Valid Durable Power of Attorney Form

When it comes to planning for the future, having a Durable Power of Attorney (DPOA) is a crucial step that many individuals overlook. This legal document allows you to appoint someone you trust to make decisions on your behalf when you are unable to do so yourself, whether due to illness, injury, or other incapacitating circumstances. The DPOA remains effective even if you become mentally or physically unable to manage your affairs, making it a vital tool for ensuring your wishes are honored. Key aspects of the form include the designation of your agent, the specific powers granted to them, and any limitations you may wish to impose. Additionally, understanding the difference between a Durable Power of Attorney and a regular Power of Attorney is essential, as the former provides continued authority even in cases of incapacitation. This document can cover a wide range of decisions, from financial matters to healthcare choices, offering peace of mind that your affairs will be managed according to your preferences. As you navigate the complexities of life, having a Durable Power of Attorney in place can protect your interests and provide clarity for your loved ones during challenging times.

Durable Power of Attorney - Customized for Each State

Different Types of Durable Power of Attorney Forms:

Revoke Power of Attorney Form California - Used when the principal no longer wishes to be represented by the agent.

In South Dakota, utilizing a Hold Harmless Agreement can be crucial for mitigating risks associated with legal liability; for instance, parties often resort to this particular agreement when engaging in construction projects or organizing special events. By executing this document, stakeholders can effectively manage their exposure to various risks, and as a reference, you may explore more about the Hold Harmless Agreement for comprehensive guidance on its application and implications.

Similar forms

- General Power of Attorney: This document grants broad powers to an agent to act on behalf of the principal in financial and legal matters. Like the Durable Power of Attorney, it allows for decision-making but may not remain effective if the principal becomes incapacitated.

- Medical Power of Attorney: This form allows an agent to make healthcare decisions for the principal if they are unable to do so. It shares the same principle of appointing someone to act on behalf of another, focusing specifically on health-related issues.

- Living Will: A living will outlines a person's wishes regarding medical treatment in the event of incapacitation. While it does not appoint an agent, it complements a Medical Power of Attorney by providing guidance on the principal's preferences.

- Advance Healthcare Directive: This document combines a Medical Power of Attorney and a living will. It allows individuals to specify their healthcare preferences and designate an agent, similar to the Durable Power of Attorney in terms of decision-making authority.

- Trust Agreement: A trust agreement establishes a fiduciary relationship where a trustee manages assets for beneficiaries. It is similar in that it involves appointing someone to act on behalf of another, though it focuses more on asset management than decision-making.

Georgia WC-100 Form: This document is crucial for initiating mediation in workers' compensation claims. By completing the Georgia Wc 100 form, parties formally request mediation to resolve disputes in a cooperative manner, facilitating potential settlements.

- Will: A will outlines how a person's assets will be distributed upon their death. While it does not grant authority during life, it serves a similar purpose of designating individuals to handle specific responsibilities.

- Guardianship Document: This legal arrangement appoints a guardian for a minor or incapacitated adult. It is similar in that it involves designating someone to make decisions on behalf of another, particularly in personal and legal matters.

- Financial Power of Attorney: This specific type of power of attorney focuses solely on financial matters. Like the Durable Power of Attorney, it allows an agent to handle financial transactions and decisions on behalf of the principal.

- Authorization for Release of Information: This document permits an individual to access another person's private information, often used in healthcare. It shares the concept of granting authority to act on behalf of someone else, albeit in a more limited capacity.

- Business Power of Attorney: This document allows an agent to act on behalf of a business owner in business-related matters. It is similar to the Durable Power of Attorney in that it grants decision-making authority, but it is specifically tailored for business contexts.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) allows someone to make financial or medical decisions on your behalf if you become unable to do so. |

| Durability | The term "durable" means that the authority continues even if you become incapacitated. |

| Agent Selection | You can choose anyone you trust to be your agent, such as a family member or close friend. |

| State-Specific Forms | Each state has its own DPOA form. For example, California's form is governed by the California Probate Code. |

| Revocation | You can revoke a Durable Power of Attorney at any time, as long as you are still mentally competent. |

| Limitations | Some states may have specific limitations on what powers can be granted through a DPOA. |

| Witness Requirements | Most states require that the DPOA be signed in the presence of witnesses or a notary public. |

| Healthcare Decisions | A DPOA can be specifically designed for healthcare decisions, often called a Durable Power of Attorney for Health Care. |

| Legal Effect | Once executed, the DPOA gives your agent the legal authority to act on your behalf, which can include managing your finances or making healthcare decisions. |

Things You Should Know About This Form

-

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to make decisions on your behalf if you become unable to do so. This can include financial, legal, and health-related decisions. The "durable" aspect means that the authority remains in effect even if you become incapacitated.

