Blank Georgia Gift Deed Form

The Georgia Gift Deed form is an essential document for anyone looking to transfer property as a gift without the exchange of money. This form allows the donor, or the person giving the gift, to convey ownership of real estate to the recipient, known as the grantee. It’s crucial to understand that the gift deed must be executed with the proper legal formalities, including notarization, to ensure its validity. The form typically includes important details such as the names of both the donor and grantee, a clear description of the property being gifted, and any specific conditions attached to the gift. Additionally, it’s important to consider the implications for taxes and future ownership rights. By using the Georgia Gift Deed, individuals can simplify the process of transferring property, making it a straightforward and generous way to share assets with family or friends.

Other Common Gift Deed State Templates

How Much Does It Cost to Transfer Property Deeds? - The Gift Deed must be signed by the donor and typically requires witnesses to validate the transaction.

When engaging in boat transactions, it is vital for both parties to understand the importance of a formal agreement, and the New York Boat Bill of Sale form serves this purpose well. This document acts as a safeguard, ensuring that all necessary details about the boat are recorded while providing legal protection to both the buyer and seller. For those unfamiliar with the process, it's essential to take the time to familiarize oneself with the requirements and specifics of the form, and you can learn more about the form to ensure a seamless transaction.

Similar forms

- Will: A will outlines how a person's assets should be distributed after their death. Like a gift deed, it transfers ownership but does so upon the individual's passing rather than immediately.

- Trust Agreement: A trust agreement allows a person to place assets in a trust for the benefit of others. Similar to a gift deed, it involves the transfer of ownership, but the assets are managed by a trustee until certain conditions are met.

- Quitclaim Deed: A quitclaim deed transfers any ownership interest one person has in a property to another. It is similar to a gift deed in that it can transfer property without monetary exchange, but it does not guarantee the ownership status.

- Sales Agreement: A sales agreement outlines the terms of a sale of property or goods. While a gift deed involves no payment, both documents serve to transfer ownership from one party to another.

- RV Bill of Sale: This document formalizes the transfer of ownership of a recreational vehicle. It includes key information such as the vehicle identification number (VIN) and the identities of the buyer and seller, similar to a Gift Deed in that it ensures clarity in ownership transfer. For more information, visit legalpdfdocs.com/.

- Deed of Trust: A deed of trust secures a loan with real estate as collateral. It is similar to a gift deed in that both involve real property, but a deed of trust involves a lender and a borrower, while a gift deed does not.

- Power of Attorney: A power of attorney allows one person to act on behalf of another in legal matters. Like a gift deed, it involves the transfer of rights or authority, but it does not transfer ownership of property.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Georgia Gift Deed is a legal document used to transfer property as a gift without any exchange of money. |

| Governing Law | The Georgia Gift Deed is governed by the Official Code of Georgia Annotated (O.C.G.A.) § 44-5-30 et seq. |

| Parties Involved | The deed involves a donor (the giver) and a donee (the receiver). |

| Consideration | No monetary consideration is required for a gift deed, distinguishing it from a sale. |

| Property Types | Real property, personal property, or both can be transferred using a gift deed. |

| Execution Requirements | The deed must be signed by the donor in the presence of a notary public. |

| Recording | To be effective against third parties, the gift deed should be recorded in the county where the property is located. |

| Tax Implications | Gift taxes may apply, and it is advisable to consult a tax professional regarding potential liabilities. |

| Revocability | A gift deed is generally irrevocable once executed, unless specified otherwise. |

| Legal Advice | Consulting with an attorney is recommended to ensure compliance with all legal requirements. |

Things You Should Know About This Form

-

What is a Georgia Gift Deed?

A Georgia Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. It is often used when a property owner wants to give their property as a gift to a family member or friend.

-

What are the requirements for a valid Gift Deed in Georgia?

For a Gift Deed to be valid in Georgia, it must be in writing, signed by the donor (the person giving the gift), and notarized. The deed should also clearly describe the property being transferred and identify the recipient.

-

Is a Gift Deed the same as a Sale Deed?

No, a Gift Deed is different from a Sale Deed. A Sale Deed involves a transaction where the property is sold for money, while a Gift Deed involves no payment. The intent behind a Gift Deed is to make a voluntary transfer of property as a gift.

-

Do I need to pay taxes on a property received as a gift?

Generally, the recipient of a gift does not pay taxes at the time of receiving the property. However, the donor may need to file a gift tax return if the value of the gift exceeds the annual exclusion limit set by the IRS. It's advisable to consult a tax professional for specific guidance.

-

Can I revoke a Gift Deed once it is executed?

Once a Gift Deed is executed and delivered, it is typically irrevocable. This means that the donor cannot take back the gift unless there was fraud or undue influence involved in the transfer. Always consider the implications before finalizing a gift.

-

How do I record a Gift Deed in Georgia?

To record a Gift Deed, take the signed and notarized document to the county clerk's office where the property is located. There may be a small fee for recording the deed. Recording the deed provides public notice of the property transfer.

-

What information should be included in a Gift Deed?

A Gift Deed should include the names and addresses of both the donor and the recipient, a legal description of the property, and the intent to gift the property. It should also be signed by the donor and notarized.

-

Can I use a template for a Gift Deed?

Yes, you can use a template for a Gift Deed, but it is important to ensure that it complies with Georgia law. Consider having a legal professional review the document to ensure all necessary elements are included and correctly formatted.

Documents used along the form

When completing a Georgia Gift Deed, several other forms and documents may be necessary to ensure a smooth transfer of property. Each of these documents serves a specific purpose in the gifting process, helping to clarify the intent and protect the interests of all parties involved.

- Affidavit of Value: This document provides an official statement regarding the value of the property being gifted. It can be essential for tax purposes and helps establish the fair market value at the time of the transfer.

