Fill a Valid Cash Receipt Template

The Cash Receipt form is a vital document in the financial management of any business or organization. It serves as proof of payment received, ensuring transparency and accountability in transactions. Typically, this form includes essential details such as the date of the transaction, the name of the payer, the amount received, and the method of payment, whether cash, check, or electronic transfer. Additionally, it may provide space for a description of the goods or services rendered, helping to clarify the purpose of the payment. By maintaining accurate records through the Cash Receipt form, businesses can track their income effectively, manage their finances better, and prepare for audits with ease. This form not only aids in internal record-keeping but also serves as an important document for tax purposes and financial reporting. Overall, the Cash Receipt form is an indispensable tool for ensuring that all financial transactions are documented and verified, promoting good financial practices within any organization.

Additional PDF Templates

California Corrective Deed - This form provides an opportunity to disclose drafting details.

Can a Dishonorable Discharge Be Reversed - Having clear goals in mind can make filling out the DD 149 more effective.

In Montana, it's essential to understand the importance of a Hold Harmless Agreement, which serves as a protective measure in legal and business dealings. This type of arrangement ensures that one party does not hold the other liable for specific risks, helping to clarify financial responsibilities and liabilities. For those looking to learn more about this critical document, the Hold Harmless Agreement provides valuable insights into its use and requirements.

Parent Consent Form - Forms part of the necessary paperwork for field trips and excursions.

Similar forms

-

Invoice: An invoice is a document that requests payment for goods or services provided. Like a cash receipt, it details the transaction, including the amount due and the date of the transaction. However, an invoice is issued before payment, while a cash receipt confirms payment has been received.

-

Sales Receipt: A sales receipt is similar to a cash receipt in that it acknowledges payment for a sale. Both documents serve as proof of transaction, but a sales receipt may also include additional details about the items purchased, such as descriptions and quantities.

-

Payment Voucher: A payment voucher is used to document a payment made to a vendor or supplier. It includes information about the amount paid and the purpose of the payment, similar to a cash receipt, which confirms the amount received and the reason for the transaction.

-

Deposit Slip: A deposit slip is used when depositing cash or checks into a bank account. Like a cash receipt, it records the amount of money being handled. However, a deposit slip is specifically for bank transactions, while a cash receipt pertains to sales transactions.

- Trailer Bill of Sale Form: For those purchasing or selling trailers, the thorough trailer bill of sale form process is crucial for documenting the transaction and ensuring proper ownership transfer.

-

Credit Memo: A credit memo is issued to reduce the amount owed by a customer. While a cash receipt confirms payment received, a credit memo serves as a record of a reduction in the customer’s balance, often due to returns or adjustments.

-

Transaction Record: A transaction record documents the details of a financial transaction, similar to a cash receipt. It may include information such as the date, amount, and parties involved, but it may not always confirm that payment has been received.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document the receipt of cash payments, ensuring accurate record-keeping for both the payer and the recipient. |

| Components | This form typically includes fields for the date, amount received, payer's name, purpose of payment, and signature of the recipient. |

| Legal Importance | In many states, maintaining accurate cash receipt records is crucial for tax compliance and financial auditing, as required by state laws. |

| State-Specific Laws | For example, California's Business and Professions Code Section 21600 mandates proper record-keeping for cash transactions. |

| Retention Period | Generally, it is advisable to retain cash receipt forms for a minimum of three to seven years, depending on state regulations and audit requirements. |

Things You Should Know About This Form

-

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof of payment for both the payer and the recipient. This form typically includes details such as the date of the transaction, the amount received, the purpose of the payment, and the signatures of the involved parties.

-

Who should use the Cash Receipt form?

The Cash Receipt form is utilized by businesses, non-profit organizations, and individuals who receive cash payments. It is essential for maintaining accurate financial records and ensuring accountability in transactions.

-

What information is required on the Cash Receipt form?

The form generally requires the following information:

- Date of the transaction

- Name of the payer

- Amount received

- Purpose of the payment

- Signature of the recipient

-

How should the Cash Receipt form be filled out?

To fill out the Cash Receipt form, start by entering the date at the top. Next, write the name of the payer and the amount received in the designated fields. Clearly state the purpose of the payment. Finally, the recipient should sign the form to confirm receipt of the cash.

-

Why is it important to keep a copy of the Cash Receipt form?

Keeping a copy of the Cash Receipt form is crucial for record-keeping purposes. It provides documentation for financial audits, tax reporting, and helps resolve any potential disputes regarding the transaction. Both the payer and recipient should retain their copies for future reference.

-

Can the Cash Receipt form be used for electronic payments?

While the Cash Receipt form is primarily designed for cash transactions, it can also be adapted for electronic payments. If using it for electronic payments, ensure to note the payment method (e.g., credit card, bank transfer) and adjust the wording accordingly to reflect the nature of the transaction.

-

Is there a specific format for the Cash Receipt form?

There is no universally mandated format for the Cash Receipt form. However, it should include all relevant information as outlined above. Organizations may create their own template or use a standard template available online. Consistency in format is important for record-keeping and clarity.

Documents used along the form

When managing financial transactions, a Cash Receipt form is just one piece of the puzzle. Several other documents complement this form, each serving a unique purpose in ensuring accurate record-keeping and transparency. Below is a list of commonly used forms and documents that work alongside the Cash Receipt form.

- Invoice: An invoice is a detailed statement issued by a seller to a buyer, outlining the goods or services provided, their quantities, and the total amount due. It serves as a request for payment and is essential for tracking sales.

