Blank Georgia Quitclaim Deed Form

The Georgia Quitclaim Deed form serves as a crucial tool in the realm of property transactions, particularly for individuals looking to transfer ownership without the complexities often associated with traditional deeds. This form allows the grantor, or the person transferring the property, to convey their interest in the property to the grantee, the recipient of that interest, without guaranteeing the quality of the title. It is particularly useful in situations where the parties involved have a pre-existing relationship, such as family members or friends, and trust that the transfer will be smooth. Essential components of the form include the names and addresses of both the grantor and grantee, a legal description of the property, and the signature of the grantor, which must be notarized to ensure its validity. While the Quitclaim Deed does not provide warranties against claims or encumbrances on the property, it can facilitate a straightforward transfer process, making it an appealing option for many. Understanding the nuances of this document can empower individuals to navigate their property transactions with greater confidence and clarity.

Other Common Quitclaim Deed State Templates

What Happens After a Quit Claim Deed Is Recorded - Use when purchasing property from a relative for a quick transfer.

In Tennessee, a Hold Harmless Agreement is crucial for parties involved in activities where liability risks are present. This legal document provides a safeguard, ensuring that one party will not hold the other liable for any potential damages or injuries that may occur. For comprehensive guidance on drafting such documents, you can refer to this Hold Harmless Agreement, which outlines the essential components necessary for compliance and protection.

Cost for Quit Claim Deed - Quitclaim Deeds are often used to add or remove names from a title.

How to Get a Quit Claim Deed - The grantor effectively relinquishes all rights to the property.

Florida Quit Claim Deed Form Pdf - This deed emphasizes transparency between parties regarding ownership transfers.

Similar forms

-

Warranty Deed: A warranty deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, which offers no such assurances, a warranty deed protects the buyer from potential claims against the property.

- Employment Verification Form: For individuals seeking validation of their work history, refer to our essential Employment Verification resources to assist with accurate documentation.

-

Grant Deed: Similar to a warranty deed, a grant deed conveys property ownership but offers fewer protections. It assures that the property has not been sold to anyone else and that there are no undisclosed liens. However, it does not guarantee against future claims like a warranty deed does.

-

Deed of Trust: A deed of trust is used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. While a quitclaim deed transfers ownership, a deed of trust creates a security interest in the property until the loan is paid off.

-

Bill of Sale: A bill of sale is a document that transfers ownership of personal property, such as vehicles or equipment. While a quitclaim deed pertains to real estate, both documents serve to officially transfer ownership from one party to another.

-

Lease Agreement: A lease agreement allows one party to use a property owned by another for a specified time in exchange for rent. Although it does not transfer ownership like a quitclaim deed, both documents establish rights and responsibilities related to property use.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. |

| Governing Law | The Georgia Quitclaim Deed is governed by the Official Code of Georgia Annotated (O.C.G.A.) § 44-5-30. |

| Usage | This form is often used in situations where the parties know each other, such as family transfers or divorces. |

| Liability | The grantor (the person transferring the property) is not liable for any claims against the property after the transfer. |

| Recording | To ensure the transfer is legally recognized, the quitclaim deed must be recorded with the county clerk's office. |

Things You Should Know About This Form

-

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. Unlike other types of deeds, a quitclaim deed does not guarantee that the person transferring the property has clear title to it. Instead, it simply transfers whatever interest the grantor has in the property, if any.

-

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in situations where the parties know each other well, such as between family members or in divorce settlements. They are also useful for clearing up title issues or transferring property into a trust. However, they may not be appropriate for transactions involving unknown parties or where title insurance is needed.

-

What information is required on a Georgia Quitclaim Deed?

A Georgia Quitclaim Deed typically requires the following information:

- The names and addresses of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- A legal description of the property being transferred.

- The date of the transfer.

- The signature of the grantor, which must be notarized.

-

Do I need to have the Quitclaim Deed notarized?

Yes, in Georgia, the signature of the grantor must be notarized for the Quitclaim Deed to be valid. This ensures that the identity of the person signing the deed is verified and adds an extra layer of legal protection to the transaction.

-

How do I file a Quitclaim Deed in Georgia?

To file a Quitclaim Deed in Georgia, you must take the completed and notarized deed to the county clerk's office where the property is located. There may be a small fee for filing the deed. Once filed, the deed becomes part of the public record.

-

Are there any tax implications when using a Quitclaim Deed?

In Georgia, transferring property through a Quitclaim Deed may have tax implications, such as transfer taxes. However, transfers between family members or for certain other reasons may be exempt from these taxes. It is advisable to consult with a tax professional to understand the specific implications for your situation.

-

Can a Quitclaim Deed be revoked?

A Quitclaim Deed, once executed and recorded, cannot be revoked unilaterally. However, the parties involved may agree to execute another deed to reverse the transaction or clarify ownership. Legal advice may be necessary to navigate this process effectively.

-

What are the risks of using a Quitclaim Deed?

One of the main risks associated with a Quitclaim Deed is that it does not provide any warranties regarding the title. This means that if there are any liens, claims, or other issues with the property title, the grantee may have no recourse against the grantor. It is important to conduct a title search and understand the property’s history before proceeding with a quitclaim transfer.

-

Can I use a Quitclaim Deed for a property with a mortgage?

Yes, you can use a Quitclaim Deed for a property that has a mortgage. However, it is important to note that transferring the property does not relieve the original owner from the mortgage obligation. The lender may have the right to call the loan due upon transfer, so it is advisable to consult with the lender before proceeding.

Documents used along the form

When transferring property in Georgia, the Quitclaim Deed form is commonly used. However, several other documents often accompany it to ensure a smooth transaction and proper legal compliance. Below is a list of forms and documents frequently utilized alongside the Quitclaim Deed.

- Warranty Deed: This document guarantees that the seller has clear title to the property and offers protection against future claims. It is often used when the buyer seeks assurance regarding the property's ownership.

- Title Search Report: A title search report provides a detailed examination of the property's title history. It reveals any liens, encumbrances, or claims against the property, ensuring the buyer is fully informed.

- Georgia WC 102B form: This important document notifies the Georgia State Board of Workers' Compensation when an attorney represents a party other than the claimant or employee in a workers' compensation case. For more information, refer to the Georgia Wc 102B form.

- Property Disclosure Statement: This statement requires the seller to disclose known issues with the property, such as structural problems or environmental hazards. It protects the buyer by providing essential information about the property's condition.

- Affidavit of Title: This sworn statement from the seller confirms their ownership of the property and that there are no undisclosed liens or claims. It adds an extra layer of security for the buyer.

- Closing Statement: This document outlines all financial aspects of the transaction, including purchase price, closing costs, and any adjustments. It provides transparency for both parties during the closing process.

- Power of Attorney: In some cases, a seller may appoint someone else to act on their behalf during the property transfer. A power of attorney grants this authority, allowing for a smooth transaction even if the seller cannot be present.

- IRS Form 1099-S: This form reports the sale of real estate to the IRS. It is required for tax purposes and ensures compliance with federal tax laws.

- Deed of Trust: This document secures a loan by placing the property as collateral. It is often used in conjunction with a mortgage and provides a legal framework for the lender's interest in the property.

Each of these documents plays a crucial role in the property transfer process. Understanding their purpose can help ensure a successful transaction and protect the interests of all parties involved.

