Blank Georgia Transfer-on-Death Deed Form

The Georgia Transfer-on-Death Deed form is a valuable estate planning tool that allows property owners to transfer real estate to their chosen beneficiaries without the need for probate. This form provides a straightforward way to ensure that your property passes directly to your heirs upon your death, streamlining the transfer process and minimizing potential disputes. By completing this deed, property owners can maintain control of their assets during their lifetime while designating who will receive their property after they pass away. The form requires specific information, including the names of the property owners, the beneficiaries, and a legal description of the property being transferred. Additionally, it must be properly executed and recorded to be legally effective. Understanding the nuances of this form can help individuals make informed decisions about their estate planning needs and secure peace of mind for themselves and their loved ones.

Other Common Transfer-on-Death Deed State Templates

Free Printable Transfer on Death Deed Form Florida - Many people find a Transfer-on-Death Deed aligns well with their overall life and estate planning goals.

Transfer on Death Deed California Common Questions - Changes in family dynamics may prompt a review and amendment of the deed as necessary.

Where Can I Get a Tod Form - It is essential to communicate your intentions to your beneficiaries to avoid confusion later.

A Hold Harmless Agreement form in Iowa is designed to ensure that one party is not held liable for the risks, liabilities, or damages that the other party may incur during their association. This legal document, often used in various contracts and transactions, serves to protect individuals and organizations from legal and financial responsibilities. Its application varies widely, encompassing events, services, and activities where potential risks are transferred from one party to another, making it essential to consider resources like the Hold Harmless Agreement for proper understanding and usage.

Can a Transfer on Death Deed Be Contested - Distributing property through this deed can simplify inheritance processes in families.

Similar forms

- Will: A will outlines how a person's assets will be distributed upon their death. Like a Transfer-on-Death Deed, it allows individuals to specify beneficiaries but requires probate, which can be a lengthy process.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they are managed after death. Similar to a Transfer-on-Death Deed, it avoids probate, allowing for a smoother transition of assets to beneficiaries.

- Recommendation Letter Form: When endorsing candidates for various opportunities, utilize our comprehensive Recommendation Letter template to highlight their qualifications effectively.

- Beneficiary Designation: Commonly used for accounts like life insurance and retirement plans, this document allows individuals to name beneficiaries directly. It functions similarly to a Transfer-on-Death Deed by transferring assets directly upon death without going through probate.

- Joint Tenancy with Right of Survivorship: This arrangement allows two or more people to own property together. When one owner dies, their share automatically passes to the surviving owner(s), akin to how a Transfer-on-Death Deed transfers property directly to named beneficiaries.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Georgia to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The use of Transfer-on-Death Deeds in Georgia is governed by O.C.G.A. § 44-6-70 through § 44-6-77. |

| Requirements | The deed must be signed by the property owner and recorded with the county clerk's office to be effective. |

| Revocation | Property owners can revoke the deed at any time before their death by recording a revocation document. |

Things You Should Know About This Form

-

What is a Transfer-on-Death Deed in Georgia?

A Transfer-on-Death Deed (TODD) is a legal document that allows a property owner to transfer their real estate to a designated beneficiary upon their death. This deed helps avoid the probate process, making it easier and quicker for beneficiaries to inherit the property.

-

Who can create a Transfer-on-Death Deed?

Any individual who owns real estate in Georgia can create a Transfer-on-Death Deed. The property owner must be of sound mind and at least 18 years old. It is important that the owner clearly identifies themselves and the property in the deed.

-

How do I fill out a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, you will need to provide specific information, including:

- The name and address of the property owner.

- A legal description of the property being transferred.

- The name and address of the beneficiary.

- The signature of the property owner.

It is advisable to consult with a legal professional to ensure the deed is filled out correctly and complies with state laws.

-

Do I need to notarize the Transfer-on-Death Deed?

Yes, the Transfer-on-Death Deed must be notarized to be valid. This means that the property owner must sign the deed in the presence of a notary public, who will then affix their seal to the document.

-

How do I record the Transfer-on-Death Deed?

Once the Transfer-on-Death Deed is completed and notarized, it must be recorded with the county clerk's office in the county where the property is located. This step is crucial, as recording the deed makes it part of the public record and ensures the transfer takes effect upon the owner's death.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, property owners can change or revoke a Transfer-on-Death Deed at any time during their lifetime. To do so, a new deed must be created and recorded, or a revocation document must be filed with the county clerk's office. It is important to follow the proper procedures to ensure the changes are legally recognized.

-

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary passes away before the property owner, the Transfer-on-Death Deed will typically become void. The property owner may want to designate an alternate beneficiary to ensure that the property is still transferred according to their wishes.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger gift taxes or estate taxes at the time of the transfer. However, it is advisable to consult with a tax professional to understand any potential tax consequences that may arise upon the death of the property owner.

-

Is a Transfer-on-Death Deed the right choice for everyone?

A Transfer-on-Death Deed can be a beneficial estate planning tool for many individuals, but it may not be suitable for everyone. Factors such as the complexity of an estate, family dynamics, and specific property considerations should be taken into account. Consulting with an estate planning attorney can help determine the best approach for your situation.

Documents used along the form

When considering a Georgia Transfer-on-Death Deed, it’s essential to understand that this document often works in conjunction with other legal forms and documents. Each of these plays a role in ensuring a smooth transition of property ownership upon the owner’s passing. Below is a list of some commonly used forms that complement the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person wishes their assets to be distributed after death. While the Transfer-on-Death Deed directly transfers property, a will can address other assets and personal wishes.

- Durable Power of Attorney: This form allows someone to make decisions on behalf of another person regarding financial and legal matters. It’s useful if the property owner becomes incapacitated and can no longer manage their affairs.

