Blank California Quitclaim Deed Form

The California Quitclaim Deed is a crucial legal document used to transfer ownership of real property from one party to another without any guarantees or warranties regarding the title. This form allows the current owner, known as the grantor, to relinquish their interest in the property to the recipient, or grantee. Often utilized in situations such as family transfers, divorce settlements, or to clear up title issues, the Quitclaim Deed provides a straightforward method for conveying property rights. While it does not ensure that the property is free from liens or other encumbrances, it is a simple tool that can facilitate the transfer process. To complete the form, specific information must be included, such as the names of the parties involved, a legal description of the property, and the signature of the grantor. Understanding the nuances of this deed is essential for anyone looking to navigate property transfers in California effectively.

Other Common Quitclaim Deed State Templates

Nj Quit Claim Deed Requirements - A Quitclaim Deed can clarify ownership among multiple owners.

Cost for Quit Claim Deed - The form must be signed and notarized to be legally binding.

To facilitate a smooth transfer of assets, it is crucial to understand the steps involved in creating an accurate document. For detailed information on crafting your comprehensive bill of sale, visit this helpful resource.

Quick Deed - This document can be helpful in resolving ownership matters related to inherited property.

Similar forms

-

Warranty Deed: This document transfers ownership of property and guarantees that the seller has a clear title. Unlike a quitclaim deed, which offers no guarantees, a warranty deed assures the buyer that the property is free of any claims or liens.

-

Grant Deed: Similar to a warranty deed, a grant deed also transfers property ownership. It provides some assurances regarding the title, such as confirming that the seller has not sold the property to anyone else. However, it does not offer the same level of protection as a warranty deed.

- Hold Harmless Agreement: This essential legal document ensures that one party will not hold another responsible for injuries or losses, making it a critical component in risk management for events and services. For more information, visit the Hold Harmless Agreement.

-

Deed of Trust: This document is used in real estate transactions to secure a loan with the property. It involves three parties: the borrower, the lender, and a trustee. While it does not transfer ownership outright, it places a lien on the property, similar to how a quitclaim deed can transfer interests in a property.

-

Life Estate Deed: This type of deed allows a person to live in a property for their lifetime while transferring the remainder interest to another party. Like a quitclaim deed, it can be used to transfer property rights, but it specifically outlines the rights of the life tenant and the remainderman.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of real estate from one party to another without any warranties about the property title. |

| Use Cases | This form is commonly used in situations such as transferring property between family members, clearing up title issues, or during divorce settlements. |

| Governing Law | The California Quitclaim Deed is governed by California Civil Code Sections 1091 and 1092. |

| Signature Requirements | The grantor must sign the quitclaim deed in front of a notary public to ensure its validity. |

| Recording | To make the transfer official, the quitclaim deed should be recorded with the county recorder’s office where the property is located. |

| Tax Implications | While a quitclaim deed itself does not trigger property taxes, it may affect the property tax basis depending on the circumstances of the transfer. |

| Limitations | This type of deed does not guarantee that the grantor has good title to the property, meaning the grantee may take on risks related to existing liens or claims. |

Things You Should Know About This Form

-

What is a California Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate in California. It allows the current owner (grantor) to transfer their interest in the property to another person (grantee) without making any warranties about the title. This means the grantor does not guarantee that they own the property free and clear of any liens or claims.

-

When should I use a Quitclaim Deed?

Use a Quitclaim Deed when you want to transfer property between family members, during divorce settlements, or when adding or removing someone from the title. It is often used in situations where the parties know each other and trust each other, as it does not provide any guarantees about the property’s title.

-

What information is required on a Quitclaim Deed?

A Quitclaim Deed must include the following information:

- The names of the grantor and grantee.

- A legal description of the property.

- The address of the property.

- The date of the transfer.

- The grantor's signature.

-

Do I need to notarize the Quitclaim Deed?

Yes, a Quitclaim Deed must be notarized in California. The grantor must sign the document in front of a notary public to ensure its validity. This step helps prevent fraud and ensures that the document can be recorded with the county.

