Blank California Deed in Lieu of Foreclosure Form

In the challenging landscape of homeownership, a California Deed in Lieu of Foreclosure can serve as a viable option for those facing financial difficulties and the threat of foreclosure. This legal document allows a homeowner to voluntarily transfer their property back to the lender, effectively bypassing the lengthy and often stressful foreclosure process. By executing this deed, the homeowner can relieve themselves of the burdens associated with mortgage payments and potential credit damage from foreclosure. The form outlines essential details, such as the property description, the parties involved, and any existing liens or encumbrances on the property. Additionally, it may address the lender's acceptance of the property in full satisfaction of the mortgage debt, providing a sense of closure for the homeowner. While this option can offer a fresh start, it is crucial to understand the implications, including potential tax consequences and the impact on credit scores. Ultimately, a Deed in Lieu of Foreclosure can be a strategic choice for those seeking to navigate a difficult financial situation with dignity and foresight.

Other Common Deed in Lieu of Foreclosure State Templates

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Lenders may review the property for any issues before accepting a Deed in Lieu transfer.

The process of establishing a corporation in Missouri begins with the completion of the Missouri Articles of Incorporation form, which is a crucial document required by the state. It acts as a formal declaration that outlines the company's essential information, such as its name, purpose, and the details of its organizers. For further guidance on this process, you may refer to the Articles of Incorporation, which provides valuable insights into what is needed for legal business formation in Missouri.

What Happens When You Do a Deed in Lieu of Foreclosure - Can help alleviate stress for borrowers facing financial difficulties.

Florida Deed in Lieu of Foreclosure - Homeowners retain the right to negotiate the timeline and potential conditions of the deed.

Foreclosure Process in Georgia - This option could also be a solution for homeowners who are relocating due to job changes.

Similar forms

- Mortgage Release: This document releases the borrower from their mortgage obligation, similar to a deed in lieu, as it signifies that the lender has relinquished their claim to the property after the borrower has fulfilled certain conditions.

- Trailer Bill of Sale Form: To ensure a valid transfer of ownership, consult the essential Trailer Bill of Sale documentation required for trailer sales transactions.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the full amount owed on the mortgage. Like a deed in lieu, this document allows the borrower to avoid foreclosure and settle their debt without further financial repercussions.

- Loan Modification Agreement: This document alters the terms of an existing mortgage to make payments more manageable. It serves a similar purpose as a deed in lieu by helping borrowers avoid foreclosure through adjusted payment plans.

- Forbearance Agreement: This agreement allows borrowers to temporarily reduce or suspend their mortgage payments. It provides a way to avoid foreclosure, akin to a deed in lieu, by giving borrowers time to recover financially.

- Quitclaim Deed: A quitclaim deed transfers ownership of property without any guarantees. While it does not directly address mortgage obligations, it can serve as a means for a borrower to relinquish their interest in the property, similar to a deed in lieu.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings. This legal process provides relief from debts, much like a deed in lieu, by allowing borrowers to manage their financial obligations in a structured manner.

- Property Settlement Agreement: In divorce cases, this document outlines the division of assets, including real estate. It may allow one spouse to take over the mortgage, similar to a deed in lieu, by transferring property ownership and responsibilities.

- Release of Liability: This document releases a borrower from any further obligations on a loan after a property is sold or transferred. It shares a similar outcome to a deed in lieu, as it frees the borrower from debt associated with the property.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Laws | This form is governed by California Civil Code Sections 2941 and 2924. |

| Eligibility | Homeowners facing financial hardship and unable to make mortgage payments may qualify for this option. |

| Benefits | It can help homeowners avoid the lengthy and costly foreclosure process, potentially minimizing damage to their credit score. |

| Considerations | Homeowners should consult with a legal professional to understand the implications, including potential tax consequences and the impact on credit. |

Things You Should Know About This Form

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This option can help homeowners who are struggling to make their mortgage payments and want to prevent the negative consequences of foreclosure on their credit report. By choosing this route, the homeowner can often resolve their debt more amicably.

-

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits associated with a Deed in Lieu of Foreclosure:

- It can help homeowners avoid the lengthy and stressful foreclosure process.

- Homeowners may have the chance to negotiate a more favorable outcome, such as a waiver of the remaining debt.

