incorporation serve as the foundational document for a corporation in Illinois. This document establishes the existence of the corporation in the eyes of the law. It outlines essential details such as the corporation's name, purpose, registered agent, and the number of shares authorized for issuance. Filing this document is a critical step in forming a corporation.

-

Who can file the Articles of Incorporation?

Any individual or group of individuals can file the Articles of Incorporation. This includes business owners, entrepreneurs, and legal representatives. However, at least one person must be designated as the registered agent, who will receive legal documents on behalf of the corporation.

-

What information is required in the Articles of Incorporation?

The Articles of Incorporation must include several key pieces of information: the corporation's name, its purpose, the address of the registered office, the name and address of the registered agent, the number of shares the corporation is authorized to issue, and the names and addresses of the incorporators. This information helps to define the corporation's structure and operational framework.

-

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation can be done online or by mail. To file online, visit the Illinois Secretary of State's website and follow the instructions for electronic submission. If filing by mail, complete the form and send it to the appropriate address along with the required filing fee. Ensure that all information is accurate to avoid delays in processing.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Illinois typically ranges from $150 to $250, depending on the type of corporation being formed. Additional fees may apply for expedited processing or other services. It is advisable to check the Illinois Secretary of State's website for the most current fee schedule.

-

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Generally, it takes about 10 to 15 business days for standard processing. Expedited services may be available for an additional fee, which can significantly reduce the processing time. Always check for current processing times as they may fluctuate.

-

What happens after the Articles of Incorporation are approved?

Once the Articles of Incorporation are approved, the corporation officially exists. The state will issue a Certificate of Incorporation, which serves as proof of the corporation's legal status. Following this, the corporation must comply with ongoing requirements, such as filing annual reports and maintaining good standing with the state.

Documents used along the form

When forming a corporation in Illinois, the Articles of Incorporation is just the beginning. There are several other important documents and forms that you may need to complete to ensure your corporation is set up properly. Here’s a brief overview of some of these essential documents.

- Bylaws: Bylaws outline the internal rules and regulations governing the corporation. They cover topics such as the management structure, the roles of officers, and procedures for meetings. Having clear bylaws helps prevent disputes and ensures smooth operations.

- Initial Report: This document must be filed within 60 days of incorporation. It provides the state with information about the corporation's address, officers, and registered agent. The Initial Report helps keep your corporate records current and compliant with state requirements.

- Employer Identification Number (EIN): An EIN is necessary for tax purposes and is required if your corporation plans to hire employees or open a bank account. You can obtain an EIN from the IRS, and it’s a straightforward process that can often be completed online.

- Business Licenses and Permits: Depending on your business type and location, you may need various licenses and permits to operate legally. This can include local business licenses, zoning permits, and state-specific licenses. Researching your requirements is crucial to avoid fines or interruptions in your business.

- Release of Liability Form: In certain activities, it may also be prudent to include a Waiver of Liability to protect your corporation from potential legal claims arising from participant actions.

- Shareholder Agreements: If your corporation has multiple shareholders, a shareholder agreement is beneficial. This document outlines the rights and responsibilities of shareholders, including how shares can be transferred and how decisions are made. It helps prevent misunderstandings and provides a clear framework for governance.

- Annual Report: After incorporation, corporations must file an Annual Report with the state to maintain good standing. This report updates the state on any changes in the corporation's structure or operations and typically includes information about the corporation’s address, officers, and registered agent.

Each of these documents plays a vital role in the successful establishment and ongoing operation of a corporation in Illinois. Being thorough and organized with these filings not only ensures compliance with state laws but also sets a solid foundation for your business's future.

