Blank California Gift Deed Form

The California Gift Deed form serves as a vital legal instrument for individuals wishing to transfer property ownership without the exchange of monetary compensation. This document allows a property owner, referred to as the donor, to voluntarily convey their real estate to another party, known as the recipient or donee. The form is designed to ensure that the transfer is clear, valid, and legally binding, providing peace of mind to both parties involved. Key elements of the Gift Deed include the identification of the property being transferred, the names and addresses of the donor and donee, and the explicit statement of the donor's intention to make a gift. Additionally, the form may require notarization and recording with the county to finalize the transfer and protect the rights of the new owner. Understanding the nuances of this form is essential for anyone considering a property gift, as it not only facilitates the transfer but also addresses potential tax implications and future ownership rights.

Other Common Gift Deed State Templates

How to Transfer Deed - Gift Deeds may also have tax implications, so it is wise to consult a tax professional.

The North Carolina Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, avoiding the probate process. This simple yet effective tool provides peace of mind for property owners who wish to ensure their assets are passed on smoothly. For more information on how to properly execute this form and facilitate property transfer without unnecessary complications, you can visit https://transferondeathdeedform.com/north-carolina-transfer-on-death-deed/.

Similar forms

Will: A will outlines how a person's assets should be distributed after their death. Like a gift deed, it involves the transfer of property, but a will takes effect only upon the testator's death, whereas a gift deed is effective immediately.

Trust Agreement: A trust agreement establishes a legal entity that holds property for the benefit of another. Similar to a gift deed, it involves the transfer of assets, but a trust can manage those assets over time, while a gift deed is a one-time transfer.

Sale Deed: A sale deed documents the sale of property from one party to another. Both documents transfer ownership, but a sale deed involves a financial transaction, while a gift deed does not require payment.

Quitclaim Deed: A quitclaim deed transfers any interest a person has in a property without guaranteeing that the title is clear. Like a gift deed, it can transfer ownership, but it does not provide the same level of protection regarding the title.

Deed of Trust: This document secures a loan with real property as collateral. While a deed of trust involves a lender and a borrower, a gift deed solely focuses on the transfer of property without financial obligations.

Lease Agreement: A lease agreement allows one party to use another's property for a specified time in exchange for rent. Both documents involve property rights, but a lease does not transfer ownership, while a gift deed does.

Power of Attorney: A power of attorney grants someone the authority to act on another's behalf in legal matters. While not a property transfer document, it can facilitate the execution of a gift deed by allowing someone to sign on behalf of the donor.

- Real Estate Purchase Agreement: This legal document outlines the terms under which a property is bought and sold, ensuring that both parties understand their rights and obligations. To create your own agreement, visit legalpdfdocs.com/.

Affidavit of Heirship: This document establishes the heirs of a deceased person's estate. Similar to a gift deed, it deals with property transfer, but it pertains to the distribution of assets after death rather than a voluntary transfer during life.

Bill of Sale: A bill of sale is a document that transfers ownership of personal property. Like a gift deed, it signifies a change in ownership, but it typically involves a sale rather than a gift.

Charitable Donation Receipt: This document acknowledges a donation made to a charity. While it serves a different purpose, both it and a gift deed involve the transfer of assets without expecting anything in return.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property as a gift without any payment involved. |

| Governing Law | The California Civil Code, specifically Section 11911, governs the use of Gift Deeds in the state. |

| Transfer of Title | The deed transfers the title of the property from the donor (the giver) to the donee (the receiver). |

| Requirements | The deed must be signed by the donor and notarized to be legally valid. |

| Tax Implications | Gift Deeds may have tax implications, including potential gift taxes for the donor. |

| Revocation | A Gift Deed cannot be revoked once it has been executed and recorded, unless specific conditions are met. |

| Property Types | Real property, such as land or buildings, can be transferred using a Gift Deed. |

| Recording | The Gift Deed should be recorded with the county recorder’s office to provide public notice of the transfer. |

| Legal Advice | It is advisable to seek legal advice before executing a Gift Deed to understand all implications. |

Things You Should Know About This Form

-

What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This type of deed is commonly used when a property owner wishes to give a gift of real estate to a family member or friend. It is important to understand that the transfer is considered a gift and may have tax implications for both the giver and the receiver.

