Valid Deed in Lieu of Foreclosure Form

In the complex landscape of real estate, homeowners facing financial difficulties often seek alternatives to foreclosure, and one such option is the Deed in Lieu of Foreclosure. This legal instrument allows a homeowner to voluntarily transfer their property title to the lender, effectively settling their mortgage obligations without the lengthy and costly process of foreclosure. By completing this form, the homeowner can avoid the damaging effects of foreclosure on their credit report and may even negotiate terms that allow for a smoother transition, such as the possibility of remaining in the home for a specified period. The Deed in Lieu of Foreclosure form typically includes essential details such as the property description, the names of the parties involved, and any stipulations regarding the release of liability for the remaining mortgage debt. Understanding the implications of this form is crucial for homeowners, as it can offer a path to financial recovery while minimizing the emotional and financial toll associated with foreclosure. However, it is vital to approach this option with careful consideration, as it may not be the best solution for everyone and can carry its own set of consequences.

Deed in Lieu of Foreclosure - Customized for Each State

Different Types of Deed in Lieu of Foreclosure Forms:

Title Companies and Transfer on Death Deeds - The property owner retains full control over the property while they are alive.

The Colorado Articles of Incorporation form serves as the foundational document required to legally establish a corporation within the state of Colorado. It outlines basic information about the corporation, including its name, structure, and purpose. Filing this document with the Colorado Secretary of State is a critical step in the incorporation process, and you can access it through Colorado PDF Forms to ensure compliance and accuracy.

Quit Claim Deed Form New Jersey - It is commonly used in property ownership transfers during inheritance.

Similar forms

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the outstanding mortgage balance. Similar to a deed in lieu of foreclosure, it aims to help homeowners avoid foreclosure by negotiating with the lender.

- Loan Modification Agreement: A loan modification alters the terms of an existing mortgage to make it more affordable for the borrower. Like a deed in lieu of foreclosure, it seeks to prevent foreclosure by providing a solution that allows the homeowner to keep their home.

- Forbearance Agreement: In this document, a lender agrees to temporarily reduce or suspend mortgage payments. This can be a helpful alternative to foreclosure, similar to a deed in lieu, as it provides the homeowner with time to recover financially.

- Transfer-on-Death Deed: This legal form allows property owners to designate beneficiaries who will inherit their real estate upon death, similar to other agreements that facilitate ownership transfer. More information can be found at https://todform.com/blank-arkansas-transfer-on-death-deed/.

- Mortgage Release: Also known as a "satisfaction of mortgage," this document releases the homeowner from their mortgage obligation once the property is sold or the debt is paid off. It is akin to a deed in lieu of foreclosure in that it signifies the end of the mortgage obligation.

- Quitclaim Deed: This document transfers ownership of property without guaranteeing the title. It can be used in situations where a homeowner wants to transfer their interest in the property, similar to how a deed in lieu transfers ownership back to the lender.

- Deed of Trust: This is a security instrument that allows a lender to hold the title to a property until the loan is paid off. While it serves a different purpose, it is similar in that it involves the transfer of property rights in relation to a mortgage.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a way for homeowners to reorganize their debts. Like a deed in lieu, it offers an alternative path to avoid losing the home.

- Property Settlement Agreement: Often used in divorce proceedings, this document outlines how property will be divided between parties. It can lead to a transfer of ownership similar to a deed in lieu, especially if one party relinquishes their interest in the property.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal agreement where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. |

| Purpose | This process allows homeowners to walk away from their mortgage obligations without undergoing a lengthy foreclosure process. |

| Eligibility | Homeowners facing financial hardship and unable to keep up with mortgage payments may be eligible for this option. |

| State-Specific Forms | Each state may have its own specific deed in lieu of foreclosure form. For example, California follows the California Civil Code Sections 2943 and 2944. |

| Impact on Credit | While a deed in lieu of foreclosure is less damaging than a foreclosure, it can still negatively affect a homeowner's credit score. |

| Tax Implications | Homeowners should be aware that they may face tax consequences, as forgiven debt could be considered taxable income. |

| Process | The homeowner must provide the lender with necessary documentation and may need to negotiate terms before signing the deed. |

| Alternatives | Other options include loan modification or short sale, which may be more beneficial depending on individual circumstances. |

| Legal Advice | It is advisable for homeowners to seek legal counsel before proceeding with a deed in lieu of foreclosure to understand all implications. |

| Finality | Once the deed is signed and accepted, the process is generally final, and the homeowner will no longer own the property. |

Things You Should Know About This Form

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This process allows the homeowner to walk away from their mortgage obligations, while the lender takes possession of the property.

