Blank Florida Deed in Lieu of Foreclosure Form

In Florida, the Deed in Lieu of Foreclosure form serves as a crucial option for homeowners facing financial distress and the threat of foreclosure. This legal document allows a homeowner to voluntarily transfer the title of their property to the lender, effectively relinquishing ownership in exchange for the cancellation of the mortgage debt. It is an alternative that can offer a more streamlined and less damaging process compared to traditional foreclosure. By choosing this route, homeowners may avoid the lengthy court proceedings associated with foreclosure, potentially preserving their credit score to a greater extent. The form typically requires the homeowner to provide specific information, such as the property address and details of the mortgage, and must be executed in accordance with state laws to ensure its validity. Importantly, both parties—homeowner and lender—must agree to the terms outlined in the deed, making it essential for homeowners to fully understand their rights and obligations before proceeding. This option not only alleviates the burden of mortgage payments but can also provide a fresh start for those ready to move on from their current financial situation.

Other Common Deed in Lieu of Foreclosure State Templates

Foreclosure Process in Georgia - The form requires both parties to agree on the transfer of property rights.

What Happens When You Do a Deed in Lieu of Foreclosure - Is an alternative to a formal foreclosure process.

Understanding the intricacies of a lease is vital for both landlords and tenants; therefore, a practical resource on the applicable Lease Agreement terms and obligations can prove invaluable in navigating this essential legal relationship.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - A Deed in Lieu of Foreclosure might also preserve the chance of securing housing in the future.

Similar forms

The Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer the title of their property to the lender in order to avoid foreclosure. This document shares similarities with several other legal instruments. Below is a list of nine documents that are comparable in nature, along with explanations of their similarities.

- Loan Modification Agreement: This document modifies the original loan terms, allowing borrowers to keep their homes while adjusting payment schedules or interest rates. Like a Deed in Lieu of Foreclosure, it aims to prevent foreclosure by providing an alternative solution.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the full amount owed on the mortgage when the property is sold. Both documents serve as alternatives to foreclosure, enabling homeowners to exit their mortgage obligations without the severe consequences of foreclosure.

- Boat Bill of Sale: The California Boat Bill of Sale form is essential for documenting the transfer of boat ownership. For more information on how to complete this important document, click here.

- Forbearance Agreement: This agreement allows a borrower to temporarily reduce or suspend mortgage payments. Similar to a Deed in Lieu of Foreclosure, it provides a way for homeowners to avoid foreclosure while they regain financial stability.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a structured way to address debts. Both bankruptcy and a Deed in Lieu of Foreclosure offer pathways to manage financial distress, although they differ in their implications and processes.

- Quitclaim Deed: A quitclaim deed transfers ownership of property without guaranteeing the title's validity. While it is typically used in different contexts, it parallels the Deed in Lieu of Foreclosure in that it facilitates a transfer of property rights.

- Deed of Trust: This document secures a loan by placing the property in trust until the loan is paid off. While it serves a different purpose, both documents involve the transfer of property interests and can be related to foreclosure processes.

- Release of Mortgage: This document indicates that a mortgage has been paid off or forgiven. It is similar to a Deed in Lieu of Foreclosure in that both signify the end of a borrower's obligation to the lender regarding a specific property.

- Assignment of Mortgage: This document transfers the mortgage from one lender to another. Both an assignment and a Deed in Lieu of Foreclosure involve the transfer of interests in property, albeit for different reasons.

- Property Settlement Agreement: Often used in divorce proceedings, this document outlines how property is divided between parties. Like a Deed in Lieu of Foreclosure, it can facilitate a resolution regarding property ownership, especially in financially strained situations.

Understanding these documents can provide homeowners with various options when facing financial difficulties. Each option has its own implications, and it is crucial to consider them carefully before making a decision.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | The deed in lieu of foreclosure in Florida is governed by Florida Statutes, particularly Chapter 697, which outlines the rules and procedures for such transactions. |

| Eligibility | Homeowners facing financial hardship and unable to meet mortgage obligations may qualify for a deed in lieu of foreclosure, but they must first discuss options with their lender. |

| Advantages | This process can be less damaging to a homeowner's credit score compared to a foreclosure, and it may allow for a quicker resolution to the financial situation. |

| Disadvantages | Homeowners may still be liable for any deficiency balance if the property sells for less than the mortgage owed, and lenders may not always agree to this option. |

| Process | The homeowner must provide the lender with a written request, along with any required documentation, to initiate the deed in lieu of foreclosure process. |

| Impact on Future Borrowing | While a deed in lieu of foreclosure is generally less harmful than a foreclosure, it can still affect a homeowner's ability to secure future loans for several years. |

Things You Should Know About This Form

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This option allows the homeowner to relinquish ownership of the property, thereby settling the mortgage debt without going through the lengthy foreclosure process.