- Payment Voucher: This document authorizes a payment to be made. It includes details such as the amount, purpose, and the recipient's information, ensuring that funds are disbursed correctly.

- Transfer-on-Death Deed: A form that allows property owners to designate beneficiaries for their real estate, ensuring a smooth transfer upon death without probate complications. For more information, visit https://todform.com/blank-indiana-transfer-on-death-deed/.

- Deposit Slip: A deposit slip is used when depositing cash or checks into a bank account. It provides a record of the transaction and helps reconcile bank statements with internal records.

- Receipt Acknowledgment: This form confirms that a payment has been received by the seller. It is often signed by the recipient and serves as proof of the transaction.

- Credit Memo: A credit memo is issued to reduce the amount owed by a buyer. It typically occurs when a product is returned or a service is canceled, providing an official record of the adjustment.

- Expense Report: An expense report details the costs incurred by employees during business activities. It is used to reimburse employees and track company spending.

- Statement of Account: This document summarizes all transactions between a buyer and seller over a specific period. It helps both parties keep track of outstanding balances and payment history.

- Purchase Order: A purchase order is a document created by a buyer to authorize a purchase transaction. It outlines the items, quantities, and agreed prices, serving as a formal agreement before the transaction is completed.

Understanding these documents is crucial for anyone involved in financial transactions. Each plays a vital role in maintaining clear records and ensuring that all parties are on the same page. Properly managing these forms can lead to smoother operations and improved financial accountability.

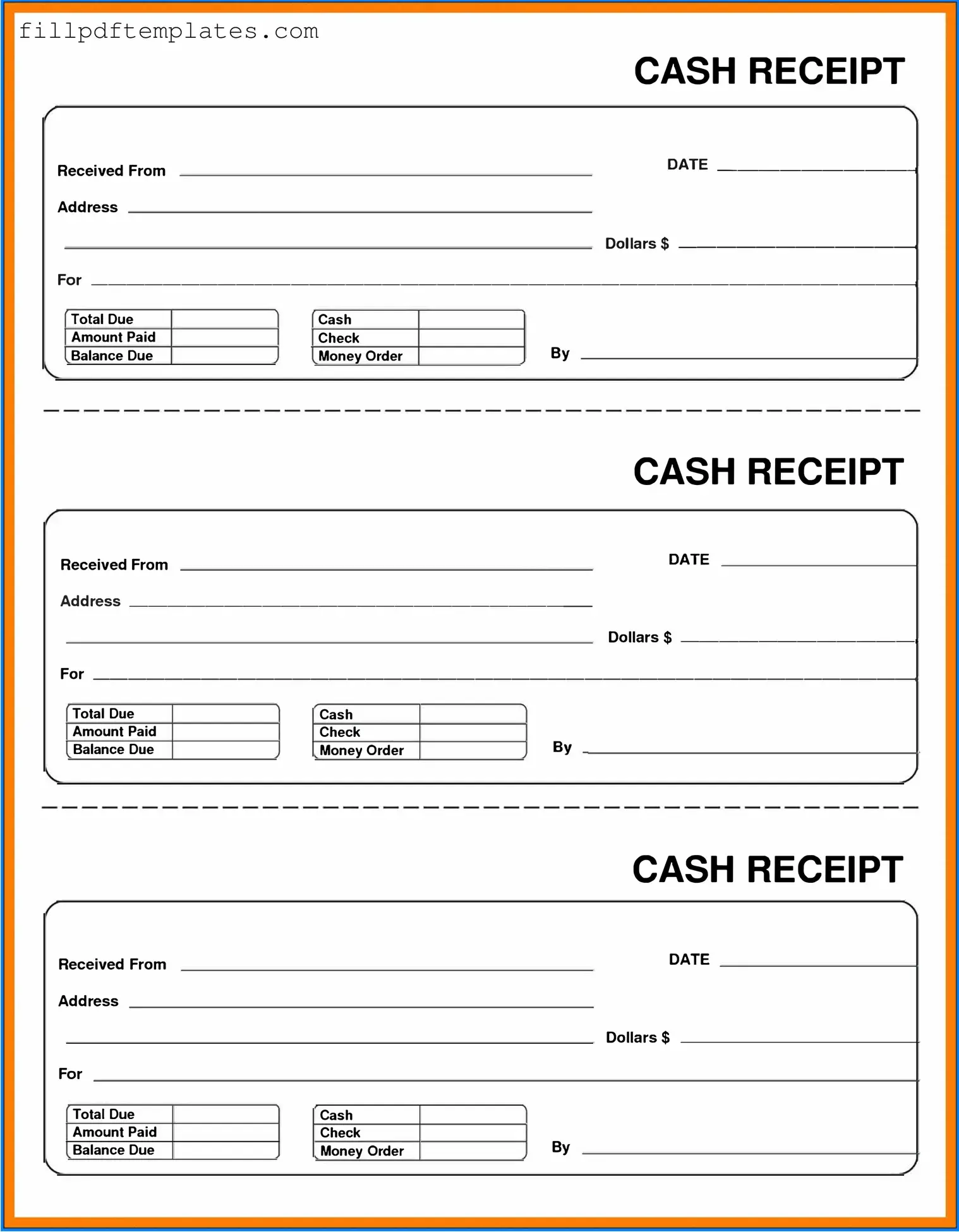

Cash Receipt Preview

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By