Blank California Transfer-on-Death Deed Form

In California, the Transfer-on-Death Deed (TOD) serves as a valuable estate planning tool that allows property owners to transfer real estate to designated beneficiaries upon their death, bypassing the often lengthy and costly probate process. This straightforward form provides a mechanism for individuals to retain control over their property during their lifetime while ensuring a seamless transition of ownership after they pass away. One of the key advantages of the TOD deed is its simplicity; it requires minimal formalities, such as notarization and recording, making it accessible for many homeowners. Additionally, the form can be revoked or modified at any time before the owner's death, offering flexibility to adapt to changing circumstances. Beneficiaries, once named, do not have any rights to the property until the owner’s death, preserving the owner's autonomy. Understanding the nuances of the TOD deed is essential for anyone looking to effectively manage their estate and provide for their loved ones, ensuring that their wishes are honored without unnecessary legal complications.

Other Common Transfer-on-Death Deed State Templates

Where Can I Get a Tod Form - The deed cannot be used for transferring certain types of assets, such as personal belongings or bank accounts.

A Hold Harmless Agreement form in Iowa is designed to ensure that one party is not held liable for the risks, liabilities, or damages that the other party may incur during their association. This legal document, often used in various contracts and transactions, serves to protect individuals and organizations from legal and financial responsibilities. For further details, you can refer to the Hold Harmless Agreement. Its application varies widely, encompassing events, services, and activities where potential risks are transferred from one party to another.

Transfer on Death Deed Form Georgia - Documentation for the deed may need to be in line with state-specific legal standards and stipulations.

Similar forms

A Transfer-on-Death (TOD) Deed allows a property owner to designate a beneficiary who will receive the property upon the owner’s death. This document shares similarities with several other legal documents. Here are ten documents that are similar to a Transfer-on-Death Deed:

- Will: A will specifies how a person's assets should be distributed after death. Like a TOD deed, it allows individuals to designate beneficiaries.

- Living Trust: A living trust holds property for the benefit of designated individuals. It can avoid probate, similar to a TOD deed.

- Beneficiary Designation Form: This form allows individuals to name beneficiaries for certain accounts, like life insurance or retirement accounts, ensuring assets pass directly to the named individuals.

- Hold Harmless Agreement: This agreement protects one party from liability or claims arising from certain activities, similar to how estate planning documents like the TOD Deed manage risks associated with asset transfer, providing a clear understanding of responsibilities, as seen in https://arizonaformpdf.com.

- Joint Tenancy Agreement: This agreement allows two or more people to own property together. When one owner dies, the property automatically passes to the surviving owner, similar to a TOD deed.

- Payable-on-Death (POD) Account: A POD account allows bank account owners to name beneficiaries who will receive the funds upon the owner's death, bypassing probate.

- Transfer-on-Death Registration for Securities: This allows individuals to designate beneficiaries for their securities, ensuring a smooth transfer upon death, much like a TOD deed for real estate.

- Life Estate Deed: This deed allows a person to live in a property for their lifetime, with the property passing to a designated beneficiary after their death, similar to a TOD deed.

- Revocable Trust: A revocable trust can be altered during the grantor's lifetime and allows for the transfer of assets upon death, similar to a TOD deed.

- Durable Power of Attorney: While not directly about property transfer, this document allows someone to manage a person's affairs, which can include property decisions, until death.

- Health Care Proxy: This document designates someone to make health care decisions for a person if they become unable to do so. While it doesn’t transfer property, it ensures the person’s wishes are respected, similar to how a TOD deed respects the property owner's wishes.

Document Properties

| Fact Name | Description |

|---|---|

| What It Is | The California Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by California Probate Code Section 5600-5696. |

| Requirements | The deed must be signed by the property owner and recorded with the county recorder's office to be effective. |

| Revocation | Property owners can revoke the Transfer-on-Death Deed at any time before their death by recording a revocation form. |

Things You Should Know About This Form

-

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to transfer their real estate to a beneficiary upon their death. This deed ensures that the property passes directly to the named beneficiary without going through probate.

-

Who can use a Transfer-on-Death Deed in California?

Any individual who owns real property in California can use a TOD Deed. This includes homeowners, landowners, and anyone with title to real estate. It is important to note that the property must be held in the owner's name, not in a trust or business entity.

-

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you must fill out the appropriate form, which includes details about the property and the beneficiary. After completing the form, you must sign it in front of a notary public. Finally, the deed must be recorded with the county recorder's office where the property is located.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TOD Deed at any time while you are alive. To do this, you must create a new deed that either names a different beneficiary or explicitly states that the previous deed is revoked. The new deed must also be recorded to take effect.

-

What happens if the beneficiary predeceases me?

If the beneficiary named in the TOD Deed passes away before you do, the deed will not transfer the property to that beneficiary. Instead, the property will become part of your estate and will be distributed according to your will or, if there is no will, according to California's intestacy laws.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a TOD Deed does not trigger any immediate tax consequences for the property owner. However, the beneficiary may be responsible for property taxes once the transfer occurs. It is advisable to consult with a tax professional for personalized advice.

-

Can I use a Transfer-on-Death Deed for all types of property?

A TOD Deed can be used for most types of real property, including single-family homes, condominiums, and vacant land. However, it cannot be used for certain types of property, such as commercial property or property held in a trust.

-

Is a Transfer-on-Death Deed the same as a will?

No, a TOD Deed is not the same as a will. A will goes into effect upon your death and must go through probate. In contrast, a TOD Deed transfers property directly to the beneficiary without the need for probate, making the process simpler and faster.

-

What if I have multiple beneficiaries?

If you want to name multiple beneficiaries in your TOD Deed, you can do so. You will need to specify how the property will be divided among them. For example, you might choose to give equal shares to each beneficiary or designate specific portions of the property to different individuals.

-

Where can I find the Transfer-on-Death Deed form?

The Transfer-on-Death Deed form can be found on the California Secretary of State's website or through your local county recorder's office. It is essential to use the most current version of the form to ensure compliance with state laws.

Documents used along the form

When dealing with property transfer in California, the Transfer-on-Death Deed (TOD Deed) is a useful tool. However, it often works in conjunction with other forms and documents to ensure a smooth transition of ownership. Here are some commonly used documents that you might encounter alongside the TOD Deed.

- Grant Deed: This document serves to transfer property ownership from one party to another. It provides a clear record of the transfer and often includes warranties regarding the title's status.

- Revocation of Transfer-on-Death Deed: If the property owner decides to cancel the TOD Deed, this document formally revokes the previous deed. It ensures that the property will not transfer upon the owner's death.

- Transfer-on-Death Deed for Arkansas: This deed allows property owners in Arkansas to transfer real estate to their beneficiaries upon death without probate, ensuring a smoother transition of assets. More information can be found at todform.com/blank-arkansas-transfer-on-death-deed.

- Affidavit of Death: This document is used to verify the death of the property owner. It may be required to finalize the transfer of ownership under the terms of the TOD Deed.

- Will: While not mandatory for the TOD Deed, a will can complement estate planning. It outlines how a person wishes their assets to be distributed upon their death, providing additional clarity beyond the TOD Deed.

Understanding these documents can help ensure that property transfers are handled efficiently and according to the owner's wishes. Each plays a significant role in the overall process of estate planning and property management.

