Blank California Loan Agreement Form

In California, a Loan Agreement form serves as a crucial document for individuals or entities entering into a lending arrangement. This form outlines the specific terms and conditions of the loan, ensuring that both the lender and borrower have a clear understanding of their rights and obligations. Key aspects of the agreement include the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it addresses potential fees, default conditions, and the legal recourse available should either party fail to uphold their end of the agreement. By providing a structured approach to lending, this form not only protects the interests of the lender but also offers borrowers a transparent framework within which they can manage their financial responsibilities. Understanding the nuances of this document is essential for anyone considering a loan in California, as it lays the groundwork for a successful financial transaction and fosters trust between both parties involved.

Other Common Loan Agreement State Templates

Promissory Note Florida Pdf - A Loan Agreement outlines the terms between a lender and a borrower.

The Arkansas Transfer-on-Death Deed form allows property owners to transfer their real estate to beneficiaries upon their death, without the need for probate. This straightforward legal tool simplifies the process of passing on property and ensures that your wishes are honored. For further details, you can visit https://todform.com/blank-arkansas-transfer-on-death-deed/ to access the necessary form and get started.

Illinois Promissory Note - It establishes a legal relationship regarding the borrowed funds.

Promissory Note Template Georgia - It outlines the use of loan proceeds as agreed by both parties.

New York Promissory Note - This agreement may include details on the method for calculating interest owed.

Similar forms

- Promissory Note: This document outlines a borrower's promise to repay a loan. Like a Loan Agreement, it specifies the amount borrowed, interest rate, and repayment terms.

- Mortgage Agreement: This document secures a loan with property as collateral. Similar to a Loan Agreement, it details the loan amount and terms, but also includes information about the property.

- Credit Agreement: This outlines the terms of a line of credit, including interest rates and repayment schedules. It shares similarities with a Loan Agreement in terms of detailing obligations and rights of both parties.

- Lease Agreement: This document governs the rental of property. It includes terms and conditions similar to a Loan Agreement, such as payment amounts and duration.

- Personal Loan Agreement: This is a specific type of Loan Agreement for personal loans. It includes terms like repayment schedule and interest rates, just like a standard Loan Agreement.

- Business Loan Agreement: This document is used for loans taken by businesses. It contains similar elements to a Loan Agreement, such as loan amount, interest rate, and repayment terms.

- Installment Agreement: This outlines a payment plan for a debt. It is similar to a Loan Agreement as it specifies payment amounts and schedules over time.

- Secured Loan Agreement: This document specifies a loan that is backed by collateral. It shares features with a Loan Agreement, such as repayment terms and the consequences of default.

- Durable Power of Attorney Form: For individuals needing to ensure decisions are made on their behalf, the comprehensive Durable Power of Attorney resources are invaluable in outlining the important legal authority granted to another person.

- Debt Settlement Agreement: This outlines the terms for settling a debt for less than the full amount owed. Similar to a Loan Agreement, it details the obligations of both parties regarding payment terms.

Document Properties

| Fact Name | Details |

|---|---|

| Purpose | The California Loan Agreement form outlines the terms and conditions under which a loan is provided, ensuring both parties understand their obligations. |

| Governing Law | This agreement is governed by the laws of the State of California, specifically under the California Civil Code. |

| Parties Involved | The form requires the identification of both the lender and the borrower, including their legal names and contact information. |

| Repayment Terms | It specifies the repayment schedule, interest rates, and any penalties for late payments, ensuring clarity in the loan repayment process. |

Things You Should Know About This Form

-

What is a California Loan Agreement?

A California Loan Agreement is a legal document that outlines the terms and conditions under which a borrower agrees to repay a loan to a lender. This agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved.

-

Who uses a Loan Agreement?

Both individuals and businesses may use a Loan Agreement. Individuals often use it for personal loans, while businesses may use it for commercial financing. It serves to protect the interests of both parties involved in the transaction.

-

What are the key components of a Loan Agreement?

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The cost of borrowing, usually expressed as a percentage.

- Repayment Terms: The schedule for repaying the loan, including the frequency of payments.

- Default Clause: Conditions under which the borrower may be considered in default.

- Collateral: Any asset pledged as security for the loan, if applicable.

-

Is a Loan Agreement legally binding?

Yes, a Loan Agreement is a legally binding contract. Both parties must adhere to the terms outlined in the agreement. If either party fails to comply, legal action may be pursued to enforce the agreement.

-

Can a Loan Agreement be modified?

Yes, a Loan Agreement can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement to ensure clarity and enforceability.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender may take several actions depending on the terms of the agreement. This may include demanding immediate repayment, charging late fees, or taking legal action to recover the owed amount. If collateral is involved, the lender may also seize the asset.

-

Are there any specific laws governing Loan Agreements in California?

Yes, Loan Agreements in California are governed by state laws, including the California Civil Code. These laws outline the rights and responsibilities of both lenders and borrowers, as well as any specific requirements for loan agreements.

-

Do I need a lawyer to create a Loan Agreement?

While it is not legally required to have a lawyer draft a Loan Agreement, it is highly recommended. A lawyer can ensure that the agreement complies with all applicable laws and adequately protects the interests of both parties.

-

Where can I find a template for a California Loan Agreement?

Templates for California Loan Agreements can be found online through various legal websites, or you may consult with a lawyer for a custom agreement tailored to your specific needs. Always ensure that any template used complies with California law.

Documents used along the form

The California Loan Agreement form is a crucial document for establishing the terms of a loan. However, several other forms and documents are often used in conjunction with it to ensure clarity and legal compliance. Below is a list of these related documents.

- Promissory Note: This document outlines the borrower's promise to repay the loan under specified terms. It includes details such as the loan amount, interest rate, and repayment schedule.

