Blank Florida Quitclaim Deed Form

In the realm of real estate transactions, the Florida Quitclaim Deed serves as a vital tool for property owners seeking to transfer their interest in a property without the complexities often associated with other types of deeds. This form allows individuals to convey their ownership rights to another party, but it does so without guaranteeing that the title is free of claims or encumbrances. As a result, the Quitclaim Deed is particularly useful in situations where the parties know each other well, such as family transfers or settling estates. The form typically includes essential information such as the names of the grantor and grantee, a legal description of the property, and the date of transfer. While it may seem straightforward, understanding the implications of using a Quitclaim Deed is crucial, as it can significantly impact the rights of both the giver and the receiver. In Florida, this document must be executed with certain formalities, including notarization, to ensure its validity. Furthermore, recording the deed with the county clerk's office is necessary to provide public notice of the transfer, safeguarding the interests of all parties involved.

Other Common Quitclaim Deed State Templates

Cost for Quit Claim Deed - The primary purpose is to divest the grantor's interest to the grantee.

For anyone looking to navigate legal complexities, a valuable resource is the necessary Power of Attorney form. This form is instrumental in empowering individuals to represent others in various legal or financial decisions, ensuring important matters are handled effectively when one is unable to do so.

Quit Claim Deed Form Iowa - The document needs to be notarized in order for the transfer to be considered valid.

What Happens After a Quit Claim Deed Is Recorded - A Quitclaim Deed is a popular choice for quick property transactions.

Nj Quit Claim Deed Requirements - This document is often used among family members.

Similar forms

- Warranty Deed: This document guarantees that the grantor has clear title to the property and provides a warranty against any future claims. Unlike a quitclaim deed, it offers more protection to the grantee.

- Grant Deed: Similar to a warranty deed, a grant deed conveys property and includes assurances that the grantor has not transferred the title to anyone else. It provides some level of protection but is less comprehensive than a warranty deed.

- Special Purpose Deed: This type of deed is used for specific transactions, such as transferring property to a spouse or in a divorce. It may include limited warranties similar to a quitclaim deed.

- Deed of Trust: Often used in real estate transactions, this document secures a loan by transferring the title to a trustee until the loan is paid off. It is similar in that it involves the transfer of property rights.

- Affidavit of Title: This document is a sworn statement by the seller regarding the ownership and status of the property. While it does not transfer ownership, it serves to clarify title issues, similar to the intent of a quitclaim deed.

- Lease Agreement: A lease agreement allows one party to use another's property for a specified time in exchange for rent. While it does not transfer ownership, it establishes rights similar to those conveyed in a quitclaim deed.

- Power of Attorney: This document grants one individual the authority to act on behalf of another in legal matters, including property transactions. It can facilitate a quitclaim deed transfer by allowing someone to sign on behalf of the property owner.

- Power of Attorney: A Colorado Power of Attorney form is a legal document that allows an individual to authorize someone else to act on their behalf in financial or health-related matters. This arrangement provides individuals the benefit of delegating important decisions to a trusted representative. More information can be found in the Power of Attorney form.

- Real Estate Purchase Agreement: This contract outlines the terms of a property sale. While it does not transfer title, it establishes the framework for a future deed, similar to the intent behind a quitclaim deed.

- Transfer on Death Deed: This deed allows an individual to transfer property to a beneficiary upon their death without going through probate. It serves a similar purpose to a quitclaim deed by facilitating the transfer of ownership.

- Bill of Sale: While primarily used for personal property, a bill of sale transfers ownership from one party to another. It is similar in function to a quitclaim deed, as both documents facilitate the transfer of rights.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate without any warranties or guarantees regarding the property title. |

| Governing Laws | The use and requirements for a Quitclaim Deed in Florida are governed by Florida Statutes, specifically Chapter 689. |

| Parties Involved | The deed involves two parties: the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| Consideration | While not required, it is common to include a nominal consideration (often $10) to validate the transfer. |

| Recording | To protect the grantee's interest, the Quitclaim Deed should be recorded with the county clerk's office where the property is located. |

| Limitations | Because a Quitclaim Deed does not guarantee clear title, it is advisable for the grantee to conduct a title search before accepting the deed. |

Things You Should Know About This Form

-

What is a Florida Quitclaim Deed?