- This option typically results in less damage to the homeowner's credit score compared to a foreclosure.

- It can provide a quicker resolution, allowing homeowners to move on and plan for their financial future.

-

Are there any drawbacks to a Deed in Lieu of Foreclosure?

While a Deed in Lieu of Foreclosure can be beneficial, there are some potential drawbacks to consider:

- Not all lenders accept this option, so it's essential to communicate with your lender early in the process.

- Homeowners may still be responsible for any unpaid mortgage balance unless negotiated otherwise.

- The process can still impact your credit score, though typically less severely than a foreclosure.

-

How do I initiate a Deed in Lieu of Foreclosure?

To initiate a Deed in Lieu of Foreclosure, follow these steps:

- Contact your lender to express your interest in this option.

- Gather necessary documentation, such as proof of income and financial hardship.

- Submit a formal request to your lender, including any required forms.

- Work with your lender to negotiate terms and finalize the deed transfer.

It is advisable to consult with a legal professional or housing counselor to ensure you understand the implications of this decision.

Documents used along the form

When navigating the complexities of property transactions, particularly in situations involving foreclosure, various documents may accompany the California Deed in Lieu of Foreclosure. Each of these forms serves a specific purpose, ensuring that both the lender and borrower are protected throughout the process. Below is a list of commonly used documents that may be relevant in such cases.

- Loan Modification Agreement: This document outlines the revised terms of a loan, including changes to interest rates, payment schedules, or the principal balance. It serves as a formal agreement between the lender and borrower to modify the original loan terms.

- Notice of Default: This is a formal notification sent to the borrower when they have failed to meet the obligations of their mortgage. It serves as a precursor to foreclosure and informs the borrower of their default status.

- Indiana Transfer-on-Death Deed: This legal document allows property owners to transfer their real estate to beneficiaries upon their death without going through probate, ensuring clarity for both you and your beneficiaries. For more information, visit transferondeathdeedform.com/indiana-transfer-on-death-deed.

- Foreclosure Notice: Issued by the lender, this document informs the borrower that foreclosure proceedings are imminent. It typically includes details about the amount owed and the timeline for the foreclosure process.

- Release of Liability: This document releases the borrower from any further obligations related to the mortgage after the deed in lieu is executed. It provides assurance that the borrower will not be pursued for any remaining debt.

- Property Condition Disclosure: This form requires the borrower to disclose any known issues or defects with the property. Transparency is crucial, as it protects the lender from potential liabilities related to property condition after the transfer.

- Title Insurance Policy: A title insurance policy protects against losses arising from defects in the title of the property. It ensures that the lender has clear ownership rights following the transfer of the deed.

- Settlement Statement: This document outlines the financial aspects of the transaction, including any costs associated with the deed in lieu process. It provides a detailed account of how funds are allocated and any outstanding debts settled.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and asserts that there are no undisclosed liens or claims against it. It is crucial for ensuring a smooth transfer of ownership.

- Power of Attorney: In some cases, a borrower may appoint someone else to act on their behalf in executing the deed in lieu. This document grants legal authority to the appointed individual to make decisions regarding the property.

Understanding these accompanying documents is vital for anyone involved in a deed in lieu of foreclosure. Each form plays a significant role in ensuring a transparent and legally sound transaction, thereby protecting the interests of all parties involved.

