Blank Georgia Loan Agreement Form

The Georgia Loan Agreement form is a crucial document that outlines the terms and conditions of a loan between a lender and a borrower. This form serves to protect both parties by clearly detailing the amount borrowed, interest rates, repayment schedules, and any applicable fees. It also specifies the consequences of default, ensuring that both the lender's and borrower's rights are upheld. Essential components of the form include the identification of the parties involved, the loan's purpose, and any collateral required to secure the loan. By providing a structured approach to borrowing, this agreement helps prevent misunderstandings and disputes, making it a vital tool for anyone engaging in a loan transaction in Georgia. Understanding its elements can facilitate smoother negotiations and foster trust between lenders and borrowers.

Other Common Loan Agreement State Templates

Illinois Promissory Note - It’s recommended to consult with a financial advisor when needed.

California Promissory Note Template - It may include conditions for loan modification requests.

The process of initiating a business venture in Wisconsin is anchored by the completion of the Wisconsin Articles of Incorporation form, which serves as a vital legal document for establishing a corporation. This form not only delineates the fundamental structure and objectives of the corporation but also sets the stage for its operational framework. Entrepreneurs must understand the significance of this step, often referring to resources such as the Articles of Incorporation to guide them through the requirements and ensure compliance with state regulations.

Promissory Note Florida Pdf - It can outline the lender’s rights after loan disbursement.

Similar forms

-

Promissory Note: A promissory note is a written promise to pay a specified amount of money to a designated party at a predetermined time. Like a loan agreement, it outlines the terms of repayment, including interest rates and due dates. However, a promissory note is often simpler and does not typically include the same level of detail regarding collateral or conditions.

-

Mortgage Agreement: A mortgage agreement is a legal document that secures a loan with real property. Similar to a loan agreement, it specifies the amount borrowed, repayment terms, and interest rates. However, it also includes details about the property being financed and the consequences of default, such as foreclosure.

-

Credit Agreement: A credit agreement governs the terms under which a lender extends credit to a borrower. This document, like a loan agreement, outlines the terms of borrowing, including limits, fees, and repayment schedules. Credit agreements may also incorporate additional terms related to fees and penalties for late payments.

- Transfer-on-Death Deed: This deed allows property owners to transfer their real estate to beneficiaries upon death, ensuring a smooth transition without probate. For detailed guidance, visit https://transferondeathdeedform.com/new-jersey-transfer-on-death-deed.

-

Security Agreement: A security agreement establishes a lender's right to take possession of collateral if the borrower defaults. This document is similar to a loan agreement in that it details the obligations of the borrower and the rights of the lender. However, it specifically focuses on the collateral that secures the loan, which is not always a feature of a standard loan agreement.

Document Properties

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Loan Agreement is governed by the laws of the State of Georgia. |

| Purpose | This form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Parties Involved | The agreement typically includes the lender and the borrower, both of whom must sign the document. |

| Loan Amount | The specific amount of money being borrowed must be clearly stated in the agreement. |

| Interest Rate | The interest rate applicable to the loan should be included, whether it is fixed or variable. |

| Repayment Terms | The agreement outlines how and when the borrower will repay the loan, including any installment details. |

| Default Clause | A section typically addresses what happens if the borrower fails to repay the loan as agreed. |

| Amendments | Any changes to the loan agreement must be made in writing and signed by both parties. |

Things You Should Know About This Form

-

What is a Georgia Loan Agreement?

A Georgia Loan Agreement is a legal document that outlines the terms and conditions under which a borrower receives funds from a lender. It specifies the amount borrowed, interest rates, repayment schedule, and other essential details.

-

Who can enter into a Loan Agreement in Georgia?

Both individuals and businesses can enter into a Loan Agreement in Georgia. The borrower must be of legal age, typically 18 years or older, and have the capacity to enter into a contract.

-

What are the key components of a Georgia Loan Agreement?

