Fill a Valid Goodwill donation receipt Template

When you donate items to Goodwill, you not only contribute to a worthy cause but also gain the opportunity to receive a donation receipt form, which can be beneficial for tax purposes. This form serves as a record of your charitable contribution, detailing the items donated, their estimated value, and the date of the donation. It's important to understand that while Goodwill provides a general guideline for estimating the value of donated items, the responsibility for determining the fair market value ultimately lies with the donor. Additionally, the receipt includes space for your name and address, ensuring that your donation is properly documented. By keeping this receipt, you can claim deductions on your tax return, which can lead to significant savings. Understanding how to fill out and utilize this form effectively can enhance your charitable giving experience and provide financial benefits during tax season.

Additional PDF Templates

Girl Friend Applications - An early riser who loves morning coffee dates.

To ensure a smooth and lawful transaction when buying or selling a dirt bike in New York, it is essential to utilize a Dirt Bike Bill of Sale form, which captures important specifics such as the identities of both parties, sale price, and the dirt bike’s description. For those needing to access this form, the form is available here, providing a straightforward solution to facilitate the ownership transfer process.

How to Print Payroll Checks - This form supports budgeting and forecasting by detailing labor costs for businesses.

Royal Caribbean Cruise Single Parent - Required by Royal Caribbean for traveler compliance.

Similar forms

- Tax Deduction Receipt: Similar to a Goodwill donation receipt, this document serves as proof of a charitable contribution, allowing donors to claim deductions on their tax returns.

- Charitable Contribution Statement: This statement outlines the details of a donation made to a nonprofit organization, confirming the donor's generosity and eligibility for tax benefits.

- Donation Acknowledgment Letter: Often sent by charities, this letter thanks the donor for their contribution and provides essential details for tax purposes, much like the Goodwill receipt.

- Cash Donation Receipt: This receipt is issued for cash donations, providing similar information as the Goodwill form, including the amount donated and the date of the contribution.

- In-Kind Donation Receipt: Used for non-cash donations, this document details items donated, their estimated value, and serves a similar purpose as the Goodwill receipt for tax deductions.

- Hold Harmless Agreement: This legal document ensures that one party will not hold the other liable for risks or losses associated with certain services or property use, similar to how the Hold Harmless Agreement protects parties from legal actions.

- Nonprofit Organization Receipt: This document confirms a donation made to a nonprofit and includes details such as the organization’s name and the amount donated, paralleling the Goodwill receipt.

- Itemized Donation List: While not a formal receipt, this list provides an inventory of items donated, similar to the Goodwill form in that it can help substantiate tax deductions.

- Volunteer Hours Confirmation: This document acknowledges the time volunteered, which can sometimes be converted into a monetary value for tax purposes, similar to how donations are treated.

- Fundraising Event Receipt: Issued after participating in a fundraising event, this receipt confirms the donation made during the event, akin to the Goodwill donation receipt.

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Goodwill donation receipt form serves as proof of donation for tax purposes. |

| Tax Deductibility | Donations to Goodwill are generally tax-deductible, provided they meet IRS guidelines. |

| Value Assessment | Donors are responsible for determining the fair market value of their donated items. |

| Itemization Requirement | Donors should itemize their donations on the receipt to support their tax claims. |

| State Variations | Some states may have specific forms or requirements for donation receipts. |

| IRS Form 8283 | For donations exceeding $500, donors must complete IRS Form 8283 in addition to the receipt. |

| Record Keeping | Donors should keep the receipt for their records and potential audits. |

| Donation Acknowledgment | Goodwill provides acknowledgment of the donation, which can enhance the donor's tax records. |

| Governing Law | IRS regulations govern the tax deductibility of donations across all states. |

| Electronic Receipts | Goodwill may offer electronic receipts, which are equally valid for tax purposes. |

Things You Should Know About This Form

-

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided to donors who give items to Goodwill Industries. This form serves as proof of the donation and can be used for tax purposes. It typically includes details such as the date of the donation, a description of the items donated, and the donor's name and contact information.

-

Why do I need a donation receipt?

The donation receipt is important for several reasons. First, it allows you to claim a tax deduction for your charitable contributions when you file your taxes. Second, it serves as a record of your generosity, which can be helpful for personal budgeting or financial planning.

-

How do I obtain a Goodwill donation receipt?

When you donate items to Goodwill, simply ask for a receipt at the time of your donation. Goodwill staff will provide you with a form that details your donation. Make sure to keep this receipt in a safe place until you need it for tax purposes.

-

What information is included on the receipt?

The receipt typically includes the following information:

- The date of the donation

- A description of the items donated

- The estimated value of the items (if applicable)

- The donor's name and contact information

- Goodwill's name and address

-

Can I estimate the value of my donated items?

Yes, you can estimate the value of your donated items. However, it is important to be reasonable and fair in your estimation. You can refer to online resources or thrift store pricing guides to help determine the value of similar items.

-

What types of items can I donate to Goodwill?

Goodwill accepts a wide range of items, including clothing, household goods, electronics, and furniture. However, there are some restrictions. Items must be in good condition and suitable for resale. Items that are damaged, hazardous, or perishable are typically not accepted.

-

Do I need to itemize my donations on my tax return?

If you are claiming a deduction for your donations, you will need to itemize them on your tax return. This means listing each item you donated and its estimated value. Keep your Goodwill donation receipt as evidence of your contributions.

-

What if I lose my donation receipt?

If you lose your donation receipt, it may be challenging to claim your tax deduction. However, you can try contacting the Goodwill location where you made your donation. They may be able to provide a duplicate receipt or help you reconstruct your donation history.

