Fill a Valid Business Credit Application Template

When starting or growing a business, securing credit is often a crucial step. A Business Credit Application form serves as a key tool in this process, allowing companies to request credit from suppliers, lenders, or financial institutions. This form typically requires essential information about the business, such as its legal name, address, and contact details. It also asks for details about the owners or key stakeholders, including their personal information and credit history. Financial information, like annual revenue and bank references, is usually included to give the lender a clearer picture of the business's financial health. Additionally, the form may request information about the type of credit being sought and the intended use of the funds. Completing this application accurately and thoroughly can significantly impact the chances of obtaining credit, making it a vital step for any business looking to expand or manage its cash flow effectively.

Additional PDF Templates

Dd 214 - Members are encouraged to review the form annually for completeness and accuracy.

For those seeking to ensure their legal and financial decisions are honored, understanding the importance of a well-crafted Power of Attorney document is vital. This form allows a designated individual to handle necessary matters on your behalf when you are unable to do so.

Rental Verification From Landlord - List reasons if full deposit was not returned.

Similar forms

- Loan Application Form: Like the Business Credit Application, this document gathers essential financial information from the applicant. It helps lenders assess creditworthiness and determine loan eligibility.

- Vendor Credit Application: This form is similar as it is used by businesses to request credit from suppliers. It typically includes business details and financial history to establish trustworthiness.

- Hold Harmless Agreement: This document is crucial in protecting parties from liability, ensuring that one party is not held accountable for damages incurred by another. Much like the Business Credit Application, it demands a clear understanding of the involved parties' responsibilities and risks. For more information, refer to the Hold Harmless Agreement.

- Business Partnership Agreement: While it serves a different purpose, this document outlines the financial responsibilities and credit terms between partners, ensuring clarity and mutual understanding.

- Personal Guarantee Form: This form often accompanies credit applications, where an individual agrees to be responsible for the business's debts. It links personal and business credit responsibilities.

- Business License Application: This document requires information about the business's financial health and operations, similar to how a credit application assesses the business's stability.

- Financial Statement: A financial statement provides a snapshot of a business's financial status, much like the information required in a credit application to evaluate credit risk.

- Credit Report Authorization Form: This form allows a lender to access a business's credit history. It is crucial for evaluating creditworthiness, paralleling the purpose of a credit application.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from lenders or suppliers. |

| Information Required | This form typically requests basic business information, financial details, and personal guarantees from owners. |

| State-Specific Requirements | In some states, additional disclosures or specific formats may be required, governed by state commercial lending laws. |

| Impact on Credit Score | Submitting a Business Credit Application can influence the credit score of the business, depending on the lender's reporting practices. |

Things You Should Know About This Form

-

What is a Business Credit Application form?

The Business Credit Application form is a document used by businesses to apply for credit from suppliers, lenders, or financial institutions. This form collects essential information about the business, including its legal structure, ownership details, financial history, and credit references. Completing this form accurately helps establish the business's creditworthiness and facilitates the approval process.

-

Why do I need to fill out a Business Credit Application?

Filling out a Business Credit Application is crucial for obtaining credit. Suppliers and lenders use this form to assess your business's financial health and determine whether to extend credit. A well-completed application can enhance your chances of approval and may lead to better credit terms, such as lower interest rates or higher credit limits.

-

What information is typically required on the application?

The application usually requires various types of information, including:

- Business name and address

- Legal structure (e.g., LLC, corporation, sole proprietorship)

- Tax identification number

- Ownership details and personal information of the owners

- Financial statements or bank references

- Trade references from suppliers

Providing accurate and complete information is essential for a smooth application process.

-

How long does it take to process a Business Credit Application?

The processing time for a Business Credit Application can vary significantly based on the lender or supplier's policies. Generally, it may take anywhere from a few days to a couple of weeks. Factors influencing the timeline include the complexity of the application, the responsiveness of references, and the lender's current workload. It’s advisable to follow up if you have not received a response within the expected timeframe.

-

What should I do if my application is denied?

If your application is denied, it is important not to panic. First, request an explanation from the lender or supplier regarding the denial. Understanding the reasons can help you address any issues. You may need to improve your credit profile, provide additional documentation, or consider applying with a co-signer. Taking these steps can enhance your chances for future applications.

-

Can I apply for business credit if I have poor personal credit?

Yes, you can still apply for business credit even if your personal credit is not in good standing. However, many lenders may consider your personal credit history as part of their evaluation process, especially for small businesses. It is helpful to demonstrate strong business financials, provide collateral, or offer a personal guarantee to improve your chances of approval.

Documents used along the form

When applying for business credit, several forms and documents may be required alongside the Business Credit Application form. These documents help lenders assess the creditworthiness of a business and ensure all necessary information is provided. Below is a list of commonly used forms and documents in this process.

- Personal Guarantee: This document holds an individual personally accountable for the business's debts. It provides additional security for lenders.

- Power of Attorney: To ensure that critical decisions can be made in the event of incapacity, consider including a Power of Attorney form with your documentation to designate a trusted representative for financial or health-related matters.