-

How do I record a Quitclaim Deed?

To record a Quitclaim Deed, take the signed and notarized document to the county recorder’s office where the property is located. You may need to pay a recording fee. Once recorded, the deed becomes part of the public record, providing notice of the ownership transfer.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. In contrast, a Quitclaim Deed transfers whatever interest the grantor has, without any guarantees.

-

Can I revoke a Quitclaim Deed?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked unilaterally. However, the grantor may create a new deed to transfer the property back or to another party. Legal advice may be necessary to navigate this process.

-

Are there tax implications when using a Quitclaim Deed?

Yes, transferring property via a Quitclaim Deed may have tax implications. Depending on the circumstances, it could trigger reassessment of property taxes or impact capital gains taxes. It is advisable to consult a tax professional to understand the potential consequences.

Documents used along the form

When transferring property in California, the Quitclaim Deed is a crucial document. However, it often works in tandem with several other forms and documents that facilitate the transfer process and ensure compliance with legal requirements. Here’s a list of commonly used documents that accompany the Quitclaim Deed.

- Grant Deed: This document provides a guarantee that the property being transferred is free from any encumbrances, except those disclosed. It offers more protection to the grantee than a Quitclaim Deed.

- Title Insurance Policy: This policy protects the buyer against any future claims or disputes over the property title. It is essential for ensuring that the buyer has clear ownership.

- Preliminary Change of Ownership Report: This form is required by the county assessor’s office when a property changes hands. It helps in determining property taxes and must be submitted along with the Quitclaim Deed.

- Property Tax Statement: This document outlines the current property tax obligations. It is important for both the buyer and seller to understand the tax implications of the property transfer.

- Affidavit of Death: In cases where the property is being transferred due to the death of an owner, this affidavit serves as proof of death and may be required for the transfer to proceed.

- Trustee’s Deed: If the property is held in a trust, this document is used to transfer ownership from the trust to the beneficiary or another party, ensuring that the terms of the trust are honored.

- Transfer-on-Death Deed: This deed allows property owners to designate beneficiaries who will receive their real estate upon their passing, without the need for probate. For more details, visit todform.com/blank-district-of-columbia-transfer-on-death-deed.

- Notice of Default: If the property is in foreclosure, this document notifies the borrower of their default on the loan. It is important for the buyer to be aware of any existing defaults.

- Escrow Instructions: These are written instructions given to the escrow agent detailing how to handle the transaction. They ensure that all parties understand their obligations and the process.

- Bill of Sale: If personal property is included in the transfer, a Bill of Sale may be used to document the sale of that personal property, ensuring clarity in the transaction.

Understanding these additional documents is essential for anyone involved in a property transfer in California. Each plays a vital role in protecting the interests of all parties and ensuring a smooth transaction. Always consult with a legal professional to ensure that you have the right documents and that they are completed correctly.

