Blank California Promissory Note Form

In California, a promissory note is a crucial financial document that outlines a borrower's promise to repay a specified sum of money to a lender under agreed-upon terms. This form serves not only as a record of the transaction but also as a binding contract that details key elements such as the loan amount, interest rate, repayment schedule, and any applicable fees. It typically includes provisions for late payments and default, ensuring both parties understand their rights and obligations. Additionally, the note may specify whether it is secured or unsecured, which can significantly impact the lender's recourse in the event of non-payment. Understanding the intricacies of the California promissory note form is essential for both borrowers and lenders, as it helps to establish clear expectations and protect against potential disputes. Properly executed, this document provides a solid foundation for financial transactions, fostering trust and accountability between parties.

Other Common Promissory Note State Templates

How to Write a Promissory Note for a Personal Loan - This note can be transferred to another party, allowing the lender to sell the debt.

The Indiana Transfer-on-Death Deed form is a crucial tool for property owners looking to streamline the transfer of their real estate to beneficiaries after they pass away. By utilizing this deed, individuals can bypass the often complicated probate process, ensuring that their property is directly handed over to loved ones without the need for extensive legal intervention. For those interested in taking the next step, more information can be found at https://todform.com/blank-indiana-transfer-on-death-deed/.

Iowa Promissory Note - Promissory notes can be crucial in establishing mutual trust between lender and borrower.

Illinois Promissory Note - A promissory note can help formalize family loans, preventing misunderstandings.

Promissory Note Template Georgia - Allows for flexibility in repayment terms if agreed upon.

Similar forms

- Loan Agreement: A loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. Like a promissory note, it is a binding contract between a lender and a borrower.

- Mortgage: A mortgage secures a loan with real property as collateral. Similar to a promissory note, it details the borrower's obligation to repay the loan, but it also includes the terms of the collateral.

- Lease Agreement: A lease agreement governs the rental of property. It shares similarities with a promissory note in that it specifies payment terms and obligations of the tenant, though it typically involves rental payments rather than a loan.

- Installment Agreement: This document allows a borrower to repay a debt in installments. Like a promissory note, it specifies the repayment terms and the total amount owed, but it may cover various types of debts beyond loans.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a debt if the primary borrower defaults. It is similar to a promissory note in that it establishes a personal obligation to pay.

- Credit Agreement: A credit agreement outlines the terms under which credit is extended to a borrower. It includes repayment terms and conditions, akin to a promissory note, but typically applies to revolving credit lines.

- Security Agreement: A security agreement provides the lender with rights to specific collateral if the borrower defaults. It complements a promissory note by detailing the collateral securing the loan.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to settle a debt for less than the full amount owed. It shares characteristics with a promissory note in that it establishes a repayment plan.

- Forbearance Agreement: A forbearance agreement allows a borrower to temporarily postpone payments. It is similar to a promissory note in that it modifies the terms of repayment while still holding the borrower accountable.

- Hold Harmless Agreement: This important document protects one party from liability, transferring risk to another, making it essential for clear responsibility assignment in both business and personal scenarios. For more details, visit the Hold Harmless Agreement page.

- Loan Modification Agreement: This document alters the terms of an existing loan. Like a promissory note, it is a binding contract that specifies new repayment terms and conditions.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The California Uniform Commercial Code (UCC) governs promissory notes in California. |

| Essential Elements | To be valid, a promissory note must include the principal amount, interest rate, maturity date, and signatures of the parties involved. |

| Interest Rate | California allows for both fixed and variable interest rates, but they must be clearly stated in the note. |

| Enforceability | A properly executed promissory note is enforceable in court, provided it meets all legal requirements. |

| Default Consequences | If the borrower defaults, the lender may pursue legal action to recover the owed amount, plus any applicable interest and fees. |

| Transferability | Promissory notes can be transferred or sold to another party, subject to certain legal requirements. |

| Notarization | While notarization is not always required, it can help establish the authenticity of the signatures on the note. |

| State-Specific Considerations | California law may impose specific requirements regarding disclosures and consumer protections for certain types of loans. |

Things You Should Know About This Form

-

What is a California Promissory Note?

