Fill a Valid Auto Insurance Card Template

The Auto Insurance Card is a crucial document for vehicle owners, serving as proof of insurance coverage while on the road. This card includes essential information such as the insurance identification number, policy number, and the effective and expiration dates of the coverage. It also details the vehicle’s make, model, and identification number, ensuring that the specific vehicle is linked to the insurance policy. Issued by the insurance agency or company, this card must be kept in the insured vehicle at all times. In the event of an accident, it is imperative to present this card upon demand. Additionally, the card reminds drivers to report any accidents to their insurance agent or company promptly. Important information, such as the names and addresses of drivers, passengers, and witnesses involved in an accident, must be collected. For verification, the front of the card features an artificial watermark that can be viewed by holding it at an angle. This card not only serves as a legal requirement but also provides peace of mind to drivers, knowing they are covered in case of unforeseen incidents.

Additional PDF Templates

Florida Real Estate Forms - The contract includes provisions allowing the buyer to conduct due diligence investigations to assess property suitability.

Filling out the Arizona Residential Lease Agreement can greatly benefit both landlords and tenants by clarifying expectations and legal obligations, and templates are readily available for easy use, such as those found on arizonaformpdf.com.

Cease and Desist Trespassing Letter Template - This letter underscores the seriousness of respecting property rights.

Form I-589 - Supporting documents should be included with your I-589 submission.

Similar forms

The Auto Insurance Card serves as a vital document for vehicle owners. Several other documents share similarities with it in terms of purpose, information included, and usage. Below is a list of ten such documents:

- Vehicle Registration Card: Like the Auto Insurance Card, this document contains essential vehicle information, including the make, model, and identification number. It must be kept in the vehicle and presented upon request by law enforcement.

- Driver's License: This document verifies a person's identity and driving privileges. It includes personal information such as name, address, and date of birth, similar to the identification details found on the Auto Insurance Card.

- Proof of Insurance Certificate: This certificate provides evidence of insurance coverage. It includes the policy number and effective dates, paralleling the information found on the Auto Insurance Card.

- Accident Report Form: This document is used to report details of an accident. It requires information about drivers and vehicles involved, akin to the accident reporting instructions on the Auto Insurance Card.

- Title Document: The vehicle title indicates ownership and includes details like the vehicle identification number. It is similar to the Auto Insurance Card in that both documents are essential for vehicle operation.

- Inspection Certificate: This document certifies that a vehicle meets safety and emissions standards. It contains vehicle details and must be presented when required, just like the Auto Insurance Card.

- Rental Agreement: When renting a vehicle, this document outlines the rental terms and includes vehicle information. It serves a similar purpose of verifying vehicle details and insurance coverage.

- Motor Vehicle Record (MVR): This document contains a driver's history, including accidents and violations. It is similar in that it provides crucial information about the driver, which may relate to insurance matters.

- Roadside Assistance Card: This card provides information about roadside assistance services. Like the Auto Insurance Card, it is important for vehicle emergencies and must be readily available.

- Transfer-on-Death Deed: This vital document allows property owners to seamlessly pass on real estate to beneficiaries upon death, bypassing the probate process. For more information and to access the form, visit todform.com/blank-new-jersey-transfer-on-death-deed/.

- Warranty Registration Document: This document details the warranty coverage for a vehicle. It includes vehicle and owner information, similar to the identification elements of the Auto Insurance Card.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Auto Insurance Card serves as proof of insurance coverage for a vehicle. |

| Legal Requirement | Most states require drivers to carry an insurance card while operating a vehicle, as mandated by state law. |

| Information Included | The card contains essential details such as the company number, policy number, effective and expiration dates, and vehicle information. |

| Vehicle Identification | It includes the Vehicle Identification Number (VIN), which uniquely identifies the insured vehicle. |

| Issuing Agency | The card must indicate the agency or company that issued the insurance policy. |

| Accident Protocol | In the event of an accident, drivers are advised to report the incident to their insurance agent as soon as possible. |

| Card Security Feature | The front of the card features an artificial watermark, which can be viewed by holding it at an angle. |

Things You Should Know About This Form

-

What is an Auto Insurance Card?

