Blank California Deed Form

When it comes to transferring property ownership in California, the California Deed form plays a crucial role in ensuring that the process is clear and legally binding. This form serves as a written document that outlines the details of the transaction, including the names of the parties involved, a description of the property being transferred, and the terms of the transfer. It is important to note that there are various types of deeds, such as grant deeds and quitclaim deeds, each serving different purposes and providing different levels of protection to the parties. Additionally, the California Deed form must be signed, notarized, and recorded with the county recorder’s office to be legally effective. Understanding these key aspects is essential for anyone looking to buy or sell property in California, as it ensures that all legal requirements are met and helps prevent future disputes over ownership. Whether you are a first-time homebuyer or a seasoned real estate investor, knowing how to properly utilize the California Deed form can simplify the property transfer process and safeguard your investment.

Other Common Deed State Templates

How Do I Find the Deed to My House - Consulting legal guidance is advisable when drafting a deed.

The Maryland Hold Harmless Agreement form is a legal document where one party agrees not to hold the other party responsible for any injuries, damages, or losses. This agreement can be used in various contexts, making it a versatile tool for managing risk. Whether you're organizing an event or conducting a service, understanding this form ensures protection and peace of mind for all parties involved, especially in complex situations where a Hold Harmless Agreement may be necessary.

Broward County Recorder of Deeds - Deeds can also include conditions, such as easements or restrictions.

Similar forms

- Contract: Like a deed, a contract is a legally binding agreement between parties. Both documents require mutual consent and can outline obligations and rights.

- Lease Agreement: A lease agreement details the rental terms between a landlord and tenant. Similar to a deed, it establishes rights and responsibilities for both parties regarding property use.

- Transfer-on-Death Deed: This deed allows for straightforward property transfer upon death, avoiding probate and ensuring wishes are honored, detailed further at https://todform.com/blank-arkansas-transfer-on-death-deed.

- Will: A will outlines how a person's assets will be distributed after death. Both documents serve to transfer property rights, though a will takes effect upon death, while a deed is effective immediately.

- Power of Attorney: This document grants someone the authority to act on another's behalf. Like a deed, it can transfer rights or responsibilities, often concerning property or financial matters.

- Trust Agreement: A trust agreement establishes a fiduciary relationship where one party holds property for the benefit of another. Both a trust and a deed facilitate the transfer and management of property rights.

- Bill of Sale: A bill of sale is used to transfer ownership of personal property. Similar to a deed, it serves as proof of the transfer and outlines the terms of the sale.

- Mortgage Document: A mortgage document secures a loan with real property. Like a deed, it involves the transfer of rights but includes specific terms regarding repayment and interest.

Document Properties

| Fact Name | Details |

|---|---|

| Purpose | A California Deed form is used to transfer ownership of real property from one person to another. |

| Types of Deeds | Common types include Grant Deed, Quitclaim Deed, and Warranty Deed. |

| Governing Law | The California Civil Code governs the use and requirements of deeds in California. |

| Signature Requirement | The grantor must sign the deed for it to be valid. |

| Notarization | Notarization of the grantor's signature is required to record the deed. |

| Recording | Deeds must be recorded with the county recorder's office to provide public notice of the property transfer. |

| Property Description | A legal description of the property must be included in the deed. |

| Transfer Tax | California may impose a transfer tax on the conveyance of real property, depending on the county. |

Things You Should Know About This Form

-

What is a California Deed form?

A California Deed form is a legal document used to transfer ownership of real property from one party to another within the state of California. This form serves as proof of the transfer and outlines the rights and responsibilities of the parties involved. Various types of deeds exist, including grant deeds, quitclaim deeds, and warranty deeds, each serving different purposes and offering varying levels of protection to the buyer.

-

What information is required to complete a California Deed form?

To complete a California Deed form, several key pieces of information are necessary:

- The names and addresses of the grantor (the seller) and the grantee (the buyer).

- A legal description of the property being transferred, which can typically be found in previous deeds or property tax documents.

- The date of the transaction.

- Any specific terms or conditions of the transfer, if applicable.

Accurate and complete information is crucial to avoid complications during the transfer process.

-

How do I file a California Deed form?

Once the California Deed form is completed and signed, it must be filed with the county recorder's office in the county where the property is located. This step is essential for the transfer to be legally recognized. It is advisable to check with the local recorder's office for any specific filing requirements or fees. After filing, the deed becomes part of the public record.

-

Are there any taxes associated with transferring property using a California Deed form?

Yes, property transfers in California may be subject to transfer taxes. These taxes vary by county and can depend on the property's value. It's important to consult with a tax professional or the local tax assessor's office to understand any potential tax implications before completing the transfer.

-

Can I use a California Deed form for any type of property?

California Deed forms can be used for various types of real property, including residential, commercial, and vacant land. However, specific types of deeds may be more appropriate depending on the situation. For example, a quitclaim deed is often used in situations involving family transfers, while a grant deed may be preferred for sales between strangers. It's important to choose the right type of deed to ensure that the transfer meets legal requirements and protects the interests of both parties.

Documents used along the form

When dealing with property transactions in California, several forms and documents often accompany the Deed form. Each document serves a specific purpose and helps ensure that the transfer of property rights is clear and legally sound. Below is a list of commonly used documents in conjunction with the California Deed form.

- Grant Deed: This document transfers ownership of property and includes guarantees that the seller has not transferred the title to anyone else.

- Quitclaim Deed: Used to transfer any interest the grantor may have in the property without making any promises about the title's validity.

- Preliminary Change of Ownership Report: This form is required by the county assessor to determine property tax assessments after a change in ownership.