-

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits to consider:

- It can help you avoid the lengthy and stressful foreclosure process.

- Your credit score may be less affected than it would be with a foreclosure.

- You may be able to negotiate a release from any remaining mortgage debt.

- It can provide a quicker resolution, allowing you to move on with your life.

-

Who qualifies for a Deed in Lieu of Foreclosure?

Typically, homeowners who are facing financial hardship and are unable to continue making mortgage payments may qualify. Lenders will assess your financial situation, including your income, debts, and the current value of your property, to determine eligibility.

-

What steps should I take to initiate a Deed in Lieu of Foreclosure?

Start by contacting your lender to discuss your situation. Gather necessary documentation, such as financial statements and proof of hardship. Submit a formal request for a Deed in Lieu, and be prepared to negotiate the terms with your lender.

-

Will I be responsible for any remaining mortgage debt?

In some cases, lenders may agree to forgive any remaining debt after the property is transferred. However, this is not guaranteed. It's crucial to discuss this aspect with your lender and get any agreements in writing.

-

How does a Deed in Lieu of Foreclosure affect my credit score?

While a Deed in Lieu of Foreclosure will impact your credit score, it may be less damaging than a foreclosure. Generally, you can expect a drop in your score, but the exact impact will depend on your overall credit history.

-

Can I still buy a home after a Deed in Lieu of Foreclosure?

Yes, you can buy a home after completing a Deed in Lieu of Foreclosure. However, you may need to wait a certain period before qualifying for a new mortgage. Lenders typically require a waiting period of 2 to 4 years, depending on their policies and your overall financial situation.

Documents used along the form

A Deed in Lieu of Foreclosure can be a helpful alternative for homeowners facing financial difficulties. However, it often requires several other forms and documents to ensure the process is smooth and legally binding. Below is a list of common documents that are typically used alongside the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines any changes to the original loan terms. It may include adjustments to the interest rate, payment schedule, or loan amount, providing a potential solution before resorting to foreclosure.

- Property Title Search: Conducting a title search confirms the ownership of the property and checks for any liens or claims against it. This is essential to ensure that the property can be transferred without legal complications.

- Release of Liability: This form releases the borrower from any further obligations related to the mortgage after the deed is transferred. It helps to clarify that the lender cannot pursue the borrower for any remaining debt.

- Hold Harmless Agreement: This form protects parties from liability associated with various activities and transactions, ensuring that one party is not held responsible for risks incurred by another. For more information, refer to the Hold Harmless Agreement.

- Affidavit of Occupancy: This document confirms that the borrower is currently living in the property. Lenders may require this to ensure that the property is not abandoned and to assess its condition.

- Settlement Statement: This statement provides a detailed breakdown of all financial transactions related to the deed transfer. It includes any fees, costs, and adjustments that must be settled before the transfer is finalized.

- Notice of Default: This document formally notifies the borrower of their default status on the mortgage. It serves as a critical step in the foreclosure process, highlighting the seriousness of the situation.

Understanding these documents can help homeowners navigate the complexities of a Deed in Lieu of Foreclosure. Each plays a vital role in ensuring that both parties—the borrower and the lender—are protected and that the transfer of property is executed smoothly.