A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without making any guarantees about the property’s title. This means the grantor (the person transferring the property) relinquishes their interest in the property, but does not guarantee that the title is clear or free of liens. It is often used between family members or in situations where the parties know each other well.

-

When should I use a Quitclaim Deed?

You might consider using a Quitclaim Deed when transferring property between family members, such as in a divorce settlement, or when adding a spouse to the title. It is also useful for clearing up title issues or when the grantor is not concerned about any existing claims against the property.

-

What information is required on a Florida Quitclaim Deed?

A Quitclaim Deed in Florida should include the following information:

- The names and addresses of the grantor and grantee.

- A legal description of the property being transferred.

- The date of the transfer.

- The signature of the grantor, which must be notarized.

It is essential to ensure that all details are accurate to avoid any future disputes.

-

Do I need to have the Quitclaim Deed notarized?

Yes, in Florida, the signature of the grantor must be notarized for the Quitclaim Deed to be valid. Notarization provides an extra layer of authenticity and helps prevent fraud.

-

How do I file a Quitclaim Deed in Florida?

After completing the Quitclaim Deed, you must file it with the county Clerk of Court where the property is located. There may be a filing fee, so it’s wise to check with the local office for specific requirements and costs.

-

Are there any tax implications when using a Quitclaim Deed?

Generally, transferring property with a Quitclaim Deed does not trigger a taxable event. However, it is advisable to consult with a tax professional to understand any potential implications, especially if the property has appreciated in value or if there are existing liens.

-

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and filed, it cannot be revoked unilaterally. If the grantor wishes to regain ownership, they would need to execute another deed transferring the property back, typically involving the consent of the grantee.

Documents used along the form

When dealing with property transfers in Florida, the Quitclaim Deed is a commonly used document. However, several other forms and documents may accompany it to ensure a smooth transaction. Understanding these documents can help clarify the process and protect the interests of all parties involved.

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. It provides more protection to the buyer compared to a quitclaim deed.

- Property Transfer Tax Form: This form is required for reporting the transfer of property and calculating any applicable taxes due at the time of the transfer.

- Title Search Report: A title search report verifies the ownership history of the property and checks for any liens or encumbrances that may affect the transfer.

- Hold Harmless Agreement: Utilizing a Hold Harmless Agreement can be crucial to protect against liabilities arising during property transactions, ensuring all parties are safeguarded against potential legal disputes.

- Affidavit of Title: This sworn statement from the seller confirms that they are the rightful owner of the property and outlines any claims or encumbrances that may exist.

- Closing Statement: Also known as a HUD-1, this document summarizes the financial aspects of the transaction, including costs and fees associated with the sale.

- Power of Attorney: If a party is unable to sign the quitclaim deed in person, a power of attorney allows another individual to act on their behalf during the transaction.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide information on rules, regulations, and any fees associated with the community.

- Notice of Intent to Transfer: This document informs relevant parties, such as the local government or HOA, about the impending transfer of property ownership.

- Certificate of Good Standing: This document may be required for corporate entities involved in the transaction, confirming that they are authorized to conduct business in Florida.

Each of these documents plays a vital role in the property transfer process. By understanding their purpose and importance, individuals can navigate the complexities of real estate transactions more effectively.