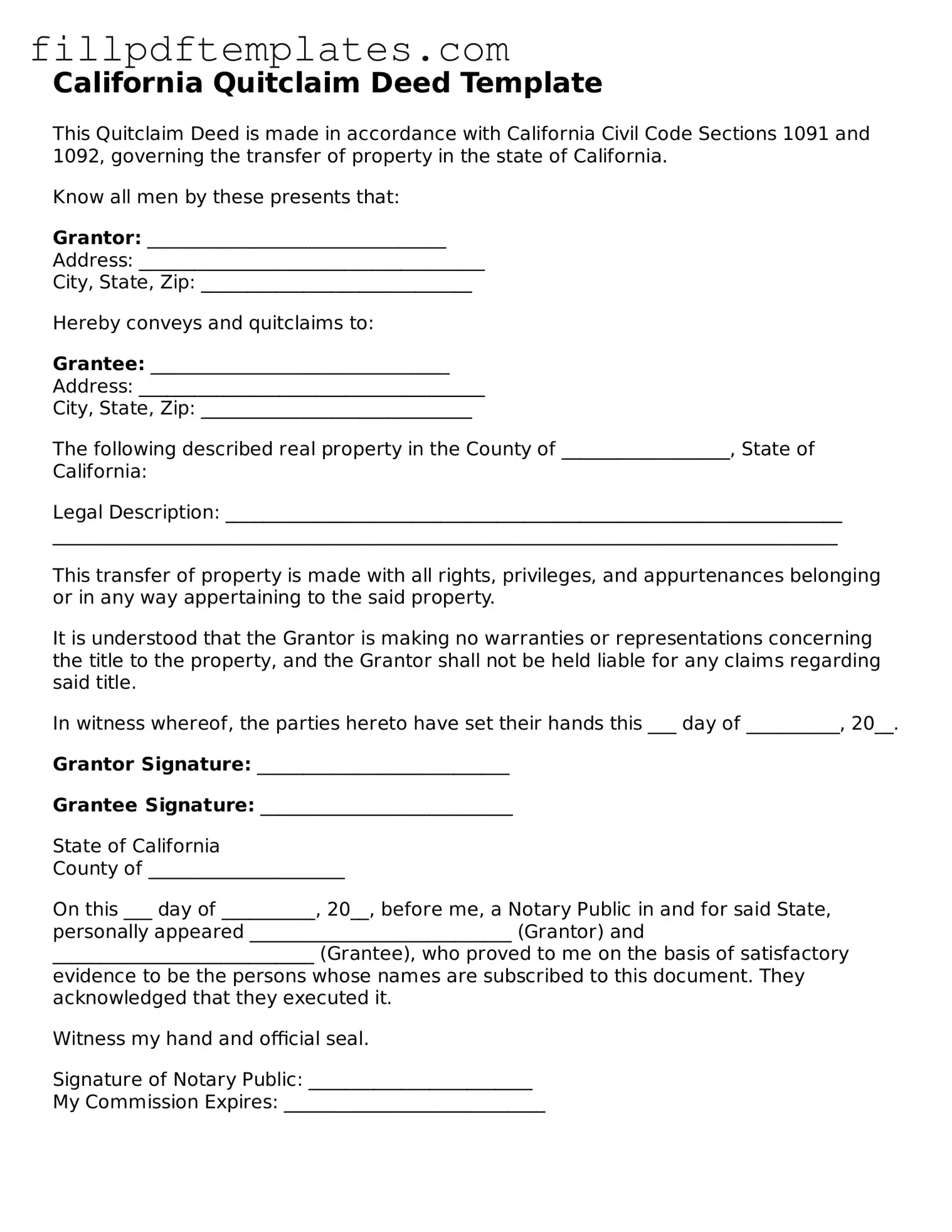

California Quitclaim Deed Preview

California Quitclaim Deed Template

This Quitclaim Deed is made in accordance with California Civil Code Sections 1091 and 1092, governing the transfer of property in the state of California.

Know all men by these presents that:

Grantor: ________________________________

Address: _____________________________________

City, State, Zip: _____________________________

Hereby conveys and quitclaims to:

Grantee: ________________________________

Address: _____________________________________

City, State, Zip: _____________________________

The following described real property in the County of __________________, State of California:

Legal Description: __________________________________________________________________

____________________________________________________________________________________

This transfer of property is made with all rights, privileges, and appurtenances belonging or in any way appertaining to the said property.

It is understood that the Grantor is making no warranties or representations concerning the title to the property, and the Grantor shall not be held liable for any claims regarding said title.

In witness whereof, the parties hereto have set their hands this ___ day of __________, 20__.

Grantor Signature: ___________________________

Grantee Signature: ___________________________

State of California

County of _____________________

On this ___ day of __________, 20__, before me, a Notary Public in and for said State, personally appeared ____________________________ (Grantor) and ____________________________ (Grantee), who proved to me on the basis of satisfactory evidence to be the persons whose names are subscribed to this document. They acknowledged that they executed it.

Witness my hand and official seal.

Signature of Notary Public: ________________________

My Commission Expires: ____________________________