- Property Tax Exemption Application: If the gifted property qualifies for certain tax exemptions, this application can help the new owner take advantage of those benefits. It is typically submitted to the local tax office.

- Quitclaim Deed: Although primarily used for transferring property rights, a quitclaim deed may accompany a gift deed to clarify the transfer of ownership. It serves as a simple way to convey any interest the giver has in the property.

- Operating Agreement: For a more structured LLC, the complete Operating Agreement outline provides essential guidelines for governance and decision-making processes.

- Gift Tax Return (Form 709): If the value of the gift exceeds the annual exclusion limit set by the IRS, this form must be filed. It documents the gift for tax purposes and ensures compliance with federal tax laws.

Understanding these accompanying documents can help streamline the gifting process and ensure that everything is in order. Always consider consulting a professional if you have questions about specific requirements or procedures related to property transfers in Georgia.

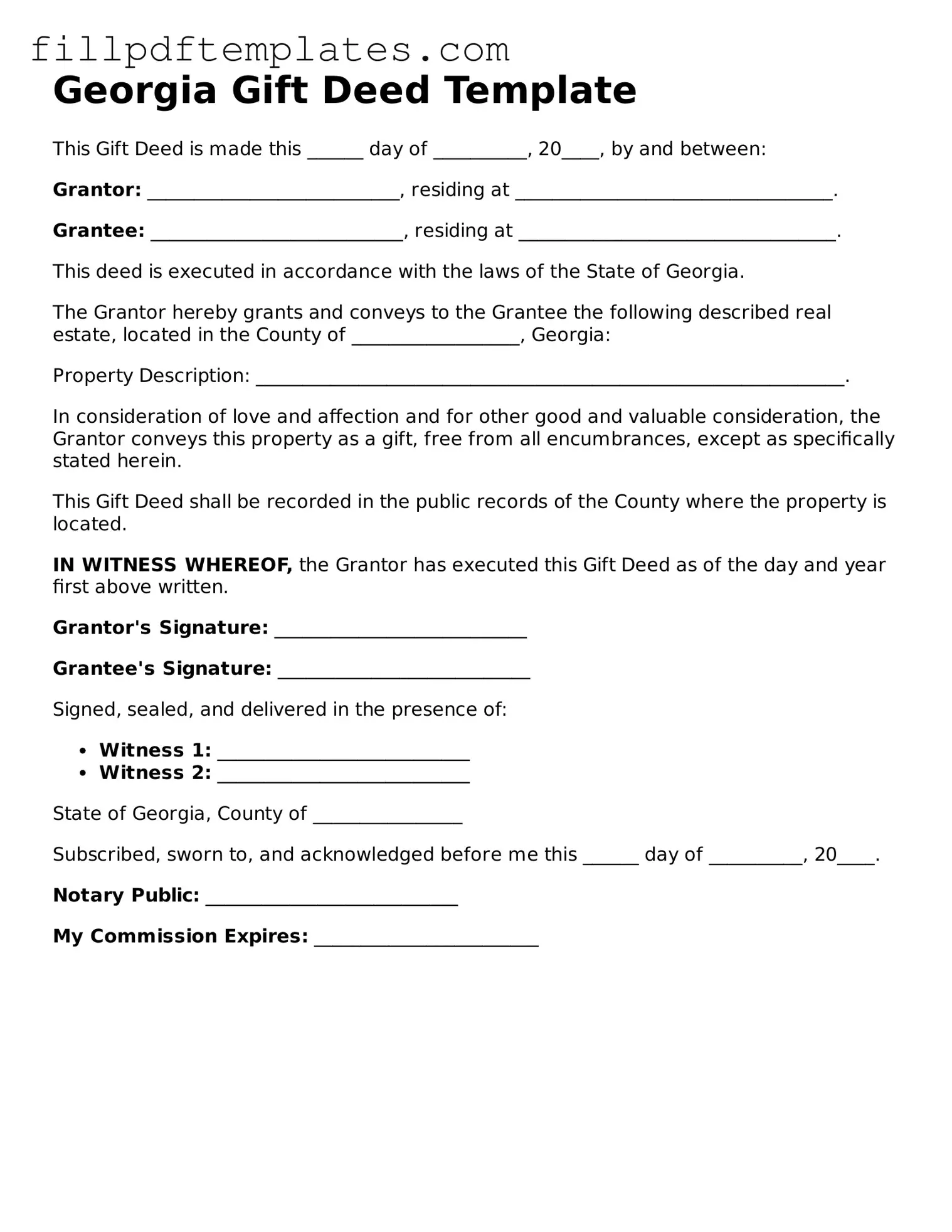

Georgia Gift Deed Preview

Georgia Gift Deed Template

This Gift Deed is made this ______ day of __________, 20____, by and between:

Grantor: ___________________________, residing at __________________________________.

Grantee: ___________________________, residing at __________________________________.

This deed is executed in accordance with the laws of the State of Georgia.

The Grantor hereby grants and conveys to the Grantee the following described real estate, located in the County of __________________, Georgia:

Property Description: _______________________________________________________________.

In consideration of love and affection and for other good and valuable consideration, the Grantor conveys this property as a gift, free from all encumbrances, except as specifically stated herein.

This Gift Deed shall be recorded in the public records of the County where the property is located.

IN WITNESS WHEREOF, the Grantor has executed this Gift Deed as of the day and year first above written.

Grantor's Signature: ___________________________

Grantee's Signature: ___________________________

Signed, sealed, and delivered in the presence of:

- Witness 1: ___________________________

- Witness 2: ___________________________

State of Georgia, County of ________________

Subscribed, sworn to, and acknowledged before me this ______ day of __________, 20____.

Notary Public: ___________________________

My Commission Expires: ________________________