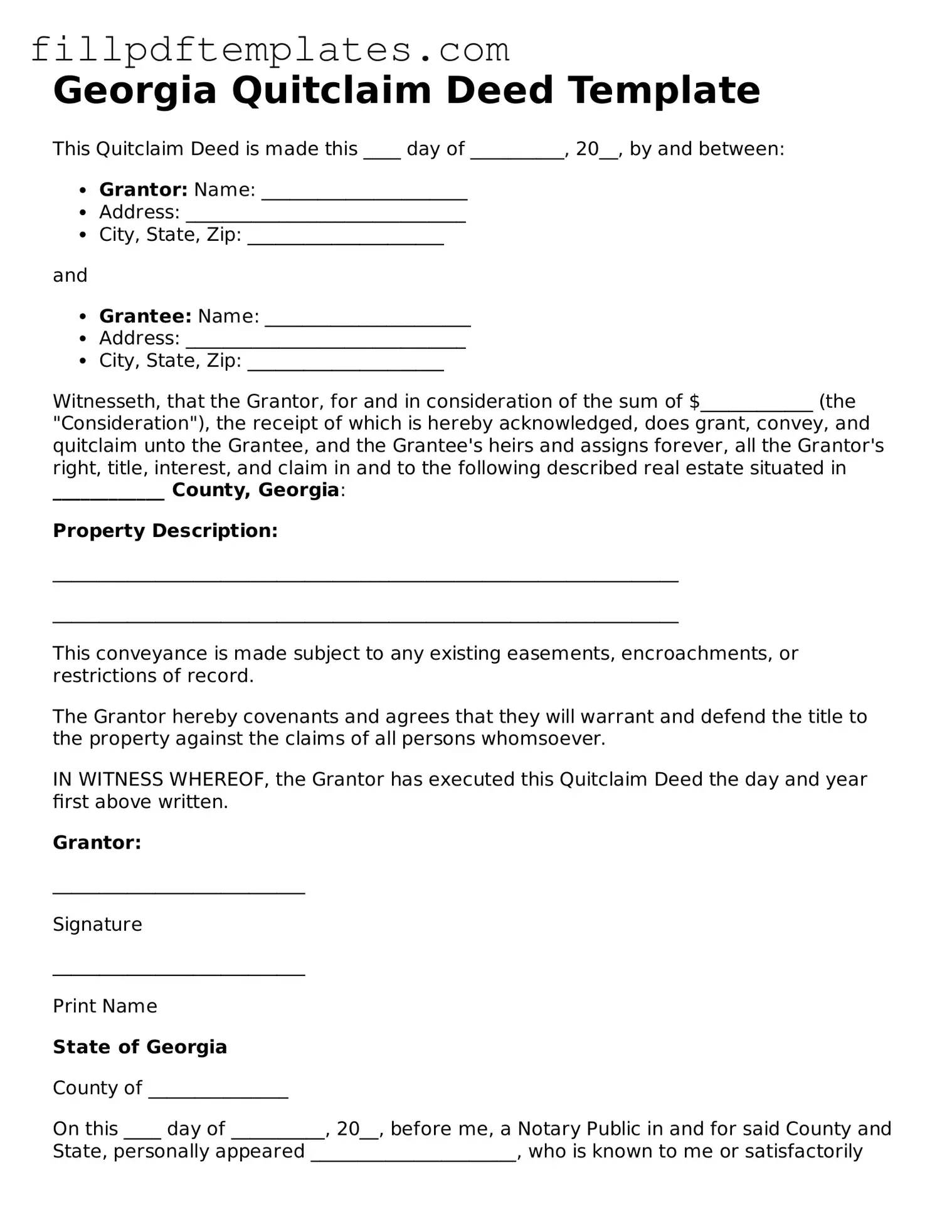

Georgia Quitclaim Deed Preview

Georgia Quitclaim Deed Template

This Quitclaim Deed is made this ____ day of __________, 20__, by and between:

- Grantor: Name: ______________________

- Address: ______________________________

- City, State, Zip: _____________________

and

- Grantee: Name: ______________________

- Address: ______________________________

- City, State, Zip: _____________________

Witnesseth, that the Grantor, for and in consideration of the sum of $____________ (the "Consideration"), the receipt of which is hereby acknowledged, does grant, convey, and quitclaim unto the Grantee, and the Grantee's heirs and assigns forever, all the Grantor's right, title, interest, and claim in and to the following described real estate situated in ____________ County, Georgia:

Property Description:

___________________________________________________________________

___________________________________________________________________

This conveyance is made subject to any existing easements, encroachments, or restrictions of record.

The Grantor hereby covenants and agrees that they will warrant and defend the title to the property against the claims of all persons whomsoever.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed the day and year first above written.

Grantor:

___________________________

Signature

___________________________

Print Name

State of Georgia

County of _______________

On this ____ day of __________, 20__, before me, a Notary Public in and for said County and State, personally appeared ______________________, who is known to me or satisfactorily proven to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I have hereunto set my hand and official seal.

_________________________

Notary Public

My Commission Expires: _____________