A California Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. It serves as a legal document that outlines the terms of the loan, including the interest rate, repayment schedule, and any consequences for default.

-

Who uses a Promissory Note?

Individuals, businesses, and financial institutions often use Promissory Notes. They are common in personal loans, business loans, and real estate transactions. Essentially, anyone who borrows or lends money can utilize this document to clarify the terms of the agreement.

-

What are the key components of a Promissory Note?

A typical Promissory Note includes:

- The names and addresses of the borrower and lender

- The principal amount being borrowed

- The interest rate (if applicable)

- The repayment schedule, including due dates

- Any late fees or penalties for missed payments

- Signatures of both parties

-

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding contract. Once both parties sign the document, it creates an obligation for the borrower to repay the loan under the agreed-upon terms. If the borrower fails to repay, the lender may take legal action to recover the owed amount.

-

Do I need a lawyer to create a Promissory Note?

While you do not necessarily need a lawyer to create a Promissory Note, it can be beneficial to consult one. A lawyer can help ensure that the document meets all legal requirements and protects your interests. This can be especially important for larger loans or complex agreements.

-

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is essential to document any modifications in writing and have both parties sign the amended note. This helps avoid misunderstandings in the future.

-

What happens if the borrower defaults?

If the borrower defaults, the lender has several options. They may pursue collection efforts, which can include contacting the borrower for payment or hiring a collection agency. In some cases, the lender may take legal action to recover the owed amount, potentially leading to a court judgment.

-

How long is a Promissory Note valid?

The validity of a Promissory Note can depend on the terms outlined in the document and state laws. Generally, a Promissory Note remains valid until the loan is repaid in full. However, if the borrower does not make payments, the lender may need to act within a specific timeframe to enforce the note, known as the statute of limitations.

-

Can I use a Promissory Note for a personal loan between friends or family?

Absolutely. Using a Promissory Note for personal loans between friends or family is a wise decision. It helps clarify expectations and protect both parties. By documenting the terms of the loan, you can help prevent misunderstandings and maintain healthy relationships.

Documents used along the form

The California Promissory Note form is a key document used in financial transactions to outline the terms of a loan between a borrower and a lender. Several other forms and documents are commonly utilized alongside the Promissory Note to ensure clarity and legal compliance in the agreement. Below is a list of these documents.

- Loan Agreement: This document details the terms of the loan, including the principal amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive outline of the lender's and borrower's obligations.

- Motorcycle Bill of Sale: This important document records the transfer of ownership of a motorcycle, detailing essential information about the vehicle and the parties involved, ensuring a secure transaction. For more details, visit https://arizonaformpdf.com/.

- Security Agreement: If the loan is secured by collateral, this document specifies the assets pledged by the borrower. It outlines the rights of the lender in case of default and the process for claiming the collateral.

- Disclosure Statement: This document provides essential information about the loan, including fees, interest rates, and any potential risks. It ensures that the borrower is fully informed before entering into the agreement.

- Personal Guarantee: In cases where the borrower is a business entity, this document may be required from an individual. It holds the individual personally responsible for the loan if the business defaults.

- Amortization Schedule: This table outlines each payment over the life of the loan, breaking down how much goes toward principal and interest. It helps borrowers understand their payment obligations over time.

These documents collectively enhance the clarity and enforceability of the loan agreement, ensuring that both parties understand their rights and responsibilities. Utilizing these forms can help prevent disputes and facilitate smoother financial transactions.

