Blank Florida Loan Agreement Form

The Florida Loan Agreement form serves as a crucial document in the realm of personal and business financing, providing clarity and structure to the lending process. This form outlines the terms and conditions under which a borrower receives funds from a lender, ensuring that both parties understand their rights and responsibilities. Key components of the agreement include the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it specifies the consequences of default, which can protect lenders while also informing borrowers of their obligations. Understanding the nuances of this form is essential for anyone engaging in a loan transaction in Florida, as it helps to mitigate risks and fosters transparency in financial dealings.

Other Common Loan Agreement State Templates

Promissory Note Template Georgia - This form serves as a foundation for sound financial practices.

In the legal landscape of the District of Columbia, a Hold Harmless Agreement form plays a pivotal role. This document is a contract where one party agrees not to hold the other party liable for risks, including physical risk or legal liability. It serves as a protective shield during various transactions, ensuring peace of mind for all involved parties. For more details, you can refer to the Hold Harmless Agreement.

California Promissory Note Template - A Loan Agreement can include personal guarantees from the borrower.

New York Promissory Note - The form may specify a grace period for late payments before penalties arise.

Similar forms

Promissory Note: This document is a written promise to pay a specific amount of money at a certain time. Like a Loan Agreement, it outlines the terms of repayment, including interest rates and due dates.

Mortgage Agreement: This document secures a loan with real property. Similar to a Loan Agreement, it details the loan amount, interest, and the consequences of default, but it also includes terms related to the property itself.

Security Agreement: This document grants a lender a security interest in personal property. It is similar to a Loan Agreement in that it specifies loan terms but focuses more on collateral used to secure the loan.

- ATV Bill of Sale: This form is essential for the legal transfer of ownership of an all-terrain vehicle in Arizona, ensuring clarity and preventing disputes. For more information, visit arizonaformpdf.com/.

Lease Agreement: This document allows a person to use property owned by another in exchange for payment. Both agreements outline payment terms and responsibilities, but a Lease Agreement typically pertains to rental situations.

Credit Agreement: This document governs a line of credit between a lender and borrower. Like a Loan Agreement, it specifies terms, including repayment schedules and interest rates, but it often allows for ongoing borrowing.

Installment Sale Agreement: This document allows a buyer to purchase an item over time through scheduled payments. Similar to a Loan Agreement, it includes payment terms but is focused on the sale of goods rather than a loan.

Personal Loan Agreement: This document outlines the terms of a loan between individuals. It is similar to a Loan Agreement in that it specifies the amount borrowed, repayment terms, and any interest, but it often has less formal structure.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | The Florida Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This form is governed by the laws of the State of Florida, specifically under Florida Statutes Chapter 687. |

| Parties Involved | The agreement typically involves two parties: the lender, who provides the funds, and the borrower, who receives the funds. |

| Loan Amount | The form specifies the total amount of money being borrowed, which is crucial for both parties to understand their financial obligations. |

| Interest Rate | The agreement outlines the interest rate applicable to the loan, which can be fixed or variable depending on the terms agreed upon. |

| Repayment Terms | It details the repayment schedule, including the frequency of payments (monthly, quarterly, etc.) and the duration of the loan. |

| Default Conditions | The form includes conditions under which the borrower may be considered in default, which can lead to penalties or legal action. |

| Collateral | If applicable, the agreement may specify any collateral that secures the loan, providing the lender with a form of protection. |

| Amendments | The document may outline how amendments to the agreement can be made, ensuring that any changes are documented properly. |

| Signatures | Both parties must sign the agreement to make it legally binding, often requiring a witness or notary for added validity. |

Things You Should Know About This Form

-

What is a Florida Loan Agreement form?

A Florida Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Florida. It details the amount borrowed, interest rates, repayment schedule, and any collateral involved. This agreement helps both parties understand their rights and responsibilities.

-

Who needs a Florida Loan Agreement form?

