Fill a Valid Adp Pay Stub Template

The ADP Pay Stub form is an essential document for employees and employers alike, serving as a detailed record of earnings and deductions for each pay period. This form typically includes crucial information such as the employee's gross pay, net pay, and various deductions like taxes, health insurance, and retirement contributions. Understanding the components of the pay stub is vital for employees to verify their earnings and ensure that all deductions are accurate. Additionally, employers must maintain these records for compliance with labor laws and tax regulations. By familiarizing yourself with the ADP Pay Stub form, you can better navigate your financial situation, plan for future expenses, and address any discrepancies that may arise. It is important to review this document regularly, as it can provide valuable insights into your overall compensation and benefits. Whether you are an employee checking your pay or an employer managing payroll, knowing how to interpret the information on the ADP Pay Stub form is crucial for financial clarity and accountability.

Additional PDF Templates

Test Drive Form Pdf - It emphasizes that the vehicle should not leave the state during the test drive.

One important document to prepare during estate planning is your Last Will and Testament guidelines. This form allows you to express your wishes regarding asset distribution, ensuring that your intentions are honored and providing peace of mind for your family during a challenging time.

Panel Load Calculation - The form is user-friendly, making it accessible to a range of professionals.

Similar forms

- W-2 Form: Like the ADP Pay Stub, the W-2 form provides a summary of an employee's earnings and tax withholdings for the year. Both documents serve to inform employees about their income and tax obligations.

- Paycheck: The paycheck is a physical or electronic representation of an employee's earnings for a specific pay period. Similar to the ADP Pay Stub, it details gross pay, deductions, and net pay, allowing employees to understand their compensation.

- Bill of Sale: A Bill of Sale is essential for documenting the transfer of ownership of personal property. For more information, visit Top Document Templates.

- Direct Deposit Statement: This statement accompanies direct deposits and outlines the same information as the ADP Pay Stub. It shows the breakdown of earnings, deductions, and the final amount deposited into the employee's bank account.

- Payroll Summary Report: This report provides a comprehensive overview of payroll data for a specific period. Much like the ADP Pay Stub, it includes details about total earnings, deductions, and taxes for all employees, making it useful for payroll departments.

- 1099 Form: For independent contractors, the 1099 form serves a similar purpose to the ADP Pay Stub. It reports income earned and any taxes withheld, helping recipients track their earnings and prepare for tax filing.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings and deductions for each pay period. |

| Components | The form typically includes information such as gross pay, net pay, taxes withheld, and other deductions. |

| Frequency | Pay stubs are usually issued on a regular basis, such as weekly, bi-weekly, or monthly, depending on the employer's payroll schedule. |

| Legal Requirement | In many states, employers are required by law to provide pay stubs to employees. Check your state’s labor laws for specific requirements. |

| Format | The ADP Pay Stub can be provided in both paper and electronic formats, allowing for easy access and record-keeping. |

| Access | Employees can often access their pay stubs online through the ADP portal, enhancing convenience and security. |

| State-Specific Forms | Some states may have specific regulations governing pay stubs, such as California's Labor Code Section 226, which mandates certain information be included. |

Things You Should Know About This Form

-

What is an ADP pay stub?

An ADP pay stub is a document provided by ADP, a payroll processing company, that outlines an employee's earnings and deductions for a specific pay period. It serves as a record of wages earned, taxes withheld, and other deductions.

-

How can I access my ADP pay stub?

You can access your ADP pay stub by logging into the ADP employee portal. Once logged in, navigate to the "Pay" section to view and download your pay stubs. If you do not have an account, you may need to contact your HR department for assistance.

-

What information is included on my ADP pay stub?

Your ADP pay stub typically includes the following information:

- Employee name and identification number

- Pay period dates

- Gross earnings

- Net pay

- Deductions for taxes, benefits, and other withholdings

-

Why is my net pay different from my gross pay?

The difference between your net pay and gross pay is due to various deductions. These can include federal and state taxes, Social Security contributions, health insurance premiums, and retirement plan contributions. Each deduction is itemized on your pay stub.

-

Can I get a paper copy of my pay stub?

Yes, if your employer offers paper pay stubs, you can request a physical copy. However, many companies are moving towards electronic pay stubs for convenience and environmental reasons.

-

What should I do if I find an error on my pay stub?

If you notice an error on your pay stub, contact your HR department or payroll administrator immediately. They will investigate the issue and make any necessary corrections. Prompt reporting is crucial to ensure timely resolution.

-

How long should I keep my pay stubs?

It is recommended to keep your pay stubs for at least one year. They can be important for tax purposes and for verifying income when applying for loans or other financial services.

-

What if I do not receive my pay stub?

If you do not receive your pay stub, first check your email and ADP portal. If it is not there, reach out to your HR department to ensure your contact information is correct and to inquire about any issues with payroll processing.

-

Is my ADP pay stub secure?

Yes, ADP takes security seriously. The online portal uses encryption and other security measures to protect your personal information. It is important to keep your login credentials confidential to maintain security.

-

Can I access my pay stubs from previous years?

Yes, you can typically access your pay stubs from previous years through the ADP portal, depending on your employer's policies. If you cannot find older pay stubs, contact your HR department for assistance.

Documents used along the form

The ADP Pay Stub form is a crucial document for employees, providing a detailed breakdown of earnings and deductions for a specific pay period. Several other forms and documents complement the pay stub, ensuring that both employees and employers maintain accurate financial records. Below is a list of these related documents, each serving a unique purpose.