- Hold Harmless Agreement: This legal document protects one party from liability for risks associated with the transaction, ensuring that they are not held responsible for any damages incurred, similar to the Hold Harmless Agreement used in Iowa.

- Security Agreement: This agreement details the collateral that secures the loan. It specifies what assets the lender can claim if the borrower defaults.

- Disclosure Statement: This document provides important information about the loan, including fees, interest rates, and other costs. It ensures that the borrower understands the financial obligations before signing.

- Loan Application: This form collects essential information about the borrower, including financial history and creditworthiness. Lenders use it to assess the risk of granting the loan.

These documents work together to provide a comprehensive framework for the loan transaction, protecting both the lender and the borrower throughout the process.

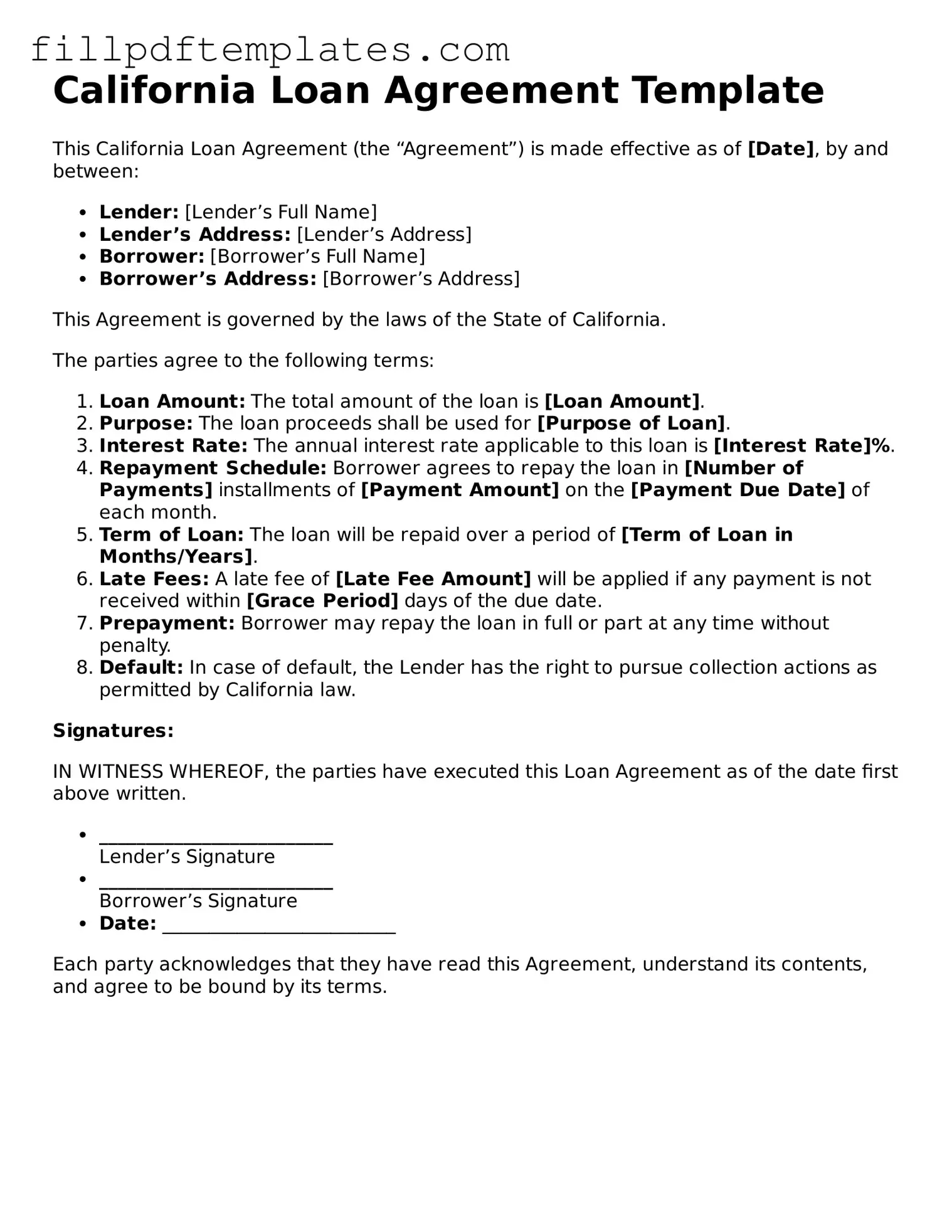

California Loan Agreement Preview

California Loan Agreement Template

This California Loan Agreement (the “Agreement”) is made effective as of [Date], by and between:

- Lender: [Lender’s Full Name]

- Lender’s Address: [Lender’s Address]

- Borrower: [Borrower’s Full Name]

- Borrower’s Address: [Borrower’s Address]

This Agreement is governed by the laws of the State of California.

The parties agree to the following terms:

- Loan Amount: The total amount of the loan is [Loan Amount].

- Purpose: The loan proceeds shall be used for [Purpose of Loan].

- Interest Rate: The annual interest rate applicable to this loan is [Interest Rate]%.

- Repayment Schedule: Borrower agrees to repay the loan in [Number of Payments] installments of [Payment Amount] on the [Payment Due Date] of each month.

- Term of Loan: The loan will be repaid over a period of [Term of Loan in Months/Years].

- Late Fees: A late fee of [Late Fee Amount] will be applied if any payment is not received within [Grace Period] days of the due date.

- Prepayment: Borrower may repay the loan in full or part at any time without penalty.

- Default: In case of default, the Lender has the right to pursue collection actions as permitted by California law.

Signatures:

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written.

- _________________________

Lender’s Signature - _________________________

Borrower’s Signature - Date: _________________________

Each party acknowledges that they have read this Agreement, understand its contents, and agree to be bound by its terms.