Anyone who is lending or borrowing money in Florida should consider using a Loan Agreement form. This includes individuals, businesses, or organizations. Having a written agreement protects both the lender and the borrower by clearly defining the terms of the loan.

-

What key elements should be included in the form?

A comprehensive Florida Loan Agreement should include:

- The names and contact information of both the lender and borrower.

- The principal amount of the loan.

- The interest rate and how it is calculated.

- The repayment schedule, including due dates.

- Any collateral securing the loan.

- Consequences of late payments or default.

Including these elements helps ensure clarity and can prevent misunderstandings later on.

-

Is it necessary to have a lawyer review the Loan Agreement?

While it is not strictly necessary, having a lawyer review the Loan Agreement can be beneficial. A legal expert can ensure that the document complies with Florida laws and that all terms are fair and clear. This step can provide peace of mind for both parties.

-

Can the terms of the Loan Agreement be changed after signing?

Yes, the terms of the Loan Agreement can be changed, but both parties must agree to the changes. It’s best to document any modifications in writing and have both parties sign the updated agreement. This helps maintain clarity and prevents future disputes.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take specific actions as outlined in the Loan Agreement. This may include charging late fees, initiating legal proceedings, or seizing collateral if applicable. It’s important for both parties to understand the consequences of default before entering into the agreement.

Documents used along the form

When entering into a loan agreement in Florida, several other forms and documents may be necessary to ensure clarity and legal compliance. These documents help outline the terms of the loan, protect the interests of both parties, and provide a clear framework for the transaction. Below is a list of commonly used forms alongside the Florida Loan Agreement.

- This document serves as a written promise from the borrower to repay the loan under specified terms, including interest rates and repayment schedules.

- If the loan is secured by collateral, this agreement details the assets pledged by the borrower to guarantee repayment.

- This form provides essential information about the loan, including fees, interest rates, and the total cost of borrowing, ensuring transparency for the borrower.

- This document may be required if the borrower is a business entity. It holds an individual personally responsible for repaying the loan if the business defaults.

- If real estate secures the loan, this document establishes the lender's legal claim to the property until the loan is repaid.

- Transfer-on-Death Deed: This form enables property owners to designate a recipient for their property posthumously, avoiding the probate process and ensuring a seamless transfer, as seen on transferondeathdeedform.com/texas-transfer-on-death-deed/.

- This outlines the timeline for payments, including due dates and amounts, helping both parties track the repayment process.

- This form provides the lender with an overview of the borrower’s financial situation, including income, assets, and liabilities, aiding in the loan approval process.

Understanding these documents is crucial for anyone involved in a loan agreement in Florida. Each form plays a vital role in protecting the rights and responsibilities of both the borrower and the lender, ensuring a smooth transaction and reducing the risk of misunderstandings.