- W-2 Form: This form summarizes an employee's annual wages and the taxes withheld. Employers must provide this to employees by January 31 each year.

- W-4 Form: Employees use this form to indicate their tax withholding preferences. It helps employers calculate the correct amount of federal income tax to withhold from paychecks.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their pay directly into their bank account, ensuring timely access to funds.

- Time Sheet: Employees record hours worked on this form. It helps employers verify hours for payroll calculations and ensures accurate compensation.

- Payroll Register: This internal document provides a summary of payroll for each pay period, detailing employee earnings, deductions, and net pay.

- Employee Handbook: While not a payroll document, it often contains important information about pay policies, benefits, and employee rights, serving as a reference for employees.

- Benefits Enrollment Form: Employees use this form to enroll in company-sponsored benefits, such as health insurance or retirement plans, impacting their overall compensation.

- Leave Request Form: This form is used by employees to formally request time off, which can affect payroll calculations and should be documented for record-keeping.

- Apartment Rental Application: This document is essential for potential tenants to seek approval from landlords or property managers for renting a property. It collects necessary personal information, financial details, and references to assess a candidate's suitability for tenancy. For more information, visit the Apartment Rental Application.

- Expense Reimbursement Form: Employees submit this form to request reimbursement for business-related expenses, which may be processed alongside payroll.

- Paycheck Stubs (for previous periods): These stubs provide historical pay information and are useful for employees needing to verify past earnings or deductions.

Understanding these documents is essential for both employees and employers. They help maintain transparency and accuracy in payroll processes, ensuring everyone is informed about their financial entitlements and obligations.

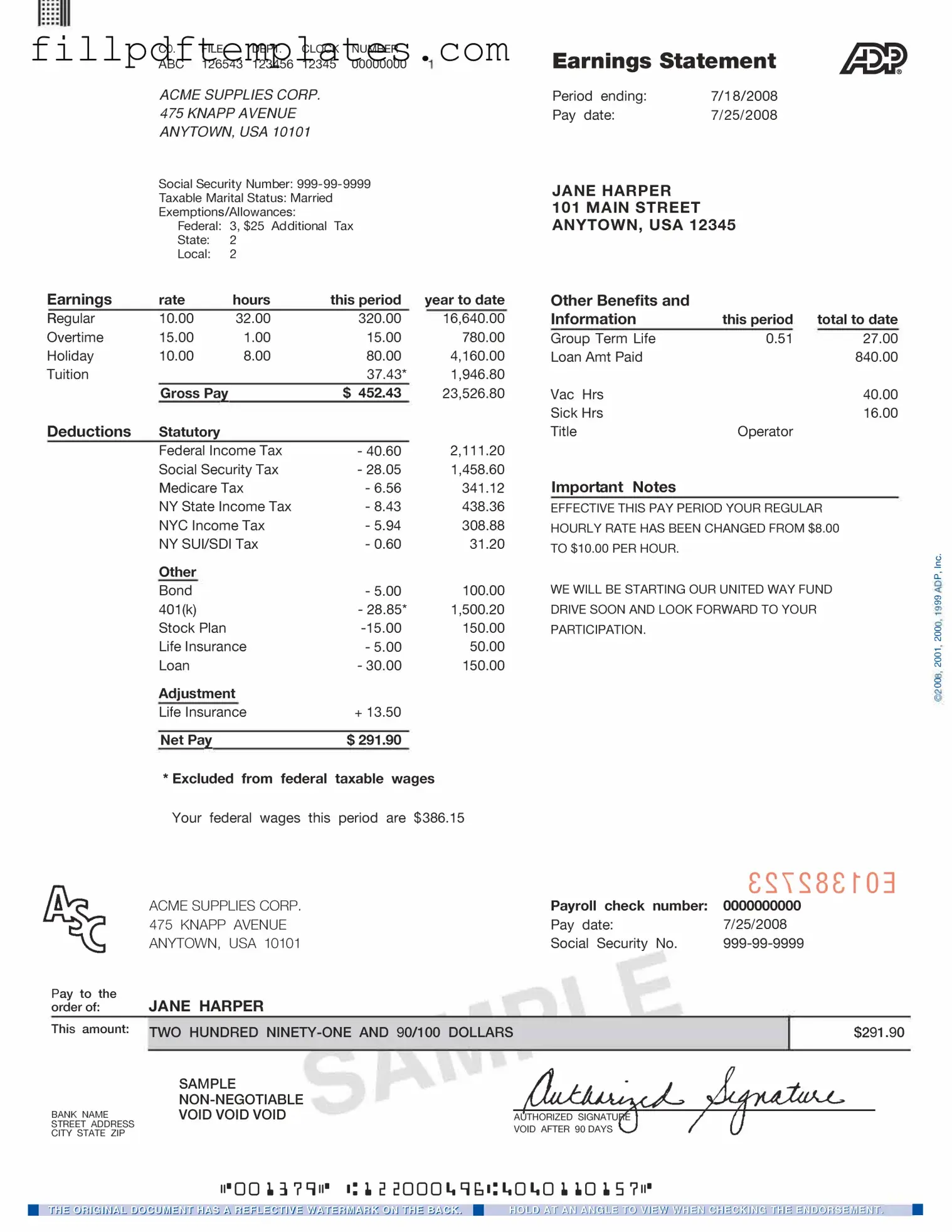

Adp Pay Stub Preview

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90