- Business Plan: A comprehensive outline of the business's goals, strategies, and financial projections. This helps lenders understand the business's potential for success.

- Financial Statements: These include balance sheets, income statements, and cash flow statements. They provide a snapshot of the business's financial health.

- Tax Returns: Recent business tax returns are often required to verify income and assess the financial stability of the business.

- Proof of Business Ownership: Documents such as articles of incorporation or partnership agreements establish the legal structure and ownership of the business.

- Trade References: A list of suppliers or vendors that can vouch for the business's payment history and reliability.

- Bank Statements: Recent bank statements provide insight into the business's cash flow and financial management.

- Identification Documents: Personal identification for business owners, such as a driver's license or passport, may be required to verify identity.

- Lease Agreements: If the business operates from a rented location, a copy of the lease agreement may be necessary to confirm operational stability.

Gathering these documents in advance can streamline the credit application process. Each document plays a crucial role in presenting a complete picture of the business's financial situation and operational integrity. Ensuring accuracy and completeness will enhance the likelihood of a favorable credit decision.

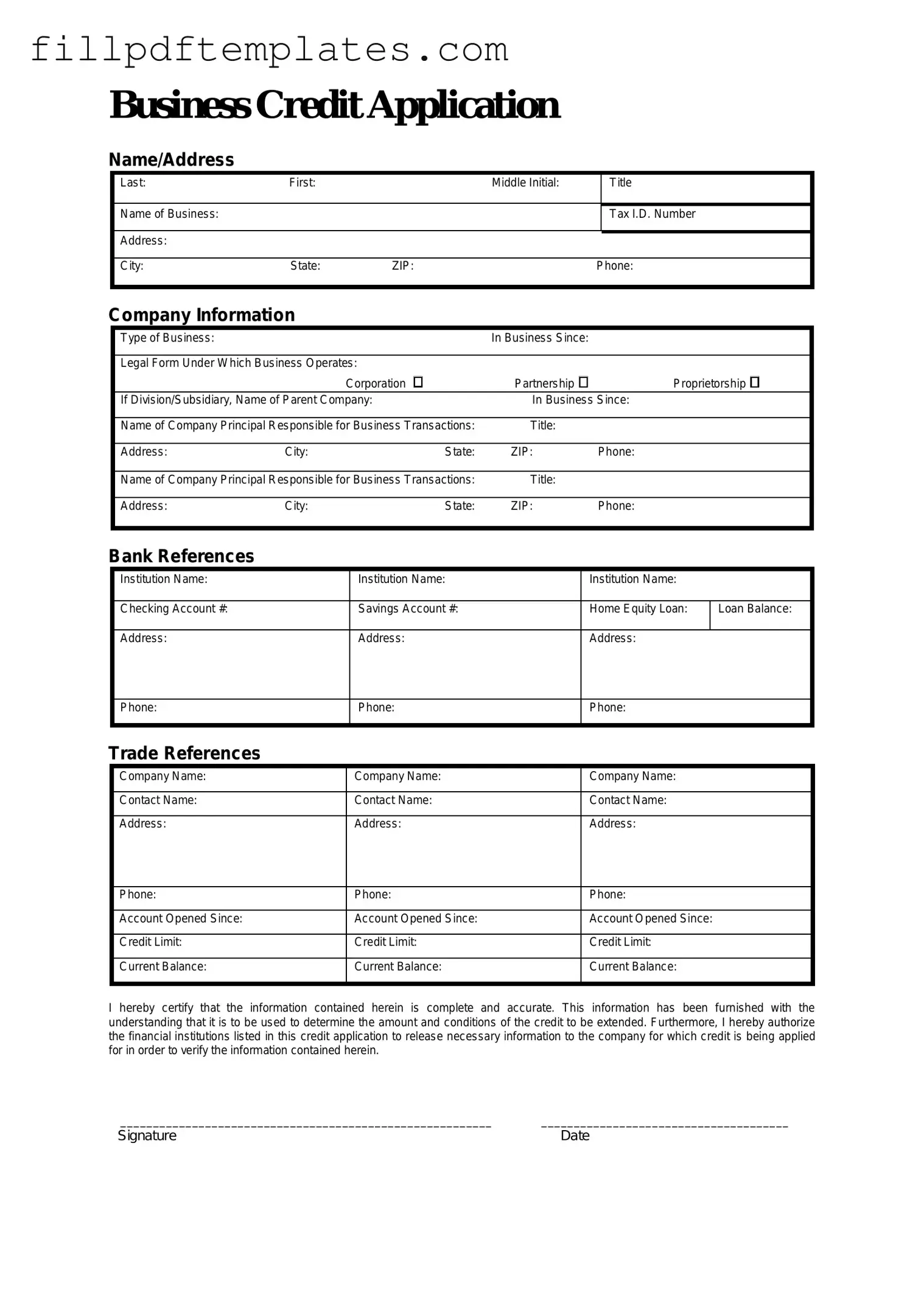

Business Credit Application Preview

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |