Fill a Valid Childcare Receipt Template

When navigating the complexities of childcare expenses, having a clear and organized method for documenting payments is essential. The Childcare Receipt form serves as a vital tool for both parents and childcare providers, ensuring transparency and accountability in financial transactions. Each receipt includes important details such as the date of service, the amount paid, and the names of the children receiving care. Additionally, it specifies the duration of the childcare services, making it easier for parents to track their expenses over time. The signature of the provider adds an extra layer of authenticity, confirming that the payment has been received. This form not only helps in managing personal finances but also plays a significant role in tax deductions for childcare expenses, providing families with potential financial relief. Understanding how to properly fill out and utilize this form can empower parents to make informed decisions regarding their childcare needs.

Additional PDF Templates

What Do You Need to Set Up Direct Deposit - This form simplifies your banking experience with Citibank.

The Indiana Transfer-on-Death Deed form is an essential tool for property owners, ensuring that their real estate is seamlessly transferred to beneficiaries upon death, thus bypassing the often arduous probate process. By utilizing this deed, individuals can provide their loved ones with a straightforward pathway to inherit property without the complexities typically associated with drafting a will. For more information, you can visit todform.com/blank-indiana-transfer-on-death-deed to help you get started on filling out the necessary forms.

Ncoer Signing Order - This report influences promotions, assignments, and overall career trajectories.

Usda 7001 - Review the completed form for any errors before presenting it at the airport.

Similar forms

-

Invoice for Services Rendered: Similar to the Childcare Receipt form, an invoice outlines the services provided, the amount due, and the recipient's details. Both documents serve as proof of payment and itemize the services rendered.

-

Payment Receipt: A payment receipt confirms that a payment has been made for a specific service. Like the Childcare Receipt, it includes the date, amount, and recipient information, ensuring both parties have a record of the transaction.

-

Service Agreement: This document outlines the terms of service between the provider and the client. While it may not serve as proof of payment, it establishes the framework for the services to be provided, similar to how the Childcare Receipt confirms those services were delivered.

-

Billing Statement: A billing statement provides a summary of charges over a specific period. It is akin to the Childcare Receipt in that it details amounts owed and services provided, although it may cover multiple transactions.

- Non-disclosure Agreement: This legal document safeguards sensitive information shared between parties, ensuring confidentiality and trust in business dealings. To understand its importance and access the template, visit https://arizonaformpdf.com/.

-

Contract for Childcare Services: This document formalizes the agreement between the caregiver and the parents. It typically includes payment terms and service details, paralleling the Childcare Receipt's role in confirming the services rendered.

-

Tax Document (e.g., 1099 or W-2): These forms report income for tax purposes. While they differ in function, they share similarities with the Childcare Receipt in that they provide official documentation of payments made for services.

Document Specifics

| Fact Name | Description |

|---|---|

| Date | The form requires the date when the childcare services were provided. |

| Amount | The total amount paid for the childcare services must be indicated on the form. |

| Received From | The name of the individual who made the payment for the childcare services is to be included. |

| Name of Child(ren) | The names of the children receiving care should be clearly stated on the form. |

| Service Dates | The period during which the childcare services were provided must be specified. |

| Provider's Signature | The form requires the signature of the childcare provider to validate the receipt. |

Things You Should Know About This Form

-

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as a record of payment for childcare services. It provides proof that a parent or guardian has paid for the care of their child or children during a specified time period. This receipt can be important for tax purposes, reimbursement requests, or personal record-keeping.

-

What information do I need to fill out on the form?

You will need to provide several details on the form, including:

- The date of payment

- The amount paid

- The name of the person making the payment

- The names of the child or children receiving care

- The start and end dates of the childcare services

- The signature of the childcare provider

-

Who should sign the Childcare Receipt form?

The childcare provider must sign the form. This signature confirms that they have received the payment for the services rendered. It adds legitimacy to the receipt and serves as an acknowledgment of the transaction.

-

Can I use this receipt for tax deductions?

Yes, the Childcare Receipt form can be used for tax purposes. Many parents can claim childcare expenses on their tax returns. Keeping this receipt helps ensure you have the necessary documentation to support your claims.

-

What if I lose the Childcare Receipt form?

If you lose the receipt, you should contact your childcare provider to request a duplicate. They may have a record of the transaction and can issue a new receipt for your records.

-

Is there a specific format for the Childcare Receipt form?

While the form should include the necessary information outlined earlier, it does not have to follow a specific format. As long as all required details are present and legible, the form is valid.

-

Can I modify the Childcare Receipt form?

It is not advisable to modify the form. Altering any information could lead to disputes or issues with tax authorities. Always fill out the form accurately and completely as it is intended.

-

What if I have multiple children in care?

If you have multiple children receiving care, you can list all their names on the form. This ensures that the receipt covers all the children for whom you are paying for childcare services.

-

How do I keep track of multiple receipts?

Organizing your receipts is essential. Consider using a folder or a digital file to store them. Label each receipt with the date and amount to make it easier to reference when needed.

-

What should I do if there is an error on the receipt?

If you notice an error on the receipt, contact the childcare provider immediately. They should correct the mistake and issue a new receipt to ensure your records are accurate.

Documents used along the form

When utilizing the Childcare Receipt form, several other documents may be necessary to ensure proper record-keeping and compliance with regulations. Each of these forms serves a specific purpose and can help both parents and childcare providers maintain clear and organized financial records.

- Childcare Agreement: This document outlines the terms and conditions of the childcare services, including hours of operation, fees, and responsibilities of both parties.

- Hold Harmless Agreement: In any childcare service, it is essential to have a Hold Harmless Agreement that protects providers from liability, ensuring that both parties understand the risks involved and agree on responsibilities.

- Enrollment Form: This form collects essential information about the child, such as emergency contacts, medical history, and any special needs, ensuring the provider is fully informed.

- Payment Schedule: This document details when payments are due, the amount owed, and any late fees that may apply, helping to clarify financial expectations.

- Tax Identification Number (TIN) Form: This form is necessary for tax purposes, allowing providers to report income accurately and parents to claim childcare expenses on their tax returns.

- Parent Handbook: This handbook provides parents with important policies, procedures, and guidelines related to the childcare facility, ensuring everyone is on the same page.

- Incident Report: In the event of an accident or injury, this form documents what occurred, when it happened, and the actions taken, providing a clear record for both parties.

- Withdrawal Notice: If a parent decides to discontinue childcare services, this form formally communicates the decision and outlines any final payments or obligations.

- Health and Immunization Records: This document provides proof of the child's vaccinations and health status, which is often required by childcare providers for enrollment.

- Emergency Contact Form: This form lists individuals to be contacted in case of an emergency involving the child, ensuring the provider can reach someone quickly if needed.

By having these documents prepared and organized, both parents and childcare providers can foster a transparent and efficient relationship. Proper documentation can prevent misunderstandings and ensure that everyone involved is well-informed and prepared for any situation that may arise.

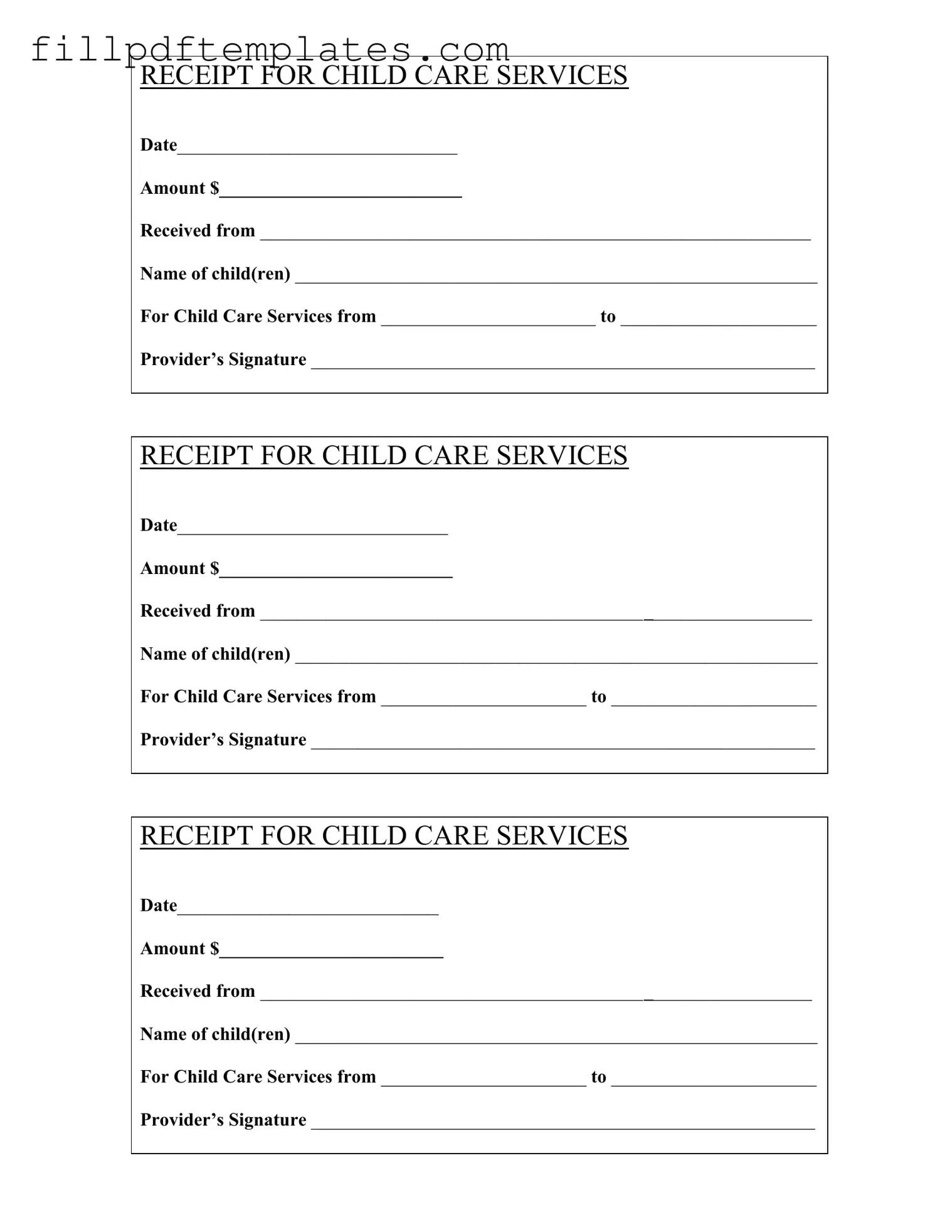

Childcare Receipt Preview

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________