- Title Insurance Policy: This document protects the buyer from any future claims against the property and ensures that the title is clear.

- Property Transfer Tax Form: This form is used to report any applicable transfer taxes due upon the sale of the property.

- Affidavit of Death: If the transfer involves the death of a property owner, this affidavit provides proof of death and facilitates the transfer of ownership.

- Power of Attorney: This document allows one person to act on behalf of another in property transactions, which can be useful if the owner is unable to sign the deed personally.

- Recommendation Letter: For candidates seeking educational or professional opportunities, the structured recommendation letter template assists writers in effectively outlining an individual's qualifications and strengths.

- Mortgage or Deed of Trust: If financing is involved, these documents secure the lender's interest in the property until the loan is repaid.

- Disclosure Statements: Sellers may need to provide disclosures about the property's condition and any known issues to the buyer.

Each of these documents plays a critical role in the process of transferring property ownership. Understanding their purposes can help ensure a smoother transaction and protect the interests of all parties involved.

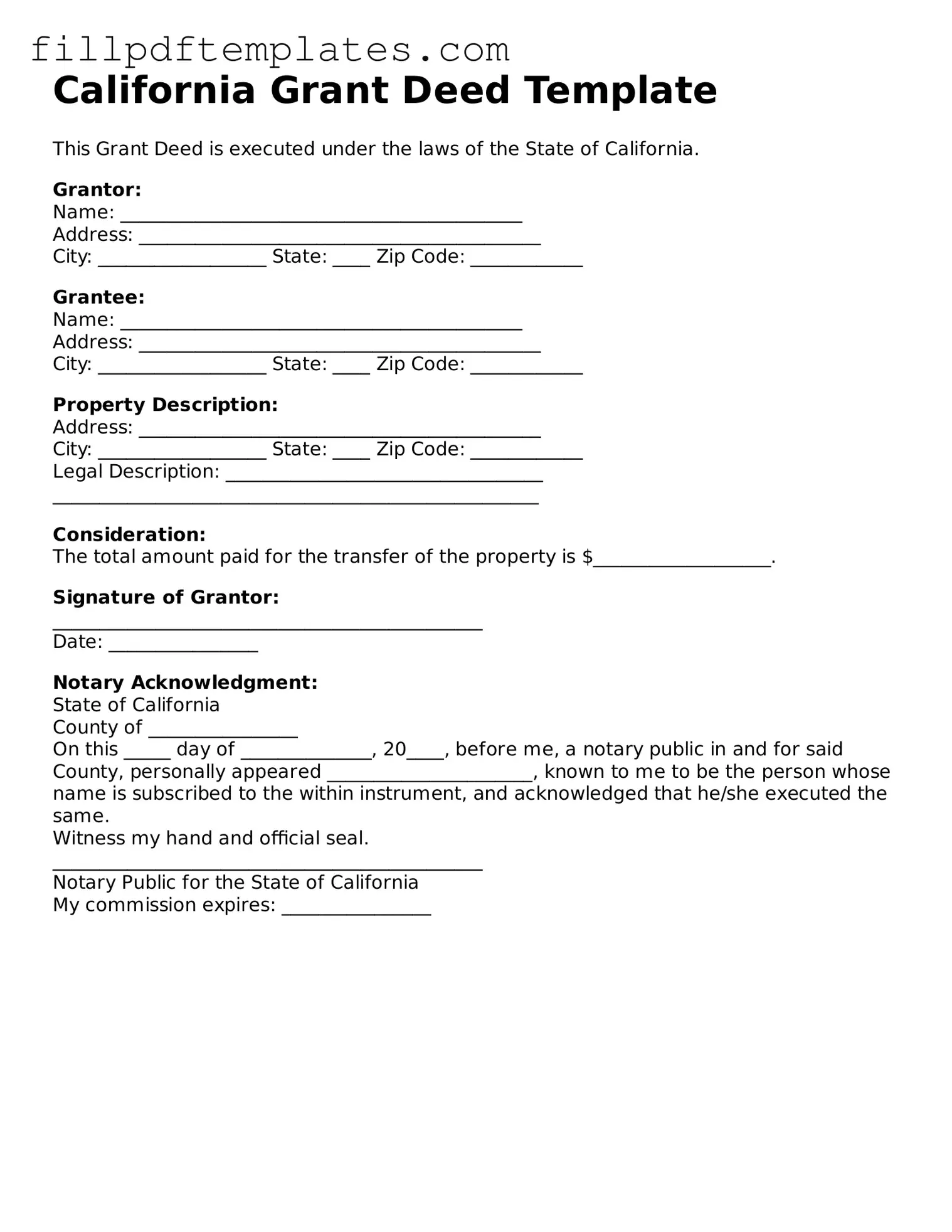

California Deed Preview

California Grant Deed Template

This Grant Deed is executed under the laws of the State of California.

Grantor:

Name: ___________________________________________

Address: ___________________________________________

City: __________________ State: ____ Zip Code: ____________

Grantee:

Name: ___________________________________________

Address: ___________________________________________

City: __________________ State: ____ Zip Code: ____________

Property Description:

Address: ___________________________________________

City: __________________ State: ____ Zip Code: ____________

Legal Description: __________________________________

____________________________________________________

Consideration:

The total amount paid for the transfer of the property is $___________________.

Signature of Grantor:

______________________________________________

Date: ________________

Notary Acknowledgment:

State of California

County of ________________

On this _____ day of ______________, 20____, before me, a notary public in and for said County, personally appeared ______________________, known to me to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same.

Witness my hand and official seal.

______________________________________________

Notary Public for the State of California

My commission expires: ________________