Blank Florida Lady Bird Deed Form

In the realm of estate planning, the Florida Lady Bird Deed stands out as a valuable tool for property owners seeking to simplify the transfer of their real estate while retaining certain rights during their lifetime. This unique legal document allows individuals to transfer their property to beneficiaries upon their passing, all while maintaining control over the property until that time. One of the most appealing features of the Lady Bird Deed is its ability to bypass the often lengthy and costly probate process, ensuring that loved ones can inherit property without unnecessary delays. Furthermore, it offers the added benefit of protecting the property from creditors, providing peace of mind to the property owner. Understanding the nuances of this deed, including how it differs from traditional life estate deeds and the implications it has on Medicaid eligibility, is crucial for anyone considering this option. As you navigate the intricacies of estate planning, the Florida Lady Bird Deed may serve as a practical solution to ensure your wishes are honored while safeguarding your family's future.

Other Common Lady Bird Deed State Templates

What Is a Lady Bird Deed in Michigan - A Lady Bird Deed can help protect the property from creditors after the owner's death.

To ensure that your wishes regarding property transfer are respected, consider utilizing the Massachusetts Transfer-on-Death Deed form, which allows real estate to be effectively passed to beneficiaries after your passing without the need for probate. For more information on this legal tool and its benefits, visit todform.com/blank-massachusetts-transfer-on-death-deed/, and take a step towards simplifying your estate planning.

Similar forms

The Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate while retaining certain rights. However, it shares similarities with several other legal documents. Below is a list of nine documents that have comparable features or purposes:

- Living Trust: Like the Lady Bird Deed, a living trust allows property to pass outside of probate. It provides flexibility in managing assets during the grantor's lifetime.

- Last Will and Testament Form: To ensure your estate is managed according to your wishes, consider using a detailed Last Will and Testament outline for proper asset distribution.

- Transfer on Death Deed (TODD): This document enables property owners to designate beneficiaries who will receive the property upon their death, similar to how a Lady Bird Deed operates.

- Joint Tenancy Deed: A joint tenancy deed allows two or more people to own property together, with rights of survivorship. This is akin to the transfer of property upon death seen in a Lady Bird Deed.

- Quitclaim Deed: A quitclaim deed transfers whatever interest a person has in a property without warranties. It can be used for informal property transfers, similar to the Lady Bird Deed's intent to simplify ownership transfer.

- Warranty Deed: This document provides a guarantee that the grantor holds clear title to the property. While more formal than a Lady Bird Deed, both serve to transfer ownership.

- Power of Attorney: A power of attorney allows someone to act on behalf of another in legal matters, including property transactions. This can complement a Lady Bird Deed by designating someone to manage the property if the owner becomes incapacitated.

- Life Estate Deed: A life estate deed grants someone the right to use the property during their lifetime, similar to the retained rights seen in a Lady Bird Deed.

- Beneficiary Deed: This document allows property owners to name beneficiaries who will receive the property upon their death, similar to the Lady Bird Deed's functionality.

- Revocable Trust: A revocable trust allows the grantor to change the terms or revoke the trust during their lifetime. This flexibility parallels the rights retained in a Lady Bird Deed.

Understanding these documents is crucial for effective estate planning. Each serves a unique purpose while sharing common goals of asset protection and efficient transfer of property. Consider consulting with a legal professional to determine which option best suits individual needs.

Document Properties

| Fact Name | Description |

|---|---|

| Purpose | The Florida Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by Florida Statutes, specifically under Chapter 689.5. |

| Benefits | It helps avoid probate, ensuring a smoother transition of property to heirs without court involvement. |

| Revocability | The property owner can revoke or change the deed at any time, offering flexibility and peace of mind. |

| Tax Implications | Using a Lady Bird Deed may help preserve the property tax benefits under Florida’s homestead exemption. |

Things You Should Know About This Form

-

What is a Florida Lady Bird Deed?

A Florida Lady Bird Deed is a specific type of deed that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. This type of deed is particularly beneficial for avoiding probate and maintaining control over the property until death.

-

How does a Lady Bird Deed work?