-

How do I complete a California Gift Deed?

To complete a California Gift Deed, you will need to provide specific information about the property and the parties involved. This includes the legal description of the property, the names of the donor (the person giving the gift) and the recipient (the person receiving the gift), and any necessary signatures. It is crucial to ensure that all information is accurate and complete to avoid any legal issues later on. Once completed, the deed must be notarized and recorded with the county recorder's office where the property is located.

-

Are there any tax implications associated with a Gift Deed?

Yes, there can be tax implications when using a Gift Deed. The IRS allows individuals to give a certain amount of money or property each year without incurring gift tax. As of 2023, this annual exclusion amount is $17,000 per recipient. If the value of the property exceeds this amount, the donor may need to file a gift tax return. Additionally, the recipient may face property tax reassessment, depending on the circumstances. Consulting a tax professional can provide clarity on these matters.

-

Can I revoke a Gift Deed after it has been executed?

Once a Gift Deed is executed and recorded, it is generally considered final and cannot be revoked. The act of gifting is typically irreversible unless specific conditions are outlined in the deed itself. If there are concerns about the gift or if the situation changes, it is advisable to seek legal counsel to explore possible options. Understanding the permanence of a Gift Deed is crucial before proceeding with the transfer.

Documents used along the form

When completing a California Gift Deed, several other forms and documents may be necessary to ensure the process is smooth and legally compliant. Each of these documents serves a specific purpose in the transfer of property without consideration. Below is a list of commonly associated forms and documents.

- Preliminary Change of Ownership Report: This form must be filed with the county assessor's office when a property changes ownership. It provides information about the transaction and helps determine property tax assessments.

- Grant Deed: While a Gift Deed transfers property as a gift, a Grant Deed can be used for various property transfers. It includes warranties that the property is free from liens and encumbrances, except those disclosed.

- Hold Harmless Agreement: This document is essential for protecting parties involved in a transaction, as it helps mitigate risks associated with potential legal liabilities, ensuring that one party is not held responsible for claims arising during the agreement. Refer to the Hold Harmless Agreement for more details.

- Property Tax Exemption Application: This application may be necessary if the property transfer qualifies for a property tax exemption. It allows the new owner to apply for a reduction in property taxes based on certain criteria.

- Affidavit of Death: If the gift involves property from a deceased owner, this affidavit may be required to establish the transfer of ownership to the heir or beneficiary.

- Title Insurance Policy: Obtaining title insurance can protect the new owner from potential disputes regarding property ownership. It provides coverage against claims that may arise after the transfer.

- Trust Document: If the property is being transferred into a trust, the trust document outlines the terms and conditions under which the property will be managed and distributed.

- Escrow Instructions: If an escrow company is involved in the transaction, these instructions detail how the transfer will be managed, including the handling of funds and documents.

Understanding these additional documents can help streamline the process of transferring property through a Gift Deed in California. Each document plays a crucial role in ensuring that the transfer is legally recognized and that all parties are protected throughout the transaction.