- Loan amount

- Interest rate

- Repayment terms

- Late payment penalties

- Default conditions

- Signatures of both parties

-

Is a Loan Agreement required to be in writing?

While verbal agreements can be legally binding, having a written Loan Agreement is highly recommended. A written document provides clear evidence of the terms and helps prevent misunderstandings between the parties involved.

-

What happens if the borrower defaults on the Loan Agreement?

If the borrower fails to make payments as outlined in the agreement, the lender may take legal action to recover the owed amount. This could include filing a lawsuit or pursuing collection efforts.

-

Can the terms of a Loan Agreement be modified?

Yes, the terms can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing to maintain clarity and legal standing.

-

Are there any specific laws governing Loan Agreements in Georgia?

Yes, Loan Agreements in Georgia are governed by both state and federal laws. It is important to ensure compliance with the Georgia Uniform Commercial Code and other applicable regulations.

-

Do I need a lawyer to draft a Loan Agreement?

While it is not mandatory to hire a lawyer, consulting one can be beneficial. A legal professional can help ensure that the agreement is comprehensive and compliant with all relevant laws.

-

What should I do if I have questions about my Loan Agreement?

If you have questions or concerns about your Loan Agreement, consider reaching out to a legal professional or financial advisor. They can provide guidance tailored to your specific situation.

Documents used along the form

When entering into a loan agreement in Georgia, several additional forms and documents may be necessary to ensure clarity and legal compliance. These documents help outline the terms of the loan, protect the interests of both parties, and provide a clear framework for the transaction.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount, detailing the interest rate, repayment schedule, and consequences of default.

- Loan Disclosure Statement: Required by law, this statement provides borrowers with essential information about the loan, including fees, interest rates, and other costs associated with borrowing.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged and the rights of the lender in the event of default.

- Personal Guarantee: This document may be requested by the lender, where an individual agrees to be personally responsible for the loan if the borrowing entity defaults.

- Credit Application: This form gathers necessary information about the borrower's financial situation, credit history, and other relevant details to assess creditworthiness.

- Bill of Sale: Essential for documenting the transfer of ownership for personal property, this form includes necessary details about the transaction, including the item's description and sale price. For further guidance, you may refer to https://legalpdfdocs.com/.

- Loan Modification Agreement: If terms of the original loan need to be changed, this document outlines the new terms and conditions agreed upon by both parties.

- Closing Statement: This statement summarizes the final terms of the loan, including the total amount borrowed, closing costs, and any other financial details that need to be settled at closing.

- UCC Financing Statement: This document is filed to publicly declare the lender's interest in the collateral securing the loan, providing legal protection for the lender's claim.

- Borrower’s Certificate: This certificate confirms that the borrower has received all necessary disclosures and understands their obligations under the loan agreement.

Having these documents prepared and understood can facilitate a smoother loan process. They help ensure that all parties are aware of their rights and responsibilities, fostering a transparent and trustworthy lending environment.

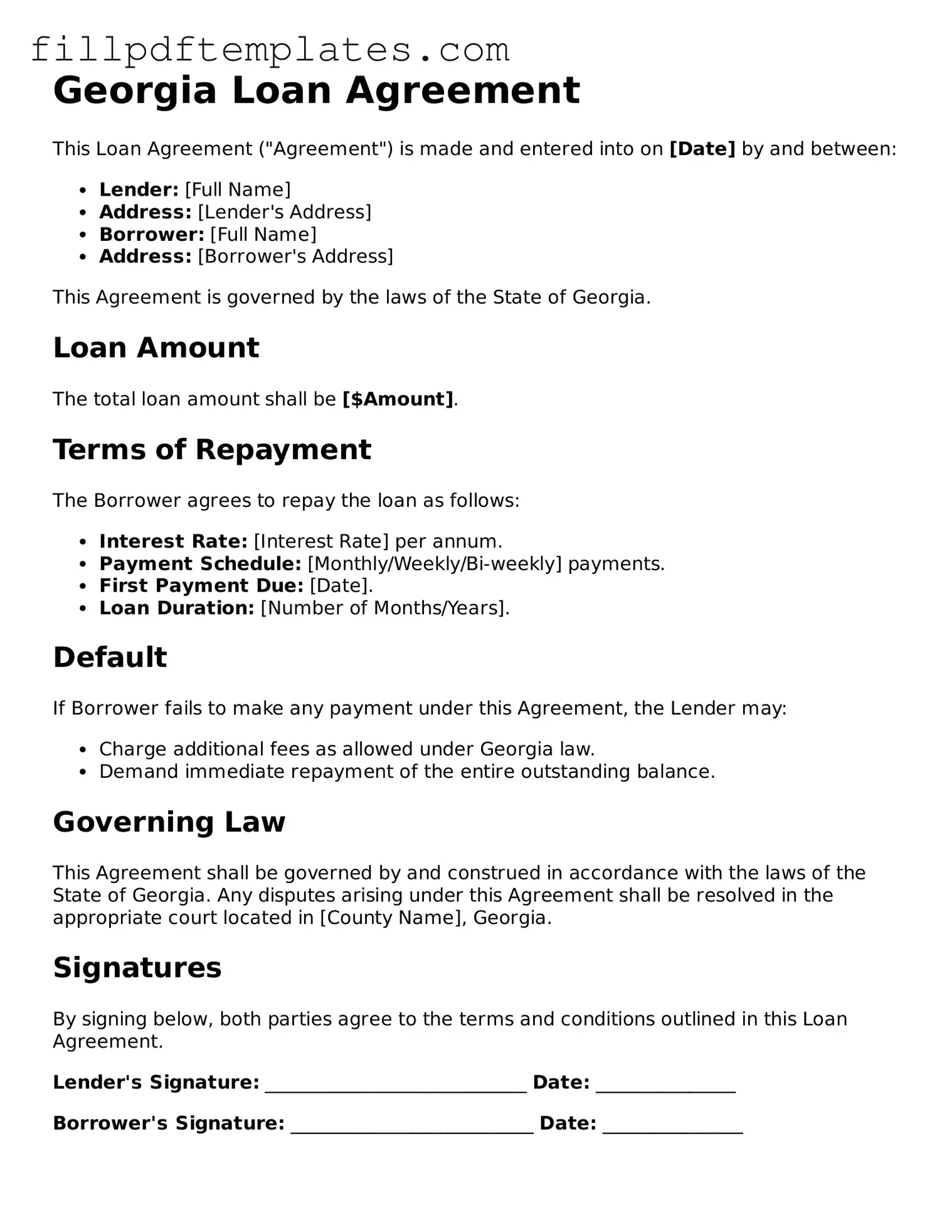

Georgia Loan Agreement Preview

Georgia Loan Agreement

This Loan Agreement ("Agreement") is made and entered into on [Date] by and between:

- Lender: [Full Name]

- Address: [Lender's Address]

- Borrower: [Full Name]

- Address: [Borrower's Address]

This Agreement is governed by the laws of the State of Georgia.

Loan Amount

The total loan amount shall be [$Amount].

Terms of Repayment

The Borrower agrees to repay the loan as follows:

- Interest Rate: [Interest Rate] per annum.

- Payment Schedule: [Monthly/Weekly/Bi-weekly] payments.

- First Payment Due: [Date].

- Loan Duration: [Number of Months/Years].

Default

If Borrower fails to make any payment under this Agreement, the Lender may:

- Charge additional fees as allowed under Georgia law.

- Demand immediate repayment of the entire outstanding balance.

Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia. Any disputes arising under this Agreement shall be resolved in the appropriate court located in [County Name], Georgia.

Signatures

By signing below, both parties agree to the terms and conditions outlined in this Loan Agreement.

Lender's Signature: ____________________________ Date: _______________

Borrower's Signature: __________________________ Date: _______________