-

How does a Deed in Lieu of Foreclosure work?

In this process, the homeowner contacts their lender to discuss the possibility of a Deed in Lieu of Foreclosure. If both parties agree, the homeowner signs the deed, transferring ownership of the property to the lender. In return, the lender typically agrees to cancel the mortgage debt. This can help the homeowner avoid a foreclosure mark on their credit report.

-

What are the benefits of choosing a Deed in Lieu of Foreclosure?

- It can be quicker than the foreclosure process, allowing homeowners to move on sooner.

- Homeowners may avoid some of the costs associated with foreclosure, such as legal fees.

- It can be less damaging to the homeowner's credit score compared to a foreclosure.

-

Are there any downsides to a Deed in Lieu of Foreclosure?

Yes, there are some potential downsides. Homeowners may still face tax consequences, as the IRS could consider the forgiven debt as taxable income. Additionally, not all lenders accept Deeds in Lieu, and homeowners may need to demonstrate financial hardship to qualify. It's essential to weigh these factors before proceeding.

-

Can I still live in my home after signing a Deed in Lieu of Foreclosure?

Once the Deed in Lieu is executed and recorded, the homeowner typically must vacate the property. The transfer of ownership means that the lender now holds the title, and they may begin the process of selling the property. However, some lenders may allow a short period for the homeowner to find alternative housing.

-

What should I do before pursuing a Deed in Lieu of Foreclosure?

It's crucial to consult with a housing counselor or a legal professional to understand the implications fully. They can help assess your financial situation and determine whether this option is in your best interest. Additionally, gathering all relevant financial documents and communicating openly with your lender can facilitate the process.

-

Will a Deed in Lieu of Foreclosure affect my credit score?

While a Deed in Lieu of Foreclosure is generally less damaging than a foreclosure, it can still negatively impact your credit score. The extent of the impact varies based on individual credit histories and how lenders report the transaction. However, the goal is often to avoid the more severe consequences of a foreclosure.

-

How can I start the process of a Deed in Lieu of Foreclosure?

To initiate this process, reach out to your lender to express your interest in a Deed in Lieu of Foreclosure. Be prepared to provide financial information and explain your situation. If your lender is open to the idea, they will guide you through the necessary steps and paperwork.

Documents used along the form

When navigating the process of a Deed in Lieu of Foreclosure in Florida, several other forms and documents may be necessary to ensure a smooth transaction. Each document serves a specific purpose and helps clarify the responsibilities and agreements between the parties involved.

- Notice of Default: This document informs the borrower that they are in default on their mortgage payments. It outlines the specific reasons for the default and may serve as a precursor to foreclosure proceedings.

- Loan Modification Agreement: This agreement modifies the original loan terms to make payments more manageable for the borrower. It can be an alternative to foreclosure and may help the borrower retain ownership of the property.

- Release of Liability: This document releases the borrower from any further liability related to the mortgage once the Deed in Lieu is executed. It protects the borrower from future claims by the lender.

- Property Condition Disclosure: This form requires the borrower to disclose any known issues with the property. It provides transparency regarding the property's condition and can influence the lender's decision.

- Articles of Incorporation: The Articles of Incorporation form is essential for anyone looking to establish a corporation in Wisconsin, outlining the fundamental aspects of the business structure and operations.

- Title Search Report: A title search report confirms the legal ownership of the property and identifies any liens or encumbrances. This document is crucial for ensuring that the lender can take possession of the property without legal complications.

- Settlement Statement: This document outlines all financial transactions related to the Deed in Lieu of Foreclosure. It details any costs, fees, or credits associated with the transfer of property ownership.

Understanding these documents can facilitate a more efficient process when dealing with a Deed in Lieu of Foreclosure. Each plays a vital role in protecting the interests of both the borrower and the lender.