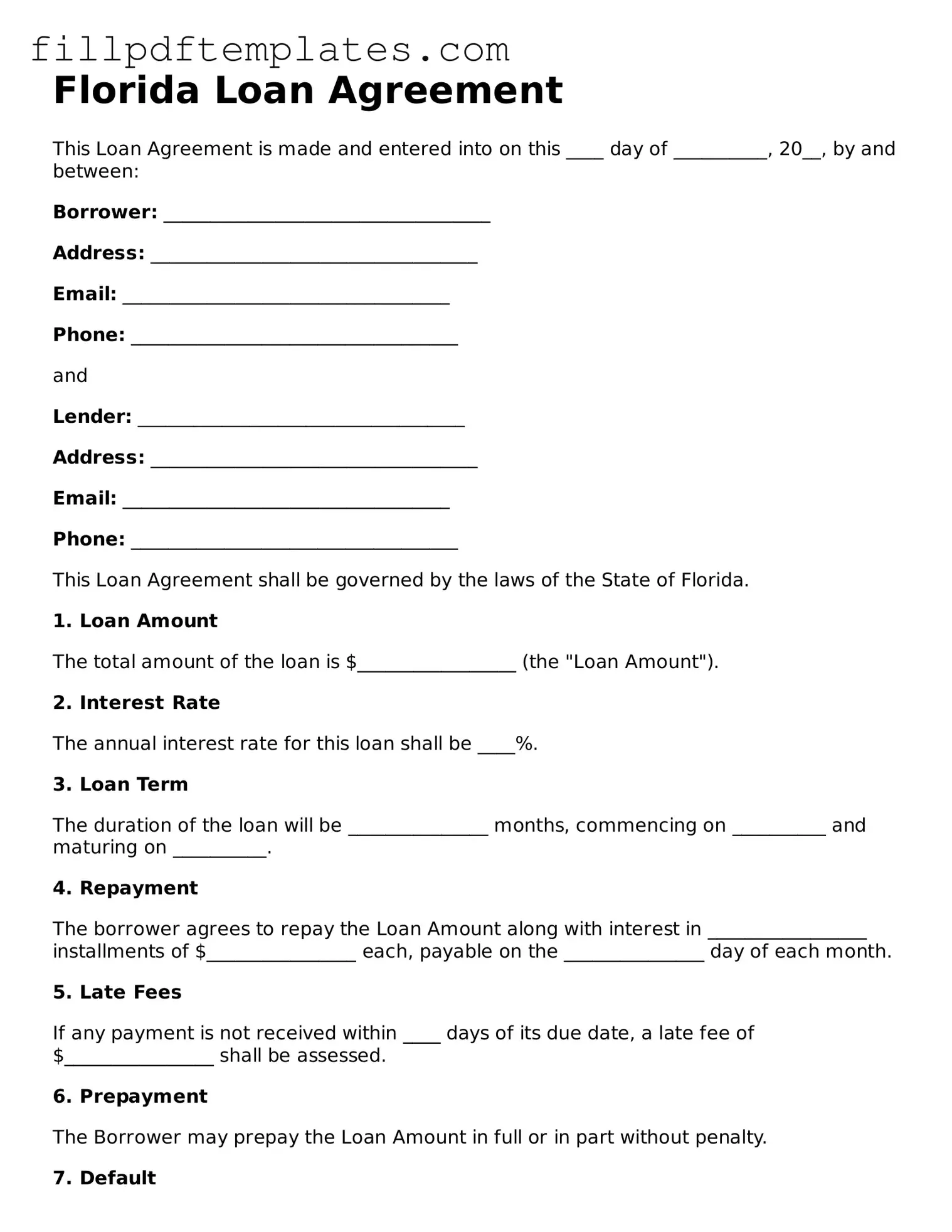

Florida Loan Agreement Preview

Florida Loan Agreement

This Loan Agreement is made and entered into on this ____ day of __________, 20__, by and between:

Borrower: ___________________________________

Address: ___________________________________

Email: ___________________________________

Phone: ___________________________________

and

Lender: ___________________________________

Address: ___________________________________

Email: ___________________________________

Phone: ___________________________________

This Loan Agreement shall be governed by the laws of the State of Florida.

1. Loan Amount

The total amount of the loan is $_________________ (the "Loan Amount").

2. Interest Rate

The annual interest rate for this loan shall be ____%.

3. Loan Term

The duration of the loan will be _______________ months, commencing on __________ and maturing on __________.

4. Repayment

The borrower agrees to repay the Loan Amount along with interest in _________________ installments of $________________ each, payable on the _______________ day of each month.

5. Late Fees

If any payment is not received within ____ days of its due date, a late fee of $________________ shall be assessed.

6. Prepayment

The Borrower may prepay the Loan Amount in full or in part without penalty.

7. Default

In the event of default, the Lender may seek all legal remedies available under Florida law.

8. Governing Law

This agreement shall be governed and interpreted in accordance with the laws of the State of Florida.

9. Amendments

This agreement may only be amended in writing and signed by both parties.

10. Signatures

The parties below have executed this Loan Agreement on the day and year first above written.

Borrower's Signature: _______________________

Date: _______________

Lender's Signature: _______________________

Date: _______________