An Auto Insurance Card is a document that proves you have valid auto insurance coverage. It contains essential information about your insurance policy, including the insurance company, policy number, and vehicle details. This card must be kept in your vehicle at all times.

-

What information is included on the Auto Insurance Card?

The Auto Insurance Card typically includes the following details:

- Insurance identification card number

- Company number

- Policy number

- Effective date of the policy

- Expiration date of the policy

- Year, make, and model of the vehicle

- Vehicle Identification Number (VIN)

- Agency or company issuing the card

-

Why is it important to carry the Auto Insurance Card?

Carrying the Auto Insurance Card is crucial because it serves as proof of insurance coverage. In the event of an accident or traffic stop, law enforcement or other parties involved may request to see this card. Not having it can lead to legal penalties or fines.

-

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, contact your insurance agent or company immediately. They can issue a replacement card. It is important to have a valid card in your vehicle to avoid complications during a traffic stop or accident.

-

How do I report an accident using the information on the Auto Insurance Card?

In the event of an accident, you should report it to your insurance agent or company as soon as possible. Gather the following information:

- Name and address of each driver, passenger, and witness

- Name of the insurance company and policy number for each vehicle involved

This information will assist your insurance company in processing your claim.

-

What does the artificial watermark on the card signify?

The artificial watermark on the Auto Insurance Card is a security feature. It helps to prevent fraud and ensures the authenticity of the document. To view the watermark, hold the card at an angle.

-

Is the Auto Insurance Card valid indefinitely?

No, the Auto Insurance Card is not valid indefinitely. Each card has an expiration date, which indicates until when the insurance coverage is active. Always ensure your card is current and renew your policy as needed to avoid lapses in coverage.

-

Can I use a digital version of the Auto Insurance Card?

Many states allow digital versions of the Auto Insurance Card to be presented on a smartphone or other electronic devices. However, it is essential to check your state’s laws regarding the acceptance of digital cards. Always carry a physical copy if required by law.

-

What happens if I fail to present my Auto Insurance Card when requested?

Failing to present your Auto Insurance Card when requested can lead to legal repercussions, including fines or penalties. It may also complicate the claims process if you are involved in an accident. Always ensure you have your card accessible while driving.

Documents used along the form

When managing auto insurance, several important documents accompany the Auto Insurance Card. Each of these forms serves a specific purpose, ensuring that drivers are protected and informed in various situations. Below is a list of commonly used documents that often go hand-in-hand with your insurance card.

- Insurance Policy Document: This comprehensive document outlines the details of your coverage, including limits, deductibles, and exclusions. It’s essential for understanding what is and isn’t covered under your policy.

- Claim Form: In the event of an accident, a claim form is necessary to report damages and request compensation. This form typically requires details about the incident and the parties involved.

- Declaration Page: This page summarizes your insurance policy, listing key information such as coverage limits, premium amounts, and the insured vehicles. It serves as a quick reference for policyholders.

- Proof of Insurance Letter: Sometimes required by law, this letter confirms that you have active insurance coverage. It may be requested by employers or lenders.

- Vehicle Registration: This document proves that your vehicle is legally registered with the state. It is often required during traffic stops or when filing claims.

- Accident Report Form: After an accident, this form helps document the details of the incident. It can be crucial for insurance claims and legal purposes.

- Driver’s License: A valid driver’s license is essential for operating a vehicle legally. It may also be required when presenting your insurance card.

- Hold Harmless Agreement: This legal document ensures that one party will not hold the other responsible for any loss or damage, which is crucial in various business dealings and can be particularly useful alongside the Hold Harmless Agreement.

- Inspection Report: If your vehicle requires inspection, this report confirms that it meets safety and emissions standards. It may be necessary for certain types of insurance coverage.

Having these documents readily available can streamline the process of handling claims, renewals, and any legal requirements. Staying organized not only helps in emergencies but also ensures that you are fully compliant with state regulations.

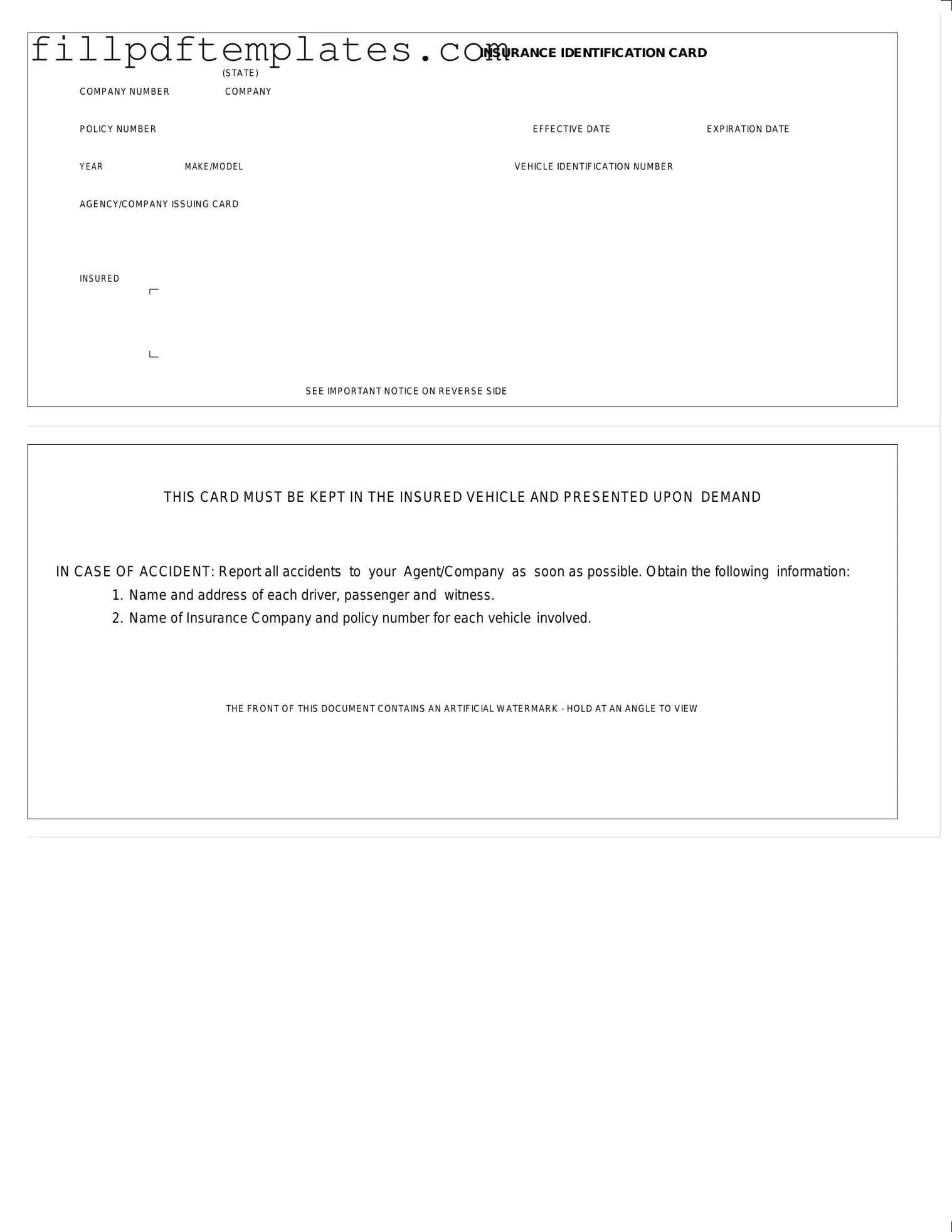

Auto Insurance Card Preview

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW