Blank Georgia Promissory Note Form

In Georgia, a Promissory Note serves as a vital financial instrument that outlines the terms under which one party agrees to pay another a specified sum of money. This document is not merely a piece of paper; it is a legally binding agreement that details the borrower's promise to repay a loan, including the principal amount, interest rate, and repayment schedule. Essential elements of the form include the names and addresses of both the lender and borrower, the date of the agreement, and the signature of the borrower, which signifies their commitment to the terms. Furthermore, the note may specify conditions under which the lender can demand immediate repayment, known as acceleration clauses. Understanding the nuances of this form is crucial for both lenders and borrowers, as it protects the rights of both parties and provides a clear framework for the loan transaction. Given the complexities involved, it is imperative for individuals to approach the drafting and execution of a Promissory Note with care, ensuring that all terms are clearly stated and understood to avoid potential disputes down the line.

Other Common Promissory Note State Templates

Promissory Note Template Florida Pdf - It’s essential to keep a copy of the signed promissory note for personal and legal records.

Illinois Promissory Note - Repayment can be structured as installments or a lump sum, as agreed by both parties.

The North Carolina Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, avoiding the probate process. This simple yet effective tool provides peace of mind for property owners who wish to ensure their assets are passed on smoothly. For more information on the execution of this form, you can visit transferondeathdeedform.com/north-carolina-transfer-on-death-deed, which can help families navigate property transfer without unnecessary complications.

Iowa Promissory Note - Promissory notes can vary in complexity and may include additional clauses for flexibility.

Similar forms

The Promissory Note is a key financial document, and several other documents share similarities with it. Here are nine documents that have comparable features:

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule.

- Mortgage: A mortgage is a secured loan document that specifies the terms of borrowing against real property, similar to how a promissory note details the borrower's commitment to repay.

- Credit Agreement: This document establishes the terms under which credit is extended, including repayment terms and interest rates, akin to a promissory note.

- Trader Joe's Application Form: To apply for a position at Trader Joe's, prospective employees must complete a specific form that collects necessary information for evaluation. For more details, visit https://legalpdfdocs.com/.

- Lease Agreement: A lease agreement, while primarily for renting property, often includes payment terms that resemble those found in a promissory note.

- Secured Promissory Note: This is a variation of the standard promissory note, where the loan is backed by collateral, similar in structure but with additional security provisions.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a loan if the primary borrower defaults, sharing the repayment obligation aspect of a promissory note.

- Installment Agreement: This document details the terms for paying off a debt in installments, much like the repayment terms found in a promissory note.

- Debt Settlement Agreement: This agreement outlines the terms for settling a debt for less than the full amount owed, which can include payment terms similar to those in a promissory note.

- Bill of Exchange: A bill of exchange is a financial document that orders one party to pay a fixed sum to another party, reflecting the promise to pay characteristic of a promissory note.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Georgia Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a certain time or on demand. |

| Governing Law | The Georgia Promissory Note is governed by the Official Code of Georgia Annotated (O.C.G.A.) § 10-12-1 et seq. |

| Parties Involved | The note involves two main parties: the borrower (maker) who promises to pay and the lender (payee) who receives the payment. |

| Interest Rates | Interest rates on promissory notes in Georgia must comply with state usury laws, which limit the maximum allowable interest rate. |

| Enforceability | A properly executed promissory note is legally enforceable in Georgia, provided it meets all necessary legal requirements. |

Things You Should Know About This Form

-

What is a Georgia Promissory Note?

A Georgia Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender. It includes important details such as the loan amount, interest rate, repayment schedule, and any consequences for failing to repay the loan.

-

Who can use a Promissory Note in Georgia?

Any individual or business can use a Promissory Note in Georgia. It is commonly used between friends, family members, or business partners. However, it is important that both parties understand the terms and conditions outlined in the note.

-

What information should be included in a Georgia Promissory Note?

A typical Georgia Promissory Note should include:

- The names and addresses of the borrower and lender

- The principal amount of the loan

- The interest rate, if applicable

- The repayment schedule, including due dates

- Any late fees or penalties for missed payments

- Signatures of both parties

-

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding contract. Once both parties sign the document, it creates an obligation for the borrower to repay the loan as outlined. If the borrower fails to repay, the lender may take legal action to recover the owed amount.

-

Do I need a lawyer to create a Promissory Note in Georgia?

While it is not required to have a lawyer draft a Promissory Note, it is advisable. A lawyer can ensure that the document meets all legal requirements and protects your interests. If you choose to create one on your own, be sure to include all necessary details.

-

Can I modify a Promissory Note after it has been signed?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the amended note to avoid any confusion in the future.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take legal action. This may include filing a lawsuit to recover the owed amount. The lender may also be able to collect any late fees or penalties outlined in the Promissory Note.

-

How long is a Promissory Note valid in Georgia?

The validity of a Promissory Note in Georgia generally depends on the terms agreed upon by the parties. However, the statute of limitations for enforcing a written contract, including a Promissory Note, is typically six years. After this period, the lender may no longer be able to take legal action to recover the debt.

Documents used along the form

A Georgia Promissory Note is often accompanied by various forms and documents that help clarify the terms of the loan, protect the interests of the parties involved, and ensure compliance with state laws. Below is a list of common documents that may be used alongside a Promissory Note in Georgia.

- Loan Agreement: This document outlines the specific terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved.

- Security Agreement: If the loan is secured by collateral, this agreement details the assets pledged as security for the repayment of the loan.

- Guaranty Agreement: A guarantor may sign this document, agreeing to take responsibility for the loan if the borrower defaults.

