Blank Florida Promissory Note Form

The Florida Promissory Note form serves as a crucial document in financial transactions, establishing a clear agreement between a borrower and a lender. This form outlines the specific terms of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. By detailing these elements, the promissory note provides both parties with a structured framework that minimizes misunderstandings. Furthermore, it typically includes provisions for default, which specify the consequences should the borrower fail to meet their obligations. This legal instrument not only protects the lender's interests but also clarifies the borrower's responsibilities, ensuring that both parties are on the same page. In Florida, the promissory note must comply with state laws to be enforceable, making it essential for individuals and businesses alike to understand its components and implications. As financial transactions become increasingly complex, having a solid grasp of this form can empower individuals to navigate their lending and borrowing relationships with confidence.

Other Common Promissory Note State Templates

Promissory Note Template Georgia - Offers clarity and often prevents conflicts regarding payments.

Illinois Promissory Note - This form is often used in various financial transactions, from informal personal loans to formal financing agreements.

The Maryland Hold Harmless Agreement form is a legal document where one party agrees not to hold the other party responsible for any injuries, damages, or losses. This agreement can be used in various contexts, making it a versatile tool for managing risk. Whether you're organizing an event or conducting a service, understanding this form ensures protection and peace of mind for all parties involved, especially when referencing a Hold Harmless Agreement.

Basic Promissory Note - Detailed attention to dates in the Promissory Note helps both parties stay on track with payments.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms under which money is borrowed. It includes details such as the loan amount, interest rate, and repayment schedule.

- Transfer-on-Death Deed: This legal form, essential for property owners, facilitates the seamless transfer of real estate to designated beneficiaries upon death, avoiding probate complications. More information can be found at todform.com/blank-arkansas-transfer-on-death-deed/.

- Mortgage: A mortgage is a specific type of loan agreement secured by real property. It shares similarities with a promissory note in that both documents establish a borrower's obligation to repay the borrowed amount.

- Personal Guarantee: A personal guarantee is a document where an individual agrees to repay a debt if the primary borrower defaults. It functions similarly to a promissory note by establishing a personal obligation to pay.

- Installment Agreement: This document details a payment plan for a debt. Like a promissory note, it specifies how much is owed and the schedule for repayment, ensuring clarity for both parties.

- Bill of Exchange: A bill of exchange is a written order for one party to pay a specific sum to another party. Similar to a promissory note, it serves as a financial instrument that promises payment.

- Credit Agreement: A credit agreement outlines the terms of a credit arrangement between a lender and a borrower. It includes repayment terms and interest rates, much like a promissory note does.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | A Florida Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Governing Law | Florida Statutes, Chapter 673 governs promissory notes in Florida. |

| Parties Involved | The note involves a borrower (maker) and a lender (payee). |

| Payment Terms | The note specifies the amount to be paid, interest rates, and payment schedule. |

| Interest Rates | Interest can be fixed or variable, and must comply with Florida usury laws. |

| Signatures Required | The borrower must sign the note for it to be legally binding. |

| Transferability | Promissory notes can be transferred or sold to other parties, subject to certain conditions. |

| Default Provisions | The note may outline consequences for default, including late fees or acceleration of payment. |

| Legal Enforceability | A properly executed promissory note is enforceable in a court of law. |

| Notarization | While notarization is not required, it can add an extra layer of authenticity. |

Things You Should Know About This Form

-

What is a Florida Promissory Note?

A Florida Promissory Note is a legal document in which one party (the borrower) agrees to pay a specified amount of money to another party (the lender) under agreed-upon terms. This note outlines the principal amount, interest rate, repayment schedule, and any penalties for late payments. It serves as a written promise to repay the borrowed funds.

-

What are the key components of a Florida Promissory Note?

Key components typically include:

- Principal Amount: The total amount of money being borrowed.

- Interest Rate: The percentage of the principal that the borrower must pay in addition to the principal.

- Repayment Schedule: Details on when payments are due, including the frequency (monthly, quarterly, etc.) and the duration of the loan.

- Default Clauses: Conditions under which the borrower would be considered in default, along with the consequences.

- Signatures: Both parties must sign the document to make it legally binding.

-

Is a Florida Promissory Note enforceable?

Yes, a Florida Promissory Note is generally enforceable in a court of law, provided it meets certain legal requirements. It must be clear, specific, and signed by both parties. If the borrower fails to repay the loan as outlined in the note, the lender can take legal action to recover the owed amount.

-

Can a Florida Promissory Note be modified?

Yes, a Florida Promissory Note can be modified if both parties agree to the changes. This might include adjusting the interest rate, extending the repayment period, or changing the payment schedule. It is important to document any modifications in writing and have both parties sign the amended agreement to ensure its enforceability.

Documents used along the form

When dealing with a Florida Promissory Note, several other documents often accompany it to ensure clarity and legal compliance. Each of these documents plays a specific role in the lending process. Below is a list of common forms and documents used alongside a Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rates, and repayment schedule. It serves as a comprehensive contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the collateral being used. It protects the lender's interests by specifying what happens if the borrower defaults.

- Disclosure Statement: This document provides important information about the loan, such as fees, interest rates, and the total cost of the loan. It ensures that the borrower understands the financial implications.

- Personal Guarantee: In cases where a business borrows money, a personal guarantee may be required from an owner or officer. This document holds them personally responsible for repayment if the business defaults.

- Amortization Schedule: This is a table that outlines each payment over the life of the loan. It shows how much of each payment goes toward principal and interest, helping borrowers plan their finances.

- Last Will and Testament: It is crucial to have your final wishes documented to avoid any disputes among heirs. You can find a reliable template at arizonaformpdf.com that helps ensure your legacy is honored.

