Blank Georgia Deed in Lieu of Foreclosure Form

In the state of Georgia, homeowners facing financial difficulties may find themselves exploring various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure, a legal process that allows a borrower to voluntarily transfer their property title to the lender in exchange for the cancellation of their mortgage debt. This arrangement can provide a more streamlined and less stressful alternative to the lengthy foreclosure process, offering benefits to both parties involved. The Deed in Lieu of Foreclosure form is a crucial document in this process, as it outlines the terms and conditions under which the property is transferred. It typically includes essential details such as the names of the parties involved, a description of the property, and any outstanding debts related to the mortgage. Additionally, the form may address any potential liabilities, ensuring that the borrower is released from further obligations once the deed is executed. Understanding this form is essential for homeowners considering this option, as it not only facilitates a smoother transition but also helps mitigate the negative impact of foreclosure on their credit history.

Other Common Deed in Lieu of Foreclosure State Templates

What Happens When You Do a Deed in Lieu of Foreclosure - Often recommended as a proactive approach to foreclosure prevention.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Homeowners need to ensure they fully understand the terms of the Deed in Lieu before signing.

Florida Deed in Lieu of Foreclosure - The deed grants the lender all rights to the property once signed and delivered.

To effectively initiate a business venture, it is essential to complete the necessary documentation, including the Articles of Incorporation, which serves as a foundational legal requirement for corporations in Washington State, outlining crucial details and granting the entity the necessary legal standing to operate.

California Property Surrender Deed - A Deed in Lieu is often recorded with the county recorder's office to document the change of ownership.

Similar forms

The Deed in Lieu of Foreclosure is a significant document in the realm of real estate and financial transactions. It serves as an alternative to the lengthy and often costly foreclosure process. Several other documents share similarities with the Deed in Lieu of Foreclosure. Below are four such documents, each highlighting their similarities:

- Short Sale Agreement: Like a Deed in Lieu of Foreclosure, a Short Sale Agreement allows a homeowner to sell their property for less than the amount owed on the mortgage. Both options aim to mitigate losses for the lender and provide a way for the homeowner to avoid foreclosure.

- Last Will and Testament - This critical document ensures your final wishes are honored, and you can find valuable resources in the essential guide to Last Will and Testament forms to help you navigate the process.

- Loan Modification Agreement: A Loan Modification Agreement alters the terms of an existing mortgage to make payments more manageable for the borrower. Similar to a Deed in Lieu of Foreclosure, it seeks to prevent foreclosure by providing a solution that allows the homeowner to retain their property.

- Forebearance Agreement: This document allows the lender to temporarily suspend or reduce mortgage payments for a specified period. Both the Forebearance Agreement and the Deed in Lieu of Foreclosure serve to prevent foreclosure by providing alternatives to the borrower during financial hardship.

- Quitclaim Deed: A Quitclaim Deed transfers ownership of property without any warranties. While it is often used in different contexts, it shares the common goal of transferring property rights. In the case of a Deed in Lieu of Foreclosure, it facilitates the transfer of the property back to the lender, thereby avoiding foreclosure proceedings.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure allows a borrower to transfer property ownership to the lender to avoid foreclosure. |

| Governing Law | Georgia law governs the process, particularly O.C.G.A. § 44-14-162.2. |

| Eligibility | Homeowners facing financial hardship may qualify for a deed in lieu if they are unable to keep up with mortgage payments. |

| Benefits | This option can help borrowers avoid the lengthy foreclosure process and potential damage to their credit score. |

| Process | Borrowers must negotiate with the lender to agree on the terms before signing the deed. |

| Documentation | Required documents may include the original mortgage, a hardship letter, and financial statements. |

| Tax Implications | Borrowers may face tax consequences due to potential cancellation of debt income. |

| Impact on Credit | A deed in lieu may still negatively impact a borrower's credit score, but less so than a foreclosure. |

| Legal Advice | Consulting with a legal professional is recommended to understand all implications before proceeding. |

Things You Should Know About This Form

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the title of their property to the lender. This typically occurs when the homeowner is unable to keep up with mortgage payments and wants to avoid the lengthy foreclosure process.