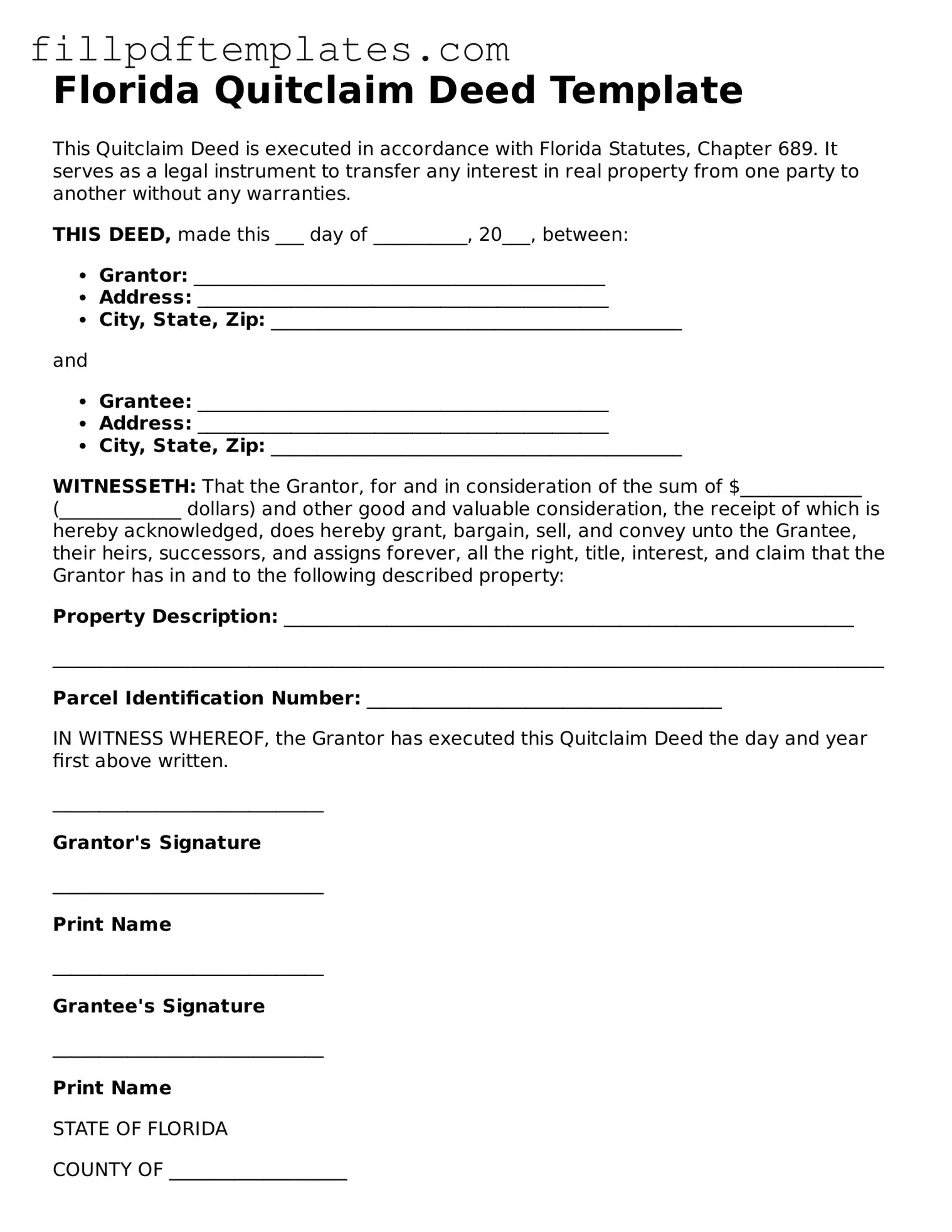

Florida Quitclaim Deed Preview

Florida Quitclaim Deed Template

This Quitclaim Deed is executed in accordance with Florida Statutes, Chapter 689. It serves as a legal instrument to transfer any interest in real property from one party to another without any warranties.

THIS DEED, made this ___ day of __________, 20___, between:

- Grantor: ____________________________________________

- Address: ____________________________________________

- City, State, Zip: ____________________________________________

and

- Grantee: ____________________________________________

- Address: ____________________________________________

- City, State, Zip: ____________________________________________

WITNESSETH: That the Grantor, for and in consideration of the sum of $_____________ (_____________ dollars) and other good and valuable consideration, the receipt of which is hereby acknowledged, does hereby grant, bargain, sell, and convey unto the Grantee, their heirs, successors, and assigns forever, all the right, title, interest, and claim that the Grantor has in and to the following described property:

Property Description: _____________________________________________________________

_________________________________________________________________________________________

Parcel Identification Number: ______________________________________

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed the day and year first above written.

_____________________________

Grantor's Signature

_____________________________

Print Name

_____________________________

Grantee's Signature

_____________________________

Print Name

STATE OF FLORIDA

COUNTY OF ___________________

On this ___ day of __________, 20___, before me, a Notary Public in and for said County and State, personally appeared ________________________ and ________________________, the Grantor and Grantee, known to me to be the persons described in and who executed the foregoing instrument, and they acknowledged that they executed the same for the purposes therein expressed.

WITNESS my hand and official seal.

_____________________________

Notary Public

My Commission Expires: ______________