Blank Florida Transfer-on-Death Deed Form

The Florida Transfer-on-Death Deed (TOD) form serves as a valuable tool for property owners seeking to streamline the process of transferring real estate upon their death. This legal document allows individuals to designate one or more beneficiaries who will automatically inherit the property without the need for probate. By utilizing a TOD deed, property owners can maintain full control of their real estate during their lifetime, ensuring that their wishes are honored after they pass away. Importantly, the form is revocable, meaning that it can be altered or canceled at any time before the owner's death, providing flexibility in estate planning. Moreover, this deed can be particularly advantageous for those looking to avoid the complexities and costs associated with probate, making it an appealing option for many Floridians. Understanding the requirements and implications of the TOD deed is essential for anyone considering this method of property transfer, as it can significantly impact the future of their estate and the beneficiaries involved.

Other Common Transfer-on-Death Deed State Templates

Can a Transfer on Death Deed Be Contested - This deed facilitates the transfer of real estate without going through probate.

Transfer on Death Deed Illinois - Property owners can revoke or change the deed at any time before their death.

The Indiana Transfer-on-Death Deed is a useful tool for property owners who want to ensure a seamless transition of their assets to their beneficiaries. By utilizing this legal document, individuals can avoid the complexities of probate, providing a straightforward method for the direct transfer of real estate. For those looking to learn more about this important aspect of estate planning, detailed information can be found at https://transferondeathdeedform.com/indiana-transfer-on-death-deed, which can help clarify the process and benefits of this deed. Ensuring that your property is passed on according to your wishes offers invaluable peace of mind for both you and your loved ones.

Transfer on Death Deed Iowa Form - It's important to carefully choose your beneficiaries on a Transfer-on-Death Deed, as they will receive your property outright.

Transfer on Death Deed Form Georgia - Certain real estate transactions, like sales or mortgages, can be processed without considering the deed.

Similar forms

The Transfer-on-Death Deed (TOD) form shares similarities with several other legal documents. Each serves a unique purpose but has common elements related to property transfer and beneficiary designations. Here are eight documents that are similar to the Transfer-on-Death Deed:

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. Like the TOD, it allows for the transfer of property but is effective only upon death.

- Living Trust: A living trust allows individuals to manage their assets during their lifetime and specifies how those assets will be distributed after death. It avoids probate, similar to the TOD.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance or retirement plans. They specify who receives the asset upon the account holder's death, akin to the beneficiary designation in a TOD.

- Joint Tenancy with Right of Survivorship: This ownership arrangement allows co-owners to inherit each other's share of property automatically upon death, similar to the transfer mechanism in a TOD.

- Transfer-on-Death Account: Similar to the TOD deed, this account allows individuals to name beneficiaries who will inherit the account assets directly upon death, bypassing probate.

- Payable-on-Death (POD) Accounts: These bank accounts allow the account holder to designate beneficiaries who will receive the funds upon their death, paralleling the TOD's intent to transfer property directly.

- Life Estate Deed: This deed allows a person to retain the right to use property during their lifetime while designating a beneficiary to receive the property after their death, similar to the TOD deed's purpose.

- Corporate Formation: Establishing a corporation often requires essential documents, including the Articles of Incorporation, which lays the groundwork for legal recognition and operational capability in business dealings.

- Revocable Living Will: While primarily focused on healthcare decisions, this document can include directives about asset management and distribution, similar to how a TOD specifies property transfer.

Document Properties

| Fact Name | Description |

|---|---|

| Purpose | The Florida Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive their real estate upon death, avoiding probate. |

| Governing Law | This deed is governed by Florida Statutes, specifically Section 732.4015, which outlines the requirements and effects of the transfer-on-death deed. |

| Revocation | Property owners can revoke the Transfer-on-Death Deed at any time before their death, ensuring flexibility in estate planning. |

| Execution Requirements | The deed must be signed by the property owner and witnessed by two individuals, and it must be recorded in the county where the property is located to be effective. |

Things You Should Know About This Form

-

What is a Transfer-on-Death Deed in Florida?

A Transfer-on-Death Deed (TOD Deed) allows a property owner to transfer real estate to a designated beneficiary upon their death, without the need for probate. This form is particularly useful for individuals who want to ensure that their property passes directly to their heirs without the complexities of the probate process.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Florida can use a Transfer-on-Death Deed. This includes homeowners, landlords, and anyone with an interest in property. However, the deed must be properly executed and recorded to be valid.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must fill out the appropriate form, which includes details about the property and the beneficiary. After completing the form, you must sign it in the presence of a notary public and then record it with the county clerk's office where the property is located.

