Blank Florida Durable Power of Attorney Form

The Florida Durable Power of Attorney form is a vital legal document that empowers individuals to designate someone they trust to manage their financial and legal affairs in the event they become incapacitated. This form ensures that your chosen agent can make decisions on your behalf, covering a wide range of responsibilities from handling bank transactions to managing real estate. It remains effective even if you lose the ability to make decisions for yourself, making it a crucial tool for long-term planning. The form can be customized to fit your specific needs, allowing you to grant broad or limited powers to your agent. Additionally, it is essential to understand the requirements for executing the document, including the necessity of notarization and witness signatures. By creating a Durable Power of Attorney, you can ensure that your financial matters are handled according to your wishes, providing peace of mind for both you and your loved ones.

Other Common Durable Power of Attorney State Templates

Durable Power of Attorney California - The Durable Power of Attorney is versatile and can serve numerous purposes tailored to individual preferences.

Power of Attorney Michigan Requirements - The authority granted in this document can be as broad or as limited as you choose.

Poa Financial Form - This document can empower your agent to act swiftly on your behalf, ensuring your needs are met.

To ensure maximum protection against unforeseen incidents, completing a thorough Release of Liability form is essential for anyone engaging in activities with inherent risks.

How to Get Power of Attorney in Ny - The Durable Power of Attorney can be tailored to specific needs or remain broad in scope.

Similar forms

- General Power of Attorney: This document grants someone the authority to act on your behalf in a wide range of legal and financial matters. Like the Durable Power of Attorney, it allows for decision-making, but it typically becomes invalid if you become incapacitated.

- Healthcare Power of Attorney: This form specifically designates someone to make medical decisions for you if you are unable to do so. Similar to a Durable Power of Attorney, it remains effective even if you become incapacitated.

- Living Will: A Living Will outlines your preferences for medical treatment and end-of-life care. While it does not appoint an agent, it complements a Healthcare Power of Attorney by providing guidance on your wishes.

- Employment Verification Form: To verify work status for various purposes, consider our essential Employment Verification form details for accurate documentation.

- Financial Power of Attorney: This document is focused solely on financial matters. It allows an agent to manage your financial affairs, similar to a Durable Power of Attorney, but may not cover health-related decisions.

- Revocable Trust: A Revocable Trust allows you to place assets into a trust while maintaining control over them. It shares similarities with a Durable Power of Attorney in that both can help manage your affairs, especially during incapacity.

- Advance Healthcare Directive: This combines a Living Will and a Healthcare Power of Attorney. It provides both your medical preferences and appoints someone to make decisions on your behalf, similar to the Durable Power of Attorney in its enduring effect.

- Guardianship Documents: These legal forms establish a guardian for someone who cannot make decisions for themselves. While not directly similar, both documents aim to protect individuals and ensure their needs are met, especially in times of incapacity.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows someone to make decisions on your behalf if you become incapacitated. |

| Governing Law | The Florida Durable Power of Attorney is governed by Florida Statutes, Chapter 709. |

| Durability | This document remains effective even if you become mentally or physically incapacitated. |

| Agent Authority | The agent can manage financial matters, make healthcare decisions, and handle legal affairs as specified in the document. |

| Revocation | You can revoke the Durable Power of Attorney at any time as long as you are mentally competent. |

| Witness Requirement | The form must be signed in the presence of two witnesses and a notary public in Florida. |

| Limitations | Some powers may be limited or excluded, depending on your specific needs and the language used in the document. |

| Execution | The form must be executed according to Florida law to be valid and enforceable. |

Things You Should Know About This Form

-

What is a Durable Power of Attorney in Florida?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to appoint someone else, called the agent or attorney-in-fact, to make decisions on their behalf. This authority remains in effect even if the principal becomes incapacitated. It is important to note that the DPOA must be signed while the principal is still competent.

-

What types of decisions can an agent make under a Durable Power of Attorney?

The agent can make a wide range of decisions, including financial, legal, and healthcare-related matters. This may involve managing bank accounts, selling property, or making medical decisions if the principal is unable to do so. The specific powers granted can be tailored to the principal’s needs and preferences.

-

How do I create a Durable Power of Attorney in Florida?