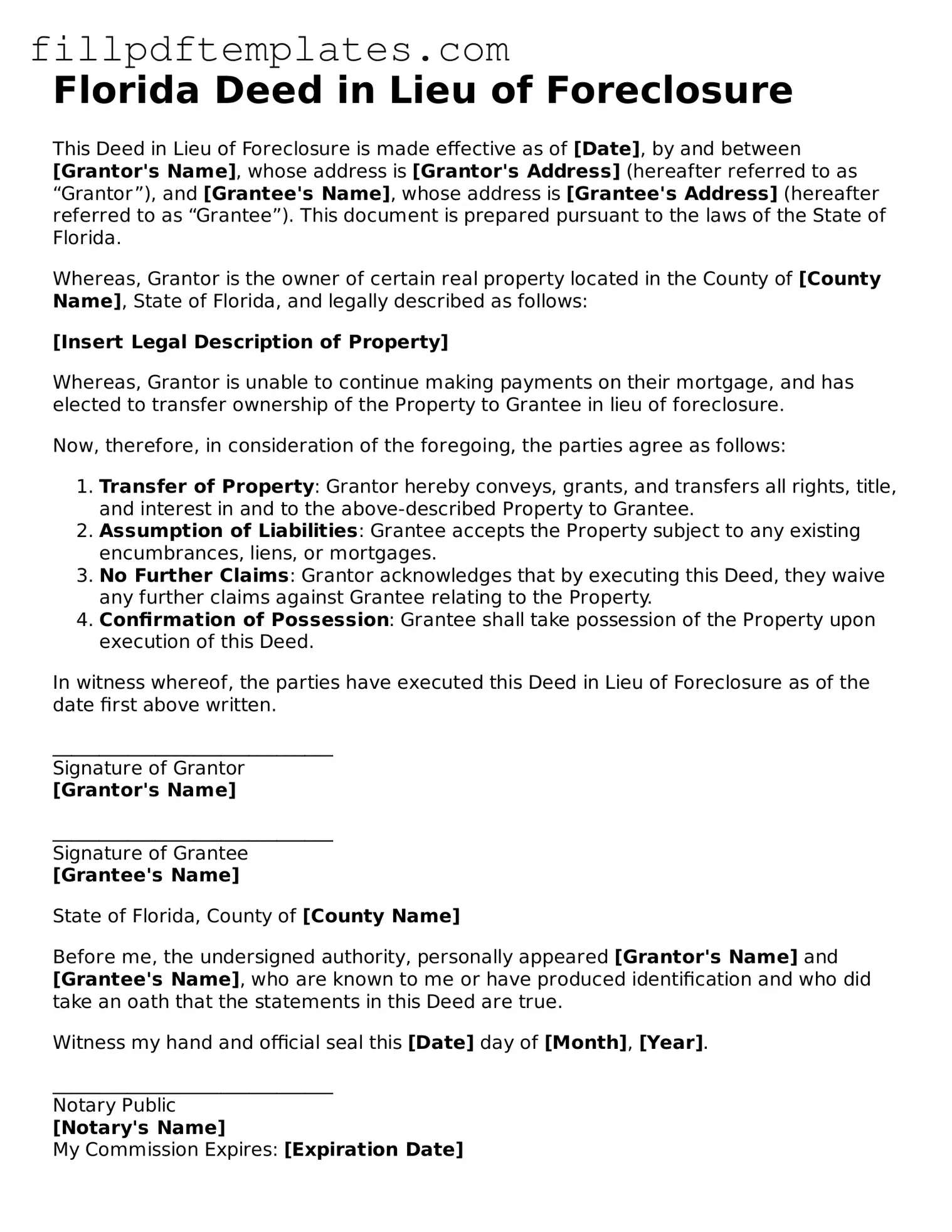

Florida Deed in Lieu of Foreclosure Preview

Florida Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made effective as of [Date], by and between [Grantor's Name], whose address is [Grantor's Address] (hereafter referred to as “Grantor”), and [Grantee's Name], whose address is [Grantee's Address] (hereafter referred to as “Grantee”). This document is prepared pursuant to the laws of the State of Florida.

Whereas, Grantor is the owner of certain real property located in the County of [County Name], State of Florida, and legally described as follows:

[Insert Legal Description of Property]

Whereas, Grantor is unable to continue making payments on their mortgage, and has elected to transfer ownership of the Property to Grantee in lieu of foreclosure.

Now, therefore, in consideration of the foregoing, the parties agree as follows:

- Transfer of Property: Grantor hereby conveys, grants, and transfers all rights, title, and interest in and to the above-described Property to Grantee.

- Assumption of Liabilities: Grantee accepts the Property subject to any existing encumbrances, liens, or mortgages.

- No Further Claims: Grantor acknowledges that by executing this Deed, they waive any further claims against Grantee relating to the Property.

- Confirmation of Possession: Grantee shall take possession of the Property upon execution of this Deed.

In witness whereof, the parties have executed this Deed in Lieu of Foreclosure as of the date first above written.

______________________________

Signature of Grantor

[Grantor's Name]

______________________________

Signature of Grantee

[Grantee's Name]

State of Florida, County of [County Name]

Before me, the undersigned authority, personally appeared [Grantor's Name] and [Grantee's Name], who are known to me or have produced identification and who did take an oath that the statements in this Deed are true.

Witness my hand and official seal this [Date] day of [Month], [Year].

______________________________

Notary Public

[Notary's Name]

My Commission Expires: [Expiration Date]