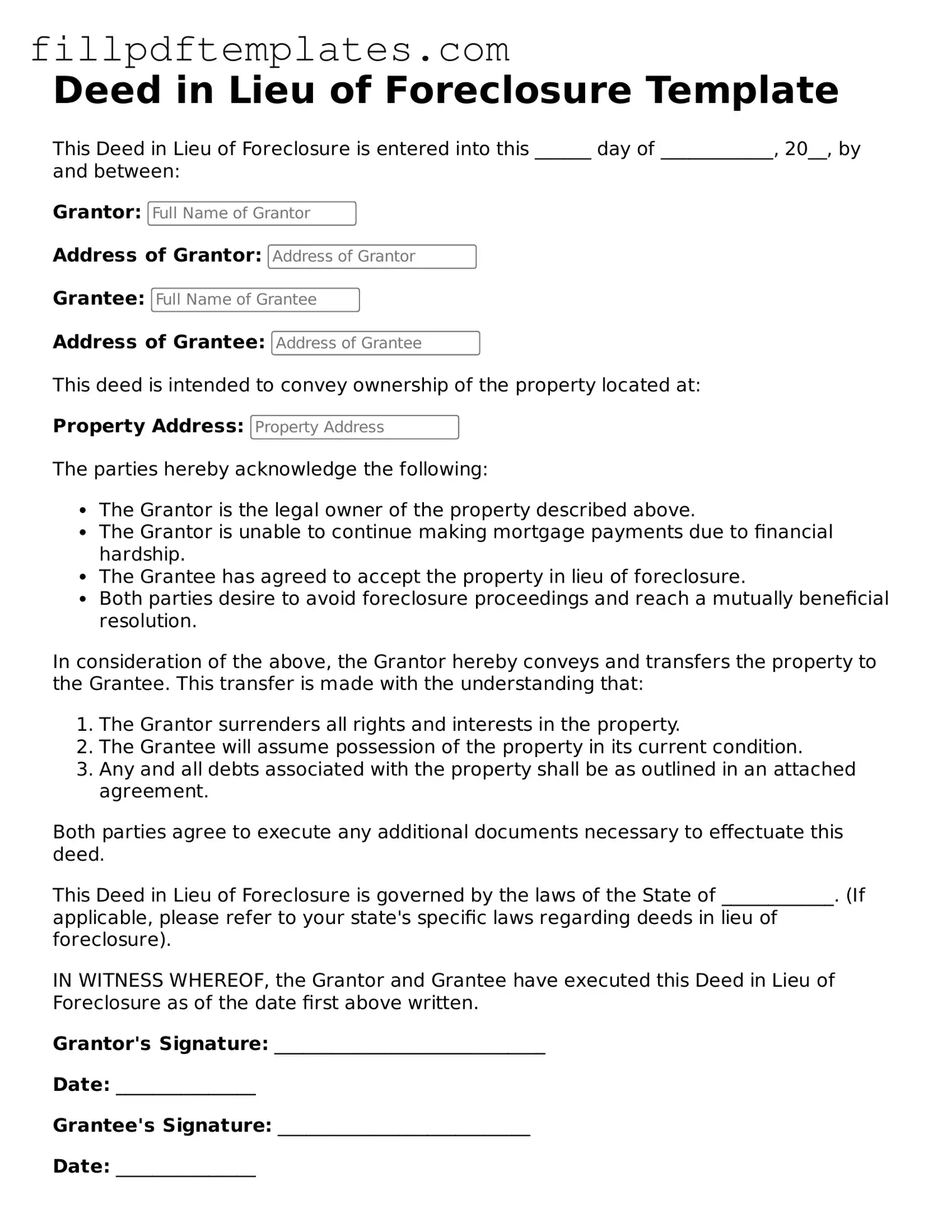

Deed in Lieu of Foreclosure Preview

Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is entered into this ______ day of ____________, 20__, by and between:

Grantor:

Address of Grantor:

Grantee:

Address of Grantee:

This deed is intended to convey ownership of the property located at:

Property Address:

The parties hereby acknowledge the following:

- The Grantor is the legal owner of the property described above.

- The Grantor is unable to continue making mortgage payments due to financial hardship.

- The Grantee has agreed to accept the property in lieu of foreclosure.

- Both parties desire to avoid foreclosure proceedings and reach a mutually beneficial resolution.

In consideration of the above, the Grantor hereby conveys and transfers the property to the Grantee. This transfer is made with the understanding that:

- The Grantor surrenders all rights and interests in the property.

- The Grantee will assume possession of the property in its current condition.

- Any and all debts associated with the property shall be as outlined in an attached agreement.

Both parties agree to execute any additional documents necessary to effectuate this deed.

This Deed in Lieu of Foreclosure is governed by the laws of the State of ____________. (If applicable, please refer to your state's specific laws regarding deeds in lieu of foreclosure).

IN WITNESS WHEREOF, the Grantor and Grantee have executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor's Signature: _____________________________

Date: _______________

Grantee's Signature: ___________________________

Date: _______________

Witnesses (if required by state law):

Witness 1 Signature: _________________________

Date: _______________

Witness 2 Signature: _________________________

Date: _______________