-

Who should I choose as my agent?

Your agent should be someone you trust completely. This could be a family member, close friend, or a professional advisor. Consider their ability to make decisions in your best interest and their willingness to take on this responsibility.

-

What powers can I grant my agent?

You can grant your agent a wide range of powers, including managing your finances, paying bills, making investment decisions, and handling real estate transactions. You may also choose to limit their powers to specific areas, such as only financial matters or healthcare decisions.

-

Can I change or revoke my Durable Power of Attorney?

Yes, you can change or revoke your DPOA at any time as long as you are mentally competent. To do this, you must create a new DPOA or provide a written notice to your agent and any relevant institutions that the previous document is no longer valid.

-

Does a Durable Power of Attorney expire?

A DPOA does not expire unless you specify a termination date in the document or revoke it. It remains effective until your death or until you revoke it while you are still competent.

-

What happens if I don’t have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, a court may appoint a guardian or conservator to make decisions on your behalf. This process can be lengthy, costly, and may not align with your wishes.

-

Do I need a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer, consulting one can ensure that your DPOA complies with state laws and accurately reflects your wishes. A lawyer can also help clarify any complex issues you may face.

-

Can I have more than one agent?

Yes, you can appoint multiple agents. However, consider how they will work together. You may want to specify whether they must act together or if they can act independently. Clear instructions can help prevent conflicts.

-

Is a Durable Power of Attorney valid in all states?

While a DPOA is generally recognized across states, each state has its own laws regarding the creation and execution of these documents. It is important to ensure that your DPOA meets the requirements of the state where you reside.

-

How do I ensure my Durable Power of Attorney is recognized?

To ensure recognition, properly execute the document according to your state’s laws. This may involve signing it in front of witnesses or having it notarized. Provide copies to your agent, family members, and financial institutions to avoid any issues in the future.

Documents used along the form

A Durable Power of Attorney (DPOA) is a vital document that allows an individual to designate someone else to make decisions on their behalf, particularly in financial or medical matters. However, there are several other forms and documents that complement the DPOA, ensuring a comprehensive approach to managing one's affairs. Below is a list of such documents, each serving a unique purpose.

- Living Will: This document outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. It typically specifies the types of life-sustaining measures one does or does not want.

- Release of Liability Form: For individuals looking to safeguard their interests, the essential Release of Liability documentation is vital for ensuring accountability and clarity in activities.

- Health Care Proxy: Similar to a DPOA, this form allows an individual to appoint someone to make medical decisions on their behalf. It is specifically focused on health care choices and may work alongside a Living Will.

- Last Will and Testament: This legal document details how a person's assets and affairs should be handled after their death. It can include instructions for guardianship of minor children and distribution of property.

- Revocable Living Trust: This trust allows an individual to manage their assets during their lifetime and specifies how those assets should be distributed after their death. It helps avoid probate and can provide for incapacity.

- Financial Power of Attorney: This document grants someone the authority to handle financial matters on behalf of another person. Unlike a DPOA, which can cover both financial and medical decisions, this form is specifically focused on financial transactions.

- Beneficiary Designations: These forms are used for accounts such as life insurance policies or retirement plans. They specify who will receive the benefits upon the account holder's death, bypassing probate.

- Property Deed: A property deed is a legal document that transfers ownership of real estate from one party to another. It can be important in estate planning, especially when transferring property into a trust.

- Authorization for Release of Medical Records: This document allows individuals to grant permission for their healthcare providers to share their medical information with designated individuals. It ensures that the appointed agents can access necessary health information.

Incorporating these documents alongside a Durable Power of Attorney can provide clarity and ensure that an individual's wishes are respected in various situations. Each document plays a crucial role in comprehensive estate planning and decision-making, helping to protect both personal and financial interests.