To create a Durable Power of Attorney in Florida, the principal must complete a form that meets state requirements. The form should be signed by the principal and witnessed by two individuals or notarized. It is advisable to consult with a legal professional to ensure that the document is valid and reflects the principal’s wishes accurately.

-

Can I revoke a Durable Power of Attorney?

Yes, a principal can revoke a Durable Power of Attorney at any time, as long as they are competent to do so. This can be done by creating a written revocation document and notifying the agent and any relevant institutions. If the principal becomes incapacitated, the DPOA remains in effect until revoked while competent.

-

What happens if I do not have a Durable Power of Attorney?

If an individual becomes incapacitated without a Durable Power of Attorney in place, family members may need to go through the court system to obtain guardianship. This process can be time-consuming, costly, and may not align with the individual's wishes. Having a DPOA in place can help avoid these complications.

-

Are there any limitations to the powers granted in a Durable Power of Attorney?

Yes, the principal can specify limitations in the Durable Power of Attorney. For instance, they may choose to restrict the agent's authority to certain transactions or decisions. It is crucial for the principal to clearly outline any limitations to ensure that the agent acts within the desired scope of authority.

Documents used along the form

A Florida Durable Power of Attorney form is an essential document that allows someone to make decisions on your behalf if you are unable to do so. However, it often works best in conjunction with other legal documents that help clarify your wishes and ensure your affairs are managed smoothly. Below is a list of related forms and documents that you may find useful.

- Living Will: This document outlines your preferences for medical treatment in situations where you cannot communicate your wishes. It specifically addresses end-of-life care and the types of life-sustaining treatments you do or do not want.

- Health Care Surrogate Designation: This form allows you to appoint someone to make medical decisions on your behalf if you become incapacitated. It complements the Living Will by providing a person to interpret your wishes and make choices in real-time.

- Last Will and Testament: This is a legal document that specifies how your assets should be distributed after your death. It also allows you to name guardians for any minor children and can help avoid family disputes.

- Revocable Living Trust: A trust allows you to manage your assets during your lifetime and specify how they will be distributed after your death. It can help avoid probate, making the transfer of your assets smoother and more private.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document gives someone the authority to handle your financial matters. It can be limited to specific tasks or be more general in nature.

- Beneficiary Designations: Many financial accounts and insurance policies allow you to name beneficiaries. Keeping these designations up-to-date ensures that your assets are distributed according to your wishes without going through probate.

- Property Deeds: If you own real estate, having clear property deeds is crucial. These documents establish ownership and can specify how property should be handled in the event of your incapacity or death.

- Advanced Healthcare Directive: This combines a Living Will and Health Care Surrogate Designation. It provides a comprehensive approach to your healthcare preferences and who will make decisions on your behalf.

- Hold Harmless Agreement: This legal document is important for shifting liability and protecting parties involved in various activities, particularly in Tennessee. For more details, you can refer to the Hold Harmless Agreement.

- HIPAA Release Form: This document allows you to designate individuals who can access your medical records and discuss your health information with healthcare providers. It ensures that your chosen representatives can make informed decisions.

Having these documents in place can provide peace of mind, knowing that your wishes will be honored and your affairs will be managed according to your preferences. Each document serves a unique purpose, and together they create a comprehensive plan for your future.

