Blank California Operating Agreement Form

In the realm of business formation, particularly for limited liability companies (LLCs) in California, the Operating Agreement plays a crucial role in establishing the framework for how the company will operate. This essential document outlines the rights and responsibilities of the members, detailing the management structure, profit distribution, and procedures for decision-making. It serves as a guiding tool, ensuring that all parties involved have a clear understanding of their roles and the operational processes of the business. Additionally, the Operating Agreement can address important matters such as member voting rights, the process for adding or removing members, and how disputes will be resolved. By providing clarity and structure, this agreement not only helps prevent misunderstandings but also protects the interests of all members. Understanding the nuances of the California Operating Agreement is vital for anyone looking to establish a successful LLC in the state, as it lays the foundation for future growth and collaboration.

Other Common Operating Agreement State Templates

Llc Operating Agreement Michigan Template - It typically includes provisions for management structure.

For those seeking to establish clear rental terms, a well-crafted detailed Lease Agreement is fundamental. This document delineates expectations between landlords and tenants, promoting a harmonious tenancy.

How to Write an Operating Agreement - This agreement can provide guidelines for performance evaluations of members.

Similar forms

- Bylaws: Bylaws outline the rules and procedures for the management of a corporation. Like an Operating Agreement, they specify how decisions are made, how meetings are conducted, and the roles of officers and directors.

- Residential Lease Agreement: This legal contract is essential for renting properties in Arizona. It details terms like rent payment and lease duration, ensuring both landlords and tenants understand their responsibilities. To get started, consider filling out the form available at https://arizonaformpdf.com/.

- Partnership Agreement: A Partnership Agreement details the terms of a partnership. Similar to an Operating Agreement, it defines each partner's responsibilities, profit-sharing arrangements, and procedures for resolving disputes.

- Shareholder Agreement: A Shareholder Agreement governs the relationship between shareholders in a corporation. It is similar to an Operating Agreement in that it addresses voting rights, share transfers, and management structure.

- LLC Membership Certificate: An LLC Membership Certificate provides proof of ownership in an LLC. It is similar to an Operating Agreement as it outlines the rights of members and can include information about profit distribution and management responsibilities.

Document Properties

| Fact Name | Details |

|---|---|

| Purpose | The California Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC). |

| Governing Law | California Corporations Code, Section 17701.01 et seq. |

| Members' Rights | The agreement specifies the rights and responsibilities of each member involved in the LLC. |

| Profit Distribution | It details how profits and losses will be distributed among members, often based on ownership percentages. |

| Management Structure | The agreement can establish whether the LLC is member-managed or manager-managed. |

| Amendments | Members can outline procedures for amending the Operating Agreement in the future. |

| Dispute Resolution | It often includes provisions for resolving disputes among members, such as mediation or arbitration. |

| Initial Capital Contributions | The agreement may specify each member's initial capital contribution and future funding obligations. |

| Duration | The Operating Agreement can define the duration of the LLC, whether it’s perpetual or for a specific term. |

| Compliance | Having an Operating Agreement is not legally required in California, but it is highly recommended for clarity and protection. |

Things You Should Know About This Form

-

What is a California Operating Agreement?

A California Operating Agreement is a crucial document for Limited Liability Companies (LLCs) in California. It outlines the internal operations of the LLC, detailing the rights, responsibilities, and ownership percentages of each member. While it is not legally required to file this document with the state, having one is highly recommended to ensure clarity and prevent disputes among members.

-

Why do I need an Operating Agreement for my LLC?

Having an Operating Agreement provides several benefits. It serves as a roadmap for how the LLC will be managed and how decisions will be made. This document helps protect the limited liability status of the members by demonstrating that the LLC is a separate entity. Additionally, in the absence of an Operating Agreement, California law will govern the LLC, which may not align with the members' intentions.

-

What should be included in a California Operating Agreement?

An effective Operating Agreement typically includes the following elements:

- The name and purpose of the LLC

- The duration of the LLC

- Details about member contributions and ownership percentages

- Management structure (member-managed or manager-managed)

- Voting rights and procedures

- Distribution of profits and losses

- Procedures for adding or removing members

- Dispute resolution methods

Including these details helps ensure that all members are on the same page regarding the operation of the LLC.

-

Is an Operating Agreement legally binding?

Yes, an Operating Agreement is a legally binding contract among the members of the LLC. Once signed, it holds all parties accountable to the terms outlined within it. However, it is essential to ensure that the agreement complies with California laws and regulations to be enforceable.