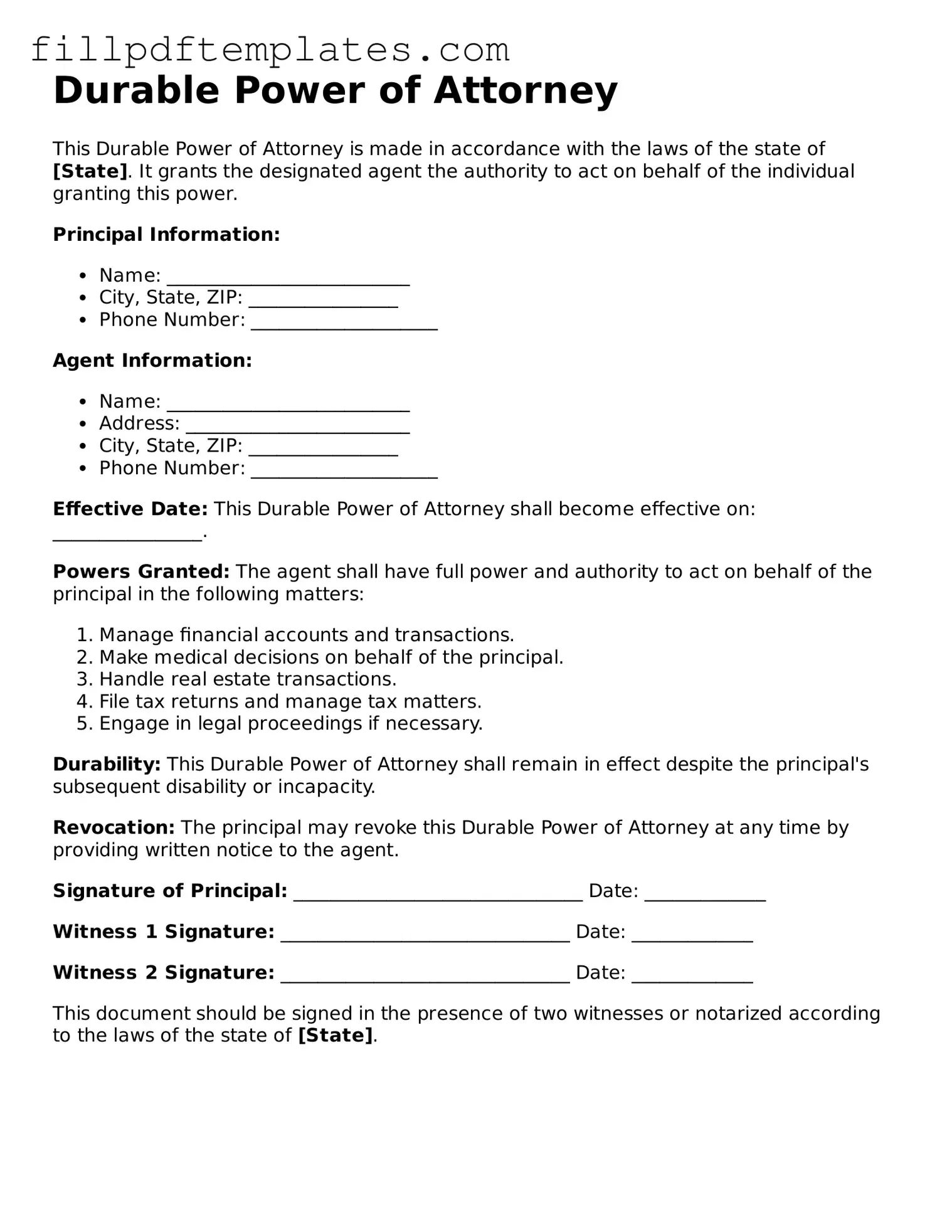

Durable Power of Attorney Preview

Durable Power of Attorney

This Durable Power of Attorney is made in accordance with the laws of the state of [State]. It grants the designated agent the authority to act on behalf of the individual granting this power.

Principal Information:

- Name: __________________________

- City, State, ZIP: ________________

- Phone Number: ____________________

Agent Information:

- Name: __________________________

- Address: ________________________

- City, State, ZIP: ________________

- Phone Number: ____________________

Effective Date: This Durable Power of Attorney shall become effective on: ________________.

Powers Granted: The agent shall have full power and authority to act on behalf of the principal in the following matters:

- Manage financial accounts and transactions.

- Make medical decisions on behalf of the principal.

- Handle real estate transactions.

- File tax returns and manage tax matters.

- Engage in legal proceedings if necessary.

Durability: This Durable Power of Attorney shall remain in effect despite the principal's subsequent disability or incapacity.

Revocation: The principal may revoke this Durable Power of Attorney at any time by providing written notice to the agent.

Signature of Principal: _______________________________ Date: _____________

Witness 1 Signature: _______________________________ Date: _____________

Witness 2 Signature: _______________________________ Date: _____________

This document should be signed in the presence of two witnesses or notarized according to the laws of the state of [State].