Fill a Valid Generic Direct Deposit Template

The Generic Direct Deposit form is a crucial document that simplifies the process of receiving payments directly into your bank account. This form requires essential information, including your name, Social Security number, and contact details, which are necessary for identification and processing. You will also need to specify whether you are setting up a new direct deposit, making a change, or canceling an existing arrangement. Providing details about your financial institution is vital, as it includes the name of the bank, your account number, and the routing transit number. These numbers ensure that your funds are directed to the correct account. Additionally, you must indicate whether your account is a savings or checking account. Signing the form authorizes your employer or the relevant entity to deposit funds directly into your account and to make adjustments if any errors occur. If the account is joint or in someone else's name, their signature is also required. Completing this form accurately is essential to avoid delays in receiving your payments, so it's advisable to double-check all entries and confirm with your financial institution that they accept direct deposits.

Additional PDF Templates

Trader Hoes - Flexible and reliable, understanding the importance of consistent attendance and teamwork.

The Oregon Hold Harmless Agreement form is a legal document that protects one party from legal responsibility for any injuries or damages incurred by another party in the course of an activity. It is often used in situations where one party is using another’s property or services. This form plays a crucial role in managing risks and liabilities for individuals and businesses alike, and for more detailed information, you can refer to the Hold Harmless Agreement.

Can a Father Sign Over His Rights in South Carolina - By signing the affidavit, the parent maintains awareness of their legal rights and duties.

Similar forms

-

W-4 Form: This form is used to determine the amount of federal income tax to withhold from your paycheck. Like the Direct Deposit form, it requires personal information and your signature to authorize changes.

-

Bank Account Application: When opening a new bank account, you provide similar information, including your name, Social Security number, and account type. Both documents require your consent to process financial transactions.

-

ACH Authorization Form: This document allows a business to withdraw funds from your bank account. It shares the same purpose of authorizing transactions and requires your account details and signature.

- Quitclaim Deed Form: This legal form allows for ownership transfer of real estate without title guarantees, as seen in the quitclaimdeedtemplate.com/colorado-quitclaim-deed-template, making it suitable for familial transfers or title clarifications.

-

Payroll Deduction Authorization: This form authorizes your employer to deduct certain amounts from your paycheck, similar to how the Direct Deposit form allows for crediting funds to your account.

-

Direct Debit Authorization: Used for recurring payments, this document also requires your bank information and signature. It serves a similar function in managing your financial transactions.

-

Tax Refund Direct Deposit Form: This form allows the IRS to deposit your tax refund directly into your bank account. It requires the same account details and your authorization.

-

Loan Application Form: When applying for a loan, you'll provide personal and financial information. Like the Direct Deposit form, it authorizes the lender to access your bank details for processing.

-

Expense Reimbursement Form: This form is used to request reimbursement for expenses. It often includes bank details for direct deposit, similar to how the Direct Deposit form is structured.

-

Investment Account Application: When opening an investment account, you provide personal information and account details. This document also requires your consent to manage your funds.

-

Social Security Direct Deposit Form: This form allows Social Security benefits to be deposited directly into your bank account. It shares the same purpose and requires similar information and authorization.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The Generic Direct Deposit form is used to authorize automatic deposits into a bank account. |

| Personal Information | Users must provide their last name, first name, middle initial, and Social Security Number to complete the form. |

| Account Details | It is necessary to include the name of the financial institution, account number, and routing transit number. |

| Account Types | Users can select between a checking or savings account for the direct deposit. |

| Ownership Declaration | The form requires users to indicate whether the account is self-owned, joint, or other. |

| Authorization | By signing the form, users authorize their employer or payment provider to deposit funds into the specified account. |

| Joint Accounts | If the account is joint, all account holders must sign the form to authorize deposits. |

| Effective Date | Users can specify an effective date for when the direct deposit should begin. |

| Verification Tips | It is recommended to call the financial institution to confirm acceptance of direct deposits and verify account details. |

| Legal Compliance | This form must comply with federal regulations governing electronic payments, including the Electronic Fund Transfer Act. |

Things You Should Know About This Form

-

What is the Generic Direct Deposit form?

The Generic Direct Deposit form is a document that allows individuals to authorize their employer or another organization to deposit funds directly into their bank account. This form is commonly used for payroll deposits, expense reimbursements, or other types of payments.

-

How do I complete the form?

To complete the form, fill in all required boxes, including your last name, first name, Social Security number, and account details. Be sure to sign and date the form at the bottom. It is also advisable to verify your account and routing numbers with your financial institution before submission.

-

What information do I need to provide?

You will need to provide your personal information, including your name and Social Security number. Additionally, you must specify the name of your financial institution, your account number, and the routing transit number. Indicate whether your account is a checking or savings account and specify ownership type (self, joint, or other).

-

What if I want to change or cancel my direct deposit?

If you wish to change or cancel your direct deposit, select the appropriate option on the form. Fill in the effective date for the change or cancellation, and ensure you sign and date the form to validate your request.

-

Do I need to provide my signature?

Yes, your signature is required to authorize the direct deposit. If the account is a joint account or in someone else's name, that individual must also sign the form to agree to the terms.

-

What should I do if I am unsure about my routing number?

If you are unsure about your routing number, contact your financial institution directly. It is important to verify this number to ensure that your direct deposit is processed correctly. Avoid using a deposit slip for verification.

-

Can I use this form for any bank account?

This form can be used for any bank account, provided that the financial institution accepts direct deposits. Always check with your bank to confirm their policies regarding direct deposits.

-

What happens if I fill out the form incorrectly?

If you fill out the form incorrectly, it may delay your direct deposit or cause funds to be deposited into the wrong account. It is crucial to double-check all information, including account and routing numbers, before submitting the form.

-

How long does it take for direct deposit to take effect?

The time it takes for direct deposit to take effect can vary. Generally, it may take one or two pay cycles for the direct deposit to be fully processed and active. It is advisable to confirm with your employer or the organization making the deposits.

Documents used along the form

When setting up direct deposit, several other forms and documents may be required to ensure a smooth process. These documents provide essential information and help facilitate the necessary transactions between employers and financial institutions. Below is a list of commonly used forms alongside the Generic Direct Deposit form.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax to withhold from an employee's paycheck. Completing this form accurately ensures that the right amount of taxes is deducted, preventing underpayment or overpayment.

- Bank Account Verification Letter: A letter from the bank confirming the account holder's details, including account number and routing number. This document serves to verify that the account is valid and can receive direct deposits, thus preventing errors in the deposit process.

- Transfer-on-Death Deed: For those considering estate planning in North Carolina, the todform.com/blank-north-carolina-transfer-on-death-deed/ allows property owners to transfer real estate to beneficiaries upon their death without the need for probate, ensuring the property is passed on according to their wishes.

- Employee Information Form: This form collects personal details from the employee, such as contact information, Social Security number, and emergency contacts. It is essential for maintaining accurate employee records and ensuring proper communication.

- Payroll Authorization Form: This document grants permission for the employer to deposit funds directly into the employee’s bank account. It outlines the terms of the payroll process and ensures that both parties agree on the payment method.

- Change of Direct Deposit Form: If an employee wishes to change their bank account details for direct deposit, this form is necessary. It allows the employee to update their banking information securely, ensuring that future payments are directed to the correct account.

- Tax Identification Number (TIN) Certification: This form certifies the employee's TIN, which is crucial for tax reporting purposes. Employers use this information to comply with tax regulations and to report wages paid to the employee accurately.

Understanding these forms and their purposes can significantly ease the direct deposit setup process. Having all necessary documentation ready ensures timely and accurate payments, fostering a positive relationship between employees and employers.

Generic Direct Deposit Preview

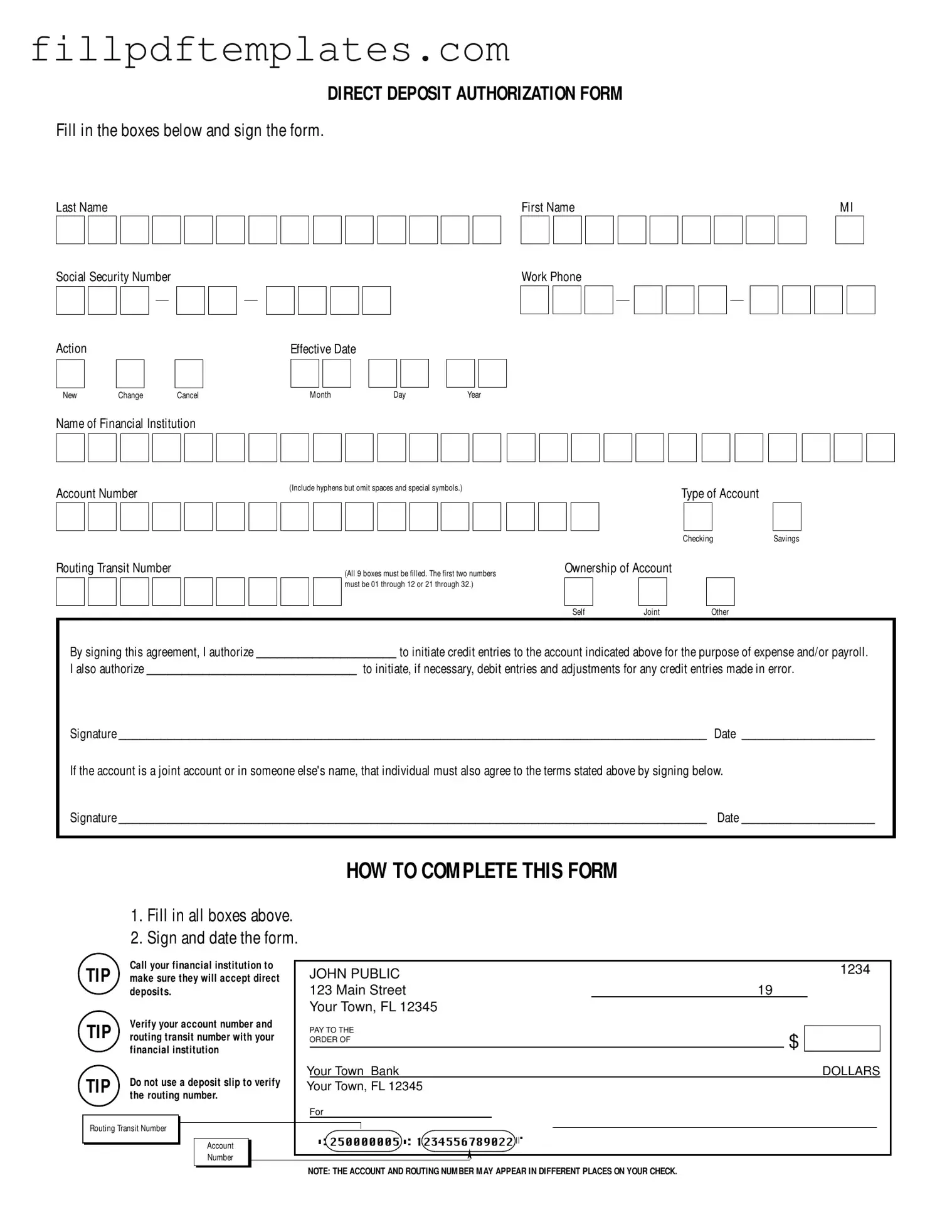

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.