Fill a Valid Gift Letter Template

When it comes to financing a home, many buyers rely on assistance from family and friends. The Gift Letter form plays a crucial role in this process, providing a formal declaration that funds given for a down payment are indeed a gift and not a loan. This document typically includes essential details such as the donor's name, relationship to the recipient, the amount of the gift, and a statement confirming that repayment is not expected. Lenders often require this letter to ensure compliance with their guidelines and to avoid any potential complications during the mortgage approval process. By clearly outlining the nature of the funds, the Gift Letter form helps to establish transparency and trust between all parties involved. Understanding its importance can streamline the home-buying experience and contribute to a smoother transaction overall.

Additional PDF Templates

Profits or Loss From Business - Being proactive in record-keeping simplifies the Schedule C filing process.

The Massachusetts Transfer-on-Death Deed form is a legal document that enables individuals to efficiently transfer real estate to beneficiaries upon their death, sidestepping the probate process. This tool offers a straightforward way to ensure that property is passed on according to one’s wishes, providing peace of mind for both the property owner and their loved ones. For further details and to access the form, visit todform.com/blank-massachusetts-transfer-on-death-deed/ as you simplify your estate planning.

Tattoo Contract - Amendments to the agreement can only be made in writing by authorized individuals.

Texas Odometer Disclosure Statement - Two specific options allow sellers to disclose odometer discrepancies explicitly.

Similar forms

-

Affidavit of Support: This document is often used by individuals who want to sponsor a relative for immigration purposes. Like a gift letter, it outlines the financial support being provided, ensuring that the recipient can meet their financial needs.

-

Loan Agreement: A loan agreement details the terms under which one party lends money to another. Similar to a gift letter, it specifies the amount, purpose, and repayment terms, but it is legally binding and expects repayment.

-

Promissory Note: This is a written promise to pay a specified amount to a designated person. Like a gift letter, it outlines the amount and the parties involved, but it involves a legal obligation to repay the borrowed funds.

-

Financial Statement: This document provides a summary of an individual’s financial situation. It can be similar to a gift letter in that it may include information about assets and liabilities, showing the donor's ability to provide a gift.

-

Trust Agreement: A trust agreement outlines how assets are to be managed for the benefit of another party. It shares similarities with a gift letter in that it can specify how and when gifts are distributed.

-

Property Deed: A property deed transfers ownership of real estate from one party to another. It is similar to a gift letter in that it documents the transfer of a significant asset without monetary exchange.

-

Inheritance Document: This document outlines the distribution of assets upon someone’s death. It is akin to a gift letter in that it details the transfer of wealth, though it occurs posthumously.

-

Notice to Quit: This form is crucial for landlords to officially request tenants to vacate a property and can be obtained from arizonaformpdf.com to ensure legal compliance.

-

Charitable Donation Receipt: This receipt acknowledges a donation made to a charitable organization. Similar to a gift letter, it confirms the transfer of funds and can be used for tax purposes.

-

Settlement Agreement: This document resolves disputes between parties, often involving the transfer of funds or assets. Like a gift letter, it can specify the conditions under which assets are transferred.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | A Gift Letter form is used to document a financial gift, often for a home purchase, ensuring clarity between the donor and recipient. |

| Donor's Intent | The form typically includes a statement from the donor indicating that the funds are a gift and do not need to be repaid. |

| Common Usage | Gift Letters are frequently required by lenders during the mortgage application process to verify the source of the down payment. |

| State-Specific Forms | Some states may have specific requirements or variations of the Gift Letter form; for example, California may require additional disclosures under state law. |

| Signatures Required | Both the donor and the recipient usually need to sign the form to validate the transaction and confirm understanding. |

| Tax Implications | Gifts over a certain amount may have tax implications for the donor, so it's important to consult tax regulations or a professional. |

Things You Should Know About This Form

-

What is a Gift Letter?

A Gift Letter is a written document that confirms a monetary gift given to an individual, often used in the context of real estate transactions. It outlines the donor's intent to gift funds, clarifying that the money does not need to be repaid.

-

Who typically needs a Gift Letter?

Individuals who are applying for a mortgage may need a Gift Letter if they receive financial assistance from family or friends for their down payment. Lenders often require this documentation to ensure that the funds are a gift and not a loan.

-

What information should be included in a Gift Letter?

A Gift Letter should include the following information:

- The donor's name, address, and contact information

- The recipient's name and relationship to the donor

- The amount of the gift

- A statement confirming that the funds are a gift and do not need to be repaid

- The date of the gift

-

Do I need to have the Gift Letter notarized?

Notarization is not always required, but some lenders may request it for additional verification. It is advisable to check with the lender for their specific requirements regarding notarization.

-

Can a Gift Letter be used for other purposes besides home purchases?

Yes, while Gift Letters are commonly associated with real estate transactions, they can also be used for other financial needs, such as education expenses or starting a business. The key factor is that the letter must clearly state the intent of the gift.

-

Are there tax implications for the donor or recipient?

Gift tax rules may apply. The donor should be aware of the annual gift tax exclusion limit set by the IRS. If the gift exceeds this limit, the donor may need to file a gift tax return. Recipients typically do not owe taxes on the gift received.

-

How does a Gift Letter affect my mortgage application?

A Gift Letter provides lenders with reassurance that the funds used for the down payment are legitimate and not a loan. This can positively impact the mortgage application process by demonstrating financial stability and reducing the risk of default.

-

Can the Gift Letter be revoked?

Once a Gift Letter is signed and the funds have been transferred, it cannot be revoked. The donor's intent must be clear, and any changes should be documented formally to avoid misunderstandings.

-

Where can I find a template for a Gift Letter?

Many online resources offer templates for Gift Letters. It is important to ensure that the template complies with the requirements of the lender and includes all necessary information. Customization may be necessary to fit specific situations.

Documents used along the form

When it comes to securing a mortgage or financing a home, the Gift Letter form is an essential document. However, it often works in conjunction with several other forms and documents that help clarify the source of funds and ensure compliance with lending requirements. Below is a list of commonly used documents that you may encounter alongside the Gift Letter.

- Bank Statements: These statements provide a clear picture of the donor's financial status, showing that they have sufficient funds to make the gift.

- Proof of Relationship: This document may include items like birth certificates or marriage licenses to establish the relationship between the donor and the recipient.

- Last Will and Testament Form: To effectively manage estate planning, consider our comprehensive Last Will and Testament guidance to ensure your wishes are clearly outlined and legally recorded.

- Gift Tax Return (Form 709): If the gift exceeds a certain amount, the donor may need to file this return to report the gift to the IRS.

- Loan Application: This form outlines the borrower's financial situation and is essential for the lender to evaluate the mortgage request.

- Purchase Agreement: This document details the terms of the home purchase, including the sale price and any contingencies, serving as a reference for all parties involved.

- Credit Report: Lenders typically review the borrower's credit report to assess their creditworthiness and determine the terms of the loan.

- Income Verification Documents: These may include pay stubs, W-2 forms, or tax returns that confirm the borrower's income and ability to repay the loan.

- Title Insurance Policy: This document protects the lender and borrower against any claims or disputes regarding the property title.

- Closing Disclosure: This form provides a detailed breakdown of the final loan terms, closing costs, and other financial details before the closing date.

Each of these documents plays a critical role in the home financing process. Together, they create a comprehensive picture that helps lenders make informed decisions while ensuring that all parties are protected and informed throughout the transaction.

Gift Letter Preview

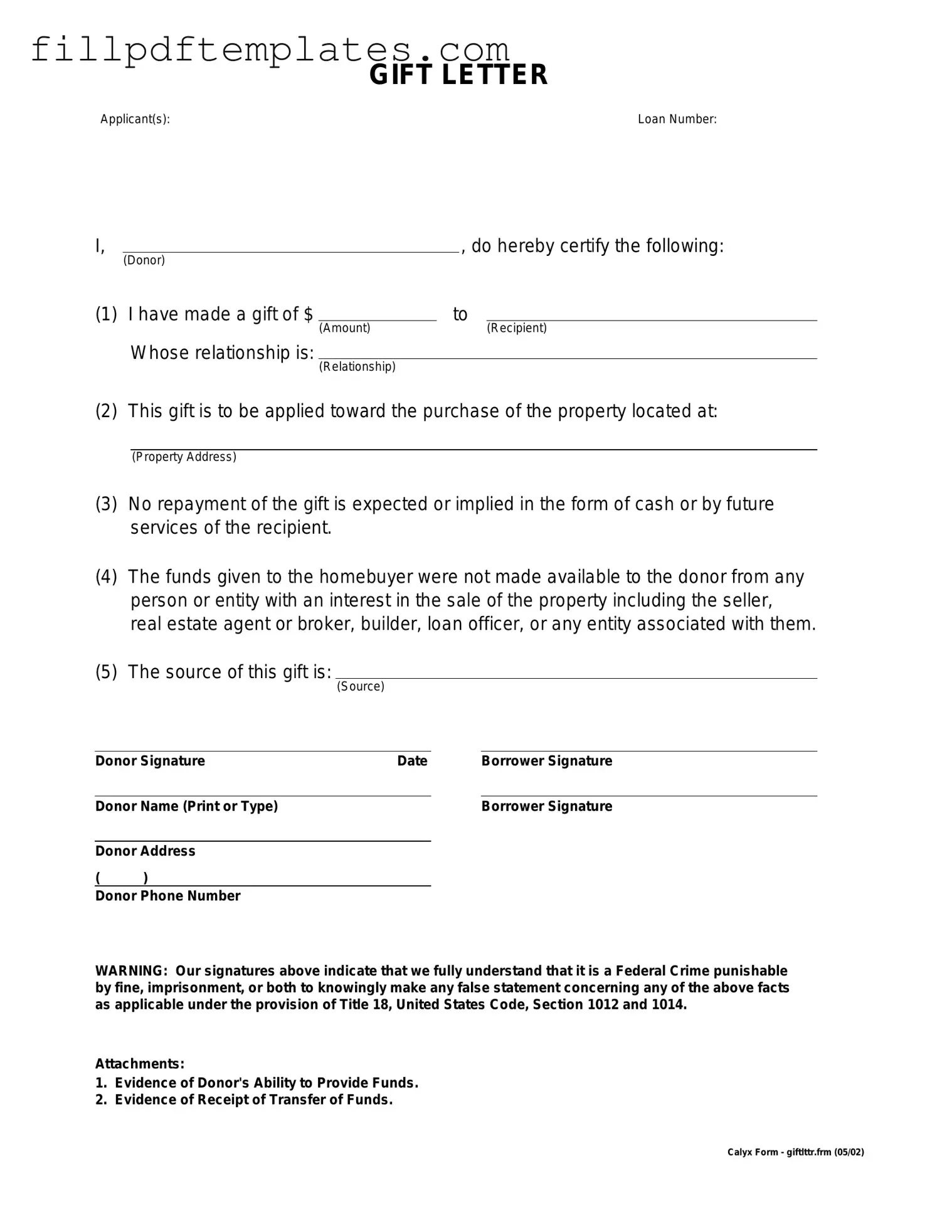

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)