-

Can I change the Operating Agreement after it is created?

Absolutely. An Operating Agreement can be amended as needed. To make changes, all members must typically agree to the amendments, and the process for doing so should be outlined in the original agreement. Keeping the document updated is vital as the business evolves or as member circumstances change.

-

What happens if I don’t have an Operating Agreement?

Operating without an agreement can lead to confusion and conflict among members. In the absence of an Operating Agreement, California's default LLC laws will apply, which may not reflect the specific intentions or arrangements agreed upon by the members. This can result in unintended consequences, including disputes over profit distribution and management responsibilities.

-

How do I create an Operating Agreement?

Creating an Operating Agreement can be done through various methods. You can draft one from scratch, use templates available online, or consult with a legal professional for assistance. Regardless of the method chosen, it is crucial to ensure that the agreement accurately reflects the members’ intentions and complies with California law.

-

Do I need a lawyer to draft my Operating Agreement?

While it is not mandatory to hire a lawyer, consulting with one can provide valuable insights, especially for complex businesses. A legal professional can help ensure that the Operating Agreement is comprehensive and tailored to your specific needs, reducing the likelihood of future disputes. However, many small businesses successfully create their own agreements using templates and guidelines.

Documents used along the form

When forming a limited liability company (LLC) in California, the Operating Agreement is a crucial document. However, several other forms and documents complement this agreement, ensuring that your business is set up correctly and operates smoothly. Below is a list of commonly used documents that you may need to consider alongside the California Operating Agreement.

- Articles of Organization: This document is filed with the California Secretary of State to officially create your LLC. It includes essential information such as the LLC's name, address, and the name of the registered agent.

- Bylaws: While not mandatory for LLCs, bylaws can outline the internal governance of the company. They specify the roles and responsibilities of members and managers, helping to maintain order and clarity.

- Member Consent Forms: These forms are used to document the approval of significant decisions by the members of the LLC. They serve as a record of agreement on actions that may affect the company.

- Operating Procedures: This document details the day-to-day operations of the LLC. It can cover various topics, including decision-making processes, meeting schedules, and record-keeping practices.

- Tax Identification Number (EIN) Application: Obtaining an Employer Identification Number from the IRS is essential for tax purposes. This number is necessary for opening a business bank account and filing taxes.

- Business License Application: Depending on your location and industry, you may need to apply for specific business licenses or permits to operate legally within your jurisdiction.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members and may include details such as the member's name and ownership percentage.

- Non-Disclosure Agreement (NDA): If your LLC plans to share sensitive information with employees, partners, or contractors, an NDA can protect your business interests by ensuring confidentiality.

- Hold Harmless Agreement: This vital document ensures that one party will not hold the other responsible for any loss or damage, providing protection during various business activities, such as the Hold Harmless Agreement.

- Annual Report: In California, LLCs must file an annual report with the Secretary of State. This document updates the state on the company’s status, including any changes in management or ownership.

Each of these documents plays a vital role in establishing and maintaining a successful LLC in California. By ensuring that you have all the necessary forms in place, you can focus on growing your business with confidence and clarity.