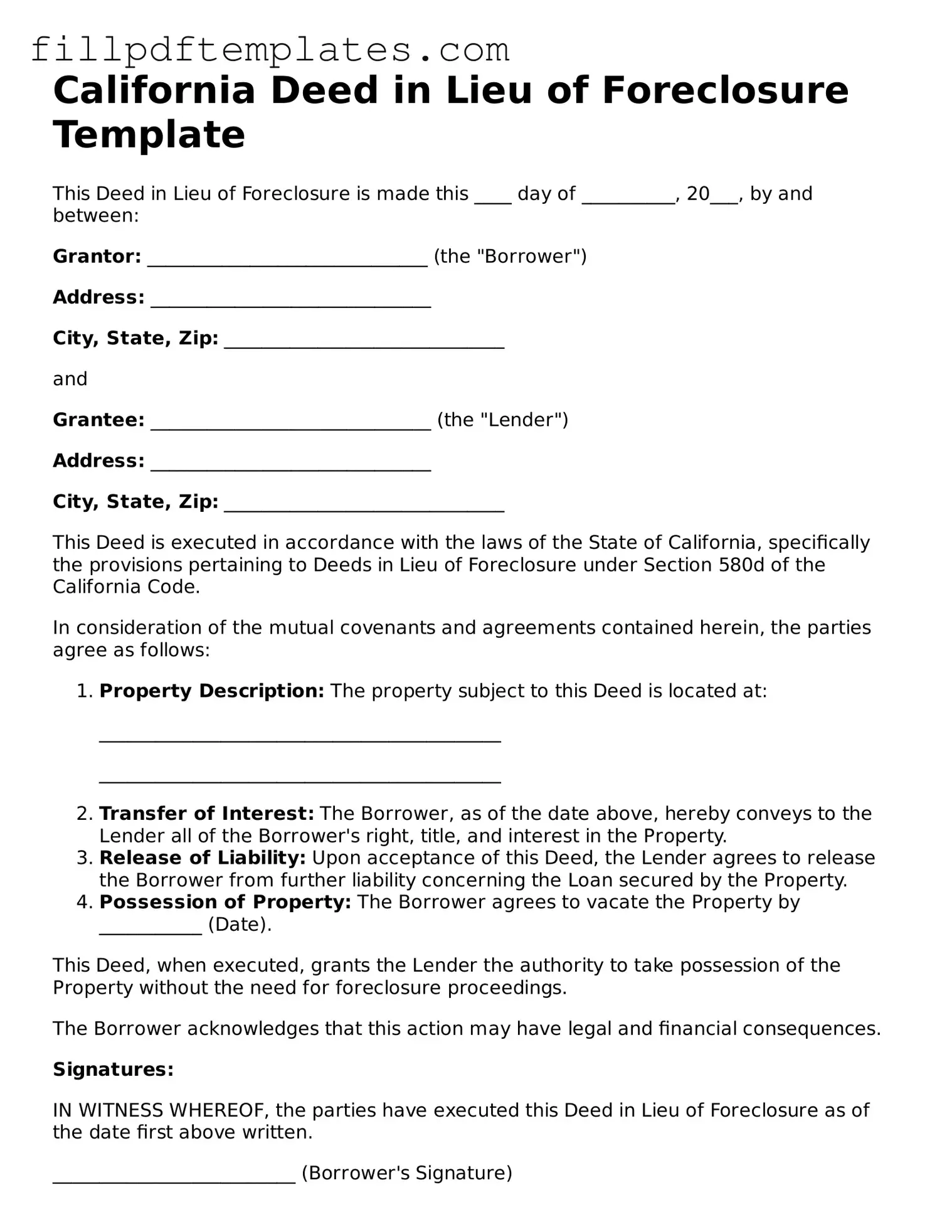

California Deed in Lieu of Foreclosure Preview

California Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ____ day of __________, 20___, by and between:

Grantor: ______________________________ (the "Borrower")

Address: ______________________________

City, State, Zip: ______________________________

and

Grantee: ______________________________ (the "Lender")

Address: ______________________________

City, State, Zip: ______________________________

This Deed is executed in accordance with the laws of the State of California, specifically the provisions pertaining to Deeds in Lieu of Foreclosure under Section 580d of the California Code.

In consideration of the mutual covenants and agreements contained herein, the parties agree as follows:

-

Property Description: The property subject to this Deed is located at:

___________________________________________

___________________________________________

- Transfer of Interest: The Borrower, as of the date above, hereby conveys to the Lender all of the Borrower's right, title, and interest in the Property.

- Release of Liability: Upon acceptance of this Deed, the Lender agrees to release the Borrower from further liability concerning the Loan secured by the Property.

- Possession of Property: The Borrower agrees to vacate the Property by ___________ (Date).

This Deed, when executed, grants the Lender the authority to take possession of the Property without the need for foreclosure proceedings.

The Borrower acknowledges that this action may have legal and financial consequences.

Signatures:

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the date first above written.

__________________________ (Borrower's Signature)

__________________________ (Lender's Signature)

__________________________ (Notary Public Signature)

__________________________ (Date)