With a Lady Bird Deed, the property owner can transfer ownership to a beneficiary, but still retain the right to live in and use the property for the rest of their life. Upon the owner's death, the property automatically transfers to the named beneficiary without going through probate, simplifying the transfer process.

-

What are the benefits of using a Lady Bird Deed?

This type of deed offers several advantages:

- Avoids probate, which can be time-consuming and costly.

- Allows the property owner to retain full control and use of the property during their lifetime.

- Provides a step-up in basis for tax purposes, potentially reducing capital gains taxes for the beneficiary.

-

Are there any drawbacks to a Lady Bird Deed?

While there are many benefits, some potential drawbacks include:

- The property may still be subject to creditors' claims during the owner's lifetime.

- It may not be recognized in all states, so it’s important to consult with a legal professional.

- Changes in the law or tax regulations could affect the deed’s benefits in the future.

-

Who should consider using a Lady Bird Deed?

This deed is often ideal for homeowners who want to ensure their property passes directly to their chosen beneficiaries without the hassle of probate. It is particularly useful for seniors who wish to retain control over their home while planning for the future.

-

How do I create a Lady Bird Deed?

Creating a Lady Bird Deed typically involves drafting the document with specific language that outlines the transfer of property and the retained rights. It is advisable to work with a qualified attorney or a legal professional who can ensure that the deed complies with Florida law and accurately reflects your wishes.

-

Can I change or revoke a Lady Bird Deed?

Yes, a Lady Bird Deed can be changed or revoked at any time while the property owner is still alive. This flexibility allows the owner to adjust beneficiaries or modify the terms as needed, making it a versatile estate planning tool.

Documents used along the form

The Florida Lady Bird Deed is a useful tool for estate planning, allowing property owners to transfer their property to beneficiaries while retaining certain rights during their lifetime. When preparing a Lady Bird Deed, several other forms and documents may also be necessary to ensure a smooth transfer and proper documentation. Below is a list of commonly used forms in conjunction with the Lady Bird Deed.

- Durable Power of Attorney: This document allows an individual to appoint someone else to make financial decisions on their behalf. It is often used to manage property and financial matters if the individual becomes incapacitated.

- Health Care Surrogate Designation: This form designates a person to make medical decisions for someone if they are unable to do so. It ensures that a trusted individual can advocate for the person's health care wishes.

- Hold Harmless Agreement: This legal document is essential for releasing one party from liability under specified circumstances, ensuring protection against potential disputes or claims, such as exemplified by the Hold Harmless Agreement.

- Last Will and Testament: A will outlines how an individual wishes their assets to be distributed after their death. It can complement a Lady Bird Deed by addressing other assets not covered by the deed.

- Living Trust: A living trust holds an individual's assets during their lifetime and specifies how those assets should be distributed upon their death. It can help avoid probate and provide more control over asset distribution.

- Quitclaim Deed: This document transfers ownership of property from one party to another without guaranteeing that the title is clear. It may be used to correct title issues or to transfer property between family members.

Understanding these additional forms and documents can enhance the effectiveness of a Lady Bird Deed. Proper documentation helps ensure that an individual's wishes are honored and that their estate is managed efficiently.