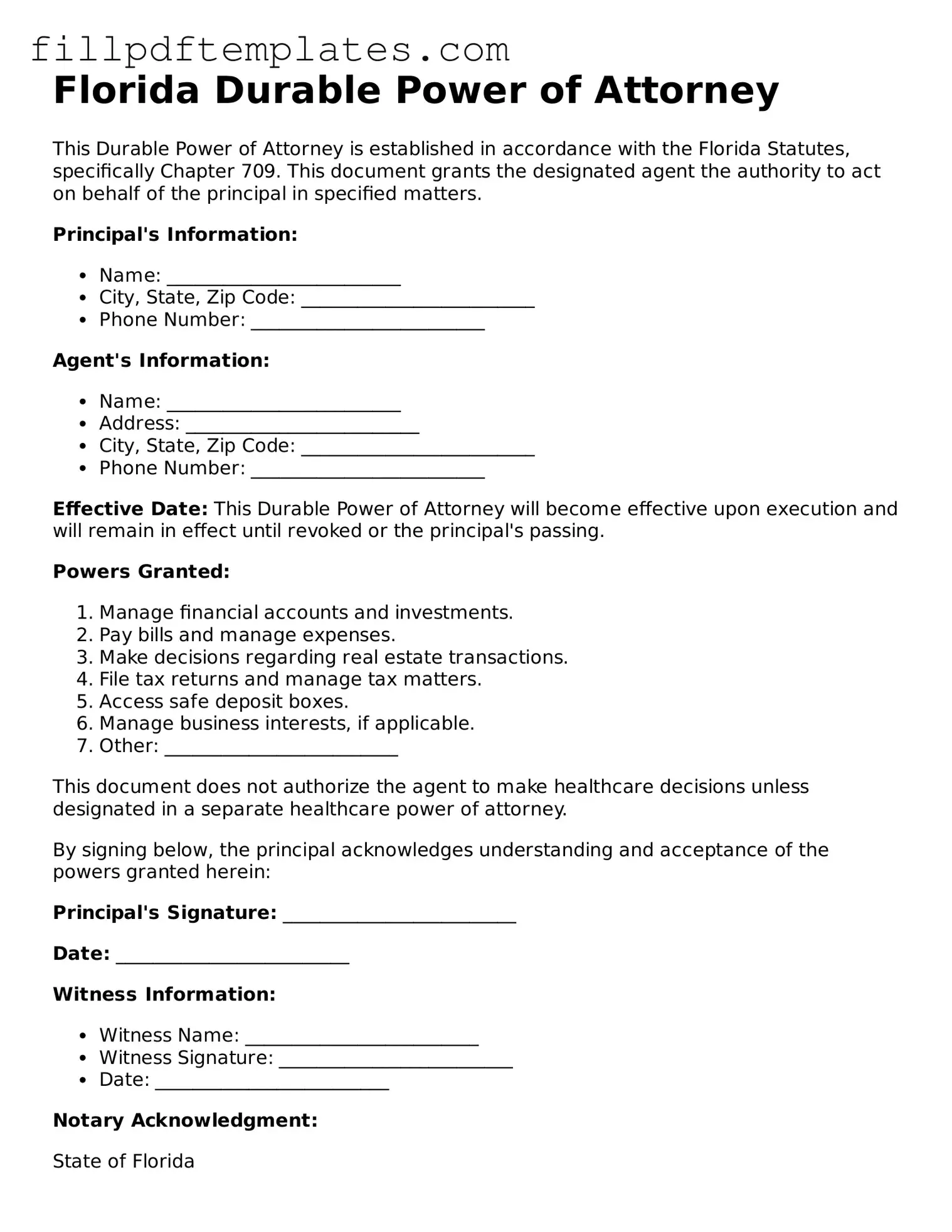

Florida Durable Power of Attorney Preview

Florida Durable Power of Attorney

This Durable Power of Attorney is established in accordance with the Florida Statutes, specifically Chapter 709. This document grants the designated agent the authority to act on behalf of the principal in specified matters.

Principal's Information:

- Name: _________________________

- City, State, Zip Code: _________________________

- Phone Number: _________________________

Agent's Information:

- Name: _________________________

- Address: _________________________

- City, State, Zip Code: _________________________

- Phone Number: _________________________

Effective Date: This Durable Power of Attorney will become effective upon execution and will remain in effect until revoked or the principal's passing.

Powers Granted:

- Manage financial accounts and investments.

- Pay bills and manage expenses.

- Make decisions regarding real estate transactions.

- File tax returns and manage tax matters.

- Access safe deposit boxes.

- Manage business interests, if applicable.

- Other: _________________________

This document does not authorize the agent to make healthcare decisions unless designated in a separate healthcare power of attorney.

By signing below, the principal acknowledges understanding and acceptance of the powers granted herein:

Principal's Signature: _________________________

Date: _________________________

Witness Information:

- Witness Name: _________________________

- Witness Signature: _________________________

- Date: _________________________

Notary Acknowledgment:

State of Florida

County of ________________

On this ____ day of ____________, 20___, before me appeared _________________________, the principal, who is personally known to me or has produced ___________________ as identification.

_____________________________

Notary Public Signature

My Commission Expires: _____________