-

What are the benefits of using a Deed in Lieu of Foreclosure?

There are several advantages to this option. First, it can save time and money compared to a foreclosure. Second, it often results in less damage to the homeowner's credit score. Additionally, homeowners may be able to negotiate terms with the lender, such as debt forgiveness or relocation assistance.

-

Are there any risks involved?

Yes, there are risks. The lender may require the homeowner to provide financial information, which could lead to further scrutiny of their financial situation. Additionally, if the property has a second mortgage or other liens, the homeowner may still be responsible for those debts. It’s crucial to fully understand the implications before proceeding.

-

How does the process work?

The process generally starts with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then review the homeowner’s financial situation and the property’s value. If approved, both parties will sign the deed, and the lender will take possession of the property.

-

Can I still live in my home during this process?

Typically, once the Deed in Lieu of Foreclosure is signed, the homeowner must vacate the property. However, some lenders may allow a grace period for the homeowner to find alternative housing. It’s essential to discuss this with the lender beforehand.

-

Do I need legal assistance to complete this process?

While it’s not mandatory to have legal assistance, consulting with a real estate attorney can be beneficial. They can help ensure that your rights are protected and that you understand all terms involved in the agreement.

Documents used along the form

When navigating the complexities of a deed in lieu of foreclosure in Georgia, several other forms and documents often accompany this process. Each of these documents serves a distinct purpose, ensuring that both parties understand their rights and obligations. Below is a list of some key documents that may be involved.

- Loan Modification Agreement: This document outlines changes to the original loan terms. It may reduce the interest rate or extend the repayment period, providing the borrower with a more manageable payment plan.

- Notice of Default: This formal notice informs the borrower that they are in default on their mortgage payments. It typically outlines the amount owed and provides a timeline for remedying the situation.

- Release of Liability: This document releases the borrower from any further obligations on the mortgage once the deed in lieu is executed. It protects the borrower from being pursued for any remaining debt after the property is transferred.

- Transfer-on-Death Deed: This form enables property owners to transfer their real estate to designated beneficiaries without probate, as detailed at transferondeathdeedform.com/massachusetts-transfer-on-death-deed/, simplifying estate management.

- Property Condition Disclosure Statement: This statement details the condition of the property being transferred. It helps the lender assess any potential issues with the property that may affect its value.

Understanding these documents can significantly impact the outcome of a deed in lieu of foreclosure. Each serves a purpose in protecting the interests of both the borrower and the lender, ultimately facilitating a smoother transition and resolution for all parties involved.