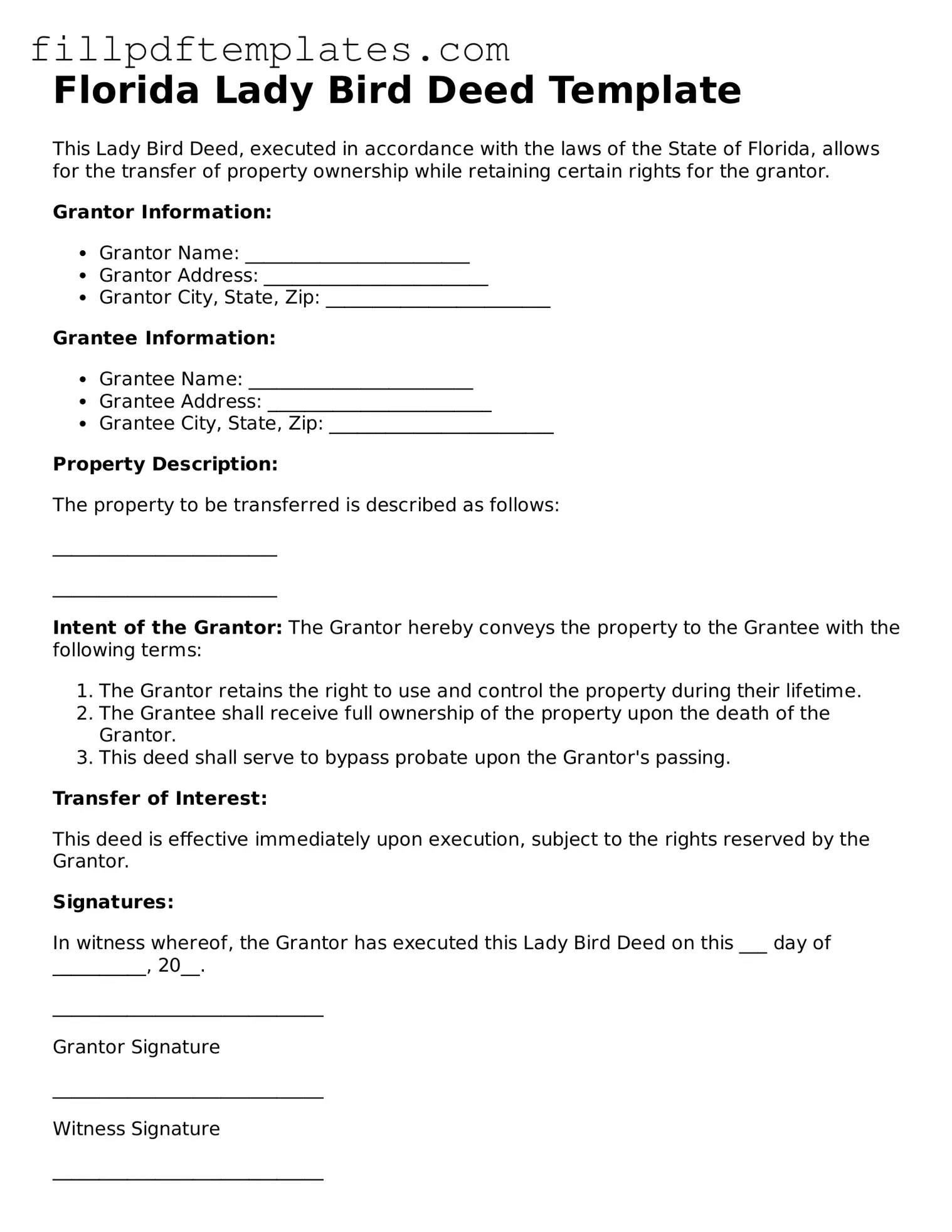

Florida Lady Bird Deed Preview

Florida Lady Bird Deed Template

This Lady Bird Deed, executed in accordance with the laws of the State of Florida, allows for the transfer of property ownership while retaining certain rights for the grantor.

Grantor Information:

- Grantor Name: ________________________

- Grantor Address: ________________________

- Grantor City, State, Zip: ________________________

Grantee Information:

- Grantee Name: ________________________

- Grantee Address: ________________________

- Grantee City, State, Zip: ________________________

Property Description:

The property to be transferred is described as follows:

________________________

________________________

Intent of the Grantor: The Grantor hereby conveys the property to the Grantee with the following terms:

- The Grantor retains the right to use and control the property during their lifetime.

- The Grantee shall receive full ownership of the property upon the death of the Grantor.

- This deed shall serve to bypass probate upon the Grantor's passing.

Transfer of Interest:

This deed is effective immediately upon execution, subject to the rights reserved by the Grantor.

Signatures:

In witness whereof, the Grantor has executed this Lady Bird Deed on this ___ day of __________, 20__.

_____________________________

Grantor Signature

_____________________________

Witness Signature

_____________________________

Witness Signature