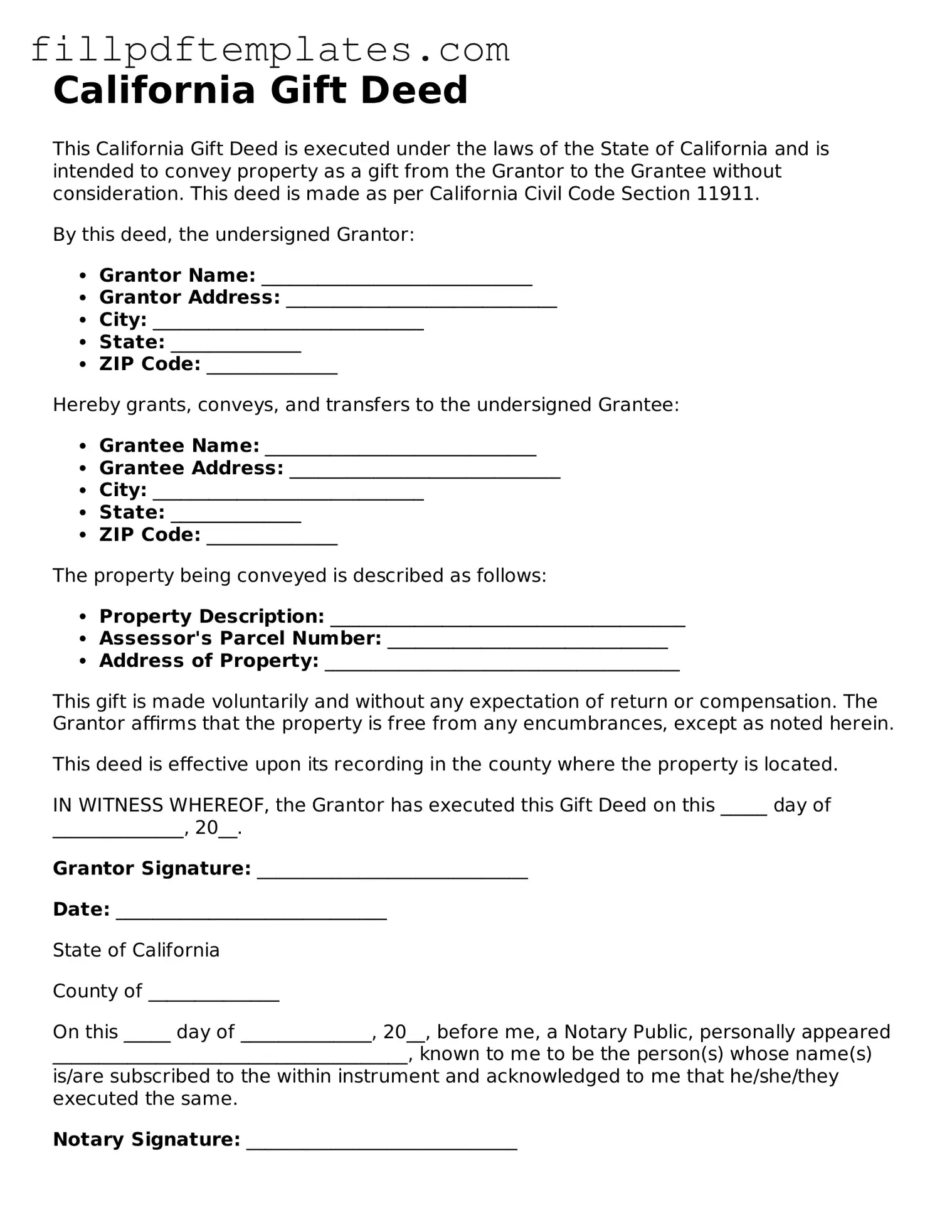

California Gift Deed Preview

California Gift Deed

This California Gift Deed is executed under the laws of the State of California and is intended to convey property as a gift from the Grantor to the Grantee without consideration. This deed is made as per California Civil Code Section 11911.

By this deed, the undersigned Grantor:

- Grantor Name: _____________________________

- Grantor Address: _____________________________

- City: _____________________________

- State: ______________

- ZIP Code: ______________

Hereby grants, conveys, and transfers to the undersigned Grantee:

- Grantee Name: _____________________________

- Grantee Address: _____________________________

- City: _____________________________

- State: ______________

- ZIP Code: ______________

The property being conveyed is described as follows:

- Property Description: ______________________________________

- Assessor's Parcel Number: ______________________________

- Address of Property: ______________________________________

This gift is made voluntarily and without any expectation of return or compensation. The Grantor affirms that the property is free from any encumbrances, except as noted herein.

This deed is effective upon its recording in the county where the property is located.

IN WITNESS WHEREOF, the Grantor has executed this Gift Deed on this _____ day of ______________, 20__.

Grantor Signature: _____________________________

Date: _____________________________

State of California

County of ______________

On this _____ day of ______________, 20__, before me, a Notary Public, personally appeared ______________________________________, known to me to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same.

Notary Signature: _____________________________

My Commission Expires: _____________________________