- Loan Payment Receipt: When a borrower makes a payment, this receipt serves as proof of payment. It is important for record-keeping and can be used in case of disputes.

- Notice of Default: If the borrower fails to make payments, this document notifies them of their default status. It is often a precursor to further legal action.

- Release of Lien: Once the loan is fully repaid, this document releases any claim the lender had on the collateral. It is essential for clearing the borrower's title.

These documents work together with the Florida Promissory Note to create a clear and enforceable agreement between lenders and borrowers. Understanding each of these forms is crucial for anyone involved in a loan transaction.

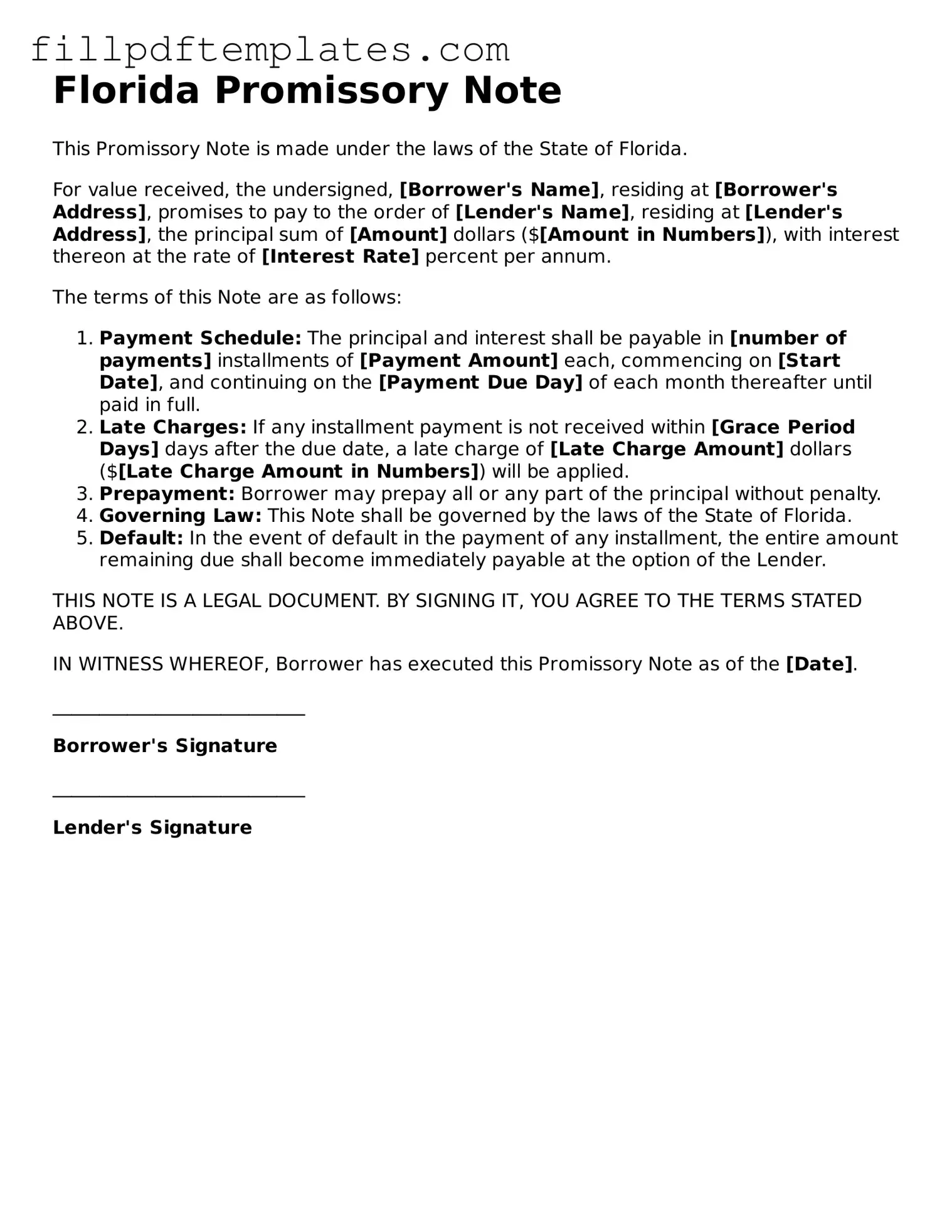

Florida Promissory Note Preview

Florida Promissory Note

This Promissory Note is made under the laws of the State of Florida.

For value received, the undersigned, [Borrower's Name], residing at [Borrower's Address], promises to pay to the order of [Lender's Name], residing at [Lender's Address], the principal sum of [Amount] dollars ($[Amount in Numbers]), with interest thereon at the rate of [Interest Rate] percent per annum.

The terms of this Note are as follows:

- Payment Schedule: The principal and interest shall be payable in [number of payments] installments of [Payment Amount] each, commencing on [Start Date], and continuing on the [Payment Due Day] of each month thereafter until paid in full.

- Late Charges: If any installment payment is not received within [Grace Period Days] days after the due date, a late charge of [Late Charge Amount] dollars ($[Late Charge Amount in Numbers]) will be applied.

- Prepayment: Borrower may prepay all or any part of the principal without penalty.

- Governing Law: This Note shall be governed by the laws of the State of Florida.

- Default: In the event of default in the payment of any installment, the entire amount remaining due shall become immediately payable at the option of the Lender.

THIS NOTE IS A LEGAL DOCUMENT. BY SIGNING IT, YOU AGREE TO THE TERMS STATED ABOVE.

IN WITNESS WHEREOF, Borrower has executed this Promissory Note as of the [Date].

___________________________

Borrower's Signature

___________________________

Lender's Signature