Valid Articles of Incorporation Form

When embarking on the journey of starting a business, one of the most crucial steps involves the completion of the Articles of Incorporation form. This essential document serves as the foundation for your corporation, outlining key details that define its existence and structure. Among the significant aspects covered in this form are the corporation’s name, which must be unique and comply with state regulations, and its purpose, which describes the activities the business intends to engage in. Additionally, the form requires the identification of the registered agent, a designated individual or entity responsible for receiving legal documents on behalf of the corporation. Information regarding the number of shares the corporation is authorized to issue is also included, along with details about the initial board of directors. By meticulously filling out the Articles of Incorporation, you not only comply with legal requirements but also lay the groundwork for your business’s future growth and stability.

Articles of Incorporation - Customized for Each State

Fill out More Documents

Affidavit of Will - It serves as a sworn statement confirming the testator's intentions.

Printable Garage Lease Agreement - It establishes a process for resolving disputes amicably, promoting cooperation.

The Massachusetts Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This tool can simplify the process of passing on property and help avoid potential legal complications. For detailed information on how to properly utilize this form, visit transferondeathdeedform.com/massachusetts-transfer-on-death-deed, which is essential for anyone looking to secure their estate for future generations.

Rental Verification From Landlord - Create a standard procedure for rental verification.

Similar forms

- Bylaws: Similar to the Articles of Incorporation, bylaws outline the internal rules and procedures for managing a corporation. They provide guidance on governance, meetings, and the roles of officers and directors.

- Operating Agreement: For limited liability companies (LLCs), an operating agreement serves a purpose akin to that of bylaws for corporations. It details the management structure and operational procedures of the LLC.

- Certificate of Incorporation: This document is often used interchangeably with the Articles of Incorporation. It serves the same purpose of formally establishing a corporation under state law.

- Business Plan: While not a legal document, a business plan outlines the goals, strategies, and financial forecasts of a business. It complements the Articles of Incorporation by providing a roadmap for the corporation's future.

- Shareholder Agreement: This document outlines the rights and responsibilities of shareholders. It works in conjunction with the Articles of Incorporation to define ownership and management structures.

- Partnership Agreement: For partnerships, this agreement specifies the terms of the partnership, similar to how the Articles of Incorporation define the corporation's structure and purpose.

- Certificate of Good Standing: This document verifies that a corporation is compliant with state regulations. It is related to the Articles of Incorporation as it confirms the corporation's legal existence.

- Annual Report: Corporations are often required to file annual reports with the state. These reports provide updated information about the corporation, similar to how the Articles of Incorporation establish initial details.

- Tax Registration Forms: These forms, required by federal and state tax authorities, ensure that a corporation is properly registered for tax purposes. They relate to the Articles of Incorporation by facilitating the corporation's legal and financial operations.

- Power of Attorney: This legal document enables someone to make decisions on your behalf, ensuring your wishes are respected when you cannot act for yourself. For more information and to obtain a template, visit https://legalpdfdocs.com/.

- Employment Agreements: These contracts outline the terms of employment for individuals working within the corporation. They are similar to the Articles of Incorporation in that they establish formal relationships within the corporate structure.

Document Properties

| Fact Name | Description |

|---|---|

| Purpose | The Articles of Incorporation establish a corporation as a legal entity, separate from its owners. |

| Required Information | Typically, the form requires the corporation's name, purpose, registered agent, and the number of shares authorized. |

| Governing Law | In the United States, each state has its own governing laws for Articles of Incorporation, often found in the state's business corporation act. |

| Filing Process | The completed form must be filed with the appropriate state agency, usually the Secretary of State, along with any required fees. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record, allowing transparency and access for stakeholders. |

Things You Should Know About This Form

-

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in the United States. They outline the basic details of the corporation, including its name, purpose, and structure. Filing these documents is a crucial step in the process of forming a corporation.

-

Why do I need to file Articles of Incorporation?

Filing Articles of Incorporation is necessary to create a legal entity that is separate from its owners. This provides liability protection for the owners and allows the corporation to conduct business, enter contracts, and own property in its own name.

-

What information is required in the Articles of Incorporation?

The Articles typically require the following information:

- The corporation's name

- The purpose of the corporation

- The registered agent's name and address

- The number of shares the corporation is authorized to issue

- The names and addresses of the incorporators

-

How do I file Articles of Incorporation?

To file Articles of Incorporation, you must complete the form provided by your state’s Secretary of State office. After filling it out, submit the form along with any required fees. This can often be done online, by mail, or in person, depending on the state.

-

What is the cost to file Articles of Incorporation?

The cost varies by state and can range from $50 to several hundred dollars. It’s important to check with your state’s Secretary of State office for the exact fee and any additional costs that may apply.

-

How long does it take to process Articles of Incorporation?

Processing times can differ significantly by state. Typically, it can take anywhere from a few days to several weeks. Some states offer expedited processing for an additional fee, which can shorten the waiting period.

-

Can I amend my Articles of Incorporation later?

Yes, amendments can be made to the Articles of Incorporation after they have been filed. This usually involves submitting a formal amendment form to your state’s Secretary of State office, along with any required fees.

-

What happens if I do not file Articles of Incorporation?

If you do not file Articles of Incorporation, your business will not be recognized as a corporation. This means you will not have the liability protection that a corporation provides, and you may face personal liability for business debts and obligations.

Documents used along the form

When forming a corporation, several key documents accompany the Articles of Incorporation. Each of these documents plays a vital role in establishing and maintaining the corporation's legal status. Below is a list of commonly used forms and documents.

- Bylaws: These are the internal rules that govern the management and operation of the corporation. Bylaws outline the responsibilities of directors and officers, meeting procedures, and voting rights.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This document typically includes information about the corporation's directors, officers, and registered agent.