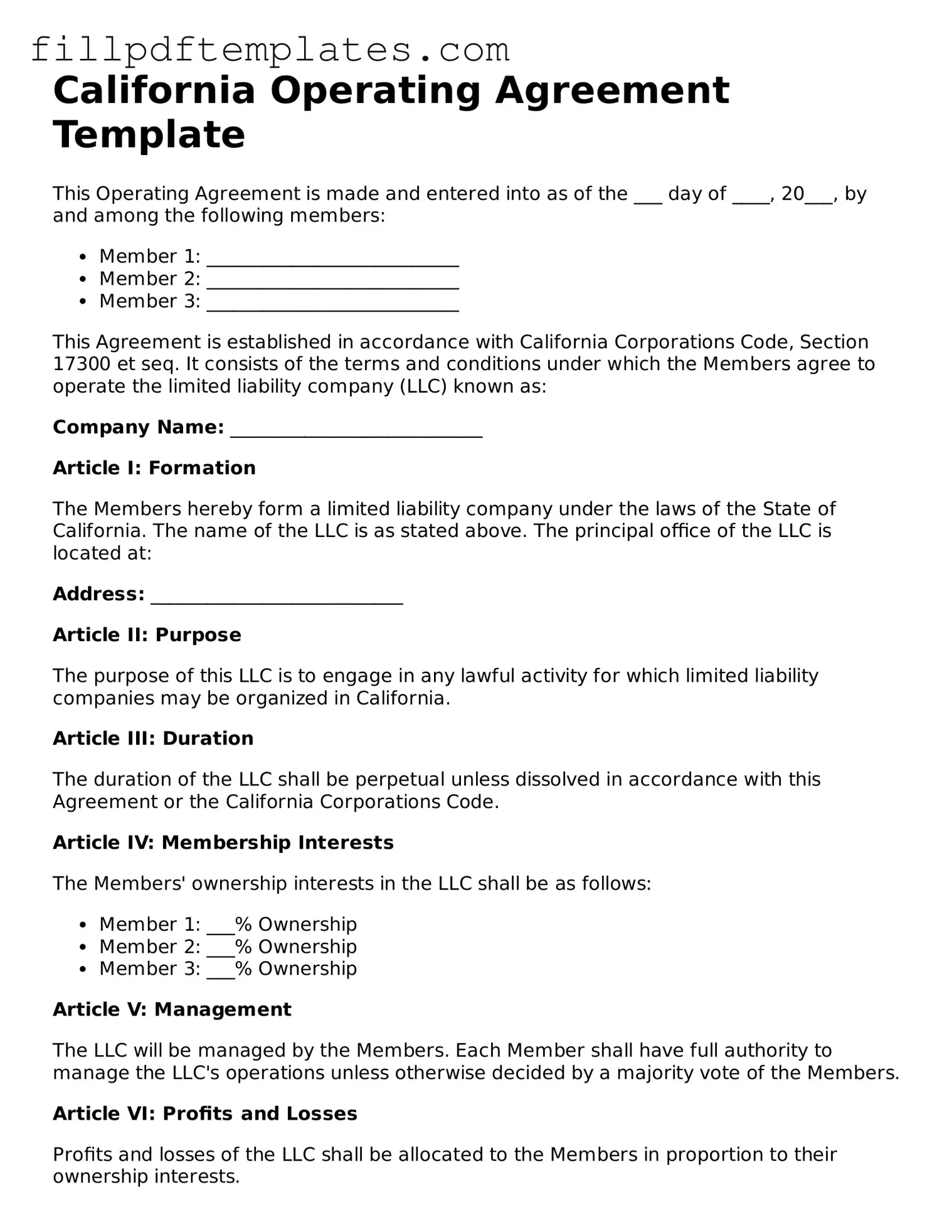

California Operating Agreement Preview

California Operating Agreement Template

This Operating Agreement is made and entered into as of the ___ day of ____, 20___, by and among the following members:

- Member 1: ___________________________

- Member 2: ___________________________

- Member 3: ___________________________

This Agreement is established in accordance with California Corporations Code, Section 17300 et seq. It consists of the terms and conditions under which the Members agree to operate the limited liability company (LLC) known as:

Company Name: ___________________________

Article I: Formation

The Members hereby form a limited liability company under the laws of the State of California. The name of the LLC is as stated above. The principal office of the LLC is located at:

Address: ___________________________

Article II: Purpose

The purpose of this LLC is to engage in any lawful activity for which limited liability companies may be organized in California.

Article III: Duration

The duration of the LLC shall be perpetual unless dissolved in accordance with this Agreement or the California Corporations Code.

Article IV: Membership Interests

The Members' ownership interests in the LLC shall be as follows:

- Member 1: ___% Ownership

- Member 2: ___% Ownership

- Member 3: ___% Ownership

Article V: Management

The LLC will be managed by the Members. Each Member shall have full authority to manage the LLC's operations unless otherwise decided by a majority vote of the Members.

Article VI: Profits and Losses

Profits and losses of the LLC shall be allocated to the Members in proportion to their ownership interests.

Article VII: Banking

All funds of the LLC shall be deposited in its name in banks or other financial institutions selected by the Members. Distributions shall be made to the Members at the times and in the manner agreed upon by all Members.

Article VIII: Amendments

This Operating Agreement may be amended only by a written agreement signed by all Members.

Article IX: Miscellaneous

This Agreement constitutes the entire understanding between the Members concerning the LLC and supersedes all prior agreements. If any provision of this Agreement is deemed invalid, the remaining provisions shall remain in full force and effect.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

______________________________ (Member 1 Signature)

______________________________ (Member 2 Signature)

______________________________ (Member 3 Signature)

This template provides a comprehensive guideline to establish and manage a limited liability company in California. Each section includes the necessary information that Members must fill in to tailor the agreement to their specific needs.