Valid Deed Form

The Deed form serves as a crucial legal document in various real estate transactions, encapsulating the transfer of property ownership from one party to another. It outlines essential details, such as the names of the grantor and grantee, the description of the property, and any conditions or restrictions associated with the transfer. Additionally, the form may include information regarding the consideration, or payment, involved in the transaction. It is important to note that different types of deeds exist, such as warranty deeds, quitclaim deeds, and special purpose deeds, each serving distinct purposes and offering varying levels of protection to the parties involved. Proper execution of the Deed form typically requires signatures, notarization, and in some cases, witness verification to ensure its validity. Understanding the intricacies of the Deed form can significantly impact the rights and responsibilities of property owners, making it a vital aspect of real estate law that warrants careful attention.

Deed - Customized for Each State

Fill out More Documents

Free Bol - This document assures all parties of their obligations during transit.

In the legal landscape of the District of Columbia, a Hold Harmless Agreement form plays a pivotal role. This document is a contract where one party agrees not to hold the other party liable for risks, including physical risk or legal liability. It serves as a protective shield during various transactions, ensuring peace of mind for all involved parties, especially when referencing the Hold Harmless Agreement.

Band Contract for Live Performance - The Artist retains artistic control over the performance and can substitute members if needed.

Similar forms

- Bill of Sale: A Bill of Sale transfers ownership of personal property from one party to another. Like a Deed, it serves as a legal document that proves the transfer of ownership.

- Lease Agreement: A Lease Agreement outlines the terms under which one party rents property from another. Similar to a Deed, it establishes rights and responsibilities related to property use.

- Quitclaim Deed: A Quitclaim Deed transfers any ownership interest one party has in a property to another without guaranteeing that the title is clear. It is similar to a Deed in that it conveys property rights but offers less protection for the buyer.

- Transfer-on-Death Deed: This document allows property owners to designate beneficiaries for property transfer upon death without probate. For more information, visit todform.com/blank-alabama-transfer-on-death-deed/.

- Trust Agreement: A Trust Agreement establishes a trust to manage property on behalf of beneficiaries. Like a Deed, it involves the transfer of property rights, but it also includes terms for management and distribution.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A deed is a legal document that conveys ownership of property from one party to another. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and special purpose deeds. |

| Governing Law | Deeds are governed by state law, which can vary significantly. For example, in California, the Civil Code regulates deeds. |

| Execution Requirements | Most states require that a deed be signed by the grantor and may need to be notarized. |

| Recording | To provide public notice of the transfer, deeds should be recorded in the county where the property is located. |

| Legal Effect | A properly executed and recorded deed transfers ownership rights and can impact property taxes and liabilities. |

Things You Should Know About This Form

-

What is a Deed form?

A Deed form is a legal document that signifies the intention of one party to transfer property or rights to another party. This form is crucial in real estate transactions, as it outlines the specifics of the transfer, including the parties involved, the property being transferred, and any conditions attached to the transfer. Unlike a simple contract, a Deed must be executed with certain formalities, often requiring signatures, witnesses, and sometimes notarization.

-

When do I need a Deed form?

You will need a Deed form when you are buying or selling real estate, transferring ownership of property, or granting rights to someone else. For instance, if you are selling your home, you will need a Deed to officially transfer ownership to the buyer. Additionally, if you are gifting property to a family member or transferring ownership as part of an estate plan, a Deed is necessary to document that change.

-

What are the different types of Deeds?

There are several types of Deeds, each serving a different purpose. The most common include:

- Warranty Deed: This type guarantees that the seller has clear title to the property and can defend against any claims.

- Quitclaim Deed: This Deed transfers whatever interest the seller has in the property without making any guarantees about the title.

- Special Purpose Deeds: These may include Deeds for specific situations, such as a Trustee's Deed or a Tax Deed, which are used in particular legal contexts.

-

How do I fill out a Deed form correctly?

Filling out a Deed form requires careful attention to detail. Start by clearly identifying the parties involved, including their full names and addresses. Next, provide a detailed description of the property, including its address and any legal descriptions. Be sure to specify the type of Deed you are using and include any necessary clauses that may apply to the transaction. After completing the form, all parties should sign it in the presence of a notary public if required. Finally, remember to file the Deed with the appropriate government office to make the transfer official.

Documents used along the form

When transferring property, several forms and documents accompany the Deed to ensure a smooth transaction. Each document serves a specific purpose in the process of property ownership transfer. Below are some common forms you may encounter.

- Title Insurance Policy: This document protects the buyer from any disputes over property ownership. It ensures that the title is clear and free of liens or encumbrances.

- Property Disclosure Statement: Sellers often provide this statement to disclose any known issues with the property. It helps buyers make informed decisions regarding their purchase.

- Settlement Statement: Also known as a HUD-1, this document outlines all the costs associated with the transaction. It details fees, taxes, and other expenses that the buyer and seller will incur.

- Transfer-on-Death Deed: This form allows property owners to designate a beneficiary who will receive their property upon their death, without the need for probate, providing an effective estate planning tool. For more information, visit https://transferondeathdeedform.com/texas-transfer-on-death-deed/.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and that there are no undisclosed liens or claims against it. It adds an extra layer of security for the buyer.

