Valid Business Purchase and Sale Agreement Form

The Business Purchase and Sale Agreement is a crucial document for anyone involved in buying or selling a business. This agreement outlines the terms and conditions of the transaction, ensuring both parties understand their rights and obligations. Key aspects include the purchase price, payment terms, and any contingencies that may affect the sale. Additionally, it addresses the assets being sold, such as inventory, equipment, and intellectual property, while also clarifying any liabilities that the buyer may assume. The agreement often includes representations and warranties from both parties, ensuring that the information provided is accurate and complete. Furthermore, it may specify the closing date and conditions under which the sale will be finalized. By clearly defining these elements, the Business Purchase and Sale Agreement helps to minimize disputes and provides a framework for a smooth transaction.

Fill out More Documents

Free Single Status Affidavit Form - It is often used to fulfill legal or immigration requirements.

Nda Agreement Template - Can include clauses about sharing information with third parties.

In Montana, a Hold Harmless Agreement is often utilized to ensure that parties can engage in activities with a clear understanding of liability. This important document not only provides protection by outlining the responsibilities and rights of each party but also incorporates assurances for those involved in high-risk interactions. By including clauses that specify the terms under which one party will not hold the other liable, this agreement fosters trust and clarity. For more detailed information, you can refer to a comprehensive resource on the Hold Harmless Agreement.

Broker Price Opinion Letter Pdf - Sets a baseline for understanding the market value of the subject property.

Similar forms

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller. It sets the stage for negotiations, detailing the basic terms of the deal before a formal agreement is drafted.

- Asset Purchase Agreement: Similar to a Business Purchase and Sale Agreement, this document focuses specifically on the purchase of individual assets rather than the entire business entity. It defines what assets are included in the sale.

Vehicle Release of Liability: This form is a crucial document for vehicle owners to protect against potential claims after transferring ownership. A well-completed form clearly outlines that the vehicle owner is no longer liable for any issues that may arise post-transfer. For more details and a template, visit legalpdfdocs.com/.

- Stock Purchase Agreement: This document is used when a buyer purchases the stock of a company. Like the Business Purchase and Sale Agreement, it includes terms and conditions of the sale but focuses on ownership transfer of shares.

- Confidentiality Agreement (NDA): Before negotiations, parties often sign this document to protect sensitive information. It ensures that both sides keep proprietary information confidential, similar to the confidentiality provisions in a Business Purchase and Sale Agreement.

- Operating Agreement: For businesses structured as LLCs, this document outlines the management and operational procedures. It can be referenced in a Business Purchase and Sale Agreement to clarify how the business will operate post-sale.

- Due Diligence Checklist: This is a tool used during the buying process to ensure all necessary information is reviewed. It complements the Business Purchase and Sale Agreement by ensuring that both parties are informed before finalizing the deal.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is sold and purchased. |

| Key Components | This agreement typically includes details about the purchase price, payment terms, assets included in the sale, and any liabilities that the buyer will assume. |

| State-Specific Forms | Many states have their own versions of this agreement. For instance, California's governing law is the California Commercial Code, while Texas follows the Texas Business and Commerce Code. |

| Importance | Having a well-drafted agreement helps to protect both the buyer and seller by clearly defining their rights and responsibilities, thereby minimizing potential disputes. |

Things You Should Know About This Form

-

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business will be sold. This agreement serves as a formal contract between the seller and the buyer, detailing the specifics of the transaction, including the purchase price, payment terms, and any representations or warranties made by either party.

-

Why is this agreement important?

This agreement is crucial for several reasons. First, it provides clarity and structure to the transaction, ensuring that both parties understand their rights and obligations. Second, it helps protect the interests of both the buyer and the seller by documenting the terms of the sale. Lastly, having a written agreement can reduce the likelihood of disputes arising after the sale is completed.

-

What key components should be included in the agreement?

A comprehensive Business Purchase and Sale Agreement typically includes the following components:

- Identification of the parties involved

- Description of the business being sold

- Purchase price and payment terms

- Assets included in the sale

- Liabilities that the buyer will assume

- Representations and warranties from both parties

- Conditions precedent to closing

- Confidentiality provisions

- Governing law and dispute resolution procedures

-

How does the negotiation process typically work?

The negotiation process often begins with the seller presenting a draft of the agreement. The buyer will review this draft and may propose changes or request additional terms. Both parties should engage in open discussions to address any concerns or questions. It is common for this process to involve back-and-forth revisions until both parties reach a mutually agreeable final version.

-

What should I do before signing the agreement?

Before signing the Business Purchase and Sale Agreement, it is essential to conduct thorough due diligence. This involves reviewing the financial records of the business, understanding any existing liabilities, and assessing the overall value of the assets being purchased. Additionally, consulting with legal and financial professionals can provide valuable insights and help ensure that the terms of the agreement align with your interests.

Documents used along the form

When engaging in a business transaction, several documents complement the Business Purchase and Sale Agreement. Each plays a crucial role in ensuring a smooth transfer of ownership and protecting the interests of all parties involved.

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller before the final agreement. It often includes key terms and conditions, providing a framework for negotiations.

- Transfer-on-Death Deed: This legal document allows property owners to transfer their real estate to beneficiaries upon their death, avoiding the lengthy probate process. For more details, visit todform.com/blank-indiana-transfer-on-death-deed.

- Due Diligence Checklist: A vital tool for buyers, this checklist helps ensure all necessary information about the business is reviewed. It typically covers financial records, legal compliance, and operational details.

- Bill of Sale: This document serves as proof of the transfer of ownership. It details the items being sold and confirms that the buyer has received them from the seller.

- Non-Disclosure Agreement (NDA): Protecting sensitive information is essential during negotiations. An NDA ensures that both parties keep confidential information private, fostering trust and security.

