Valid Business Bill of Sale Form

When selling or buying a business, having the right documentation is crucial. One essential document in this process is the Business Bill of Sale form. This form serves as a written record of the transaction, outlining the details of the sale and providing legal protection for both parties involved. It typically includes important information such as the names and addresses of the buyer and seller, a description of the business being sold, and the purchase price. Additionally, it may specify any assets included in the sale, such as equipment, inventory, or intellectual property. By using this form, both parties can ensure clarity and agreement on the terms of the sale, helping to avoid potential disputes in the future. Understanding the components of the Business Bill of Sale form can make the process smoother and more secure for everyone involved.

Different Types of Business Bill of Sale Forms:

Sample Bill of Sale for Trailer - Used for personal or commercial trailer transactions.

To facilitate a smooth transaction and ensure all necessary details are captured, it is vital to utilize an accurate Alabama bill of sale form tailored to your needs. You can find a suitable template by visiting our page on the Alabama bill of sale form requirements.

Similar forms

- Vehicle Bill of Sale: This document serves as proof of the sale of a vehicle. Like the Business Bill of Sale, it includes details about the buyer, seller, and the item being sold. Both documents transfer ownership and can be used for registration purposes.

- Personal Property Bill of Sale: Similar to the Business Bill of Sale, this document outlines the sale of personal items. It details the buyer and seller information along with a description of the property. Both documents provide legal protection for both parties involved in the transaction.

- Real Estate Purchase Agreement: This agreement is used for the sale of real property. It includes terms of the sale, similar to the Business Bill of Sale, which specifies the conditions under which the sale occurs. Both documents ensure that the rights of both parties are acknowledged and protected.

- General Bill of Sale Form: To avoid any ambiguities, the General Bill of Sale is a document that records the transfer of ownership of personal property from one party to another. It serves as proof of the transaction and outlines details such as the items sold, the purchase price, and the date of sale. If you're ready to document your sale, you can fill out the form by clicking the button below. More information can be found at https://legalpdfdocs.com/.

- Equipment Bill of Sale: This document is specifically for the sale of equipment. It includes essential details about the equipment and the transaction. Like the Business Bill of Sale, it provides a record of the sale and serves as evidence of ownership transfer.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Business Bill of Sale is a legal document that transfers ownership of a business from one party to another. |

| Purpose | This form serves to provide proof of the sale and protect both the buyer and seller. |

| Included Details | It typically includes the names of the buyer and seller, a description of the business, and the sale price. |

| Governing Law | The governing law can vary by state; for example, in California, it falls under the California Commercial Code. |

| Notarization | While notarization is not always required, it can add an extra layer of authenticity to the document. |

| Assets Transfer | The form can also outline specific assets being transferred, such as equipment or inventory. |

| Liabilities | It may specify which liabilities, if any, the buyer is assuming as part of the sale. |

| State Variations | Different states may have specific requirements for the Bill of Sale, so it’s important to check local laws. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records, as it can be important for tax purposes. |

Things You Should Know About This Form

-

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the transfer of ownership of a business or its assets from one party to another. It serves as proof of the transaction and outlines the details of the sale.

-

What information is included in a Business Bill of Sale?

The document typically includes:

- The names and addresses of the buyer and seller.

- A description of the business or assets being sold.

- The purchase price.

- The date of the transaction.

- Any terms or conditions related to the sale.

-

Why do I need a Business Bill of Sale?

This document is important for several reasons. It provides legal proof of the transaction, protects both parties, and helps in the transfer of any licenses or permits. Having a written record can also help resolve any disputes that may arise in the future.

-

Is a Business Bill of Sale required by law?

While it may not be legally required in all states, it is highly recommended. Many buyers and sellers prefer to have a written agreement to ensure clarity and protection during the sale.

-

Can I create my own Business Bill of Sale?

Yes, you can create your own Business Bill of Sale. However, it is essential to include all necessary information and ensure that it complies with your state’s laws. Using a template can help guide you through the process.

-

What should I do after completing the Business Bill of Sale?

Once the document is completed and signed by both parties, it’s important to keep copies for your records. The buyer should also ensure that the ownership is properly transferred with any relevant government agencies, if applicable.

-

Can a Business Bill of Sale be used for different types of businesses?

Yes, a Business Bill of Sale can be used for various types of businesses, whether it’s a sole proprietorship, partnership, or corporation. The key is to accurately describe the assets being sold and the terms of the sale.

-

What if there are outstanding debts on the business?

If there are outstanding debts, it’s crucial to address them in the Business Bill of Sale. The seller may need to clarify whether the buyer assumes responsibility for these debts or if they will remain with the seller after the sale.

Documents used along the form

A Business Bill of Sale is an essential document for transferring ownership of a business. However, it is often accompanied by several other forms and documents that help clarify the transaction and protect both parties involved. Here are five important documents that are commonly used alongside a Business Bill of Sale:

- Asset Purchase Agreement: This document outlines the specific assets being sold, such as equipment, inventory, and intellectual property. It details the terms of the sale, including the purchase price and any contingencies that must be met.

- Motor Vehicle Bill of Sale: This form is essential for documenting the purchase and sale of a vehicle in Florida, providing proof of transaction and protecting the rights of both parties involved. To ensure compliance and understand its importance, learn more about the form.

- Non-Disclosure Agreement (NDA): An NDA is crucial for protecting sensitive information. It ensures that both parties keep confidential business information private, preventing any potential misuse after the sale.

- Lease Assignment: If the business operates from a leased location, a lease assignment may be necessary. This document transfers the existing lease from the seller to the buyer, ensuring that the new owner can continue operations without interruption.

- Employee Agreements: If the business has employees, these agreements outline the terms of their employment post-sale. They may include details about job responsibilities, compensation, and any changes in benefits.

- Financial Statements: Providing recent financial statements is essential for transparency. These documents give the buyer insight into the business's financial health, helping them make informed decisions about the purchase.

By understanding these additional documents, both buyers and sellers can navigate the complexities of a business sale more effectively. Each document plays a vital role in ensuring a smooth transition and protecting the interests of all parties involved.

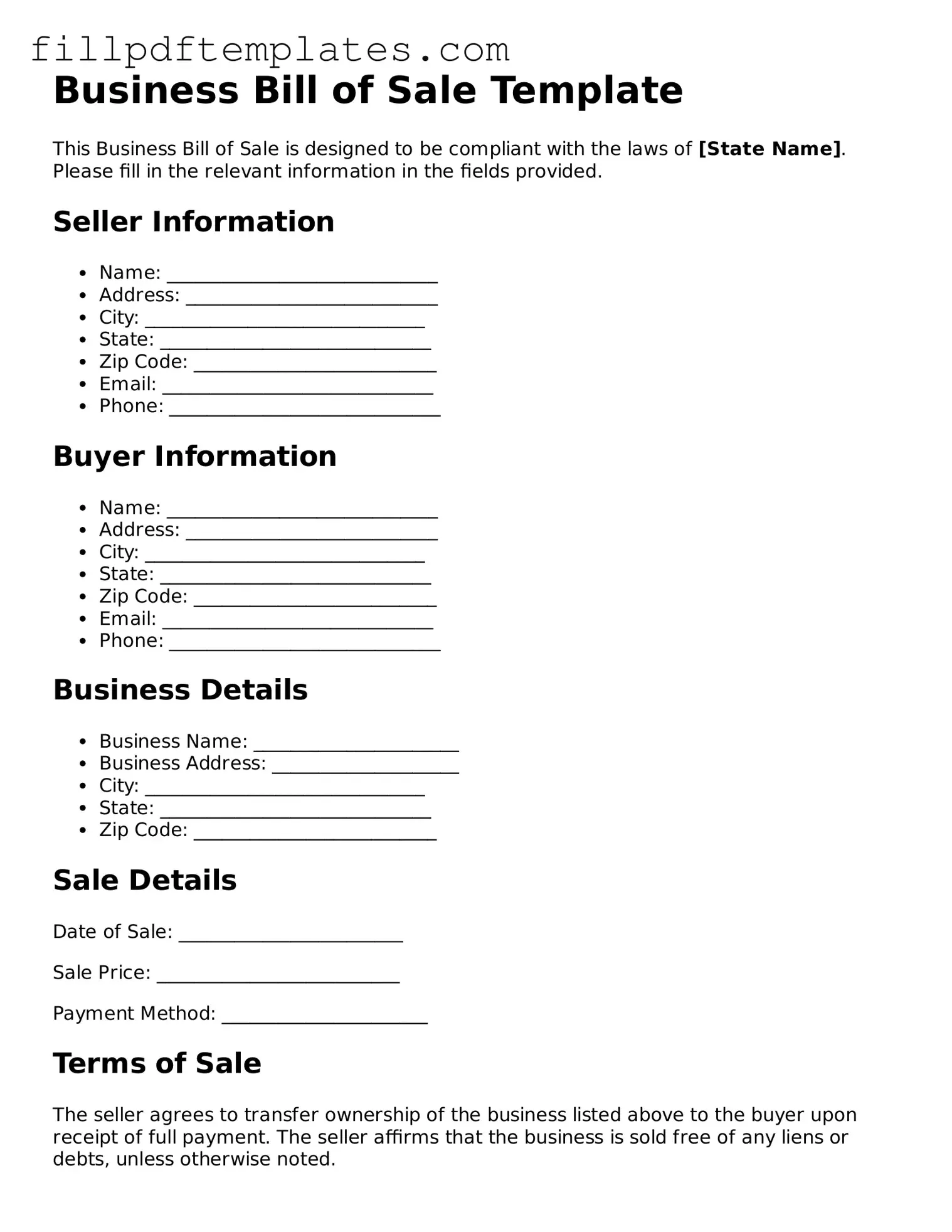

Business Bill of Sale Preview

Business Bill of Sale Template

This Business Bill of Sale is designed to be compliant with the laws of [State Name]. Please fill in the relevant information in the fields provided.

Seller Information

- Name: _____________________________

- Address: ___________________________

- City: ______________________________

- State: _____________________________

- Zip Code: __________________________

- Email: _____________________________

- Phone: _____________________________

Buyer Information

- Name: _____________________________

- Address: ___________________________

- City: ______________________________

- State: _____________________________

- Zip Code: __________________________

- Email: _____________________________

- Phone: _____________________________

Business Details

- Business Name: ______________________

- Business Address: ____________________

- City: ______________________________

- State: _____________________________

- Zip Code: __________________________

Sale Details

Date of Sale: ________________________

Sale Price: __________________________

Payment Method: ______________________

Terms of Sale

The seller agrees to transfer ownership of the business listed above to the buyer upon receipt of full payment. The seller affirms that the business is sold free of any liens or debts, unless otherwise noted.

Signatures

- Seller's Signature: ____________________ Date: __________

- Buyer's Signature: ____________________ Date: __________

Please retain a copy of this Bill of Sale for your records. This document serves as proof of the transaction and adheres to the relevant laws of [State Name].