Valid Gift Deed Form

When considering the transfer of property or assets without the exchange of money, a Gift Deed form becomes an essential legal instrument. This document serves as a formal declaration of the donor's intent to gift their property to the recipient, known as the donee. It typically includes crucial details such as the names of both parties, a clear description of the property being gifted, and any terms or conditions that may apply to the transfer. Additionally, the Gift Deed must be signed and notarized to ensure its validity and to protect the interests of both parties involved. Understanding the significance of this form is vital, as it not only facilitates the smooth transfer of ownership but also helps avoid potential disputes in the future. Whether you are giving a family heirloom, real estate, or other valuable assets, knowing how to properly execute a Gift Deed can provide peace of mind and legal clarity.

Gift Deed - Customized for Each State

Different Types of Gift Deed Forms:

What Is a Deed in Lieu of Foreclosure? - By signing this deed, the borrower can potentially minimize negative impacts on their credit score.

Filing the Washington Articles of Incorporation form is essential for anyone looking to start a business in Washington State, as it provides the necessary legal foundation for the corporation. For more detailed guidance on this important step, you can refer to the Articles of Incorporation.

Similar forms

Quitclaim Deed: This document transfers ownership of property from one party to another. Unlike a Gift Deed, it does not guarantee that the property is free of claims, but it serves a similar purpose in transferring rights.

Warranty Deed: This type of deed provides a guarantee that the property title is clear. Like a Gift Deed, it facilitates the transfer of ownership, but it offers more legal protection to the buyer.

- Rental Application: A Rental Application seeks essential information from potential tenants, much like other documents in property transactions. If you're interested in creating one, you can access a useful template here: https://legalpdfdocs.com/.

Transfer on Death Deed: This deed allows property to be passed to beneficiaries upon the owner’s death. It is similar to a Gift Deed in that it transfers ownership, but it takes effect only after the owner's death.

Bill of Sale: While typically used for personal property, a Bill of Sale documents the transfer of ownership. It is similar to a Gift Deed in that it can be used to give property without payment.

Trust Agreement: This document establishes a trust and outlines how property will be managed and distributed. It can be similar to a Gift Deed as it may involve transferring assets to beneficiaries, often without immediate compensation.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A gift deed is a legal document that allows a person to transfer ownership of property to another person without any exchange of money. |

| Purpose | It is used to make a gift of real estate or personal property, ensuring that the transfer is legally recognized. |

| Consideration | Gift deeds do not require consideration, meaning no payment is necessary for the transfer to be valid. |

| Governing Law | In the United States, the laws governing gift deeds vary by state. For example, California Civil Code Section 1146 applies to gift deeds in California. |

| Requirements | Typically, a gift deed must be in writing, signed by the donor, and notarized to be legally binding. |

| Revocation | Once executed, a gift deed generally cannot be revoked unless specific conditions are met, such as fraud or undue influence. |

| Tax Implications | Gift deeds may have tax implications for both the donor and the recipient, including potential gift tax liabilities. |

| Title Transfer | Ownership of the property is transferred to the recipient upon execution of the gift deed, assuming all legal requirements are met. |

| Recording | It is advisable to record the gift deed with the local county recorder's office to provide public notice of the ownership transfer. |

| Legal Advice | Consulting with a legal professional is recommended to ensure compliance with state laws and to address any potential issues. |

Things You Should Know About This Form

-

What is a Gift Deed?

A Gift Deed is a legal document that transfers ownership of property or assets from one person to another without any exchange of money. It is a way for the giver, known as the donor, to give a gift to the recipient, known as the donee.

-

Who can create a Gift Deed?

Any person who is the legal owner of a property or asset can create a Gift Deed. The donor must have the legal capacity to transfer ownership, meaning they should be of legal age and mentally competent.

-

What types of property can be transferred using a Gift Deed?

A Gift Deed can be used to transfer various types of property, including real estate, vehicles, bank accounts, and personal belongings. However, it is important to check local laws as some types of property may have specific requirements.

-

Is a Gift Deed taxable?

In the United States, gifts above a certain value may be subject to gift tax. The donor is typically responsible for reporting the gift to the IRS. It's advisable to consult a tax professional to understand any tax implications related to the gift.

-

Do I need witnesses for a Gift Deed?

Most states require that a Gift Deed be signed in the presence of witnesses. This helps verify the authenticity of the document. Check your state’s requirements to ensure compliance.

-

How do I revoke a Gift Deed?

Revoking a Gift Deed usually requires a formal process. The donor may need to create a new legal document stating the intent to revoke the gift. It's important to follow local laws to ensure the revocation is valid.

-

Can a Gift Deed be contested?

Yes, a Gift Deed can be contested in court. If someone believes the gift was made under duress, fraud, or if the donor lacked capacity, they may challenge the deed. Legal advice is recommended in such cases.

-

What happens if the donor dies before the Gift Deed is executed?

If the donor passes away before the Gift Deed is executed, the property typically becomes part of the donor's estate. The intended recipient may need to go through probate to claim the gift.

-

How do I ensure my Gift Deed is valid?

To ensure validity, the Gift Deed should be in writing, signed by the donor, and witnessed as required by your state. It is also advisable to have the deed notarized and recorded with the appropriate local authority.

-

Can a Gift Deed be used for future gifts?

A Gift Deed typically applies to a specific transfer of property at a specific time. For future gifts, a new Gift Deed would need to be created for each transaction.

Documents used along the form

A Gift Deed is a crucial document used to transfer ownership of property or assets from one individual to another without any exchange of money. When preparing a Gift Deed, several other forms and documents may also be necessary to ensure a smooth transfer and to comply with legal requirements. Below is a list of documents often associated with a Gift Deed.

- Letter of Gift Acceptance: This document confirms that the recipient accepts the gift. It serves as a formal acknowledgment of the transfer and can help prevent disputes in the future.

- Property Appraisal: An appraisal provides an estimated value of the property being gifted. This can be important for tax purposes and ensures both parties understand the value of the transaction.

- Title Transfer Form: This form is used to officially transfer the title of the property from the giver to the recipient. It is essential for updating public records and establishing legal ownership.

- Tax Documents: Depending on the value of the gift, tax documents may be required. This can include a gift tax return to report the transfer to the IRS and ensure compliance with tax regulations.

- Witness Statements: Witnesses may be required to sign the Gift Deed or related documents. Their statements can provide additional validation of the gift and the intent behind it.

- Notarization Certificate: Notarization adds a layer of authenticity to the Gift Deed. A notary public verifies the identities of the parties involved and ensures that the document is signed voluntarily.

- Affidavit of Gift: This sworn statement outlines the details of the gift and can be used to clarify the intentions of the giver. It may serve as additional evidence in case of disputes.

- Transfer-on-Death Deed: This document enables property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. For more information, you can visit transferondeathdeedform.com/massachusetts-transfer-on-death-deed.

- Power of Attorney: In some cases, a power of attorney may be necessary if the giver cannot be present to sign the Gift Deed. This document allows another person to act on their behalf.

Each of these documents plays a vital role in the process of gifting property or assets. They help to protect the interests of both the giver and the recipient, ensuring that the transfer is legally sound and recognized by authorities. Proper documentation is essential for a successful and conflict-free transaction.