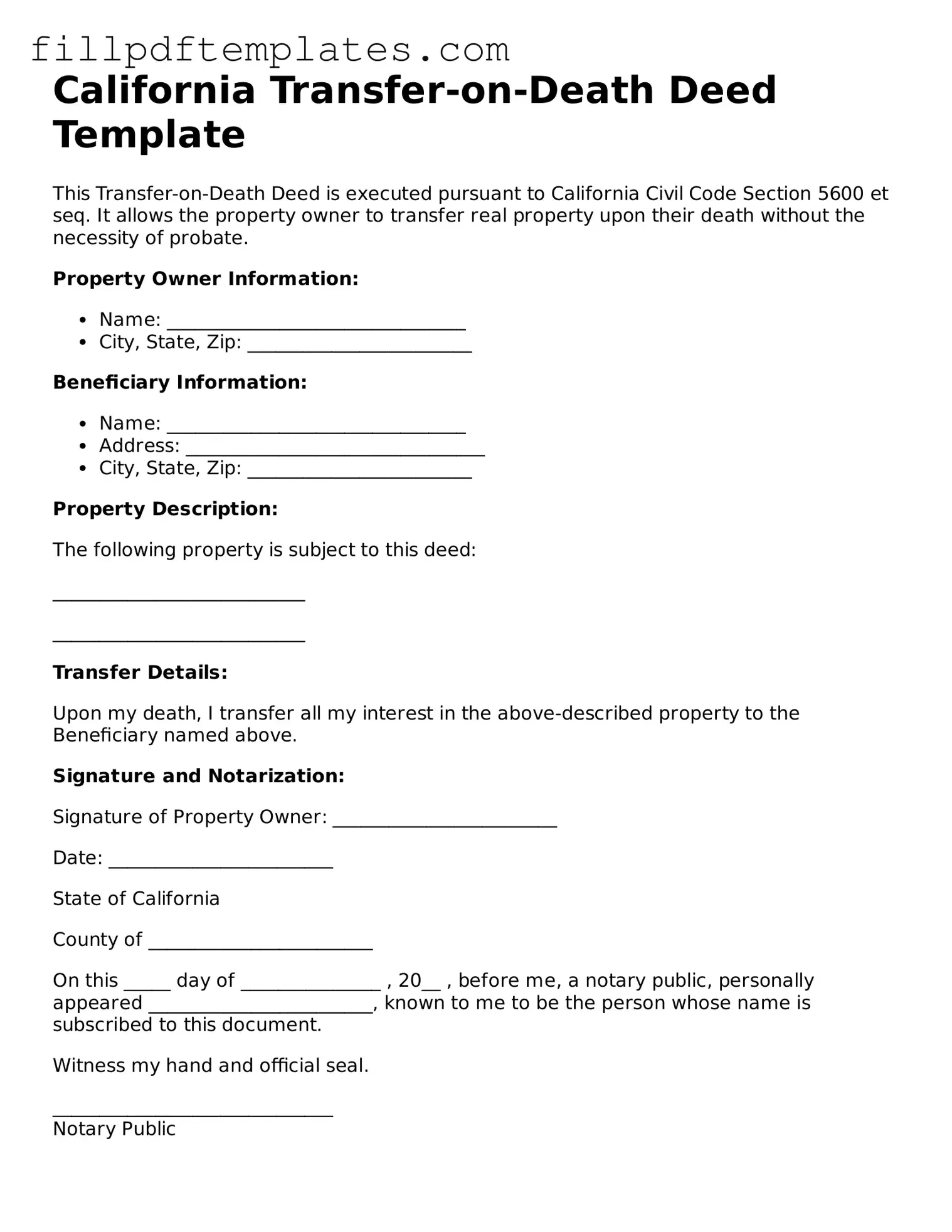

California Transfer-on-Death Deed Preview

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed pursuant to California Civil Code Section 5600 et seq. It allows the property owner to transfer real property upon their death without the necessity of probate.

Property Owner Information:

- Name: ________________________________

- City, State, Zip: ________________________

Beneficiary Information:

- Name: ________________________________

- Address: ________________________________

- City, State, Zip: ________________________

Property Description:

The following property is subject to this deed:

___________________________

___________________________

Transfer Details:

Upon my death, I transfer all my interest in the above-described property to the Beneficiary named above.

Signature and Notarization:

Signature of Property Owner: ________________________

Date: ________________________

State of California

County of ________________________

On this _____ day of _______________ , 20__ , before me, a notary public, personally appeared ________________________, known to me to be the person whose name is subscribed to this document.

Witness my hand and official seal.

______________________________

Notary Public