- Disclosure Statement: This statement provides important information about the loan, such as fees, interest rates, and the total cost of borrowing, ensuring transparency for the borrower.

- Amortization Schedule: This schedule breaks down the repayment plan, showing how much of each payment goes toward interest and principal over the life of the loan.

- Default Notice: Should the borrower fail to meet the repayment terms, this document formally notifies them of the default and outlines potential consequences.

- Hold Harmless Agreement: This document is vital in various agreements, including loan transactions, as it helps protect parties from liability. A key example is the Hold Harmless Agreement, which ensures one party cannot be held responsible for the risks undertaken by another.

- Release of Lien: Once the loan is fully repaid, this document is issued to confirm that the lender no longer has a claim on the collateral.

Understanding these accompanying documents can help borrowers and lenders navigate the complexities of loan agreements, ensuring that all parties are well-informed and protected throughout the lending process.

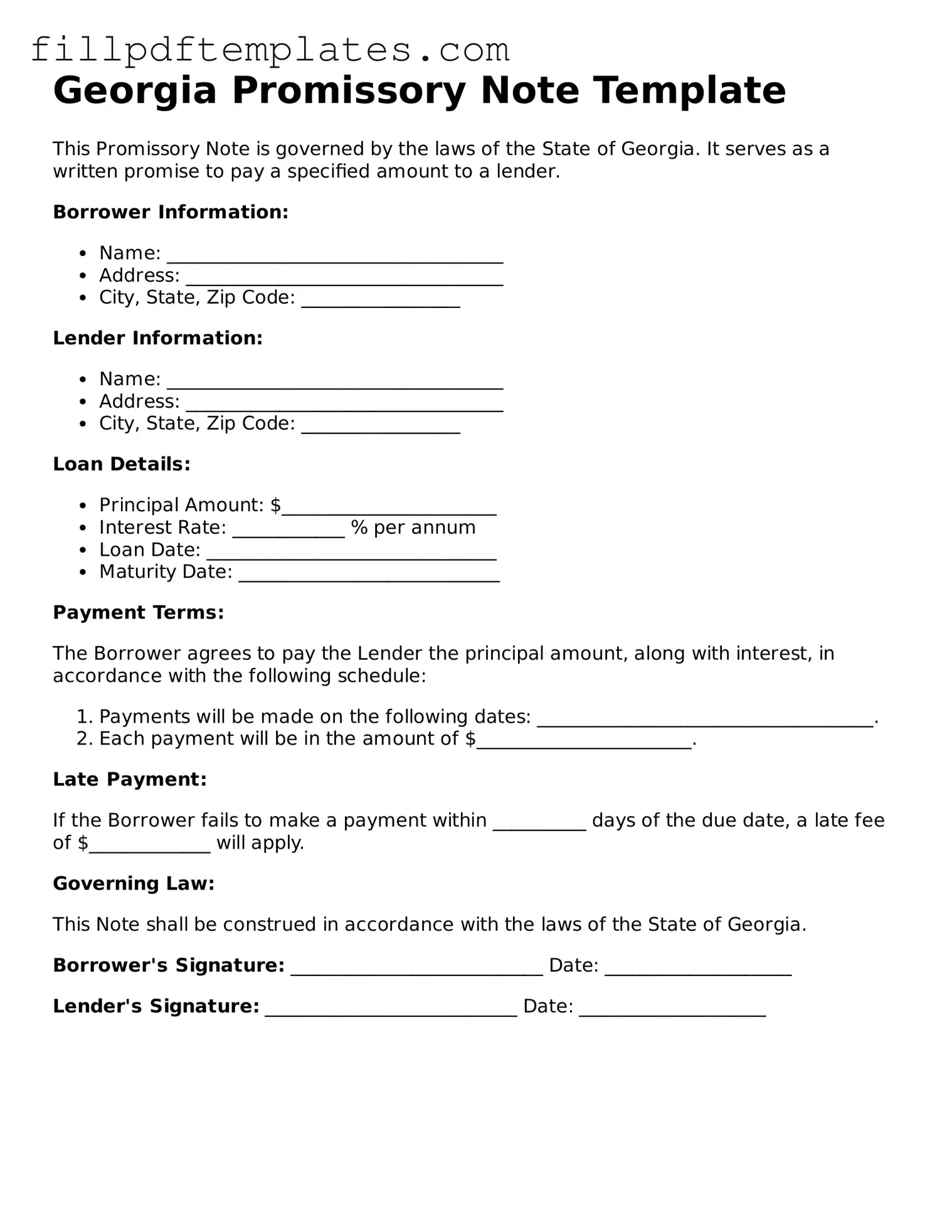

Georgia Promissory Note Preview

Georgia Promissory Note Template

This Promissory Note is governed by the laws of the State of Georgia. It serves as a written promise to pay a specified amount to a lender.

Borrower Information:

- Name: ____________________________________

- Address: __________________________________

- City, State, Zip Code: _________________

Lender Information:

- Name: ____________________________________

- Address: __________________________________

- City, State, Zip Code: _________________

Loan Details:

- Principal Amount: $_______________________

- Interest Rate: ____________ % per annum

- Loan Date: _______________________________

- Maturity Date: ____________________________

Payment Terms:

The Borrower agrees to pay the Lender the principal amount, along with interest, in accordance with the following schedule:

- Payments will be made on the following dates: ____________________________________.

- Each payment will be in the amount of $_______________________.

Late Payment:

If the Borrower fails to make a payment within __________ days of the due date, a late fee of $_____________ will apply.

Governing Law:

This Note shall be construed in accordance with the laws of the State of Georgia.

Borrower's Signature: ___________________________ Date: ____________________

Lender's Signature: ___________________________ Date: ____________________