-

Is there a limit to how much I can deduct for my donations?

While there is no specific limit on the amount you can deduct for charitable donations, the IRS does have guidelines. Generally, you can deduct contributions up to 60% of your adjusted gross income. It’s wise to consult a tax professional for personalized advice.

-

Can I donate items that I purchased on sale?

Yes, you can donate items that you purchased on sale. The value you claim on your tax return should reflect the fair market value of the items at the time of donation, regardless of what you paid for them. This means you can donate items bought at a discount and still claim their estimated value.

Documents used along the form

When donating items to organizations like Goodwill, it's important to keep track of various documents. These documents can help you with tax deductions and provide proof of your charitable contributions. Here are five other forms and documents that are often used alongside the Goodwill donation receipt form.

- Donation Inventory List: This is a detailed list of all items donated. It helps you keep track of what you gave and can be useful for both personal records and tax purposes.

- Tax Deduction Worksheet: This worksheet helps you calculate the value of your donations. It can assist you in determining how much you can claim on your tax return.

- Chick-fil-A Job Application Form: For those looking to join the team at Chick-fil-A, it's crucial to accurately complete the application process. Interested individuals can begin by accessing the Chick-fil-A Application for Employment, which collects necessary personal information, work experience, and availability.

- Appraisal Report: If you donate high-value items, an appraisal report may be necessary. This document provides an expert evaluation of the item's worth, which can be important for tax deductions.

- Charitable Contribution Statement: Some organizations provide this statement, summarizing your donations over a year. It serves as an official record for tax filing.

- IRS Form 8283: This form is required for non-cash charitable contributions exceeding $500. It provides the IRS with information about your donated items and their value.

Keeping these documents organized can simplify the process of claiming tax deductions and ensure that you have proof of your generous contributions. Always consult a tax professional if you have questions about your specific situation.

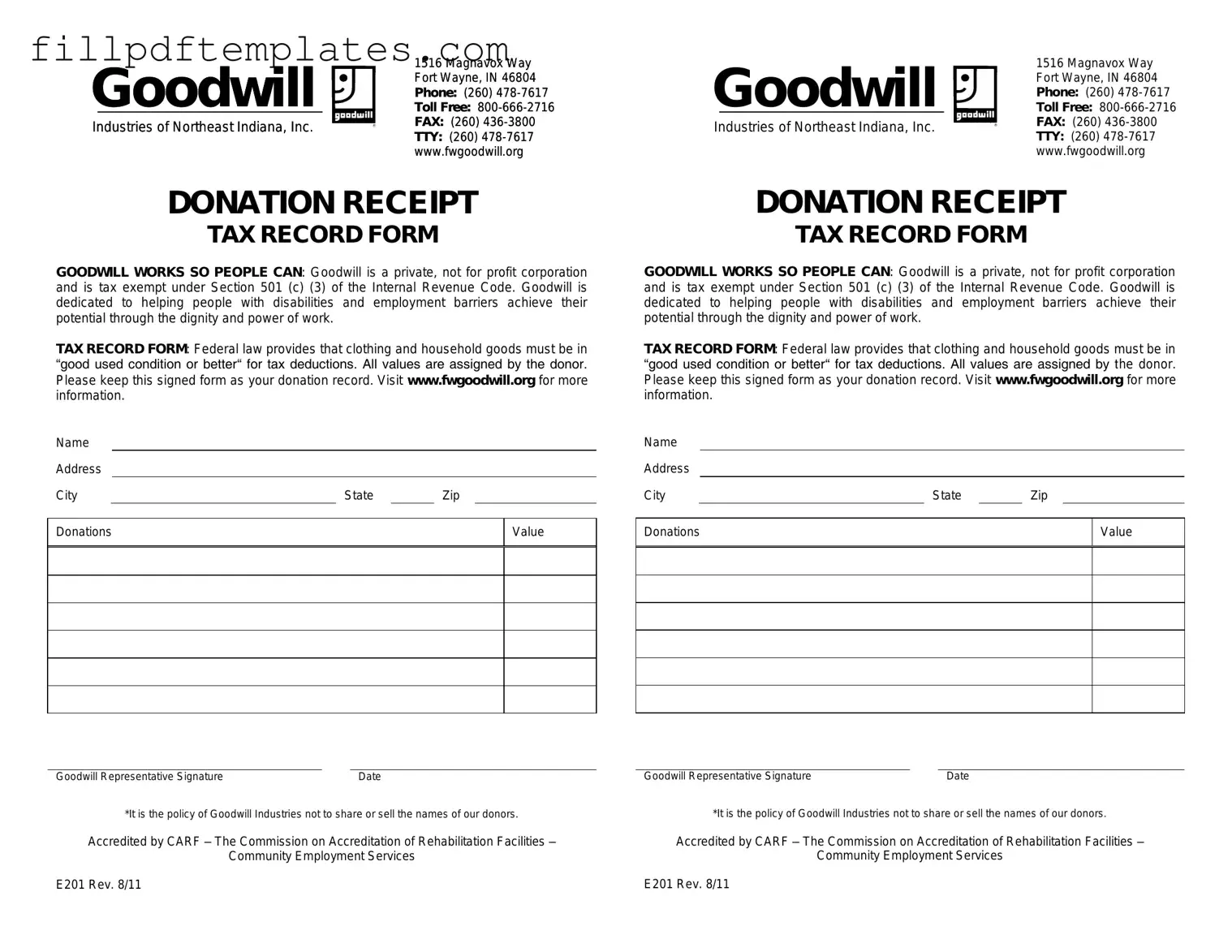

Goodwill donation receipt Preview

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11