- Employer Identification Number (EIN) Application: This form, often referred to as Form SS-4, is submitted to the IRS to obtain a unique identification number for tax purposes. An EIN is essential for opening a bank account and hiring employees.

- Operating Agreement: While more common in LLCs, corporations may also benefit from an operating agreement. This document outlines the management structure and operational procedures, ensuring clarity among stakeholders.

- Hold Harmless Agreement: This legal document is essential for protecting one party from liability for any injuries or damages suffered by another party. It is particularly important in Alabama, where specific state laws can influence its enforceability and scope. For more information, you can refer to the Hold Harmless Agreement.

- Shareholder Agreement: This agreement details the rights and obligations of shareholders. It can cover aspects such as share transfers, voting rights, and dispute resolution, providing a framework for shareholder relations.

- Business Licenses and Permits: Depending on the nature of the business and its location, various licenses and permits may be required. These documents ensure compliance with local, state, and federal regulations.

- Meeting Minutes: Corporations must maintain records of meetings held by the board of directors and shareholders. Meeting minutes serve as official documentation of decisions made and actions taken during these meetings.

Incorporating a business involves more than just filing the Articles of Incorporation. Each of these documents contributes to the legal framework that supports the corporation's operations and governance. Ensuring that all necessary forms are completed and filed correctly is essential for long-term success.

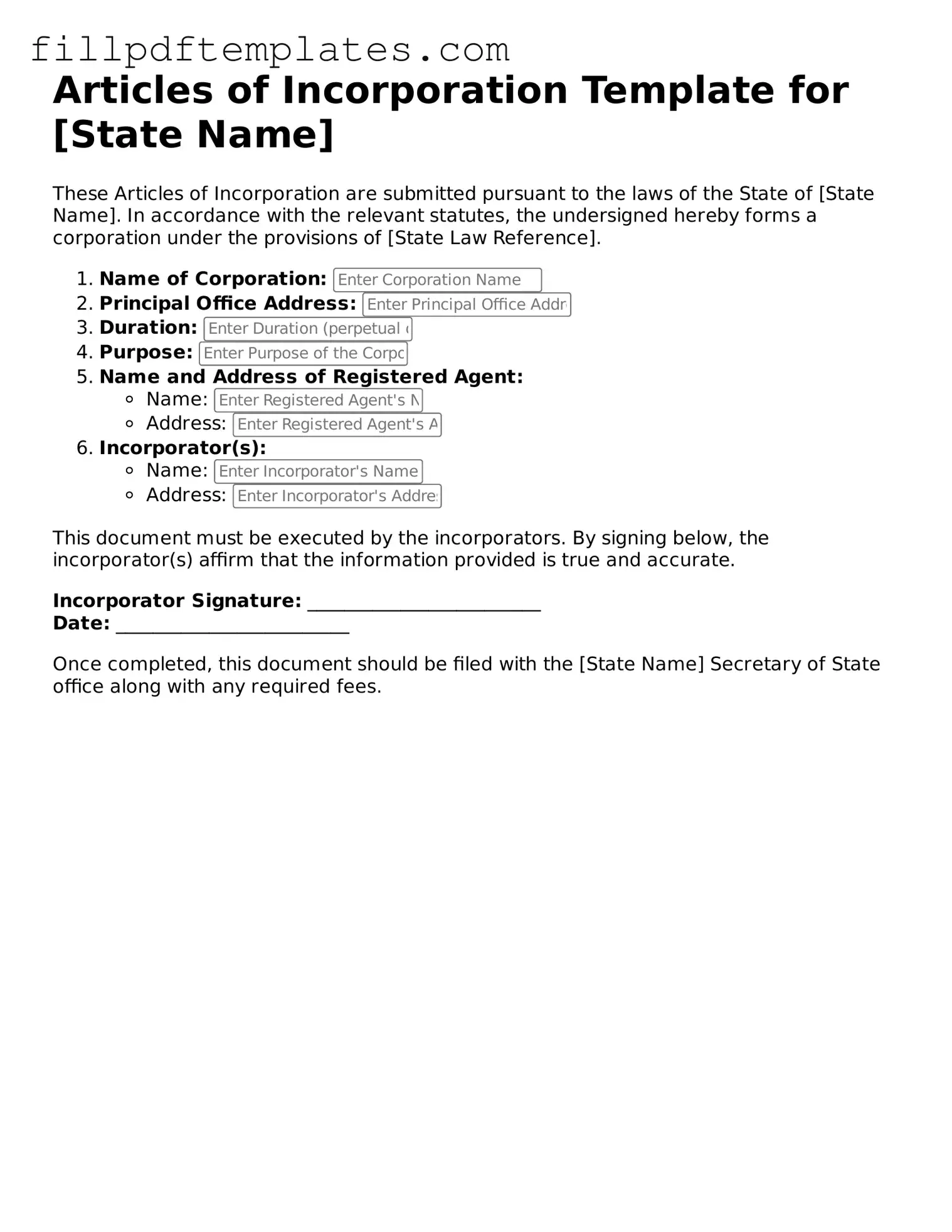

Articles of Incorporation Preview

Articles of Incorporation Template for [State Name]

These Articles of Incorporation are submitted pursuant to the laws of the State of [State Name]. In accordance with the relevant statutes, the undersigned hereby forms a corporation under the provisions of [State Law Reference].

- Name of Corporation:

- Principal Office Address:

- Duration:

- Purpose:

-

Name and Address of Registered Agent:

- Name:

- Address:

-

Incorporator(s):

- Name:

- Address:

This document must be executed by the incorporators. By signing below, the incorporator(s) affirm that the information provided is true and accurate.

Incorporator Signature: _________________________

Date: _________________________

Once completed, this document should be filed with the [State Name] Secretary of State office along with any required fees.