Understanding these documents can help streamline the property transfer process. Each plays a vital role in protecting the interests of both buyers and sellers.

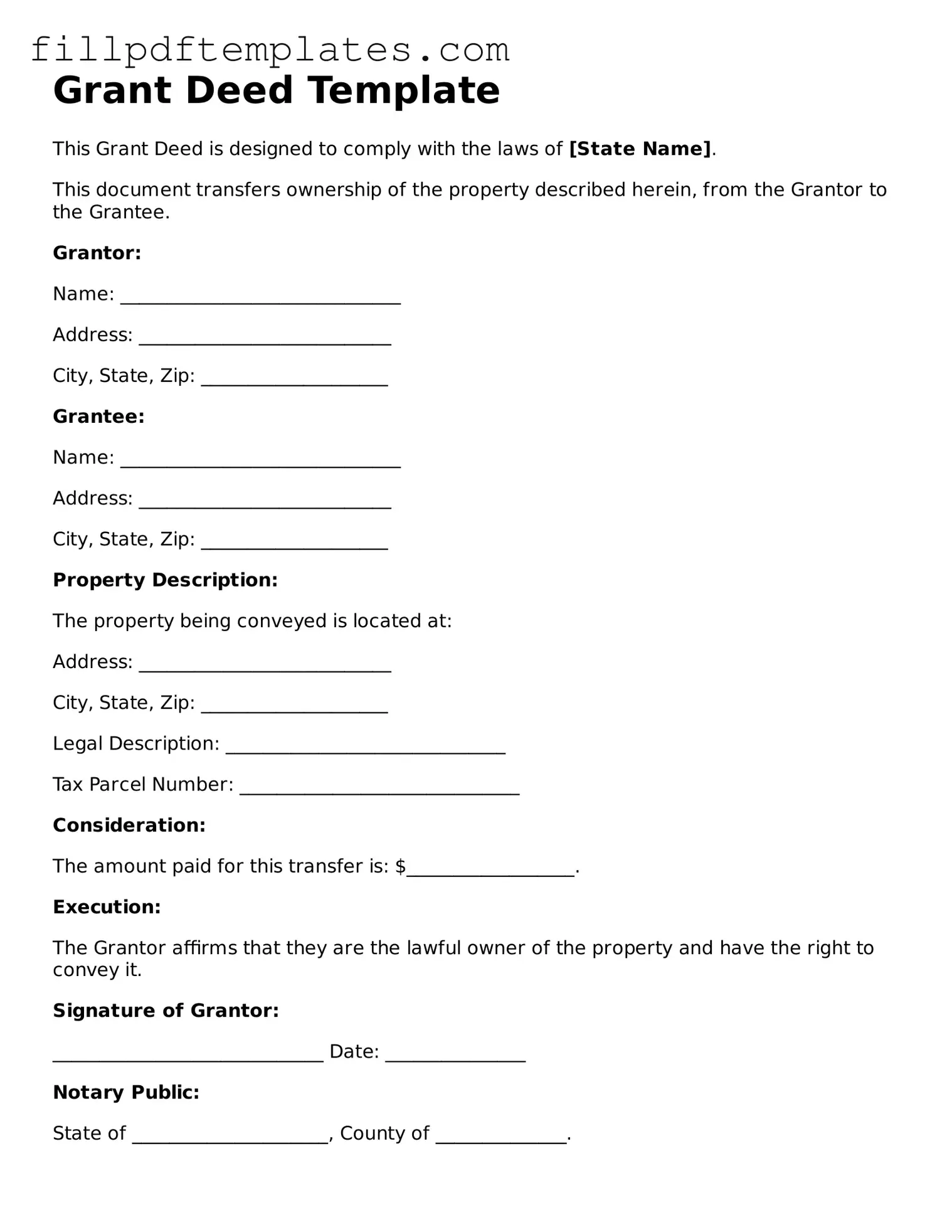

Deed Preview

Grant Deed Template

This Grant Deed is designed to comply with the laws of [State Name].

This document transfers ownership of the property described herein, from the Grantor to the Grantee.

Grantor:

Name: ______________________________

Address: ___________________________

City, State, Zip: ____________________

Grantee:

Name: ______________________________

Address: ___________________________

City, State, Zip: ____________________

Property Description:

The property being conveyed is located at:

Address: ___________________________

City, State, Zip: ____________________

Legal Description: ______________________________

Tax Parcel Number: ______________________________

Consideration:

The amount paid for this transfer is: $__________________.

Execution:

The Grantor affirms that they are the lawful owner of the property and have the right to convey it.

Signature of Grantor:

_____________________________ Date: _______________

Notary Public:

State of _____________________, County of ______________.

On this ________ day of __________, 20___, before me, a Notary Public, personally appeared ______________________________, known to me to be the person whose name is subscribed to this document and acknowledged that they executed the same.

Notary Signature: ___________________

My Commission Expires: ________________