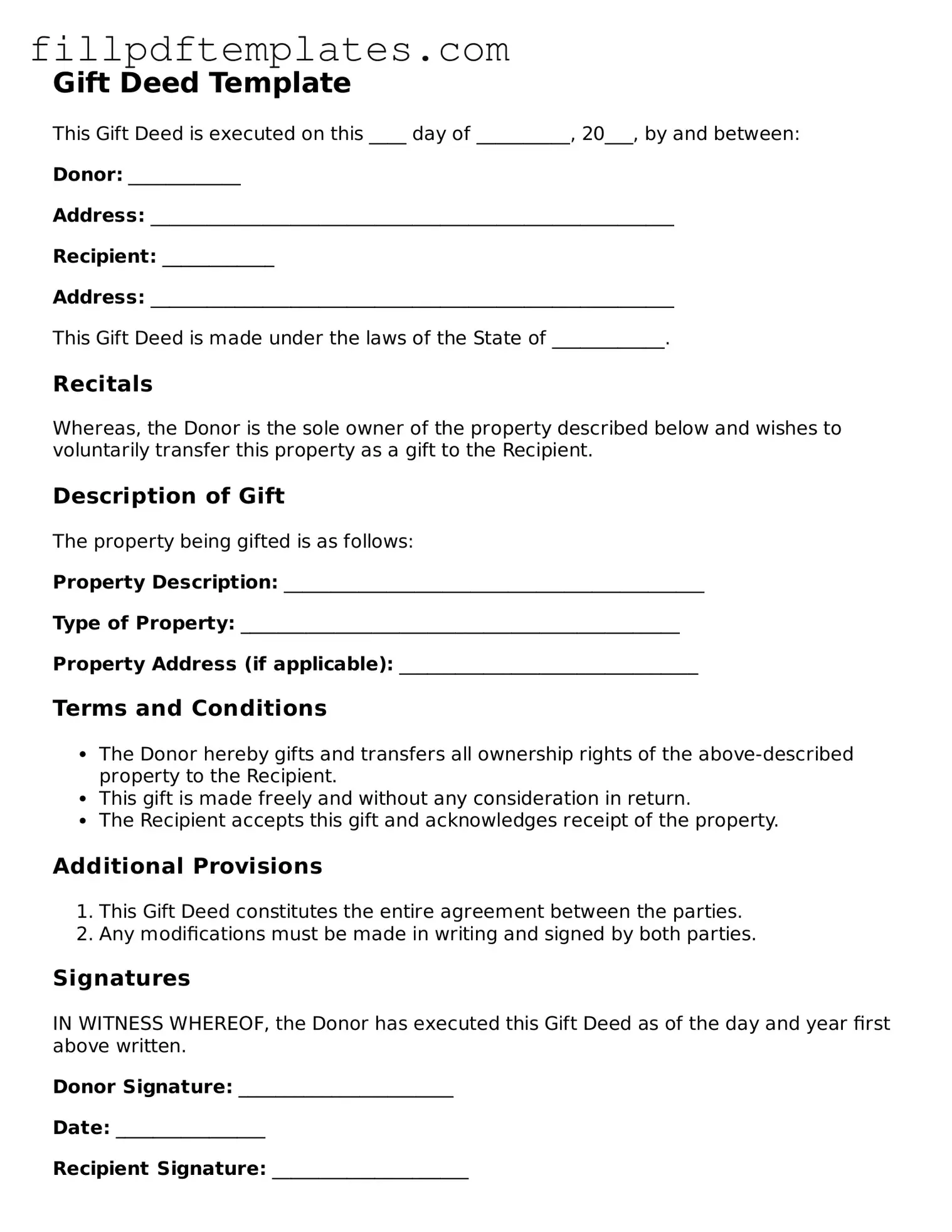

Gift Deed Preview

Gift Deed Template

This Gift Deed is executed on this ____ day of __________, 20___, by and between:

Donor: ____________

Address: ________________________________________________________

Recipient: ____________

Address: ________________________________________________________

This Gift Deed is made under the laws of the State of ____________.

Recitals

Whereas, the Donor is the sole owner of the property described below and wishes to voluntarily transfer this property as a gift to the Recipient.

Description of Gift

The property being gifted is as follows:

Property Description: _____________________________________________

Type of Property: _______________________________________________

Property Address (if applicable): ________________________________

Terms and Conditions

- The Donor hereby gifts and transfers all ownership rights of the above-described property to the Recipient.

- This gift is made freely and without any consideration in return.

- The Recipient accepts this gift and acknowledges receipt of the property.

Additional Provisions

- This Gift Deed constitutes the entire agreement between the parties.

- Any modifications must be made in writing and signed by both parties.

Signatures

IN WITNESS WHEREOF, the Donor has executed this Gift Deed as of the day and year first above written.

Donor Signature: _______________________

Date: ________________

Recipient Signature: _____________________

Date: ________________