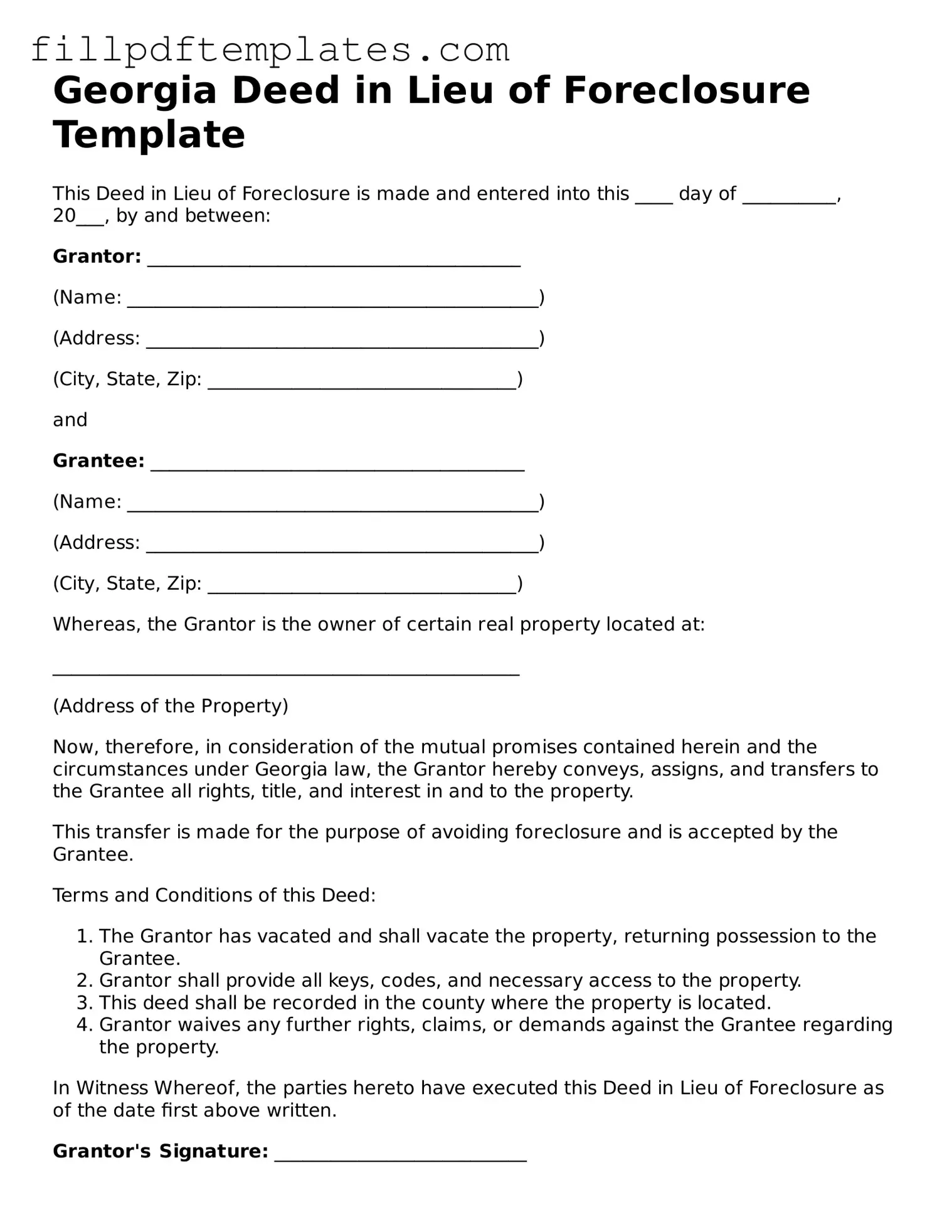

Georgia Deed in Lieu of Foreclosure Preview

Georgia Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made and entered into this ____ day of __________, 20___, by and between:

Grantor: ________________________________________

(Name: ____________________________________________)

(Address: __________________________________________)

(City, State, Zip: _________________________________)

and

Grantee: ________________________________________

(Name: ____________________________________________)

(Address: __________________________________________)

(City, State, Zip: _________________________________)

Whereas, the Grantor is the owner of certain real property located at:

__________________________________________________

(Address of the Property)

Now, therefore, in consideration of the mutual promises contained herein and the circumstances under Georgia law, the Grantor hereby conveys, assigns, and transfers to the Grantee all rights, title, and interest in and to the property.

This transfer is made for the purpose of avoiding foreclosure and is accepted by the Grantee.

Terms and Conditions of this Deed:

- The Grantor has vacated and shall vacate the property, returning possession to the Grantee.

- Grantor shall provide all keys, codes, and necessary access to the property.

- This deed shall be recorded in the county where the property is located.

- Grantor waives any further rights, claims, or demands against the Grantee regarding the property.

In Witness Whereof, the parties hereto have executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor's Signature: ___________________________

Date: ________________________________________

Grantee's Signature: ___________________________

Date: ________________________________________

Executed in the presence of:

Witness #1 Signature: _________________________

Date: ________________________________________

Witness #2 Signature: _________________________

Date: ________________________________________

This Deed in Lieu of Foreclosure is made in accordance with O.C.G.A. § 44-5-152 and other relevant Georgia laws. Please ensure all parties have proper legal advice before executing this document.