-

Is there a cost associated with filing a Transfer-on-Death Deed?

Yes, there may be a filing fee when you record the Transfer-on-Death Deed with the county clerk's office. The fee varies by county, so it’s best to check with your local office for the exact amount. Additionally, if you seek legal assistance in preparing the deed, there may be additional costs involved.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed that explicitly revokes the previous one or record a formal revocation document. It is important to ensure that the new deed is properly executed and recorded.

-

What happens if the beneficiary predeceases me?

If the designated beneficiary dies before you, the property will not automatically transfer to them. Instead, the property will pass according to your will or, if there is no will, according to Florida's intestacy laws. To avoid complications, consider naming an alternate beneficiary.

-

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to have an attorney, consulting one is advisable. An attorney can help ensure that the deed is completed correctly and meets all legal requirements. This can prevent potential issues down the line.

-

Will a Transfer-on-Death Deed affect my property taxes?

No, a Transfer-on-Death Deed does not affect your property taxes while you are alive. You will continue to be responsible for property taxes until your death. Once the property transfers to the beneficiary, they will then assume responsibility for the taxes.

Documents used along the form

When considering a Transfer-on-Death Deed in Florida, it is essential to understand that this document often works in conjunction with various other forms and documents. Each of these documents serves a specific purpose in ensuring a smooth transfer of property upon the owner's death, while also addressing legal and administrative requirements. Below is a list of commonly associated documents that may be utilized alongside the Transfer-on-Death Deed.

- Last Will and Testament: This document outlines how a person wishes to distribute their assets after death. It can complement a Transfer-on-Death Deed by addressing any property not included in the deed.

- Living Trust: A living trust allows individuals to manage their assets during their lifetime and specify how they should be distributed after death. It can provide additional control over property that may not be covered by the Transfer-on-Death Deed.

- Lease Agreement: A https://legalpdfdocs.com/ form is essential for outlining the rental terms between landlords and tenants, ensuring clarity and legal protection for both parties.

- Affidavit of Heirship: This sworn statement identifies the heirs of a deceased person. It may be necessary to establish rightful ownership of property when a Transfer-on-Death Deed is not utilized.

- Property Deed: This document serves as proof of ownership for real estate. It may need to be referenced to ensure the Transfer-on-Death Deed is correctly applied to the intended property.

- Beneficiary Designation Forms: These forms are used for accounts such as life insurance and retirement plans. They can work alongside the Transfer-on-Death Deed to ensure all assets are directed to the intended beneficiaries.

- Notice of Death: This document informs relevant parties, such as creditors and heirs, of an individual's passing. It may be necessary to ensure proper notification following the execution of a Transfer-on-Death Deed.

- Estate Tax Return: Depending on the value of the estate, this document may be required to report and pay any applicable estate taxes. It is essential for compliance with tax regulations after the transfer of property.

- Change of Ownership Form: This form may be needed to update property records with local authorities. It ensures that the transfer outlined in the Transfer-on-Death Deed is officially recognized.

- Power of Attorney: This document grants someone the authority to act on behalf of another person in legal matters. It can be useful if the property owner becomes incapacitated before their death.

In summary, understanding the various documents that often accompany a Florida Transfer-on-Death Deed is crucial for effective estate planning. Each document plays a vital role in ensuring that the transfer of property is executed according to the owner's wishes and in compliance with legal requirements. Being informed about these forms can help facilitate a smoother transition for loved ones during a challenging time.

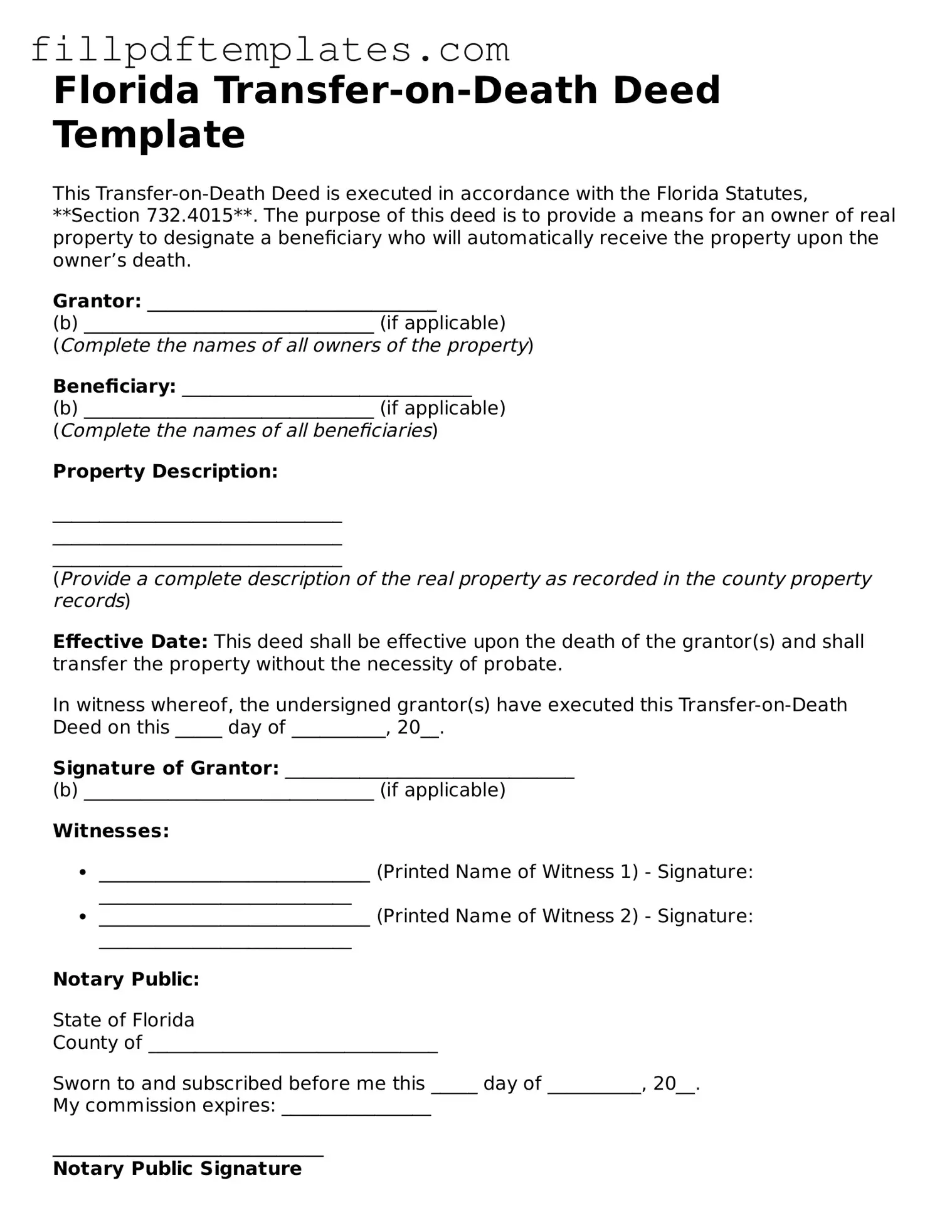

Florida Transfer-on-Death Deed Preview

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the Florida Statutes, **Section 732.4015**. The purpose of this deed is to provide a means for an owner of real property to designate a beneficiary who will automatically receive the property upon the owner’s death.

Grantor: _______________________________

(b) _______________________________ (if applicable)

(Complete the names of all owners of the property)

Beneficiary: _______________________________

(b) _______________________________ (if applicable)

(Complete the names of all beneficiaries)

Property Description:

_______________________________

_______________________________

_______________________________

(Provide a complete description of the real property as recorded in the county property records)

Effective Date: This deed shall be effective upon the death of the grantor(s) and shall transfer the property without the necessity of probate.

In witness whereof, the undersigned grantor(s) have executed this Transfer-on-Death Deed on this _____ day of __________, 20__.

Signature of Grantor: _______________________________

(b) _______________________________ (if applicable)

Witnesses:

- _____________________________ (Printed Name of Witness 1) - Signature: ___________________________

- _____________________________ (Printed Name of Witness 2) - Signature: ___________________________

Notary Public:

State of Florida

County of _______________________________

Sworn to and subscribed before me this _____ day of __________, 20__.

My commission expires: ________________

_____________________________

Notary Public Signature