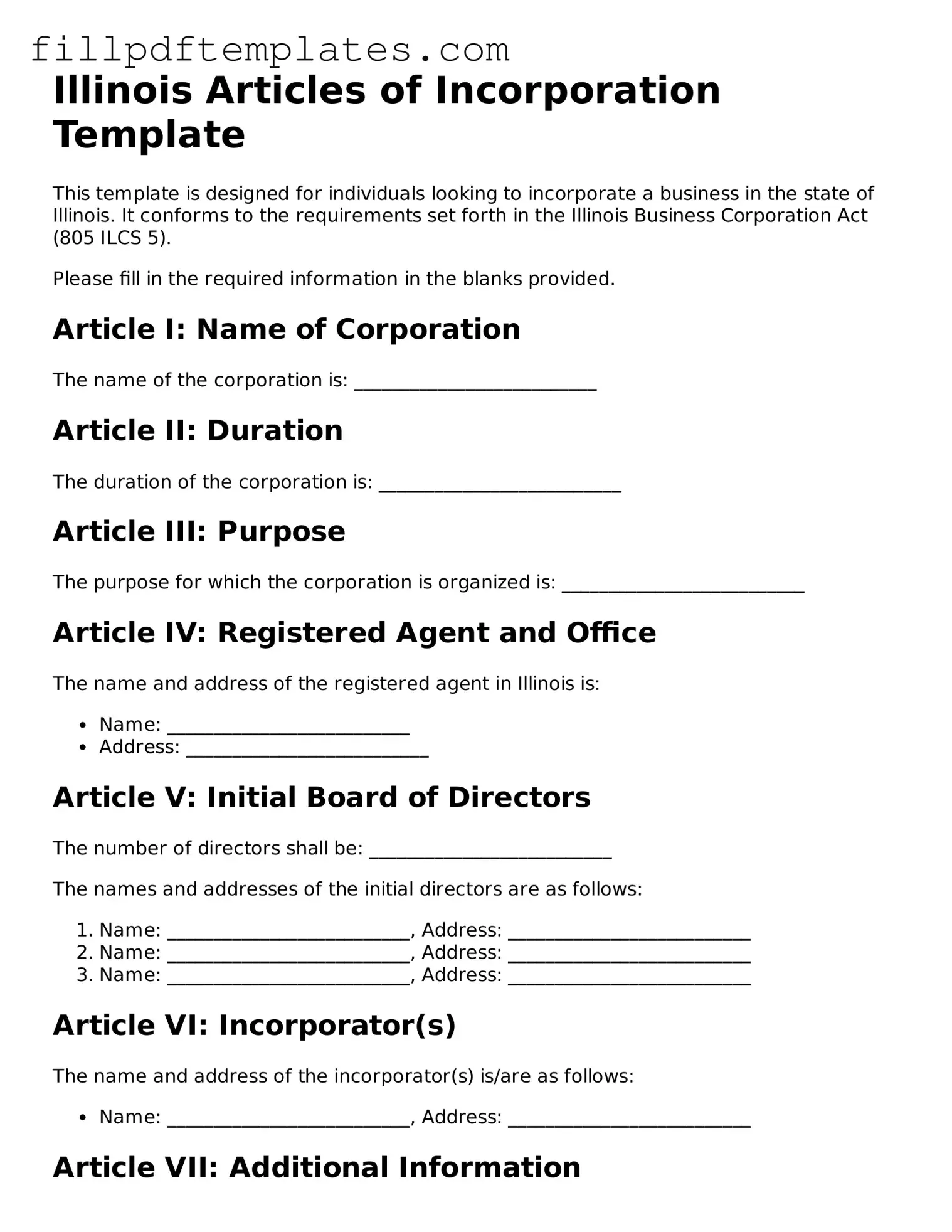

Illinois Articles of Incorporation Preview

Illinois Articles of Incorporation Template

This template is designed for individuals looking to incorporate a business in the state of Illinois. It conforms to the requirements set forth in the Illinois Business Corporation Act (805 ILCS 5).

Please fill in the required information in the blanks provided.

Article I: Name of Corporation

The name of the corporation is: __________________________

Article II: Duration

The duration of the corporation is: __________________________

Article III: Purpose

The purpose for which the corporation is organized is: __________________________

Article IV: Registered Agent and Office

The name and address of the registered agent in Illinois is:

- Name: __________________________

- Address: __________________________

Article V: Initial Board of Directors

The number of directors shall be: __________________________

The names and addresses of the initial directors are as follows:

- Name: __________________________, Address: __________________________

- Name: __________________________, Address: __________________________

- Name: __________________________, Address: __________________________

Article VI: Incorporator(s)

The name and address of the incorporator(s) is/are as follows:

- Name: __________________________, Address: __________________________

Article VII: Additional Information

Optional additional provisions may be included here: __________________________

Signature

Executed on this _____ day of __________, 20____.

Incorporator's Signature: __________________________

Print Name: __________________________

Title: __________________________

By completing this form, the incorporator confirms that all information provided is true and correct to the best of their knowledge.