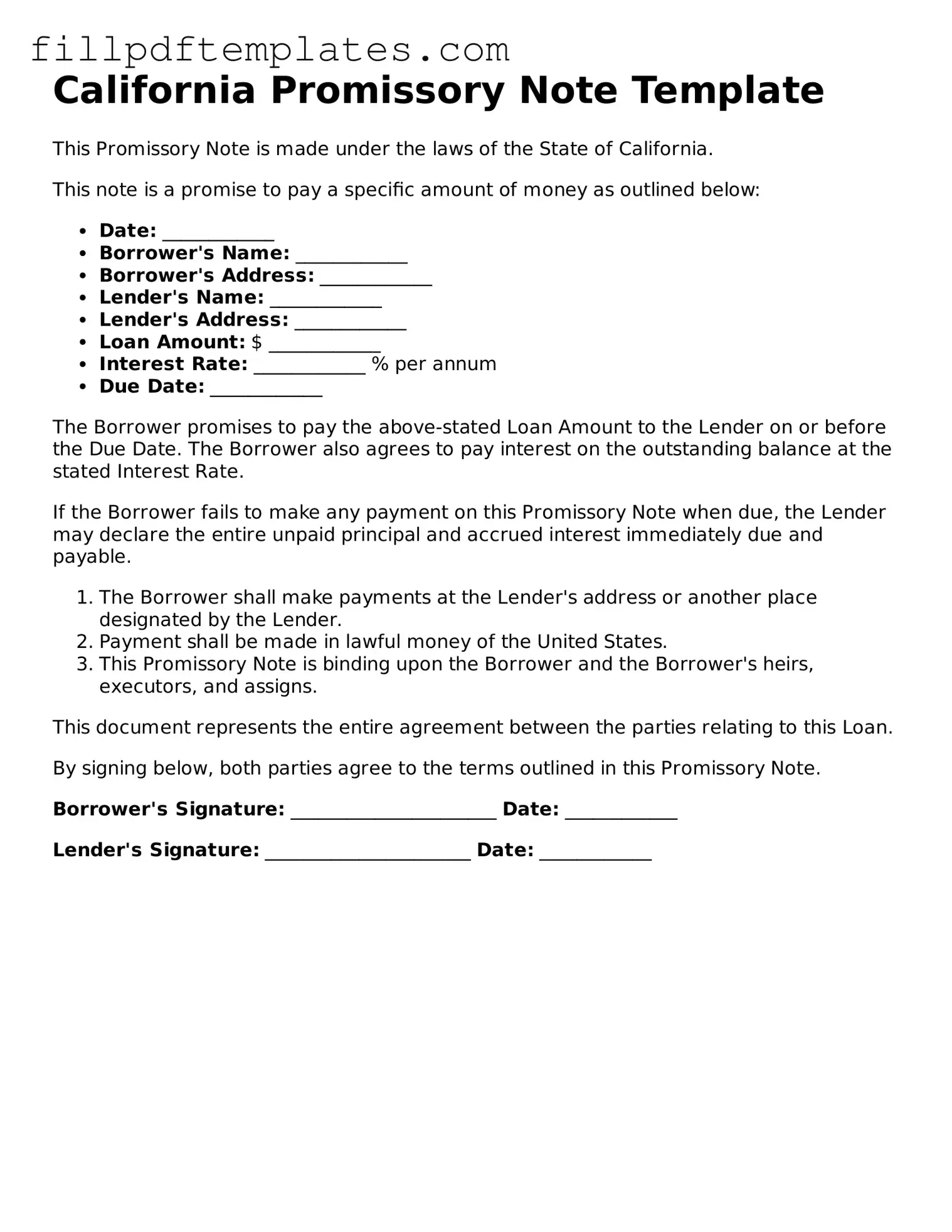

California Promissory Note Preview

California Promissory Note Template

This Promissory Note is made under the laws of the State of California.

This note is a promise to pay a specific amount of money as outlined below:

- Date: ____________

- Borrower's Name: ____________

- Borrower's Address: ____________

- Lender's Name: ____________

- Lender's Address: ____________

- Loan Amount: $ ____________

- Interest Rate: ____________ % per annum

- Due Date: ____________

The Borrower promises to pay the above-stated Loan Amount to the Lender on or before the Due Date. The Borrower also agrees to pay interest on the outstanding balance at the stated Interest Rate.

If the Borrower fails to make any payment on this Promissory Note when due, the Lender may declare the entire unpaid principal and accrued interest immediately due and payable.

- The Borrower shall make payments at the Lender's address or another place designated by the Lender.

- Payment shall be made in lawful money of the United States.

- This Promissory Note is binding upon the Borrower and the Borrower's heirs, executors, and assigns.

This document represents the entire agreement between the parties relating to this Loan.

By signing below, both parties agree to the terms outlined in this Promissory Note.

Borrower's Signature: ______________________ Date: ____________

Lender's Signature: ______________________ Date: ____________