- Living Will: A living will specifies an individual’s preferences for medical treatment in case they become unable to communicate their wishes. Although it doesn’t deal with property, it is an important document that complements estate planning.

- Transfer-on-Death Deed for Arkansas: This form allows property owners in Arkansas to seamlessly transfer their real estate to beneficiaries upon death, avoiding probate. For more information, visit todform.com/blank-arkansas-transfer-on-death-deed.

- Affidavit of Heirship: This document establishes the heirs of a deceased person. It can be helpful in situations where property is transferred outside of probate, providing clarity on ownership and rights.

Understanding these documents and their purposes can greatly assist in effective estate planning. Each serves a unique function, ensuring that personal wishes are honored and that property transitions smoothly to the intended beneficiaries.

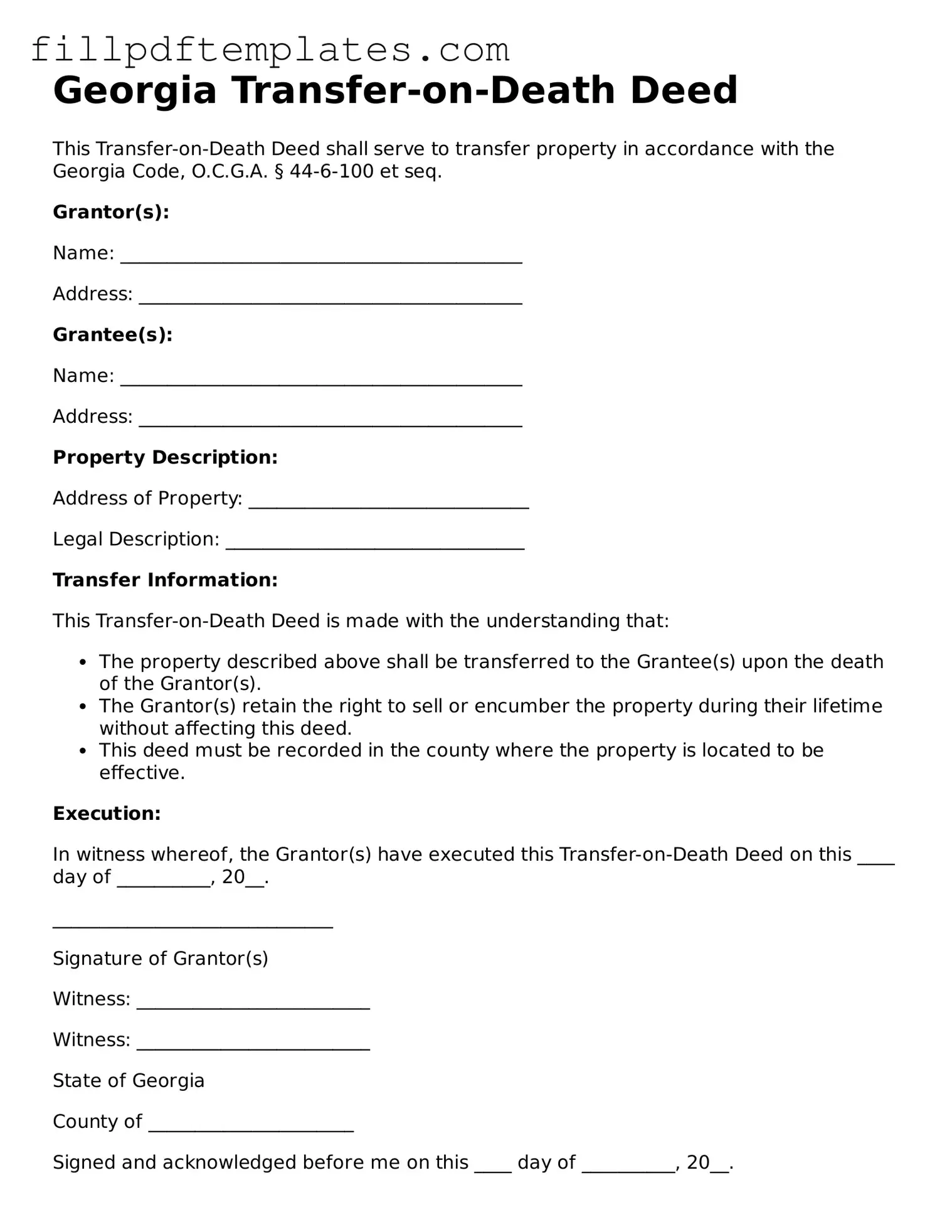

Georgia Transfer-on-Death Deed Preview

Georgia Transfer-on-Death Deed

This Transfer-on-Death Deed shall serve to transfer property in accordance with the Georgia Code, O.C.G.A. § 44-6-100 et seq.

Grantor(s):

Name: ___________________________________________

Address: _________________________________________

Grantee(s):

Name: ___________________________________________

Address: _________________________________________

Property Description:

Address of Property: ______________________________

Legal Description: ________________________________

Transfer Information:

This Transfer-on-Death Deed is made with the understanding that:

- The property described above shall be transferred to the Grantee(s) upon the death of the Grantor(s).

- The Grantor(s) retain the right to sell or encumber the property during their lifetime without affecting this deed.

- This deed must be recorded in the county where the property is located to be effective.

Execution:

In witness whereof, the Grantor(s) have executed this Transfer-on-Death Deed on this ____ day of __________, 20__.

______________________________

Signature of Grantor(s)

Witness: _________________________

Witness: _________________________

State of Georgia

County of ______________________

Signed and acknowledged before me on this ____ day of __________, 20__.

______________________________

Notary Public

My Commission Expires: ______________