- Asset Purchase Agreement: If the transaction involves purchasing specific assets rather than the entire business, this agreement outlines the terms of the asset sale, including valuation and transfer details.

Understanding these documents can significantly streamline the business acquisition process. Each one serves a specific purpose, contributing to a successful transaction and minimizing potential disputes.

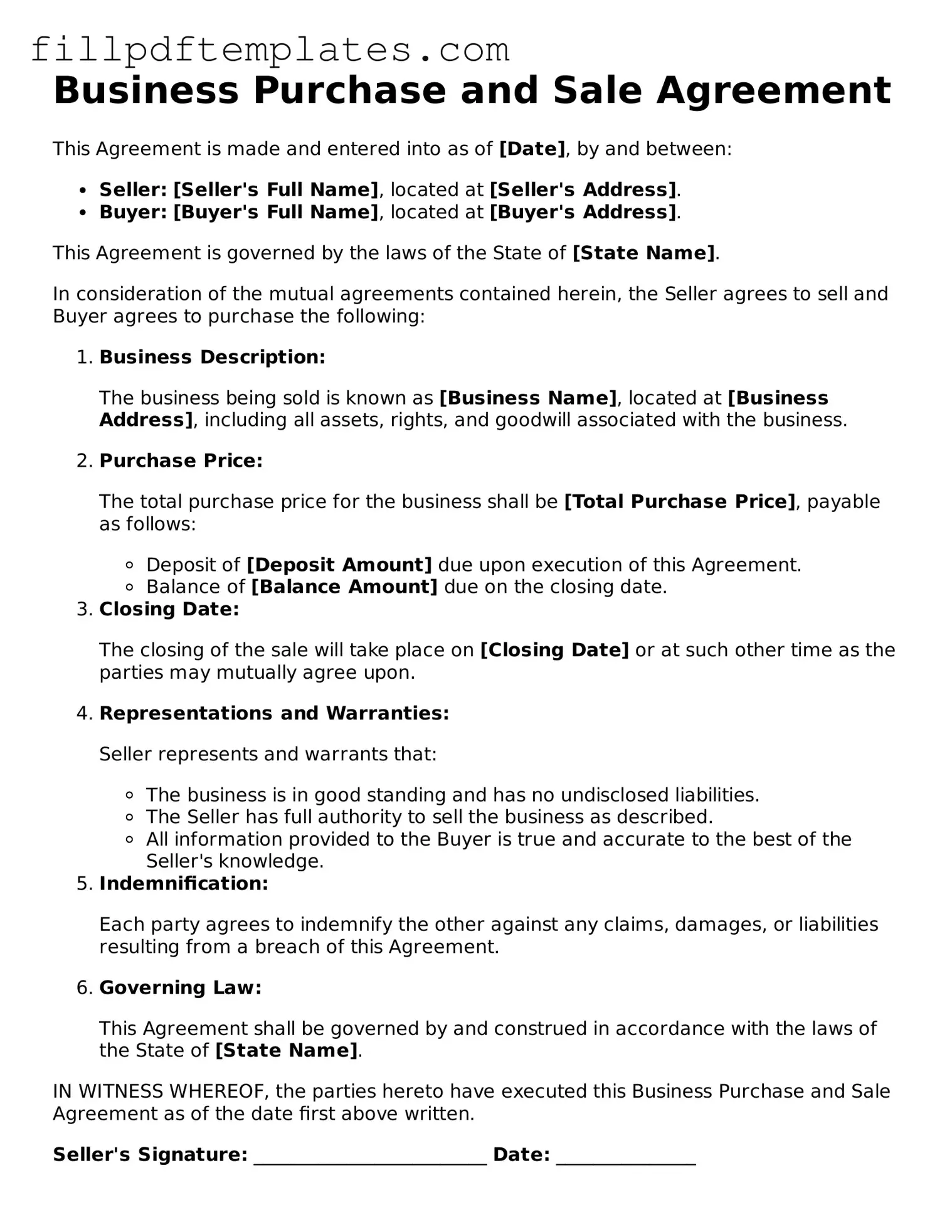

Business Purchase and Sale Agreement Preview

Business Purchase and Sale Agreement

This Agreement is made and entered into as of [Date], by and between:

- Seller: [Seller's Full Name], located at [Seller's Address].

- Buyer: [Buyer's Full Name], located at [Buyer's Address].

This Agreement is governed by the laws of the State of [State Name].

In consideration of the mutual agreements contained herein, the Seller agrees to sell and Buyer agrees to purchase the following:

- Business Description:

The business being sold is known as [Business Name], located at [Business Address], including all assets, rights, and goodwill associated with the business.

- Purchase Price:

The total purchase price for the business shall be [Total Purchase Price], payable as follows:

- Deposit of [Deposit Amount] due upon execution of this Agreement.

- Balance of [Balance Amount] due on the closing date.

- Closing Date:

The closing of the sale will take place on [Closing Date] or at such other time as the parties may mutually agree upon.

- Representations and Warranties:

Seller represents and warrants that:

- The business is in good standing and has no undisclosed liabilities.

- The Seller has full authority to sell the business as described.

- All information provided to the Buyer is true and accurate to the best of the Seller's knowledge.

- Indemnification:

Each party agrees to indemnify the other against any claims, damages, or liabilities resulting from a breach of this Agreement.

- Governing Law:

This Agreement shall be governed by and construed in accordance with the laws of the State of [State Name].

IN WITNESS WHEREOF, the parties hereto have executed this Business Purchase and Sale Agreement as of the date first above written.

Seller's Signature: _________________________ Date: _______________

Buyer's Signature: _________________________ Date: _______________